Protective Life Offers New Choices in Variable Annuity Living Benefits

March 03 2008 - 12:58PM

Business Wire

Protective Life Insurance Company today announced updates to the

popular SecurePay Withdrawal BenefitSM. The enhanced offering now

includes a choice of two lifetime withdrawal benefits: The original

SecurePay Withdrawal Benefit, or The new �SecurePay with Roll-Up�

option. Each benefit offers a selection of innovative optional

features such as RightTimeSM (an option to buy the rider at issue

or at a later date), SecurePay MESM (an option that may result in

higher annual withdrawal amounts for clients with qualifying

medical conditions), and a new Guaranteed Minimum Accumulation

Benefit. SecurePay with Roll-Up In addition to offering many of the

benefits found in the original SecurePay Withdrawal Benefit (such

as lifetime annual withdrawal benefits of up to 6% and an annual

Benefit Base step-up provision), the SecurePay with Roll-Up option

offers the potential to double the annuity�s initial Benefit Base

after 10 years. The compounding �roll-up� increases the Benefit

Base by 7.2% each contract anniversary (adjusted for withdrawals)

during a 10-year roll-up period, providing clients a guaranteed

minimum increase in the Benefit Base regardless of market

performance. Guaranteed Minimum Accumulation Benefit Another new

feature, the Guaranteed Minimum Accumulation Benefit (GMAB), offers

clients an additional safety net in the form of a �return of

purchase payments� guarantee. This ensures that 10 years after the

purchase of the benefit, the annuity value will be no less than the

total of the purchase payments made during the first year of the

contract (adjusted for withdrawals), even in the event of negative

investment performance. The benefit also offers a step-up option

five years after the benefit is purchased. This enables clients to

lock-in the fifth year contract anniversary value and reset the

10-year guarantee period. The GMAB option is only available when

SecurePay or SecurePay with Roll-Up is also purchased. The new

benefits, which offer clients the opportunity to select the options

that best fit their individual needs, are available with all

ProtectiveAccess� XL and ProtectiveRewards B2A� variable annuities

purchased on or after March 3, 2008 (subject to state

availability). �Protective Life designs products with consumers in

mind,� said Eric Miller, Vice President and National Marketing

Director for Protective�s Life and Annuity Division. �We recognize

that variable annuity buyers have a wide variety of individual

needs and long-term objectives. We strive to deliver the innovative

products, features and flexibility needed for truly personalized

solutions. These enhancements to our living benefit options

demonstrate our commitment to delivering new choices with both

security and flexibility in mind.� More information available

Consumers are encouraged to contact their insurance and financial

advisors for more information about Protective Life�s variable

annuities and living benefits as well as Protective Life�s other

life insurance and annuity products. These products are designed to

help address critical needs throughout various stages of the

financial lifecycle, and may play meaningful roles in building,

protecting, distributing and transferring wealth. Financial

Advisors interested in selling Protective Life variable annuities

and living benefit options should check with their Broker/Dealer

regarding availability or contact the Protective Annuity Sales Desk

at (800) 628-6390 for more information. Important Consumer

Information Purchase of SecurePay, SecurePay with Roll-Up or the

Guaranteed Minimum Accumulation Benefit has certain requirements

(including how contract value must be allocated), is available at

an additional cost, and will affect the underlying annuity contract

features. For complete details, please read the prospectus.

SecurePay, SecurePay with Roll-Up, the Guaranteed Minimum

Accumulation Benefit and the Medical Evaluation option are each

subject to state availability. Variable annuity contracts issued by

Protective Life Insurance Company (PLICO). Securities offered by

Investment Distributors, Inc. (IDI). Both located at 2801 Highway

280 South, Birmingham, AL 35223. PLICO and IDI are each

subsidiaries of Protective Life Corporation. Protective Life

Corporation is a separate company and is not responsible for the

financial condition or the contractual obligations of PLICO or IDI.

SecurePay benefits provided by rider form number IPV-2154 (and

state variations thereof). SecurePay with Roll-Up benefits provided

under rider form number IPV-2157 (and state variations thereof).

Guaranteed Minimum Accumulation Benefit provided under rider form

number IPV-2158 (and state variations thereof). Medical Evaluation

endorsement provided under policy form number IPV-2156 (and state

variations thereof). All guarantees are subject to the

claims-paying ability of Protective Life Insurance Company. Keep in

mind that variable annuities are long-term investments intended for

retirement planning and involve market risk and the possible loss

of principal. Investments in variable annuities are subject to fees

and charges from the insurance company and the investment managers.

Investors should carefully consider the investment objectives,

risks, charges, and expenses of a variable annuity, any GLWB or

GMAB rider, and the underlying investment options before investing.

This and other information is contained in the prospectuses for a

variable annuity and its underlying investment options. Investors

should read the prospectuses carefully before investing.

Prospectuses may be obtained by contacting PLICO at (800) 628-6390.

Not a Deposit Not Insured by Any Federal Government Agency No Bank

Guarantee Not FDIC Insured May Lose Value About Protective Life

Insurance Company Protective Life Insurance Company was established

on a profound belief in the American dream. Since 1907, Protective

Life Insurance Company has remained true to its core beliefs:

quality, serving people, and growth. This unwavering commitment to

treating people the way we would like to be treated has been

rewarded with stable, long-term relationships and growth. Today,

Protective Life is one of the nation�s leading insurance companies,

proving the wisdom of our Company�s vision: Doing the right thing

is smart business�.

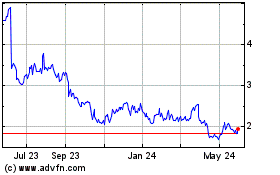

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

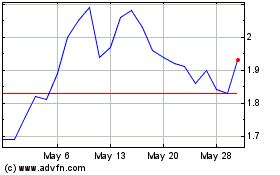

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024