A.M. Best Affirms Ratings of Protective Life Corporation

June 02 2008 - 2:27PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating (FSR) of

A+ (Superior) and issuer credit ratings (ICR) of �aa� of Protective

Life Corporation�s (Protective) (Birmingham, AL) [NYSE: PL] direct

and indirect life/health subsidiaries led by Protective Life

Insurance Company (PLIC) (Tennessee). Concurrently, A.M. Best has

affirmed the ICR of �a� and debt ratings of Protective. In

addition, A.M. Best has affirmed the debt ratings of the

outstanding notes issued for the various funding agreement-backed

securities (FABS) programs of PLIC. A.M. Best also has affirmed the

FSR of A- (Excellent) and ICR of �a-� of Protective�s indirect

property/casualty subsidiary, Lyndon Property Insurance Company

(St. Louis, MO). The outlook for all ratings is stable. (Please see

link below for a detailed listing of the companies and ratings.)

Protective�s ratings reflect its consistent earnings performance,

diversified revenue and profit sources, broad distribution

capabilities, historically solid risk-adjusted capitalization and

superior investment performance. The ratings also acknowledge

Protective�s success in deploying excess capital via acquisition

and effectively integrating acquired insurance companies and blocks

of business. Protective�s steady sales and profitability are

supported by its diversified network of non-captive distribution

channels and its well-managed growth strategy. In addition,

Protective�s acquisitions have increased its earnings and allowed

the organization to enter new markets and realize certain operating

efficiencies. Protective maintains a high-quality, diversified

investment portfolio, which has experienced a significantly lower

level of realized losses on sales and impairments than many of its

peers. While the ratings recognize Protective�s strong and diverse

business profile, A.M. Best notes that a few of the group�s product

lines are not material in size or synergy with Protective�s core

businesses. Furthermore, a significant portion of its GAAP and

statutory earnings are generated by segments that are somewhat

opportunistic and products that are commoditized in nature.

Additionally, Protective�s all-in financial

leverage�senior-plus-subordinated debt�is slightly over 30% and

near the upper end of the range for its current ratings. However,

Protective�s interest coverage is strong at approximately eight

times, partially mitigating A.M. Best�s financial leverage

concerns. For a complete listing of Protective Life Corporation�s

FSRs, ICRs and debt ratings, please visit

www.ambest.com/press/060208protective.pdf. Founded in 1899, A.M.

Best Company is a global full-service credit rating organization

dedicated to serving the financial and health care service

industries, including insurance companies, banks, hospitals and

health care system providers. For more information, visit

www.ambest.com.

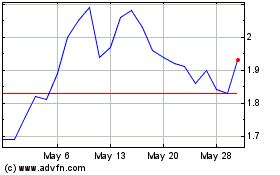

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

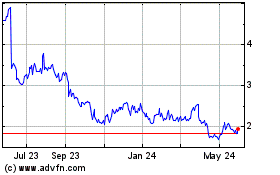

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024