Increases 2019

Full-Year Reported Diluted EPS Forecast to at Least $4.94 (from at

Least $4.87) vs. $5.08 in 2018; Reflecting Currency-Neutral

Like-for-Like Adjusted Diluted EPS Growth of at Least

9%

Regulatory News:

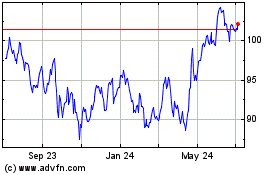

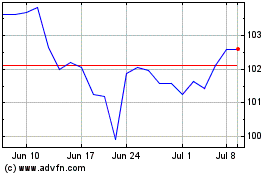

Philip Morris International Inc. (NYSE: PM) today announced its

2019 second-quarter results and increases its 2019 full-year

reported diluted earnings per share forecast. Comparisons presented

in this press release on a "like-for-like" basis reflect pro forma

2018 results, which have been adjusted for the deconsolidation of

PMI's Canadian subsidiary, Rothmans, Benson & Hedges, Inc.

(RBH), effective March 22, 2019 (the date of deconsolidation). In

addition, reflecting the deconsolidation, PMI's total market share

has been restated for previous periods.

2019 SECOND-QUARTER &

YEAR-TO-DATE HIGHLIGHTS

2019 Second-Quarter

- Reported diluted EPS of $1.49, up by 5.7%; up by 10.6%,

excluding currency

- Adjusted diluted EPS of $1.46, up by 3.5%; up by 15.0% on a

like-for-like basis, excluding currency

- Cigarette and heated tobacco unit shipment volume down by 1.4%

(down by 0.7% on a like-for-like basis), reflecting cigarette

shipment volume down by 3.6% and heated tobacco unit shipment

volume up by 37.0%

- Net revenues down by 0.3%; up by 9.0% on a like-for-like basis,

excluding currency

- Operating income up by 3.0%; up by 8.4%, excluding

currency

- Adjusted operating income up by 15.7% on a like-for-like basis,

excluding currency

- Adjusted operating income margin, excluding currency, increased

by 2.4 points to 41.4% on a like-for-like basis

- PMI declared a regular quarterly dividend of $1.14,

representing an annualized rate of $4.56 per common share

- The U.S. Food and Drug Administration announced that the

marketing of IQOS, PMI's electrically heated tobacco system, is

appropriate for the protection of public health and authorized it

for sale in the United States

2019 Six Months Year-to-Date

- Reported diluted EPS of $2.36, down by 2.1%; up by 3.3%,

excluding currency

- Adjusted diluted EPS of $2.55, up by 5.8%; up by 15.0% on a

like-for-like basis, excluding currency

- Cigarette and heated tobacco unit shipment volume down by 0.2%

(up by 0.1% on a like-for-like basis), reflecting cigarette

shipment volume down by 1.9% and heated tobacco unit shipment

volume up by 29.2%

- Net revenues down by 1.2%; up by 6.2% on a like-for-like basis,

excluding currency

- Operating income down by 5.1%; up by 0.5%, excluding

currency

- Adjusted operating income up by 12.7% on a like-for-like basis,

excluding currency

- Adjusted operating income margin, excluding currency, increased

by 2.2 points to 39.4% on a like-for-like basis

"Building on our encouraging start to the year, we delivered

another strong quarter that continues to demonstrate the soundness

of our strategies and the quality of our execution," said André

Calantzopoulos, Chief Executive Officer.

"Of particular note is our combined cigarette and heated tobacco

unit shipment volume, which -- for the first six months of the year

-- was up by 0.1% on a like-for-like basis. This positive

performance was led by robust in-market heated tobacco unit

year-to-date sales growth of 34.0%, making HEETS/HeatSticks,

combined, a top-ten international tobacco brand, despite only being

present in approximately one quarter of our markets. In the markets

where they are sold, our heated tobacco brands held a sizable

combined share of 5.0% year-to-date, driving a total international

share of 2.1%, up by 0.6 points."

"Our strong year-to-date results are the reason behind today's

announcement to increase our full-year guidance and raise our

currency-neutral, like-for-like 2019 full-year adjusted diluted EPS

growth rate by one percentage point to at least 9% in a further

demonstration of our overall confidence in PMI's short and

long-term growth prospects. This projection includes additional

investment behind our RRP portfolio to support geographic expansion

and portfolio development that should help us enter 2020 in an even

stronger position."

2019 FULL-YEAR

FORECAST

Full-Year

2019 EPS Forecast

2019 Forecast

2018

Adjusted Growth

Reported Diluted EPS

≥ $4.94

(a)

$5.08

2018 Tax items

—

0.02

2019 Tax items

(0.04

)

—

2019 Asset impairment and exit costs

0.03

—

2019 Canadian tobacco litigation-related

expense

0.09

—

2019 Loss on deconsolidation of RBH

0.12

—

Adjusted Diluted EPS

$5.14

$5.10

Net earnings attributable to RBH

(0.26

)

(b)

Adjusted Diluted EPS

$5.14

$4.84

(c)

Currency

(0.14

)

Adjusted Diluted EPS, excl.

currency

$5.28

$4.84

(c)

≥ 9 %

(a) Reflects the exclusion of previously

anticipated net EPS of approximately $0.28 attributable to RBH from

March 22, 2019 through December 31, 2019. The impact relating to

the eight-day stub period was not material.

(b) Net reported diluted EPS attributable

to RBH from March 22, 2018 through December 31, 2018.

(c) Pro forma.

PMI revises its full-year 2019 reported diluted EPS forecast to

be at least $4.94 at prevailing exchange rates, compared to the

previously communicated forecast of at least $4.87, versus $5.08 in

2018.

This revised full-year guidance reflects:

- The net impact of the loss on deconsolidation of PMI's Canadian

subsidiary Rothmans, Benson & Hedges Inc. (RBH) under U.S. GAAP

of approximately $0.12 per share, recorded in the first quarter of

2019, which is a non-cash item, as well as the Canadian tobacco

litigation-related expense of approximately $0.09 per share;

- The exclusion, announced on March 22, 2019, of RBH’s previously

anticipated net earnings from PMI’s consolidated financial

statements, from March 22, 2019 (the date of deconsolidation) to

December 31, 2019, of approximately $0.28 per share;

- Asset impairment and exit costs of approximately $0.03 per

share resulting from plant closures as part of global manufacturing

infrastructure optimization, reflecting: $0.01 per share related to

Pakistan recorded in the first quarter of 2019; and $0.02 per share

related to Colombia ($0.01 per share recorded in the second quarter

of 2019 and $0.01 per share anticipated in the third quarter of

2019);

- A favorable tax item of $0.04 per share related to a reduction

in estimated U.S. federal income tax on dividend repatriation for

the years 2015-2018;

- An unfavorable currency impact, at prevailing exchange rates,

of approximately $0.14;

- A full-year effective tax rate of approximately 23%, excluding

discrete tax items and Loss on Deconsolidation of RBH; and

- A projected increase of at least 9%, excluding currency, versus

pro forma adjusted diluted earnings per share of $4.84 in 2018, as

detailed in the attached Schedule 3 and as shown in the 2019 EPS

Forecast table above.

2019 Full-Year Forecast Overview & Assumptions

This forecast assumes:

- A total cigarette and heated tobacco unit shipment volume

decline for PMI of approximately 1.0%, on a like-for-like basis,

compared to the previously disclosed range of approximately 1.5% to

2.0%;

- An estimated total international industry volume decline,

excluding China and the U.S., at the lower end of the previously

disclosed range of approximately 2.5% to 3.0%; and

- Currency-neutral net revenue growth of at least 6% on a

like-for-like basis, compared to the previously disclosed

assumption of at least 5%, which includes an adverse impact of

approximately 0.7 points related to the move to highly inflationary

accounting in Argentina resulting in the treatment of the U.S.

dollar as the functional currency of the company’s Argentinian

affiliates.

