UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2020

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation – PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

Financial Information

Jan-Sep/2020

—

|

B3: PETR3 (ON) | PETR4 (PN)

NYSE: PBR (ON) | PBRA (PN)

www.petrobras.com.br/ir

petroinvest@petrobras.com.br

+ 55 21 3224-1510

Disclaimer

This presentation

contains some financial indicators that are not recognized by GAAP or the IFRS. The indicators presented herein do not have standardized

meanings and may not be comparable to indicators with a similar description used by others. We provide these indicators because

we use them as measures of company performance; they should not be considered in isolation or as a substitute for other financial

metrics that have been disclosed in accordance with IFRS. See definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA from Continuing

operations, LTM Adjusted EBITDA, LTM Adjusted EBITDA from Continuing operations, LTM Adjusted EBITDA from Discontinued operations,

Adjusted cash and cash equivalents, Net Debt, Gross Debt, Free cash flow, Leverage in the Glossary and their reconciliations in

the Liquidity and Capital Resources, Reconciliation of Adjusted EBITDA and Consolidated Debt sections.

TABLE OF CONTENTS

|

CONSOLIDATED RESULTS

|

|

|

Key Financial Information

|

4

|

|

Sales Revenues

|

4

|

|

Cost of Sales

|

5

|

|

Income (Expenses)

|

5

|

|

Net finance income (expense)

|

6

|

|

Income tax expenses

|

6

|

|

Net Income attributable to shareholders of Petrobras

|

7

|

|

|

|

|

CAPITAL EXPENDITURES (CAPEX)

|

8

|

|

|

|

|

LIQUIDITY AND CAPITAL RESOURCES

|

9

|

|

|

|

|

CONSOLIDATED DEBT

|

10

|

|

RECONCILIATION

OF LTM ADJUSTED EBITDA, GROSS DEBT/ LTM ADJUSTED EBITDA AND NET DEBT/LTM ADJUSTED EBITDA METRICS

|

|

|

Adjusted EBITDA

|

11

|

|

LTM Adjusted EBITDA

|

12

|

|

Gross Debt/LTM Adjusted EBITDA and Net Debt/LTM Adjusted EBITDA Metrics

|

13

|

|

|

|

|

RESULTS BY OPERATING BUSINESS SEGMENTS

|

|

|

Exploration and Production (E&P)

|

14

|

|

Refining, Transportation and Marketing

|

15

|

|

Gas and Power

|

16

|

|

|

|

|

GLOSSARY

|

17

|

CONSOLIDATED RESULTS

The main functional currency of the Petrobras

Group is the Brazilian real, which is the functional currency of the parent company and its Brazilian subsidiaries. As the presentation

currency of the Petrobras Group is the U.S. dollar, the results of operations in Brazilian reais are translated into U.S. dollars

using the average exchange rates prevailing during the period.

Key Financial Information

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change

(%)

|

|

Sales revenues

|

39,772

|

56,721

|

(29.9)

|

|

Cost of Sales

|

(22,811)

|

(34,868)

|

(34.6)

|

|

Gross profit

|

16,961

|

21,853

|

(22.4)

|

|

Income (expenses)

|

(19,858)

|

(4,885)

|

306.5

|

|

Consolidated net income (loss) attributable to the shareholders of Petrobras

|

(10,368)

|

8,170

|

−

|

|

Net cash provided by operating activities

|

21,818

|

18,206

|

19.8

|

|

Adjusted EBITDA

|

19,580

|

23,829

|

(17.8)

|

|

Average Brent crude (US$/bbl)

|

40.82

|

64.65

|

(36.9)

|

|

Average Crude Oil sales price (US$/bbl)

|

38.90

|

60.58

|

(35.8)

|

|

Average Domestic basic oil products price (US$/bbl)

|

50.20

|

75.06

|

(33.1)

|

|

US$ million

|

09.30.2020

|

12.31.2019

|

Change

(%)

|

|

Gross debt

|

79,588

|

87,121

|

(8.6)

|

|

Net debt

|

66,218

|

78,861

|

(16.0)

|

|

Gross Debt/LTM Adjusted EBITDA ratio

|

2.80

|

2.66

|

5.3

|

|

Net Debt/LTM Adjusted EBITDA ratio

|

2.33

|

2.41

|

(3.3)

|

Sales Revenues

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change

(%)

|

|

Diesel

|

10,241

|

17,398

|

(41.1)

|

|

Gasoline

|

4,518

|

7,291

|

(38.0)

|

|

Liquefied petroleum gas (LPG)

|

2,461

|

3,175

|

(22.5)

|

|

Jet fuel

|

1,113

|

2,852

|

(61.0)

|

|

Naphtha

|

1,364

|

1,247

|

9.4

|

|

Fuel oil (including bunker fuel)

|

540

|

772

|

(30.1)

|

|

Other oil products

|

1,915

|

2,582

|

(25.8)

|

|

Subtotal Oil Products

|

22,152

|

35,317

|

(37.3)

|

|

Natural gas

|

2,692

|

4,434

|

(39.3)

|

|

Renewables and nitrogen products

|

45

|

202

|

(77.7)

|

|

Revenues from non-exercised rights

|

368

|

508

|

(27.6)

|

|

Electricity

|

466

|

934

|

(50.1)

|

|

Services, agency and others

|

594

|

706

|

(15.9)

|

|

Total Domestic Market

|

26,317

|

42,101

|

(37.5)

|

|

Exports

|

12,308

|

12,650

|

(2.7)

|

|

Sales abroad (*)

|

1,147

|

1,970

|

(41.8)

|

|

Total Foreign Market

|

13,455

|

14,620

|

(8.0)

|

|

Total

|

39,772

|

56,721

|

(29.9)

|

* Sales revenues

from operations outside of Brazil, including trading and excluding exports.

