PG&E Corp. to Issue Shares - Analyst Blog

March 15 2012 - 11:00AM

Zacks

PG&E Corporation (PCG) has recently

announced a secondary offering of 5,900,000 shares, valued at

approximately $250 million. The shares are expected to be issued on

March 20, 2012.

The offering would be utilized partly to meet a portion of the

company's estimated equity needs during 2012. The rest of the

proceeds would be utilized in its regulated utility subsidiary,

Pacific Gas and Electric Company, for general corporate

purposes.

PG&E ended fiscal 2011 with cash and cash equivalents of

approximately $513 million compared with $291 million at year-end

2010. Cash generated from operations in 2011 totaled $3.7 billion

versus cash from operations of $3.2 billion in the year-ago period.

Long-term debt however increased to $11.8 billion at fiscal 2011

end from roughly $10.9 billion at the end of fiscal 2010.

PG&E operates in the regulatory progressive state of

California. The California Public Utilities Commission (CPUC)

provides the company with ample regulatory support through

progressive mechanisms like decoupling. Decoupling insulates the

top line of the company from risks of lower customer usage,

vagaries of weather and volatility in prices. The revenue

decoupling mechanism is paired with an annual attrition mechanism

that adjusts annually for customer growth, inflation and

replacement of aging infrastructure facilities.

PG&E Corporation has a solid portfolio of regulated utility

assets that offer a stable earnings base and substantial long-term

growth potential. The company strives to optimize generation

margins by improving the cost structure, performance and

reliability of its nuclear as well as fossil units. Going forward,

PG&E’s earnings growth will be driven by favorable decisions

from CPUC and FERC, as well as long-term supply agreements,

diversification into alternative power sources and infrastructure

improvement programs (such as Cornerstone and Smart Meter).

These positives, however, will be partially offset by risks,

including the present unfavorable macro backdrop, headwinds in the

California economy, tepid demand for electricity, risk of penalties

related to the San Bruno pipeline explosion and power-price

volatility. The company presently retains a short-term Zacks #3

Rank (Hold) that corresponds with our long-term Neutral

recommendation on the stock.

San Francisco, California-based PG&E Corporation is the

parent holding company of California’s largest regulated electric

and gas utility, Pacific Gas and Electric Company (Pacific Gas).

The company mainly competes with Edison

International (EIX) and Sempra Energy

(SRE).

EDISON INTL (EIX): Free Stock Analysis Report

PG&E CORP (PCG): Free Stock Analysis Report

SEMPRA ENERGY (SRE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

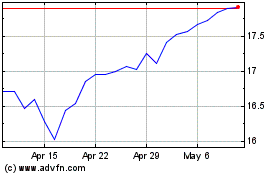

PG&E (NYSE:PCG)

Historical Stock Chart

From Jun 2024 to Jul 2024

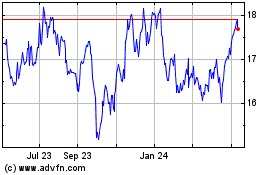

PG&E (NYSE:PCG)

Historical Stock Chart

From Jul 2023 to Jul 2024