This forecast further assumes:

- Net incremental investment behind RRPs of approximately $400

million for the full year 2019, compared to the previously

disclosed estimate of approximately $300 million. Approximately

half of the total net incremental investment of $400 million is

expected in the third quarter;

- An increase in full-year currency-neutral, like-for-like

adjusted operating income margin of at least 100 basis points

compared to 2018;

- Operating cash flow of approximately $9.5 billion, subject to

year-end working capital requirements;

- Capital expenditures of approximately $1.1 billion; and

- No share repurchases.

This forecast excludes the impact of any future acquisitions,

unanticipated asset impairment and exit cost charges, future

changes in currency exchange rates, further developments related to

the Tax Cuts and Jobs Act, further developments pertaining to the

judgment in the two Québec Class Action lawsuits and the Companies’

Creditors Arrangement Act (CCAA) protection granted to RBH and any

unusual events. This forecast also excludes the contemplated

proposal, previously communicated by PMI's local affiliate, to end

cigarette production in Berlin, Germany, by January 2020. Factors

described in the Forward-Looking and Cautionary Statements section

of this release represent continuing risks to these

projections.

FDA Authorization for Sale of IQOS in the United

States

On April 30, 2019, the U.S. Food and Drug Administration (FDA)

announced that the marketing of IQOS, PMI's electrically heated

tobacco system, is appropriate for the protection of public health

and authorized it for sale in the United States. The FDA’s decision

follows its comprehensive assessment of PMI’s premarket tobacco

product applications (PMTAs) submitted to the Agency in 2017.

PMI will bring IQOS to the U.S. through an exclusive license

with Altria Group, Inc., whose subsidiary, Philip Morris USA, will

market the product and comply with the provisions set forth in the

FDA's marketing order, and has the expertise and infrastructure to

ensure a successful launch, beginning with the initial lead market

of Atlanta, Georgia.

For additional information about the FDA's marketing order, see

the FDA News Release of April 30, 2019, set out at the end of this

release.

Conference Call

A conference call, hosted by Martin King, Chief Financial

Officer, will be webcast at 9:00 a.m., Eastern Time, on July 18,

2019. Access is at www.pmi.com/2019Q2earnings. The audio webcast

may also be accessed on iOS or Android devices by downloading PMI’s

free Investor Relations Mobile Application at

www.pmi.com/irapp.

CONSOLIDATED SHIPMENT VOLUME & MARKET

SHARE

PMI Shipment Volume by Region

Second-Quarter

Six Months

Year-to-Date

(million units)

2019

2018

Change

2019

2018

Change

Cigarettes

European Union

46,367

47,984

(3.4

)%

85,855

87,655

(2.1

)%

Eastern Europe

27,080

28,454

(4.8

)%

47,400

50,493

(6.1

)%

Middle East & Africa

31,659

34,177

(7.4

)%

64,963

63,425

2.4

%

South & Southeast Asia

46,376

44,788

3.5

%

87,868

85,006

3.4

%

East Asia & Australia

13,845

15,114

(8.4

)%

25,958

29,205

(11.1

)%

Latin America & Canada

18,472

20,204

(8.6

)%

36,052

39,217

(8.1

)%

Total PMI

183,799

190,721

(3.6

)%

348,096

355,001

(1.9

)%

Heated Tobacco Units

European Union

3,043

1,195

+100%

5,336

2,123

+100%

Eastern Europe

2,807

951

+100%

4,355

1,515

+100%

Middle East & Africa

719

971

(26.0

)%

1,473

1,680

(12.3

)%

South & Southeast Asia

—

—

—

%

—

—

—

%

East Asia & Australia

8,428

7,838

7.5

%

15,277

15,180

0.6

%

Latin America & Canada

59

32

84.4

%

113

55

+100%

Total PMI

15,056

10,987

37.0

%

26,554

20,553

29.2

%

Cigarettes and Heated Tobacco

Units

European Union

49,410

49,179

0.5

%

91,191

89,778

1.6

%

Eastern Europe

29,887

29,405

1.6

%

51,755

52,008

(0.5

)%

Middle East & Africa

32,378

35,148

(7.9

)%

66,436

65,105

2.0

%

South & Southeast Asia

46,376

44,788

3.5

%

87,868

85,006

3.4

%

East Asia & Australia

22,273

22,952

(3.0

)%

41,235

44,385

(7.1

)%

Latin America & Canada

18,531

20,236

(8.4

)%

36,165

39,272

(7.9

)%

Total PMI

198,855

201,708

(1.4

)%

374,650

375,554

(0.2

)%

Second-Quarter

PMI's total shipment volume decreased by 1.4%, or by 0.7% on a

like-for-like basis, principally due to:

- Middle East & Africa, reflecting lower cigarette shipment

volume, notably Saudi Arabia and Turkey, partly offset by

Egypt;

- East Asia & Australia, reflecting lower cigarette shipment

volume in Japan and lower cigarette and heated tobacco unit

shipment volume in Korea, partly offset by higher heated tobacco

unit shipment volume in Japan; and

- Latin America & Canada, reflecting lower cigarette shipment

volume, principally in Argentina, Canada (reflecting the impact of

the deconsolidation of RBH), and Venezuela, partly offset by

Mexico. On a like-for-like basis, PMI's total shipment volume in

the Region decreased by 1.4%;

partly offset by

- the EU, reflecting higher heated tobacco unit shipment volume

across the Region, partly offset by lower cigarette shipment

volume, notably France, Germany and Italy, partially offset by

Poland;

- Eastern Europe, reflecting higher heated tobacco unit shipment

volume across the Region, notably Russia and Ukraine, partly offset

by lower cigarette shipment volume, mainly Russia and Ukraine;

and

- South & Southeast Asia, reflecting higher cigarette

shipment volume, principally in Pakistan and Thailand.

Impact of Inventory Movements

On a like-for-like basis, excluding the net unfavorable impact

of estimated distributor inventory movements of approximately 0.2

billion units, PMI’s total in-market sales declined by 0.6%, due to

a 2.6% decline of cigarette in-market sales, partially offset by a

33.3% increase in heated tobacco unit in-market sales.

Six Months Year-to-Date

PMI's total shipment volume decreased by 0.2%, or increased by

0.1% on a like-for-like basis, due to:

- Eastern Europe, reflecting lower cigarette shipment volume,

principally in Russia and Ukraine, partly offset by higher heated

tobacco unit shipment volume across the Region, notably Kazakhstan,

Russia and Ukraine;

- East Asia & Australia, reflecting lower cigarette shipment

volume in Japan, lower cigarette and heated tobacco unit shipment

volume in Korea, partly offset by higher heated tobacco unit

shipment volume in Japan; and

- Latin America & Canada, reflecting lower cigarette shipment

volume, principally in Argentina, Canada (primarily reflecting the

impact of the deconsolidation of RBH), and Venezuela, partly offset

by Mexico. On a like-for-like basis, PMI's total shipment volume in

the Region decreased by 4.4%;

partly offset by

- the EU, reflecting higher heated tobacco unit shipment volume

across the Region, and higher cigarette shipment volume in Poland

and Spain, partly offset by lower cigarette shipment volume in

France and Italy;

- Middle East & Africa, primarily reflecting higher cigarette

shipment volume, notably Egypt, Saudi Arabia and Turkey, partly

offset by lower cigarette shipment volume in PMI Duty Free and

Tunisia; and

- South & Southeast Asia, reflecting higher cigarette

shipment volume, principally in Pakistan, the Philippines and

Thailand, partly offset by Indonesia.