Sales revenues were US$ 39,772 million

for the period Jan-Sep/2020, a 29.9% decrease (US$ 16,949 million) when compared to US$ 56,721 million for the period

Jan-Sep/2019, mainly due to:

|

|

·

|

Decrease in domestic revenues (US$ 15,784

million), mainly as a result of:

|

|

|

(i)

|

Decrease in oil products revenues (US$ 13,165

million) due to the 36.9% drop in Brent prices and to the lower sales volume of jet fuel, diesel and gasoline as a consequence

of the impacts of the social distancing measures implemented

in response to the COVID-19 pandemic at the end of March 2020, which lowered demand.

|

|

|

(ii)

|

Decrease in natural gas revenues (US$ 1,742

million) due to lower demand and price as consequence of the COVID-19 pandemic and the drop in Brent prices.

|

|

|

·

|

Decreased revenues from operations abroad

(US$ 823 million) mainly due to the disposal of Pasadena Refinery, the sale of E&P assets of PAI and the distribution

companies in Paraguay (all of which occurred in 2019) and lower Brent prices.

|

Cost of Sales

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change

(%)

|

|

Raw material, products for resale, materials and third-party services *

|

(9,487)

|

(15,760)

|

(39.8)

|

|

Depreciation, depletion and amortization

|

(7,237)

|

(9,302)

|

(22.2)

|

|

Production taxes

|

(4,386)

|

(7,300)

|

(39.9)

|

|

Employee compensation

|

(1,701)

|

(2,506)

|

(32.1)

|

|

Total

|

(22,811)

|

(34,868)

|

(34.6)

|

* It includes short-term leases and inventory

turnover.

Cost of sales was US$ 22,811 million

for the period Jan-Sep/2020, a 34.6% decrease (US$ 12,057 million) when compared to US$ 34,868 million for the period

Jan-Sep/2019, mainly due to

|

|

·

|

Lower production taxes costs due to lower

average oil price;

|

|

|

·

|

Higher oil volumes offset by lower lifting

costs;

|

|

|

·

|

Lower import volumes of oil -products as

a result of the decrease in domestic demand;

|

|

|

·

|

Lower volumes and costs of natural gas

imports; and

|

|

|

·

|

Lower costs from operations abroad, following

the disposal of E&P assets of PAI, the sale of distribution companies in Paraguay and the disposal of Pasadena Refinery, which

occurred in 2019.

|

Income (Expenses)

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change

(%)

|

|

Selling expenses

|

(3,756)

|

(3,090)

|

21.6

|

|

General and administrative expenses

|

(1,011)

|

(1,630)

|

(38.0)

|

|

Exploration costs

|

(437)

|

(344)

|

27.0

|

|

Research and development expenses

|

(255)

|

(430)

|

(40.7)

|

|

Other taxes

|

(761)

|

(300)

|

153.7

|

|

Impairment of assets

|

(13,358)

|

(627)

|

2030.5

|

|

Other income and expenses, net

|

(280)

|

1,536

|

−

|

|

Total

|

(19,858)

|

(4,885)

|

306.5

|

Selling expenses were US$ 3,756 million

for the period Jan-Sep/2020, a 21.6% increase (US$ 666 million) compared to US$ 3,090 million for the period Jan-Sep/2019,

mainly due to higher transportation charges, as consequence of the payment of tariffs for the use of third party gas pipelines,

following the sale of Transportadora Associada de Gás SA - TAG in June 2019 and also by higher logistical expenses due to

higher shipping costs and higher crude oil export volumes.

General and administrative expenses were

US$ 1,011 million for the period Jan-Sep/2020, a 38.0% decrease (US$ 619 million) compared to US$ 1,630 million

for the period Jan-Sep/2019, mainly from lower employee expenses due to reduction of headcount and currency depreciation.

Impairment

of assets represented a US$ 13,358 DOC_FLD00002 # " #,##0 " million

loss for the period Jan-Sep/2020, US$ 12,731 million higher compared to a US$ 627 million loss for the period Jan-Sep/2019,

mainly due to revision in the assumption of long-term Brent price from 65 US$/bbl to 50 US$/bbl. Moreover, 62 shallow waters production

platforms were mothballed during Jan-Sep/2020.

Other taxes totaled US$ 761 million

in expense for the period Jan-Sep/2020, a 153.7% (US$ 461 million) increase compared to the US$ 300 million for the period

Jan-Sep/2019, mainly due to the adhesion to tax amnesty programs in RJ and ES, through which we agreed to pay US$ 358 million

to eliminate a contingent liability of US$ 690 million.

