Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 22 2021 - 9:47AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

October, 2021

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on agreement with ANP

—

Rio de Janeiro, October 22, 2021

- Petróleo Brasileiro S.A. – Petrobras informs that, on 10/14/2021, its Executive Board analyzed and approved the submission

to the Board of Directors of a proposal to enter into an Agreement between Petrobras and the National Agency of Petroleum, Natural Gas

and Biofuels (ANP) related to royalties on the operation of the Shale Industrialization Unit (SIX), located in São Mateus do Sul/PR.

The terms of the agreement were approved today by the ANP's collegiate board and will still be analyzed by Petrobras' Board of Directors.

The agreement proposal involves

an installment payment of R$ 559 million (amount based on June/21, to be updated until the agreement is signed), of which R$ 302 million

have already been provisioned in the 2Q21 financial statements.

The beginning of the payment by

the company will occur after the signing of the Agreement and will result in the termination of all legal and administrative proceedings

related to the collection of royalties and administrative fines arising from the mining of oil shale performed at SIX, as well as in the

execution of a concession agreement between Petrobras and ANP to discipline the research and mining of shale at SIX. The terms of the

agreement, as well as the draft concession agreement, will be submitted to public consultation and hearing by the ANP, as a measure of

transparency, legitimacy and legal security.

The decision to adhere to the Agreement

is in line with the risk management policy associated with contingency management and with the strategy of generating value through the

negotiation of amounts in dispute.

Facts deemed relevant on the subject

will be timely disclosed to the market.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valladares 28 – 19th floor –

20031-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 22, 2021

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

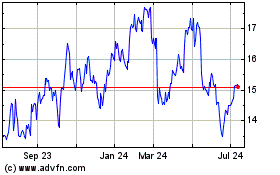

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

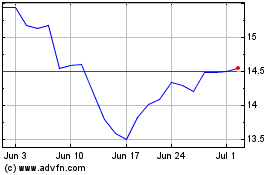

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Sep 2023 to Sep 2024