Impact of Inventory Movements

On a like-for-like basis, excluding the net unfavorable impact

of estimated distributor inventory movements of approximately 1.3

billion units, PMI’s total in-market sales growth was 0.5%, driven

by a 34.0% increase in heated tobacco unit in-market sales, partly

offset by a 1.4% decline of cigarette in-market sales.

PMI Shipment Volume by Brand

PMI Shipment Volume by Brand

Second-Quarter

Six Months

Year-to-Date

(million units)

2019

2018

Change

2019

2018

Change

Cigarettes

Marlboro

68,060

68,893

(1.2

)%

128,024

126,866

0.9

%

L&M

23,522

23,196

1.4

%

45,337

42,422

6.9

%

Chesterfield

14,202

14,926

(4.8

)%

28,501

28,801

(1.0

)%

Philip Morris

12,950

12,523

3.4

%

23,673

23,182

2.1

%

Parliament

9,847

10,993

(10.4

)%

18,677

19,453

(4.0

)%

Sampoerna A

9,355

10,174

(8.0

)%

17,256

18,798

(8.2

)%

Dji Sam Soe

7,839

6,877

14.0

%

14,490

13,573

6.8

%

Bond Street

7,741

8,390

(7.7

)%

13,412

15,365

(12.7

)%

Lark

5,349

5,969

(10.4

)%

10,619

11,546

(8.0

)%

Fortune

3,441

4,155

(17.2

)%

6,487

7,739

(16.2

)%

Others

21,493

24,625

(12.7

)%

41,620

47,256

(11.9

)%

Total Cigarettes

183,799

190,721

(3.6

)%

348,096

355,001

(1.9

)%

Heated Tobacco Units

15,056

10,987

37.0

%

26,554

20,553

29.2

%

Total PMI

198,855

201,708

(1.4

)%

374,650

375,554

(0.2

)%

Note: Sampoerna A includes Sampoerna;

Philip Morris includes Philip Morris/Dubliss; and Lark includes

Lark Harmony.

Second-Quarter

PMI's cigarette shipment volume of the following brands

decreased:

- Marlboro, mainly due to Italy and Japan, partly reflecting the

impact of out-switching to heated tobacco units, as well as France

and Saudi Arabia, partly offset by Indonesia, Mexico, the

Philippines and Turkey;

- Chesterfield, mainly due to Argentina, Russia, Saudi Arabia,

Turkey and Venezuela, partly offset by Brazil, Mexico and

Morocco;

- Parliament, mainly due to Russia and Turkey;

- Sampoerna A in Indonesia, mainly reflecting the impact of

retail price increases resulting in widened price gaps with

competitors' products and the impact of estimated trade inventory

movements following the absence of an excise tax increase in

January 2019;

- Bond Street, mainly due to Russia and Ukraine;

- Lark, mainly due to Turkey;

- Fortune in the Philippines, mainly reflecting up-trading to

Marlboro resulting from a narrowed price gap; and

- "Others," notably due to: the impact of the deconsolidation of

RBH in Canada; mid-price Sampoerna U in Indonesia, partly

reflecting the impact of above-inflation retail price increases;

and low-price brands, notably in Russia, partly offset by low-price

brands in Pakistan.

The increase in PMI's heated tobacco unit shipment volume was

mainly driven by the EU, notably Italy, Eastern Europe, notably

Russia and Ukraine, as well as Japan, partly offset by Korea and

PMI Duty Free.

PMI's cigarette shipment volume of the following brands

increased:

- L&M, mainly driven by Egypt and Thailand, partly offset by

Russia, Saudi Arabia and Turkey;

- Philip Morris, mainly driven by Indonesia and Russia, partly

offset by Argentina; and

- Dji Sam Soe in Indonesia, driven by the strong performance of

the DSS Magnum Mild 16 variant and the introduction of 20s and 50s

variants.

International Share of Market

PMI's total international market share (excluding China and the

United States), defined as PMI's cigarette and heated tobacco unit

sales volume as a percentage of total industry cigarette and heated

tobacco unit sales volume, increased by 0.1 point to 28.3%,

reflecting:

- Total international cigarette market share of 26.2%, down by

0.4 points; and

- Total international heated tobacco unit market share of 2.1%,

up by 0.5 points.

PMI's total international cigarette market share, defined as

PMI's cigarette sales volume as a percentage of total industry

cigarette sales volume, was 26.9%, down by 0.3 points.

Six Months Year-to-Date

PMI's cigarette shipment volume of the following brands

decreased:

- Chesterfield, mainly due to Argentina, Italy, Russia and

Venezuela, partly offset by Brazil, Mexico, Morocco and

Poland;

- Parliament, mainly due to Korea and Russia, partly offset by

Turkey;

- Sampoerna A in Indonesia, reflecting the same factors as in the

quarter;

- Bond Street, mainly due to Russia and Ukraine;

- Lark, mainly due to Japan and Turkey;

- Fortune in the Philippines, mainly reflecting up-trading to

Marlboro resulting from a narrowed price gap; and

- "Others," notably due to: the impact of the deconsolidation of

RBH in Canada; mid-price Sampoerna U in Indonesia, partly

reflecting the impact of above-inflation retail price increases;

and low-price brands, notably in Mexico and Russia, partly offset

by mid and low-price brands in Pakistan.

The increase in PMI's heated tobacco unit shipment volume was

mainly driven by: the EU, notably Italy, Eastern Europe, notably

Russia and Ukraine, and Japan; partly offset by Korea and PMI Duty

Free.

PMI's cigarette shipment volume of the following brands

increased:

- Marlboro, mainly driven by Indonesia, Mexico, the Philippines,

Saudi Arabia and Turkey, partially offset by Italy and Japan,

partly reflecting the impact of out-switching to heated tobacco

units, as well as France and PMI Duty Free;

- L&M, mainly driven by Egypt, Saudi Arabia and Thailand,

partly offset by Russia and Turkey;

- Philip Morris, mainly driven by Indonesia and Russia, partly

offset by Argentina; and

- Dji Sam Soe in Indonesia, driven by the same factors as for the

quarter.

International Share of Market

PMI's total international market share (excluding China and the

United States), defined as PMI's cigarette and heated tobacco unit

sales volume as a percentage of total industry cigarette and heated

tobacco unit sales volume, increased by 0.5 points to 28.2%,

reflecting:

- Total international cigarette market share of 26.1%, down by

0.1 point; and

- Total international heated tobacco unit market share of 2.1%,

up by 0.6 points.

PMI's total international cigarette market share, defined as

PMI's cigarette sales volume as a percentage of total industry

cigarette sales volume, was 26.8%, up by 0.1 point.

CONSOLIDATED FINANCIAL SUMMARY

Second-Quarter

Financial Summary - Quarters Ended June

30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other (1)

(in millions)

Net Revenues

$ 7,699

$ 7,726

(0.3

)%

5.4

%

(27

)

(447

)

459

209

(248

)

Cost of Sales

(2,665)

(2,744)

2.9

%

(2.0

)%

79

134

—

(84

)

29

Marketing, Administration and Research

Costs

(1,831)

(1,868)

2.0

%

(5.9

)%

37

148

—

—

(111

)

Amortization of Intangibles

(16)

(21)

23.8

%

23.8

%

5

—

—

—

5

Operating Income

$ 3,187

$ 3,093

3.0

%

8.4

%

94

(165

)

459

125

(325

)

Asset Impairment & Exit Costs (2)

(23

)

—

—

%

—

%

(23

)

—

—

—

(23

)

Adjusted Operating Income

$ 3,210

$ 3,093

3.8

%

9.1

%

117

(165

)

459

125

(302

)

Adjusted Operating Income

Margin

41.7

%

40.0

%

1.7pp

1.4pp

(1) Cost/Other variance includes the

impact of the RBH deconsolidation.

(2) Included in Marketing, Administration

and Research Costs above.