Other income and expenses totaled US$ 280

million in expense for the period Jan-Sep/2020, a US$ 1,816 million decrease compared to the US$ 1,536 in income for

the period Jan-Sep/2019, mainly due to:

|

|

·

|

a US$ 5,500 million

gain on the sale of TAG in Jan-Sep/2019;

|

|

|

·

|

a US$ 1,477 million

gain in Jan-Sep/2020, due to the exclusion of VAT tax (ICMS) from the calculation basis of the PIS and COFINS, following a favorable

judicial decision;

|

|

|

·

|

a US$ 1,098 million

reduction in legal, administrative and arbitration proceedings expenses (a US$ 390 million expense for the period Jan-Sep/2020

compared to a US$ 1,488 million expense for the period Jan-Sep/2019); and

|

|

|

·

|

a US$ 709 million

gain from the equalization related mainly due to the individualization agreement of the Tupi area and Sepia and Atapu fields (a

US$ 685 million increase when compared to a US$ 24 million gain for the period Jan-Sep/2019).

|

Net finance income (expense)

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change

(%)

|

|

Finance income

|

406

|

928

|

(56.3)

|

|

Income from investments and marketable securities (Government Bonds)

|

166

|

399

|

(58.4)

|

|

Discount and premium on repurchase of debt securities

|

2

|

5

|

(60.0)

|

|

Gains from signed agreements (electric sector)

|

−

|

79

|

−

|

|

Other income, net

|

238

|

445

|

(46.5)

|

|

Finance expenses

|

(4,570)

|

(5,793)

|

(21.1)

|

|

Interest on finance debt

|

(2,825)

|

(3,831)

|

(26.3)

|

|

Unwinding of discount on lease liabilities

|

(994)

|

(1,154)

|

(13.9)

|

|

Discount and premium on repurchase of debt securities

|

(783)

|

(850)

|

(7.9)

|

|

Capitalized borrowing costs

|

707

|

1,007

|

(29.8)

|

|

Unwinding of discount on the provision for decommissioning costs

|

(499)

|

(605)

|

(17.5)

|

|

Other finance expenses and income, net

|

(176)

|

(360)

|

(51.1)

|

|

Foreign exchange gains (losses) and indexation charges

|

(6,830)

|

(2,297)

|

197.3

|

|

Foreign exchange gains (losses)

|

(5,127)

|

(215)

|

2284.7

|

|

Reclassification of hedge accounting to the Statement of Income

|

(3,586)

|

(2,240)

|

60.1

|

|

Pis and Cofins inflation indexation income - exclusion of ICMS (VAT tax) from the basis of calculation

|

1,780

|

−

|

−

|

|

Other foreign exchange gains (losses) and indexation charges, net

|

103

|

158

|

(34.8)

|

|

Total

|

(10,994)

|

(7,162)

|

53.5

|

|

|

|

|

|

|

Net finance expense was US$ 10,994 million

for the period Jan-Sep/2020, a 53.5% increase (US$ 3,832 million) compared to the expense of US$ 7,162 million for the

period Jan-Sep/2019, mainly due to:

|

|

·

|

Higher expenses with foreign exchange and

indexation charges (US$ 4,533 million) primarily related to:

|

|

|

(i)

|

higher foreign exchange variation expenses

associated with the net liability exposure in US dollars; and

|

|

|

(ii)

|

reclassification of cash flow hedging amounts

from shareholders’ equity to the statement of income.

|

These effects were partially offset by a US$ 1,780

income relating to the inflation indexation on the amount recovered from the exclusion if the ICMS (VAT tax) from the basis of

calculation of PIS and COFINS, and by a US$ 1,006 million decrease in interest on finance debt (US$ 2,825 million expense

for the period Jan-Sep/2020 compared to US$ 3,831 million for the period Jan-Sep/2019), due to lower finance debt and interest

rates.

Income tax expenses

Income tax presented an income of US$ 3,899

million for the period Jan-Sep/2020, a US$ 8,340 million positive change compared to a US$ 4,441 million expense for

the period Jan-Sep/2019, mainly due to the loss for the period Jan-Sep/2020 compared to a net income in the comparative period.

Net Income (loss) attributable to shareholders

of Petrobras

Net income (loss) attributable to shareholders

of Petrobras presented a US$ 10,368 million loss for the period Jan-Sep/2020, a US$ 18,538 million decrease compared

to a US$ 8,170 million income for the period Jan-Sep/2019, mainly due to US$ 13,358 million impairment losses arising

from the revision of our long-term Brent prices projections and the current lower price and depressed demand environment.

CAPITAL EXPENDITURES (CAPEX)

Capital expenditures, or CAPEX, based on the

cost assumptions and financial methodology adopted in our strategic plans, which includes acquisition of intangible assets and

property, plant and equipment, investment in investees and other items that do not necessarily qualify as cash flows used in investing

activities, comprising geological and geophysical expenses, research and development expenses, pre-operating charges, purchase

of property, plant and equipment on credit and borrowing costs directly attributable to works in progress.

|

CAPEX (US$ million)

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change

(%)

|

|

Exploration and Production

|

5,038

|

6,003

|

(16.1)

|

|

Refining, Transportation & Marketing

|

593

|

1,013

|

(41.5)

|

|

Gas and Power

|

269

|

324

|

(16.9)

|

|

Corporate and other businesses

|

102

|

217

|

(52.9)

|

|

Total

|

6,002

|

7,557

|

(20.6)

|

We invested a total of US$ 6,002 million

in the period Jan-Sep/2020, of which 83.9% was in E&P business, a 20.6% decrease when compared to our Capital Expenditures

of US$ 7,557 million in the period Jan-Sep/2019. In line with our Strategic Plan, our Capital Expenditures were primarily

directed toward the most profitable investment projects relating to oil and gas production.

In Jan-Sep/2020, investments in the E&P

segment totaled US$ 5.0 billion, mainly concentrated on: (i) the development of ultra-deep water production in the Santos

Basin pre-salt complex (US$ 2.5 billion); (ii) development of new projects in deep water (US$ 0.5 billion); and (iii)

exploratory investments (US$ 0.5 billion).

LIQUIDITY AND CAPITAL RESOURCES

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

|

Adjusted cash and cash equivalents at the beginning of period

|

8,260

|

14,982

|

|

Government bonds and time deposits with maturities of more than 3 months at the beginning of period *

|

(883)

|

(1,083)

|

|

Cash and cash equivalents at the beginning of period

|

7,377

|

13,899

|

|

Net cash provided by operating activities

|

21,818

|

18,206

|

|

Net cash provided by operating activities from continuing operations

|

21,818

|

17,883

|

|

Net cash provided by operating activities - discontinued operations

|

−

|

323

|

|

Net cash used in investing activities

|

(4,193)

|

6,076

|

|

Net cash used in investing activities from continuing operations

|

(4,193)

|

4,264

|

|

Acquisition of PP&E and intangibles assets and investments in investees

|

(5,427)

|

(5,422)

|

|

Proceeds from disposal of assets (Divestments)

|

1,038

|

9,110

|

|

Dividends received

|

201

|

836

|

|

Divestment (Investment) in marketable securities

|

(5)

|

(260)

|

|

Net cash used in investing activities - discontinued operations

|

−

|

1,812

|

|

(=) Net cash provided by operating and investing activities

|

17,625

|

24,282

|

|

Net cash provided by (used) in financing activities from continuing operations

|

(11,852)

|

(25,182)

|

|

Net financings

|

(6,359)

|

(20,125)

|

|

Proceeds from financing

|

15,897

|

4,729

|

|

Repayments

|

(22,256)

|

(24,854)

|

|

Repayment of lease liability

|

(4,371)

|

(3,622)

|

|

Dividends paid to shareholders of Petrobras

|

(1,020)

|

(1,304)

|

|

Dividends paid to non-controlling interest

|

(38)

|

(89)

|

|

Investments by non-controlling interest

|

(64)

|

(42)

|

|

Net cash used in financing activities - discontinued operations

|

−

|

(508)

|

|

Net cash provided by (used) in financing activities

|

(11,852)

|

(25,690)

|

|

Effect of exchange rate changes on cash and cash equivalents

|

(446)

|

688

|

|

Cash and cash equivalents at the end of period

|

12,704

|

13,179

|

|

Government bonds and time deposits with maturities of more than 3 months at the end of period *

|

666

|

1,303

|

|

Adjusted cash and cash equivalents at the end of period

|

13,370

|

14,482

|

|

Reconciliation of Free Cash Flow

|

|

|

|

|

Net cash provided by operating activities

|

21,818

|

18,206

|

|

Acquisition of PP&E and intangibles assets and investments in investees

|

(5,427)

|

(5,422)

|

|

Free cash flow

|

16,391

|

12,784

|

|

|

|

|

|

|

|

* Includes short-term government bonds

and time deposits and cash and cash equivalents of companies classified as held for sale.

As of September 30, 2020, the balance of

cash and cash equivalents was US$ 12,704 million and adjusted cash and cash equivalents totaled US$ 13,370 million. Our

goal is to adopt measures to preserve cash during this crisis.

The nine-month period ended September 30,

2020 had net cash provided by operating activities of US$ 21,818 million, proceeds from disposal of assets (divestments) of

US$ 1,038 million and proceeds from financing of US$ 15,897 million. Those resources were allocated to debt prepayments

and to amortizations of principal and interest due in the period of US$ 22,256 million, repayment of lease liability of US$ 4,371

million and to acquisition of PP&E and intangibles assets and investments in investees of US$ 5,427 million.

In the nine-month period ended September 30,

2020, proceeds from financing amounted to US$ 15,897 million, principally reflecting: (i) funds raised from banking market

(in Brazil and abroad), in the amount of US$ 3,144 million; (ii) use of revolving credit lines, in the amount of US$ 8,010

million; and (iii) global notes issued in the capital market in the amount of US$ 3,207 million, of which US$ 1,495 million

relates to the issue of new bonds maturing in 2031 and US$ 1,712 million relates to new bonds issued maturing in 2050.