Net revenues, excluding unfavorable currency, increased by 5.4%,

mainly reflecting: a favorable pricing variance, driven notably by

Germany, Indonesia, Japan, the Philippines and Turkey, partly

offset by Argentina; as well as a favorable volume/mix, mainly

driven by favorable volume/mix of heated tobacco units, notably in

the EU and Eastern Europe, partly offset by unfavorable volume/mix

of cigarettes, mainly in the EU and East Asia & Australia. The

currency-neutral growth in net revenues of 5.4% came despite the

unfavorable impact of $248 million, shown in "Cost/Other,"

predominantly resulting from the deconsolidation of RBH. On a

like-for-like basis, net revenues, excluding unfavorable currency,

increased by 9.0%, as detailed in the attached Schedule 9.

Operating income, excluding unfavorable currency, increased by

8.4%. Excluding asset impairment and exit charges related to a

plant closure in Colombia as part of global manufacturing

infrastructure optimization, adjusted operating income, excluding

unfavorable currency, increased by 9.1%, primarily reflecting: a

favorable pricing variance; favorable volume/mix, notably in the

EU; partly offset by higher manufacturing costs, higher marketing,

administration and research costs and the net unfavorable impact

resulting from the deconsolidation of RBH shown in "Cost/Other." On

a like-for-like basis, adjusted operating income, excluding

unfavorable currency, increased by 15.7%, as detailed in the

attached Schedule 9.

Adjusted operating income margin, excluding currency, increased

by 1.4 points to 41.4%, reflecting the factors mentioned above, as

detailed in the attached Schedule 8, or by 2.4 points to 41.4% on a

like-for-like basis, as detailed in the attached Schedule 9.

Six Months Year-to-Date

Financial Summary - Six Months Ended

June 30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other (1)

(in millions)

Net Revenues

$ 14,450

$ 14,622

(1.2

)%

4.4

%

(172

)

(816

)

687

194

(237

)

Cost of Sales

(5,130

)

(5,359

)

4.3

%

(0.3

)%

229

244

—

(74

)

59

Marketing, Administration and Research

Costs (2)

(4,048

)

(3,701

)

(9.4

)%

(16.5

)%

(347

)

262

—

—

(609

)

Amortization of Intangibles

(35

)

(43

)

18.6

%

16.3

%

8

1

—

—

7

Operating Income

$ 5,237

$ 5,519

(5.1

)%

0.5

%

(282

)

(309

)

687

120

(780

)

Asset Impairment & Exit Costs (3)

(43

)

—

—

%

—

%

(43

)

—

—

—

(43

)

Canadian Tobacco Litigation-Related

Expense (3)

(194

)

—

—

%

—

%

(194

)

—

—

—

(194

)

Loss on Deconsolidation of RBH (3)

(239

)

—

—

%

—

%

(239

)

—

—

—

(239

)

Adjusted Operating Income

$ 5,713

$ 5,519

3.5

%

9.1

%

194

(309

)

687

120

(304

)

Adjusted Operating Income

Margin

39.5

%

37.7

%

1.8pp

1.7pp

(1) Cost/Other variance includes the

impact of the RBH deconsolidation.

(2) Unfavorable Cost/Other variance

includes the 2019 Canadian tobacco litigation-related expense, the

loss on deconsolidation of RBH, asset impairment and exit costs,

and the impact of the RBH deconsolidation.

(3) Included in Marketing, Administration

and Research Costs above.

Net revenues, excluding unfavorable currency, increased by 4.4%,

mainly reflecting: a favorable pricing variance, notably in Canada,

Germany, Indonesia, Japan, the Philippines and Turkey, partly

offset by Argentina and Saudi Arabia; and favorable volume/mix,

mainly driven by favorable volume/mix of heated tobacco units in

the EU and Eastern Europe, partly offset by unfavorable volume/mix

of cigarettes, mainly in the EU, Eastern Europe and East Asia &

Australia, as well as unfavorable volume/mix of heated tobacco

units in East Asia & Australia. The currency-neutral growth in

net revenues of 4.4% came despite the unfavorable impact of $237

million, shown in "Cost/Other," predominantly resulting from the

deconsolidation of RBH. On a like-for-like basis, net revenues,

excluding unfavorable currency, increased by 6.2%, as detailed in

the attached Schedule 9.

Operating income, excluding unfavorable currency, increased by

0.5%. Excluding the loss on deconsolidation of RBH, the Canadian

tobacco litigation-related expense, and asset impairment and exit

charges related to plant closures in Colombia and Pakistan as part

of global manufacturing infrastructure optimization, adjusted

operating income, excluding unfavorable currency, increased by

9.1%, primarily reflecting: a favorable pricing variance; favorable

volume/mix, mainly in the EU, partly offset by East Asia &

Australia; and lower manufacturing costs; partly offset by higher

marketing, administration and research costs, the net unfavorable

impact resulting from the deconsolidation of RBH, shown in

"Cost/Other," as well as increased investment behind reduced-risk

products mainly in the EU and Eastern Europe. On a like-for-like

basis, adjusted operating income, excluding unfavorable currency,

increased by 12.7%, as detailed in the attached Schedule 9.

Adjusted operating income margin, excluding currency, increased

by 1.7 points to 39.4%, reflecting the factors mentioned above, as

detailed in the attached Schedule 8, or by 2.2 points to 39.4% on a

like-for-like basis, as detailed in the attached Schedule 9.

EUROPEAN UNION REGION

Second-Quarter

Financial Summary - Quarters Ended June

30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 2,577

$ 2,503

3.0

%

11.6

%

74

(216

)

84

206

—

Operating Income

$ 1,195

$ 1,177

1.5

%

11.8

%

18

(121

)

84

168

(113

)

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 1,195

$ 1,177

1.5

%

11.8

%

18

(121

)

84

168

(113

)

Adjusted Operating Income

Margin

46.4

%

47.0

%

(0.6)pp

0.1pp

Net revenues, excluding unfavorable currency, increased by

11.6%, reflecting a favorable pricing variance, driven principally

by France and Germany, and favorable volume/mix, driven by

favorable heated tobacco unit volume, notably in the Czech

Republic, Germany, Italy and Poland, partly offset by unfavorable

cigarette volume, notably in France and Italy, and unfavorable

cigarette volume/mix in Germany.

Operating income, excluding unfavorable currency, increased by

11.8%, mainly reflecting: a favorable pricing variance; favorable

volume/mix, notably in the Czech Republic, Italy and Poland, driven

by heated tobacco unit volume, partly offset by lower cigarette

volume, notably in France and Italy, and unfavorable volume/mix in

Germany; partially offset by higher manufacturing costs and higher

marketing, administration and research costs primarily related to

reduced-risk products.

Adjusted operating income margin, excluding currency, increased

by 0.1 point to 47.1%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Six Months Year-to-Date

Financial Summary - Six Months Ended

June 30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 4,736

$ 4,491

5.5

%

13.4

%

245

(359

)

152

452

—

Operating Income

$ 2,091

$ 1,917

9.1

%

19.2

%

174

(195

)

152

365

(148

)

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 2,091

$ 1,917

9.1

%

19.2

%

174

(195

)

152

365

(148

)

Adjusted Operating Income

Margin

44.2

%

42.7

%

1.5pp

2.2pp

Net revenues, excluding unfavorable currency, increased by

13.4%, reflecting a favorable pricing variance, driven principally

by Germany, and favorable volume/mix, primarily reflecting

favorable heated tobacco unit volume/mix, notably in the Czech

Republic, Germany, Italy and Poland, partly offset by lower

cigarette volume, notably in France and Italy, and lower cigarette

volume/mix in Germany.

Operating income, excluding unfavorable currency, increased by

19.2%, mainly reflecting: a favorable pricing variance; favorable

volume/mix, notably in the Czech Republic, Italy and Poland, driven

by heated tobacco unit volume, partially offset by lower cigarette

volume/mix, notably in France, Germany and Italy; partially offset

by higher manufacturing costs and higher marketing, administration

and research costs primarily related to reduced-risk products.

Adjusted operating income margin, excluding currency, increased

by 2.2 points to 44.9%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Total Market, PMI Shipment & Market Share

Commentaries

European Union Key Data

Second-Quarter

Six Months

Year-to-Date

Change

Change

2019

2018

% / pp

2019

2018

% / pp

Total Market (billion units)

124.3

126.2

(1.5

)%

231.5

234.0

(1.1

)%

PMI Shipment Volume (million

units)

Cigarettes

46,367

47,984

(3.4

)%

85,855

87,655

(2.1

)%

Heated Tobacco Units

3,043

1,195

+100.0%

5,336

2,123

+100.0%

Total EU

49,410

49,179

0.5

%

91,191

89,778

1.6

%

PMI Market Share

Marlboro

18.1

%

18.5

%

(0.4

)

18.1

%

18.4

%

(0.3

)

L&M

6.9

%

7.0

%

(0.1

)

6.8

%

6.9

%

(0.1

)

Chesterfield

5.8

%

5.9

%

(0.1

)

5.9

%

5.9

%

—

Philip Morris

2.7

%

2.9

%

(0.2

)

2.8

%

3.0

%

(0.2

)

HEETS

2.4

%

1.0

%

1.4

2.3

%

0.9

%

1.4

Others

3.0

%

3.1

%

(0.1

)

3.0

%

3.2

%

(0.2

)

Total EU

38.9

%

38.4

%

0.5

38.9

%

38.3

%

0.6

Second-Quarter

The estimated total market in the EU decreased by 1.5% to 124.3

billion units, mainly due to:

- France, down by 6.6%, mainly due to the impact of significant

excise-tax driven price increases, as well as an increase in the

prevalence of illicit trade;

- Germany, down by 3.4%, primarily reflecting the impact of price

increases in the first quarter of 2019; and

- Italy, down by 3.1%, primarily reflecting the impact of price

increases in the first quarter of 2019;

partly offset by

- Poland, up by 8.0%, primarily reflecting a lower prevalence of

illicit trade.

PMI's total shipment volume increased by 0.5% to 49.4 billion

units, notably driven by:

- higher heated tobacco unit shipment volume across the Region,

notably Italy, driven by higher market share; and

- higher cigarette shipment volume, notably in Poland, driven by

the higher total market;

partly offset by:

- lower cigarette shipment volume, mainly in France and Germany

due to the lower total market, and Italy, due to the lower total

market and lower cigarette market share.

Six Months Year-to-Date

The estimated total market in the EU decreased by 1.1% to 231.5

billion units, notably due to:

- France, down by 7.3%, primarily reflecting the impact of price

increases in 2018 and the first quarter of 2019;

- Germany, down by 3.7%, primarily reflecting the impact of price

increases in 2018 and the first quarter of 2019; and

- Italy, down by 3.0%, primarily reflecting the impact of price

increases in 2018 and the first quarter of 2019;

partly offset by

- Poland, up by 8.0%, reflecting the same factors as in the

quarter; and

- Spain, up by 0.9%, partly reflecting a lower prevalence of

illicit trade.

PMI's total shipment volume increased by 1.6% to 91.2 billion

units, notably driven by:

- higher heated tobacco unit shipment volume across the Region,

notably Italy, driven by higher market share; and

- higher cigarette shipment volume, notably in Poland, mainly

driven by the higher total market;

partly offset by

- lower cigarette shipment volume, mainly in France due to the

lower total market, and Italy, due to the lower total market and

lower cigarette market share.

EASTERN EUROPE REGION

Second-Quarter

Financial Summary - Quarters Ended June

30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 822

$ 760

8.2

%

16.8

%

62

(66

)

36

92

—

Operating Income

$ 256

$ 261

(1.9

)%

4.2

%

(5

)

(16

)

36

27

(52

)

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 256

$ 261

(1.9

)%

4.2

%

(5

)

(16

)

36

27

(52

)

Adjusted Operating Income

Margin

31.1

%

34.3

%

(3.2)pp

(3.7)pp

Net revenues, excluding unfavorable currency, increased by

16.8%, reflecting a favorable pricing variance, driven notably by

Russia and Ukraine, and favorable volume/mix, predominantly driven

by heated tobacco unit volume in Russia, partly offset by lower

cigarette volume/mix in Russia.

Operating income, excluding unfavorable currency, increased by

4.2%, reflecting: a favorable pricing variance; favorable

volume/mix, predominantly driven by heated tobacco unit volume in

Russia, partly offset by lower cigarette volume/mix in Russia;

partly offset by higher marketing, administration and research

costs, notably reflecting increased investments behind reduced-risk

products, primarily in Russia in support of geographic

expansion.

Adjusted operating income margin, excluding currency, decreased

by 3.7 points to 30.6%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Six Months Year-to-Date

Financial Summary - Six Months Ended

June 30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 1,401

$ 1,327

5.6

%

15.4

%

74

(130

)

53

151

—

Operating Income

$ 385

$ 412

(6.6

)%

1.9

%

(27

)

(35

)

53

41

(86

)

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 385

$ 412

(6.6

)%

1.9

%

(27

)

(35

)

53

41

(86

)

Adjusted Operating Income

Margin

27.5

%

31.0

%

(3.5)pp

(3.6)pp

Net revenues, excluding unfavorable currency, increased by

15.4%, reflecting a favorable pricing variance, driven notably by

Ukraine, and favorable volume/mix, predominantly driven by heated

tobacco unit volume in Russia, partly offset by lower cigarette

volume/mix in Russia.

Operating income, excluding unfavorable currency, increased by

1.9%, reflecting: a favorable pricing variance; favorable

volume/mix, predominantly driven by heated tobacco unit volume in

Russia, partly offset by lower cigarette volume/mix in Russia;

partly offset by higher manufacturing costs and higher marketing,

administration and research costs, notably reflecting increased

investments behind reduced-risk products, primarily in Russia in

support of geographic expansion.

Adjusted operating income margin, excluding currency, decreased

by 3.6 points to 27.4%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume

Second-Quarter

Six Months

Year-to-Date

(million units)

2019

2018

Change

2019

2018

Change

Cigarettes

27,080

28,454

(4.8

)%

47,400

50,493

(6.1

)%

Heated Tobacco Units

2,807

951

+100.0%

4,355

1,515

+100.0%

Total Eastern Europe

29,887

29,405

1.6

%

51,755

52,008

(0.5

)%

Second-Quarter

The estimated total market in Eastern Europe decreased, notably

due to:

- Russia, down by 3.8%, primarily reflecting the impact of price

increases, as well as an increase in the prevalence of illicit

trade; and

- Ukraine, down by 14.5%, primarily reflecting the impact of

excise tax-driven price increases, as well as an increase in the

prevalence of illicit trade.

PMI's total shipment volume increased by 1.6% to 29.9 billion

units, driven by:

- Kazakhstan, up by 11.7%, reflecting a higher total market and a

higher market share of heated tobacco units; and

- Russia, up by 1.1%, reflecting a higher market share of heated

tobacco units, partially offset by the lower total market;

partly offset by

- Ukraine, down by 4.3%, reflecting a lower total market, partly

offset by higher market share of cigarettes and heated tobacco

units.

Six Months Year-to-Date

The estimated total market in Eastern Europe decreased, notably

due to:

- Russia, down by 4.9%, reflecting the same factors as in the

quarter, as well as the unfavorable impact in the first quarter of

2019 of estimated trade inventory movements in certain key

accounts; and

- Ukraine, down by 12.8%, reflecting the same factors as in the

quarter.