The Company repaid several finance debts, in

the amount of US$ 22,256 million, notably: (i) pre-payment of banking loans in the domestic and international market totaling

US$ 2,979 million; and (ii) US$ 5,399 million relating to repurchase of global bonds previously issued by the Company

in the capital market, with net premium paid to bond holders amounting to US$ 780 million; (iii) partial prepayment of its

revolving credit lines, in the amount of US$ 7.6 billion. In addition, the Company carried out, in the international banking

market, operations to improve its debt profile and to extend its maturity, not involving financial settlements, in the total amount

of US$ 2,490 million.

CONSOLIDATED DEBT

|

Debt (US$ million)

|

09.30.2020

|

12.31.2019

|

Change (%)

|

|

Finance debt

|

57,573

|

63,260

|

(9.0)

|

|

Capital Markets

|

32,553

|

35,944

|

(9.4)

|

|

Banking Market

|

19,878

|

21,877

|

(9.1)

|

|

Development banks

|

1,483

|

1,967

|

(24.6)

|

|

Export Credit Agencies

|

3,441

|

3,233

|

6.4

|

|

Others

|

218

|

239

|

(8.8)

|

|

Lease liabilities

|

22,015

|

23,861

|

(7.7)

|

|

Gross Debt

|

79,588

|

87,121

|

(8.6)

|

|

Adjusted cash and cash equivalents

|

13,370

|

8,260

|

61.9

|

|

Net debt

|

66,218

|

78,861

|

(16.0)

|

|

Leverage: Net Debt/(Net Debt + Shareholders' Equity)

|

60%

|

52%

|

8

|

|

Average interest rate (% p.a.)

|

5.8

|

5.9

|

(1.7)

|

|

Weighted average maturity of outstanding debt (years)

|

11.19

|

10.80

|

3.6

|

The unprecedented event of the COVID-19 pandemic,

with its effect on oil prices and economic activity encouraged us to take several measures to preserve our cash position. One of

the most important actions was to draw down the Revolving Credit Facilities, that we had signed with several banks, in order to

have an increase in available funds during this period of crisis.

In addition, liability management helped the

average interest rate to be reduced to 5.8% as of September 30, 2020, from 5.9% as of December 31, 2019. The average maturity of

outstanding debt as of September 30, 2020 is 11.19 years compared to 10.80 years as of December 31, 2019.

Despite the crisis, deleveraging still is a

priority for Petrobras. In April, the Board of Directors approved the revision of the top metrics included in the 2020-2024 Strategic

Plan and the net debt/adjusted EBITDA indicator was replaced by the gross debt. The target for 2020 is US$ 87 billion, the

same level of the end of 2019. It is important to highlight that the company continues to pursue the reduction of gross debt to

US$ 60 billion, in line with our dividend policy.

Gross debt decreased 8.6% (US$ 7,533 million)

from US$ 87,121 million on December 31, 2019 to US$ 79,588 million on September 30, 2020, which is better than the target

for 2020 of US$ 87 billion mentioned above. This decrease was due to the repayment of several finance debts, in the amount

of US$ 22,256 million, notably: (i) pre-payment of banking loans in the domestic and international market totaling US$ 2,979

million; (ii) US$ 5,399 million relating to repurchase of global bonds previously issued by the Company in the capital market,

with net premium paid to bond holders amounting to US$ 780 million; (iii) partial prepayment of its revolving credit lines,

in the amount of US$ 7.6 billion and lower lease liabilities, partially offset by proceeds from financing of US$ 15,897

million.

RECONCILIATION OF LTM ADJUSTED EBITDA, GROSS

DEBT/ LTM ADJUSTED EBITDA AND NET DEBT/LTM ADJUSTED EBITDA METRICS

LTM Adjusted EBITDA reflects the sum of

the last twelve months of Adjusted EBITDA, which is computed by using the EBITDA (net income before net finance income (expense),

income taxes, depreciation, depletion and amortization) adjusted by items not considered part of the Company’s primary business,

which include results in equity-accounted investments, impairment, cumulative foreign exchange adjustments reclassified to the

statement of income and results from disposal and write-offs of assets and on remeasurement of investment retained with loss of

control.

Adjusted EBITDA, reflecting the sum of the last

twelve months (Last Twelve Months), represents an alternative to the company's operating cash generation. This measure is used

to calculate the metric Gross Debt/LTM Adjusted EBITDA and Net Debt/LTM Adjusted EBITDA, to support management’s assessment

of liquidity and leverage.

EBITDA, Adjusted EBITDA from continuing

operations, Adjusted EBITDA, LTM adjusted EBITDA, LTM Adjusted EBITDA from continuing operations, LTM Adjusted EBITDA from discontinued

operations, Net debt, Gross debt, Gross debt/LTM Adjusted EBITDA and Net debt/LTM Adjusted EBITDA are not defined in the International

Financial Reporting Standards – IFRS. Our calculation may not be comparable to the calculation of other companies and it

should not be considered in isolation or as a substitute for any measure calculated in accordance with IFRS. These measures must

be considered together with other measures and indicators for a better understanding of the Company's financial conditions.