PMI's total shipment volume decreased by 0.5% to 51.8 billion

units, primarily in:

- Russia, down by 1.5%. Excluding the net unfavorable impact of

estimated distributor inventory movements of 0.5 billion units,

primarily of heated tobacco units, PMI's in-market sales growth was

0.3%, reflecting a higher market share of heated tobacco units,

partially offset by the lower total market;

partly offset by

- Kazakhstan, up by 11.9%, reflecting a higher total market and a

higher market share of heated tobacco units.

MIDDLE EAST & AFRICA REGION

Second-Quarter

Financial Summary - Quarters Ended June

30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 1,004

$ 1,022

(1.8

)%

7.0

%

(18

)

(90

)

115

(48

)

5

Operating Income

$ 441

$ 403

9.4

%

20.8

%

38

(46

)

115

(47

)

16

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 441

$ 403

9.4

%

20.8

%

38

(46

)

115

(47

)

16

Adjusted Operating Income

Margin

43.9

%

39.4

%

4.5pp

5.1pp

Net revenues, excluding unfavorable currency, increased by 7.0%,

primarily reflecting a favorable pricing variance, driven

predominantly by Turkey, partly offset by unfavorable volume/mix,

notably due to unfavorable heated tobacco unit volume in PMI Duty

Free, and unfavorable cigarette volume in the GCC, primarily Saudi

Arabia, and Turkey, partly offset by Egypt.

Operating income, excluding unfavorable currency, increased by

20.8%, mainly reflecting a favorable pricing variance and lower

manufacturing costs, partly offset by unfavorable volume/mix,

notably due to unfavorable cigarette and heated tobacco unit volume

in PMI Duty Free, and unfavorable cigarette volume in the GCC,

primarily Saudi Arabia, and Turkey.

Adjusted operating income margin, excluding currency, increased

by 5.1 points to 44.5%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Six Months Year-to-Date

Financial Summary - Six Months Ended

June 30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 1,931

$ 1,983

(2.6

)%

5.3

%

(52

)

(158

)

65

25

16

Operating Income

$ 785

$ 777

1.0

%

10.3

%

8

(72

)

65

(12

)

27

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 785

$ 777

1.0

%

10.3

%

8

(72

)

65

(12

)

27

Adjusted Operating Income

Margin

40.7

%

39.2

%

1.5pp

1.8pp

Net revenues, excluding unfavorable currency, increased by 5.3%,

mainly reflecting: a favorable pricing variance, driven by Egypt,

PMI Duty Free and Turkey, partly offset by Saudi Arabia; favorable

volume/mix, driven by favorable cigarette volume/mix, notably in

Saudi Arabia and Turkey, partly offset by unfavorable cigarette and

heated tobacco unit volume in PMI Duty Free; and a favorable

cost/other variance mainly driven by the timing of other

revenues.

Operating income, excluding unfavorable currency, increased by

10.3%, mainly reflecting: a favorable pricing variance, lower

manufacturing costs and a favorable cost/other variance, as noted

above; partly offset by unfavorable volume/mix, notably due to

unfavorable cigarette and heated tobacco unit volume in PMI Duty

Free, partly offset by favorable cigarette volume/mix in Saudi

Arabia and favorable cigarette volume in Turkey.

Adjusted operating income margin, excluding currency, increased

by 1.8 points to 41.0%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume

Second-Quarter

Six Months

Year-to-Date

(million units)

2019

2018

Change

2019

2018

Change

Cigarettes

31,659

34,177

(7.4

)%

64,963

63,425

2.4

%

Heated Tobacco Units

719

971

(26.0

)%

1,473

1,680

(12.3

)%

Total Middle East & Africa

32,378

35,148

(7.9

)%

66,436

65,105

2.0

%

Second-Quarter

The estimated total market in the Middle East & Africa

increased, notably driven by:

- Saudi Arabia, up by 6.7%, primarily reflecting a favorable

comparison with the second quarter of 2018, which was down by 23.8%

mainly due to the impact of retail price increases in 2017 and the

first quarter of 2018 following the introduction of the new excise

tax in June 2017 and VAT in January 2018, respectively; and

- Turkey, up by 9.2%, mainly reflecting a lower prevalence of

illicit trade;

partly offset by

- Egypt, down by 4.7%, mainly due to the impact of price

increases in 2018.

PMI's total shipment volume decreased by 7.9% to 32.4 billion

units, notably in:

- PMI Duty Free, down by 8.5%. Excluding the net unfavorable

impact of estimated distributor inventory movements of 0.2 billion

units, principally cigarettes, PMI's in-market sales decline was

5.9%;

- Saudi Arabia, down by 50.2%. Net unfavorable estimated

distributor inventory movements totaled 0.9 billion cigarettes,

mainly attributable to the pay-back of adjustments in the first

quarter of 2019 resulting from the delayed importation deadline

before the implementation of plain packaging scheduled for January

1, 2020. Excluding the impact of these inventory movements, PMI's

in-market sales grew by 3.5%, reflecting a favorable comparison

with the second quarter of 2018, which was down by 40.1%, mainly

due to the impact of the factors described for the total market

above; and

- Turkey, down by 7.6%, reflecting lower market share, mainly

driven by the timing of retail price increases in April 2019

compared to competition, partly offset by a higher total

market;

partly offset by

- Egypt, up by 11.5%, primarily reflecting higher market share,

driven by L&M, partly offset by a lower total market.

Six Months Year-to-Date

The estimated total market in the Middle East & Africa

increased, notably driven by:

- Algeria, up by 4.9%, or down by 4.1% excluding the net

favorable impact of estimated trade inventory movements associated

with expectations regarding excise tax announcements in 2019

compared to 2018;

- Saudi Arabia, up by 7.5%, primarily reflecting a favorable

comparison with the first six months of 2018, which was down by

33.2% mainly due to the impact of retail price increases in 2017

and the first quarter of 2018 following the introduction of the new

excise tax in June 2017 and VAT in January 2018, respectively;

and

- Turkey, up by 11.5%, mainly reflecting the same factor as in

the quarter;

partly offset by

- Egypt, down by 2.2%, mainly reflecting the same factor as in

the quarter.

PMI's total shipment volume increased by 2.0% to 66.4 billion

units, notably in:

- Egypt, up by 10.5%, primarily reflecting higher market share,

driven by L&M, partly offset by a lower total market;

- Saudi Arabia, up by 69.0%. Net favorable estimated distributor

inventory movements totaled 1.7 billion cigarettes, mainly

attributable to the timing of shipments compared to 2018. Excluding

the impact of these inventory movements, PMI's in-market sales grew

by 6.1%, reflecting a favorable comparison with the first six

months of 2018, which were down by 48.3%, mainly due to the impact

of the factors described for the quarter above; and

- Turkey, up by 5.6%, driven by a higher total market, partly

offset by a lower market share reflecting the same factor as in the

quarter;

partly offset by

- PMI Duty Free, down by 10.4%. Excluding the net unfavorable

impact of estimated distributor inventory movements of 0.6 billion

units, PMI's in-market sales decline was 4.3%.

SOUTH & SOUTHEAST ASIA REGION

Second-Quarter

Financial Summary - Quarters Ended June

30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 1,248

$ 1,156

8.0

%

10.7

%

92

(32

)

114

10

—

Operating Income

$ 492

$ 440

11.8

%

15.0

%

52

(14

)

114

9

(57

)

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 492

$ 440

11.8

%

15.0

%

52

(14

)

114

9

(57

)

Adjusted Operating Income

Margin

39.4

%

38.1

%

1.3pp

1.4pp

Net revenues, excluding unfavorable currency, increased by

10.7%, predominantly reflecting a favorable pricing variance driven

by Indonesia and the Philippines.