Adjusted EBITDA

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change (%)

|

|

Net income (loss)

|

(10,669)

|

8,288

|

-

|

|

Net finance income (expense)

|

10,994

|

7,162

|

53.5

|

|

Income taxes

|

(3,899)

|

4,441

|

-

|

|

Depreciation, depletion and amortization

|

9,209

|

11,205

|

(17.8)

|

|

EBITDA

|

5.635

|

31,096

|

(81.9)

|

|

Results in equity-accounted investments

|

677

|

(363)

|

-

|

|

Impairment

|

13,358

|

627

|

2,030.5

|

|

Reclassification of comprehensive income (loss) due to the disposal

of equity-accounted investments

|

43

|

34

|

26.5

|

|

Results on disposal/write-offs of assets and on remeasurement of investment retained with loss of control

|

(133)

|

(5,426)

|

(97.5)

|

|

Foreign exchange gains or losses on provisions for legal proceedings

|

0

|

120

|

-

|

|

Net income from discontinued operations for the period

|

-

|

(2,560)

|

-

|

|

Adjusted EBITDA from continuing operations

|

19,580

|

23,528

|

(16.8)

|

|

Net income from discontinued operations for the period

|

-

|

2,560

|

-

|

|

Net finance income (expense) from discontinued operations

|

-

|

(139)

|

-

|

|

Income taxes from discontinued operations

|

-

|

1,357

|

-

|

|

Depreciation, depletion and amortization from discontinued operations

|

-

|

77

|

-

|

|

Results on disposal/write-offs of assets and on remeasurement of investment retained with loss of control from discontinued operations

|

-

|

(3,554)

|

-

|

|

Adjusted EBITDA

|

19,580

|

23,829

|

(17.8)

|

LTM Adjusted EBITDA

|

|

US$ million

|

|

|

Last twelve months (LTM) at

|

|

|

|

|

|

|

09.30.2020

|

12.31.2019

|

4Q-2019

|

1Q-2020

|

2Q-2020

|

3Q-2020

|

|

Net income (loss)

|

(8,594)

|

10,363

|

2,075

|

(9,976)

|

(436)

|

(257)

|

|

Net finance income (expenses)

|

12,596

|

8,764

|

1,602

|

4,551

|

2,257

|

4,186

|

|

Income taxes

|

(4,140)

|

4,200

|

(241)

|

(3,300)

|

(31)

|

(568)

|

|

Depreciation, depletion and amortization

|

12,840

|

14,836

|

3,631

|

3,543

|

2,793

|

2,873

|

|

EBITDA

|

12,702

|

38,163

|

7,067

|

(5,182)

|

4,583

|

6,234

|

|

Results in equity-accounted investments

|

887

|

(153)

|

210

|

298

|

211

|

168

|

|

Impairment

|

15,579

|

2,848

|

2,221

|

13,371

|

−

|

(13)

|

|

Reclassification of comprehensive income (loss) due to the disposal

of equity-accounted investments

|

43

|

34

|

−

|

−

|

−

|

43

|

|

Results on disposal/write-offs of assets and on remeasurement of investment retained with loss of control

|

(753)

|

(6,046)

|

(620)

|

94

|

(9)

|

(218)

|

|

Foreign exchange gains or losses on provisions for legal proceedings

|

−

|

120

|

−

|

−

|

−

|

-

|

|

Net income from discontinued operations for the period

|

−

|

(2,560)

|

−

|

−

|

−

|

-

|

|

Adjusted EBITDA from continuing operations

|

28,458

|

32,406

|

8,878

|

8,581

|

4,785

|

6,214

|

|

Net income from discontinued operations for the period

|

−

|

2,560

|

−

|

−

|

−

|

−

|

|

Net finance income (expense) from discontinued operations

|

−

|

(139)

|

−

|

−

|

−

|

−

|

|

Income taxes from discontinued operations

|

−

|

1,357

|

−

|

−

|

−

|

−

|

|

Depreciation, depletion and amortization from discontinued operations

|

−

|

77

|

−

|

−

|

−

|

−

|

|

Results on disposal/write-offs of assets and on remeasurement of investment retained with loss of control from discontinued operations

|

−

|

(3,554)

|

−

|

−

|

−

|

−

|

|

Adjusted EBITDA

|

28,458

|

32,707

|

8,878

|

8,581

|

4,785

|

6,214

|

|

Income taxes

|

4,140

|

(4,200)

|

241

|

3,300

|

31

|

568

|

|

Allowance (reversals) for impairment of trade and others receivables

|

142

|

87

|

18

|

97

|

35

|

(8)

|

|

Trade and other receivables, net

|

(611)

|

2,233

|

(542)

|

973

|

(1,477)

|

435

|

|

Inventories

|

327

|

(281)

|

(415)

|

446

|

660

|

(364)

|

|

Trade payables

|

(33)

|

(989)

|

(204)

|

(830)

|

538

|

463

|

|

Deferred income taxes, net

|

(4,255)

|

2,798

|

(69)

|

(3,470)

|

(144)

|

(572)

|

|

Taxes payable

|

1,596

|

(2,105)

|

(81)

|

(807)

|

991

|

1,493

|

|

Others

|

(486)

|

(4,650)

|

(366)

|

(513)

|

38

|

355

|

|

Net cash provided by operating activities -OCF

|

29,278

|

25,600

|

7,460

|

7,777

|

5,457

|

8,584

|

|

Net cash provided by operating activities from continuing operations

|

29,278

|

25,277

|

7,460

|

7,777

|

5,457

|

8,584

|

|

Net cash provided by operating activities from discontinued operations

|

−

|

323

|

−

|

−

|

−

|

-

|

Gross Debt/LTM Adjusted EBITDA

and Net Debt/LTM Adjusted EBITDA Metrics

The Gross Debt/LTM Adjusted EBITDA ratio

and Net debt/LTM Adjusted EBITDA ratio are important metrics that support our management in assessing the liquidity and leverage

of Petrobras Group. These ratios are important measures for management to assess the Company’s ability to pay off its debt,

mainly because gross debt became a top metric of the Company in April 2020.

The following table presents the reconciliation

for those metrics to the most directly comparable GAAP measure in accordance with IFRS, which is in this case the Gross Debt Net

of Cash and Cash Equivalents/Net Cash provided by operating activities ratio:

|

|

|

US$ million

|

|

|

|

|

|

|

|

|

09.30.2020

|

12.31.2019

|

|

Cash and cash equivalents

|

|

12,700

|

7,372

|

|

Government securities and time deposits (maturity of more than three months)

|

|

670

|

888

|

|

Adjusted cash and cash equivalents

|

|

13,370

|

8,260

|

|

Current and non-current debt - Gross Debt

|

|

79,588

|

87,121

|

|

Net debt

|

|

66,218

|

78,861

|

|

Net cash provided by operating activities from continuing operations

|

|

29,278

|

25,277

|

|

Net cash provided by operating activities from discontinued operations

|

|

-

|

323

|

|

Net cash provided by operating activities -LTM OCF

|

|

29,278

|

25,600

|

|

Income taxes

|

|

4,140

|

(4,200)

|

|

Allowance (reversals) for impairment of trade and other receivables

|

|

142

|

87

|

|

Trade and other receivables, net

|

|

(611)

|

2,233

|

|

Inventories

|

|

327

|

(281)

|

|

Trade payables

|

|

(33)

|

(989)

|

|

Deferred income taxes, net

|

|

(4,255)

|

2,798

|

|

Taxes payable

|

|

1,596

|

(2,105)

|

|

Others

|

|

(486)

|

(4,650)

|

|

LTM Adjusted EBITDA

|

|

28,458

|

32,707

|

|

LTM Adjusted EBITDA from continuing operations

|

|

28,458

|

32,406

|

|

LTM Adjusted EBITDA from discontinued operations

|

|

-

|

301

|

|

Gross debt net of cash and cash equivalents/LTM OCF ratio

|

|

2.28

|

3.12

|

|

Gross debt/LTM Adjusted EBITDA ratio

|

|

2.80

|

2.66

|

|

Net debt/LTM Adjusted EBITDA ratio

|

|

2.33

|

2.41

|

RESULTS BY OPERATING BUSINESS SEGMENTS

Exploration and Production (E&P)

Financial information

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change (%)

|

|

Sales revenues

|

25,400

|

36,595

|

(30.6)

|

|

Gross profit

|

11,331

|

16,167

|

(29.9)

|

|

Income (Expenses)

|

(13,991)

|

(2,400)

|

483.0

|

|

Operating income (loss)

|

(2,660)

|

13,767

|

−

|

|

Net income (loss) attributable to the shareholders of Petrobras

|

(1,910)

|

9,184

|

−

|

|

Average Brent crude (US$/bbl)

|

40.82

|

64.65

|

(36.9)

|

|

Sales price – Brazil

|

|

|

|

|

Average Crude oil (US$/bbl)

|

38.90

|

60.58

|

(35.8)

|

|

Production taxes – Brazil

|

4,396

|

8,194

|

(46.4)

|

|

Royalties

|

2,448

|

3,466

|

(29.4)

|

|

Special Participation

|

1,919

|

4,692

|

(59.1)

|

|

Retention of areas

|

29

|

36

|

(20.4)

|

[1]

In the period Jan-Sep/2020, gross profit for

the E&P segment amounted to US$ 11,331 million, a 29.9% reduction compared to the period Jan-Sep/2019, due to lower sales

revenue, which reflects lower sales prices despite the increase in oil and natural gas production, partially offset by lower lifting

costs.

The US$ 2,660 million operating loss in

the period Jan-Sep/2020 reflects the impairment losses due to the reduction in expected Brent price and hibernation of shallow

water platforms.

In the period Jan-Sep/2020, the reduction in

production taxes was caused by lower Brent prices, compared to the period Jan-Sep/2019.

Operational information

|

Production in thousand barrels of oil equivalent per day (mboed)

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change (%)

|

|

Crude oil, NGL and natural gas – Brazil

|

2,839

|

2,604

|

9.0

|

|

Crude oil and NGL (mbpd)

|

2,310

|

2,097

|

10.2

|

|

Natural gas (mboed)

|

529

|

507

|

4.3

|

|

Crude oil, NGL and natural gas – Abroad

|

49

|

81

|

(39.5)

|

|

Total (mboed)

|

2,888

|

2,685

|

7.6

|

Production of crude oil, NGL and natural gas

was 2,888 mboed in the period Jan-Sep/2020, representing an increase in production of 7.6%, due to the ramp-up of the eight systems

that started-up from 2018 to 2020 in Búzios (P-74, P-75, P-76 and P-77), Tupi (P-67 and P-69), Berbigão and Sururu

fields (P-68) and Atapu field (P-70).