Operating income, excluding unfavorable currency, increased by

15.0%, predominantly reflecting a favorable pricing variance,

partly offset by higher manufacturing costs, mainly due to

Indonesia, and higher marketing, administration and research costs,

notably due to the Philippines, partly offset by Indonesia.

Adjusted operating income margin, excluding currency, increased

by 1.4 points to 39.5%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Six Months Year-to-Date

Financial Summary - Six Months Ended

June 30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 2,361

$ 2,237

5.5

%

9.7

%

124

(93

)

190

27

—

Operating Income

$ 932

$ 869

7.2

%

12.3

%

63

(44

)

190

23

(106

)

Asset Impairment & Exit Costs (1)

(20

)

—

—

%

—

%

(20

)

—

—

—

(20

)

Adjusted Operating Income

$ 952

$ 869

9.6

%

14.6

%

83

(44

)

190

23

(86

)

Adjusted Operating Income

Margin

40.3

%

38.8

%

1.5pp

1.8pp

(1) Included in marketing, administration

and research costs at the consolidated operating income level.

Net revenues, excluding unfavorable currency, increased by 9.7%,

reflecting: a favorable pricing variance, driven principally by

Indonesia and the Philippines, as well as a favorable volume/mix,

largely driven by favorable cigarette volume and mix in the

Philippines, partly offset by lower cigarette volume and mix in

Indonesia.

Operating income, excluding unfavorable currency, increased by

12.3%. Excluding asset impairment and exit costs related to a plant

closure in Pakistan in the first quarter of 2019 as part of global

manufacturing infrastructure optimization, adjusted operating

income, excluding unfavorable currency, increased by 14.6%, mainly

reflecting: a favorable pricing variance; favorable volume/mix,

mainly driven by favorable cigarette volume and mix in the

Philippines, partly offset by lower cigarette volume and mix in

Indonesia; partly offset by higher manufacturing costs, mainly due

to Indonesia and the Philippines, and higher marketing,

administration and research costs, partly due to the

Philippines.

Adjusted operating income margin, excluding currency, increased

by 1.8 points to 40.6%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume

Second-Quarter

Six Months

Year-to-Date

(million units)

2019

2018

Change

2019

2018

Change

Cigarettes

46,376

44,788

3.5

%

87,868

85,006

3.4

%

Heated Tobacco Units

—

—

—

%

—

—

—

%

Total South & Southeast

Asia

46,376

44,788

3.5

%

87,868

85,006

3.4

%

Second-Quarter

The estimated total market in South & Southeast Asia

increased, notably driven by:

- Indonesia, up by 4.8%, mainly driven by the absence of an

excise tax increase in January 2019;

- Pakistan, up by 21.7%, mainly driven by the timing of estimated

trade inventory movements related to anticipated excise tax-driven

price increases in 2019 compared to the prior year. Excluding the

impact of these inventory movements, the total market is estimated

to have declined by 7.3%; and

- Thailand, up by 10.0%, primarily reflecting on-going recovery

from the September 2017 excise tax reform;

partly offset by

- the Philippines, down by 1.5%, mainly due to the impact of

price increases in the below premium segment in the fourth quarter

of 2018; and

- Vietnam, down by 2.9% reflecting the impact of the excise tax

increase in January 2019.

PMI's total shipment volume increased by 3.5% to 46.4 billion

units, notably driven by:

- Pakistan, up by 33.6%, mainly reflecting a higher total market

and higher market share resulting from the timing of estimated

trade inventory movements described above; and

- Thailand, up by 19.8%, mainly reflecting a higher market share

driven by the continued strong performance of L&M 7.1 and the

favorable impact of distribution expansion in 2018, as well as a

higher total market.

Six Months Year-to-Date

The estimated total market in South & Southeast Asia

increased, notably driven by:

- Indonesia, up by 2.1%, reflecting the same factor as in the

quarter;

- Pakistan, up by 10.5%, reflecting the same factor as in the

quarter. Excluding the impact of trade inventory movements, the

total market is estimated to have declined by 4.0%;

- the Philippines, up by 3.2%, mainly reflecting the impact of

net favorable estimated trade inventory movements in the first

quarter of 2019 associated with expectations regarding excise

tax-driven price increases, partly offset by the impact of price

increases in the below premium segment in the fourth quarter of

2018; and

- Thailand, up by 17.8%, reflecting the same factor as in the

quarter;

partly offset by

- Vietnam, down by 5.3% reflecting the same factor as in the

quarter.

PMI's total shipment volume increased by 3.4% to 87.9 billion

units, notably driven by:

- Pakistan, up by 22.3%, mainly reflecting a higher market share

resulting from the timing of estimated trade inventory movements

described above, as well as a higher total market;

- the Philippines, up by 3.7%, mainly reflecting the higher total

market; and

- Thailand, up by 26.6%, reflecting the same factors as in the

quarter;

partly offset by

- Indonesia, down by 1.8%, mainly reflecting a lower market share

primarily due to the widened retail price gap of A Mild to

competitive brands following its price increase in October 2018,

partly offset by the higher total market.

EAST ASIA & AUSTRALIA REGION

Second-Quarter

Financial Summary - Quarters Ended June

30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 1,521

$ 1,478

2.9

%

4.6

%

43

(25

)

121

(53

)

—

Operating Income

$ 642

$ 498

28.9

%

23.7

%

144

26

121

(32

)

29

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 642

$ 498

28.9

%

23.7

%

144

26

121

(32

)

29

Adjusted Operating Income

Margin

42.2

%

33.7

%

8.5pp

6.1pp

During the quarter, net revenues, excluding currency, increased

by 4.6%, reflecting a favorable pricing variance, driven

predominantly by Japan, partly offset by unfavorable volume/mix,

mainly due to unfavorable cigarette volume in Australia and Japan

and unfavorable cigarette and heated tobacco unit volume in

Korea.

Operating income, excluding favorable currency, increased by

23.7%, mainly reflecting a favorable pricing variance and lower

manufacturing costs, mainly in Korea, as well as lower marketing,

administration and research costs, partly offset by unfavorable

volume/mix, mainly due to unfavorable cigarette volume in Australia

and Japan and unfavorable cigarette and heated tobacco unit volume

in Korea, partially offset by heated tobacco unit volume in

Japan.

Adjusted operating income margin, excluding currency, increased

by 6.1 points to 39.8%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Six Months Year-to-Date

Financial Summary - Six Months Ended

June 30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other

(in millions)

Net Revenues

$ 2,842

$ 3,069

(7.4

)%

(6.6

)%

(227

)

(25

)

207

(409

)

—

Operating Income

$ 1,069

$ 1,013

5.5

%

3.5

%

56

21

207

(254

)

82

Asset Impairment & Exit Costs

—

—

—

%

—

%

—

—

—

—

—

Adjusted Operating Income

$ 1,069

$ 1,013

5.5

%

3.5

%

56

21

207

(254

)

82

Adjusted Operating Income

Margin

37.6

%

33.0

%

4.6pp

3.6pp

Net revenues, excluding unfavorable currency, decreased by 6.6%,

reflecting a challenging comparison with the first six months of

2018 in which net revenues, excluding currency, grew by 16.8%,

partly fueled by higher IQOS device shipments. The decline of 6.6%

primarily reflected unfavorable volume/mix, due to lower cigarette

shipment volume in Australia, lower cigarette and IQOS device

shipment volume in Japan, and lower cigarette, heated tobacco unit

and IQOS device shipment volume in Korea, partly offset by a

favorable pricing variance driven predominantly by Japan.

Operating income, excluding favorable currency, increased by

3.5%, mainly reflecting: a favorable pricing variance, lower

manufacturing costs related to Japan and Korea, lower marketing,

administration and research costs, notably in Australia and Korea,

partly offset by Japan; partly offset by unfavorable volume/mix as

described above.

Adjusted operating income margin, excluding currency, increased

by 3.6 points to 36.6%, reflecting the factors mentioned above, as

detailed on Schedule 8.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume

Second-Quarter

Six Months

Year-to-Date

(million units)

2019

2018

Change

2019

2018

Change

Cigarettes

13,845

15,114

(8.4

)%

25,958

29,205

(11.1

)%

Heated Tobacco Units

8,428

7,838

7.5

%

15,277

15,180

0.6

%

Total East Asia & Australia

22,273

22,952

(3.0

)%

41,235

44,385

(7.1

)%

Second-Quarter

The estimated total market in East Asia & Australia,

excluding China, decreased, notably due to:

- Australia, down by 10.8%, mainly reflecting the impact of

excise tax-driven retail price increases;

- Japan, down by 4.3%, mainly reflecting the impact of the

October 1, 2018 excise tax-driven retail price increases; and

- Taiwan, down by 16.3%, primarily reflecting the impact of

excise tax-driven retail price increases.

PMI's total shipment volume decreased by 3.0% to 22.3 billion

units, notably in:

- Japan, down by 0.4%. Excluding the net favorable impact of

estimated distributor inventory movements of approximately 0.7

billion units, comprised of approximately 0.5 billion heated

tobacco units and approximately 0.2 billion cigarettes, PMI's

in-market sales decline was 5.5%, reflecting the lower total market

and lower cigarette market share; and

- Korea, down by 9.8%, principally due to lower cigarette market

share.

Six Months Year-to-Date

The estimated total market in East Asia & Australia,

excluding China, decreased, notably due to:

- Japan, down by 4.4%, mainly reflecting the same factor as in

the quarter; and

- Taiwan, down by 3.8%, primarily reflecting the impact of excise

tax-driven retail price increases in 2017.

PMI's total shipment volume decreased by 7.1% to 41.2 billion

units, notably in:

- Japan, down by 7.1%. Excluding the net unfavorable impact of

estimated distributor inventory movements of approximately 0.5

billion units, comprised of approximately 0.1 billion heated

tobacco units and approximately 0.4 billion cigarettes, PMI's

in-market sales decline was 5.5%, reflecting the lower total market

and lower cigarette market share; and

- Korea, down by 9.7%, principally due to lower cigarette market

share.

LATIN AMERICA & CANADA REGION

Second-Quarter

Financial Summary - Quarters Ended June

30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other (1)

(in millions)

Net Revenues

$ 527

$ 807

(34.7

)%

(32.5

)%

(280

)

(18

)

(11

)

2

(253

)

Operating Income

$ 161

$ 314

(48.7

)%

(50.6

)%

(153

)

6

(11

)

—

(148

)

Asset Impairment & Exit Costs (2)

(23

)

—

—

%

—

%

(23

)

—

—

—

(23

)

Adjusted Operating Income

$ 184

$ 314

(41.4

)%

(43.3

)%

(130

)

6

(11

)

—

(125

)

Adjusted Operating Income

Margin

34.9

%

38.9

%

(4.0)pp

(6.2)pp

(1) Unfavorable Cost/Other variance

includes the impact of the RBH deconsolidation.

(2) Included in marketing, administration

and research costs at the consolidated operating income level.

Net revenues, excluding unfavorable currency, decreased by

32.5%, almost entirely due to the unfavorable impact of $253

million, shown in "Cost/Other," resulting from the deconsolidation

of RBH. On a like-for-like basis, net revenues, excluding

unfavorable currency, decreased by 2.0%, as detailed in the

attached Schedule 10, mainly due to an unfavorable pricing variance

primarily resulting from the adoption of highly inflationary

accounting in Argentina.

Operating income, excluding favorable currency, decreased by

50.6%, predominantly due to the unfavorable impact, shown in

"Cost/Other," resulting from the deconsolidation of RBH. Excluding

asset impairment and exit costs related to a plant closure in

Colombia as part of global manufacturing infrastructure

optimization, adjusted operating income, excluding favorable

currency, decreased by 43.3%. On a like-for-like basis, excluding

favorable currency, adjusted operating income increased by 29.0%,

as detailed in the attached Schedule 10, mainly reflecting lower

manufacturing costs, and lower marketing, administration and

research costs, partly resulting from the adoption of highly

inflationary accounting in Argentina.

Adjusted operating income margin, excluding currency, decreased

by 6.2 points to 32.7%, reflecting the factors mentioned above, as

detailed on Schedule 8, or increased by 7.9 points to 32.7% on a

like-for-like basis, as detailed in the attached Schedule 10.

Six Months Year-to-Date

Financial Summary - Six Months Ended

June 30,

Change Fav./(Unfav.)

Variance Fav./(Unfav.)

2019

2018

Total

Excl. Curr.

Total

Cur- rency

Price

Vol/ Mix

Cost/ Other (1)

(in millions)

Net Revenues

$ 1,179

$ 1,515

(22.2

)%

(18.8

)%

(336

)

(51

)

20

(52

)

(253

)

Operating Income (Loss)

$ (25)

$ 531

-(100)%

-(100)%

(556

)

16

20

(43

)

(549

)

Asset Impairment & Exit Costs (2)

(23

)

—

—

%

—

%

(23

)

—

—

—

(23

)

Canadian Tobacco Litigation-Related

Expense (2)

(194

)

—

—

%

—

%

(194

)

—

—

—

(194

)

Loss on Deconsolidation of RBH (2)

(239

)

—

—

%

—

%

(239

)

—

—

—

(239

)

Adjusted Operating Income

$ 431

$ 531

(18.8

)%

(21.8

)%

(100

)

16

20

(43

)

(93

)

Adjusted Operating Income

Margin

36.6

%

35.0

%

1.6pp

(1.3)pp

(1) Unfavorable Cost/Other variance

includes the impact of the RBH deconsolidation.

(2) Included in marketing, administration

and research costs at the consolidated operating income level.

Net revenues, excluding unfavorable currency, decreased by

18.8%, predominantly due to: the unfavorable impact of $253

million, shown in "Cost/Other," resulting from the deconsolidation

of RBH. On a like-for-like basis, net revenues, excluding

unfavorable currency, decreased by 2.7%, as detailed in the

attached Schedule 10, reflecting: unfavorable volume, mainly due to

Argentina and Canada, partly offset by Mexico (largely due to the

timing of retail price increases compared to 2018); partly offset

by a favorable pricing variance, notably in Canada and Mexico,

partially offset by Argentina mainly due to the adoption of highly

inflationary accounting.

Operating income, excluding favorable currency, decreased by

over 100%, predominantly due to the unfavorable impact, shown in

"Cost/Other," resulting from the deconsolidation of RBH. Excluding

asset impairment and exit costs related to a plant closure in

Colombia as part of global manufacturing infrastructure

optimization, the Canadian tobacco litigation-related expense and

the loss on deconsolidation of RBH, adjusted operating income,

excluding favorable currency, decreased by 21.8%. On a

like-for-like basis, excluding favorable currency, adjusted

operating income increased by 16.9%, as detailed in the attached

Schedule 10. This increase reflected: a favorable pricing variance;

lower manufacturing costs and lower marketing, administration and

research costs, partly resulting from the adoption of highly

inflationary accounting in Argentina; partly offset by an

unfavorable volume/mix, mainly due to lower cigarette volume in

Argentina and Canada, partly offset by higher cigarette volume in

Mexico (largely due to the timing of retail price increases

compared to 2018).

Adjusted operating income margin, excluding currency, decreased

by 1.3 points to 33.7%, reflecting the factors mentioned above, as

detailed on Schedule 8, or increased by 5.6 points to 33.7% on a

like-for-like basis, as detailed in the attached Schedule 10.

Total Market, PMI Shipment & Market Share

Commentaries

PMI Shipment Volume

Second-Quarter

Six Months