Refining, Transportation and Marketing

Financial information

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change (%)

|

|

Sales revenues

|

35,696

|

49,932

|

(28.5)

|

|

Gross profit

|

2,527

|

4,014

|

(37.0)

|

|

Income (Expenses)

|

(3,074)

|

(2,772)

|

10.9

|

|

Operating income (loss)

|

(547)

|

1,242

|

−

|

|

Net income attributable to the shareholders of Petrobras

|

(865)

|

913

|

−

|

|

Average refining cost (US$ / barrel) – Brazil

|

1.78

|

2.52

|

(29.4)

|

|

Average domestic basic oil products price (US$/bbl)

|

50.20

|

75.06

|

(33.1)

|

For the period Jan-Sep/2020, Refining,

Transportation and Marketing gross profit was US$ 2,527 million, US$ 1.5 billion lower in relation to the period

Jan-Sep/2019. Losses with devaluation of inventories were the main cause for this reduction in the segment gross profit. The refining

cost was US$ 0.74/bbl lower than in 2019, primarily due to the exchange rate variation in the period (R$/US$ 3.89 in the period

Jan-Sep/2019 and R$/US$ 5.08 in the period Jan-Sep/2020).

For the period Jan-Sep/2020, there were

lower margins of oil products in the domestic market, specifically Diesel and Jet fuel, reflecting the lower international crack

spreads due the effects from the COVID-19 pandemic, partially offset by higher margins on LPG and Naphtha. Additionally, there

was lower sales volumes in the domestic market of Diesel, Jet Fuel and Gasoline, due the restrictions of mobility also caused by

the COVID-19 pandemic.

On the other hand, exports of fuel oil

showed higher margins and volumes, due to the implementation of the IMO – 2020 standards, as well as higher volume of crude

oil exports compared to the period Jan-Sep/2019.

The operating loss for the period Jan-Sep/2020

reflects the lower gross profit and the higher operating expenses due to higher sales expenses, voluntary dismissal plan and unscheduled

maintenance stoppages in refineries, partially offset by lower impairment losses.

Operational information

|

Thousand barrels per day (mbpd)

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change (%)

|

|

Total production volume

|

1,805

|

1,774

|

1.7

|

|

Domestic sales volume

|

1,630

|

1,763

|

(7.5)

|

|

Reference feedstock

|

2,176

|

2,176

|

-

|

|

Refining plants utilization factor (%)

|

77%

|

77%

|

-

|

|

Processed feedstock (excluding NGL)

|

1,684

|

1,681

|

0.2

|

|

Processed feedstock

|

1,730

|

1,724

|

0.3

|

|

Domestic crude oil as % of total

|

94%

|

90%

|

4.0

|

Domestic sales in the period Jan-Sep/2020

were 1,630 mbpd, a decrease of 7.5% compared to Jan-Sep/2019, reflecting the strong contraction in demand caused by the COVID-19

pandemic. However, there was a recovery in demand for diesel and gasoline in 3Q20 compared to 2Q20, due to the gradual return to

activities and easing of the mobility restrictions imposed by COVID-19 in 2Q20 and seasonal factors, with increase in sales and

market share in these products in the period mentioned above. LPG and Naphtha were the only oil products with a higher sales volumes

in Jan-Sep/2020 compared to Jan-Sep/2019. In the case of LPG, mainly due to the effect of social isolation that led to an increase

in residential consumption and, in relation to naphtha, the increase occurred due to the growth in demand from customers.

Total production of oil products

for the period Jan-Sep/2020 was 1,805 mbpd, 1.7% higher than Jan-Sep/2019. Despite the drop in demand caused by the pandemic, optimizations

were carried out in our refineries, in order to adapt the production of oil products to variations in demand and a series of logistical

and commercial actions were carried out to increase our oil and oil products exports.

Processed feedstock for the period

Jan-Sep/2020 was 1,730 mbpd, with a utilization factor of 77%, 0.3% above Jan-Sep/2019 and higher in 3Q20 than the months before

the pandemic, reflecting the demand increase.

Gas and Power

Financial information

|

US$ million

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change (%)

|

|

Sales revenues

|

5,469

|

8,744

|

(37.5)

|

|

Gross profit

|

2,753

|

2,806

|

(1.9)

|

|

Income (expenses)

|

(1,840)

|

3,779

|

−

|

|

Operating income (loss)

|

913

|

6,585

|

(86.1)

|

|

Net income attributable to the shareholders of Petrobras

|

627

|

4,336

|

(85.5)

|

|

Average natural gas sales price – Brazil (US$/bbl)

|

34.96

|

47.66

|

(26.6)

|

For the period Jan-Sep/2020, the

gross profit of the Gas and Power segment was US$ 2.7 billion, a decrease of 1.9% when compared to the period Jan-Sep/2019,

due to:

(i)

lower sales of natural gas due to COVID-19 pandemic

and lower price as consequence of the drop in Brent prices;

(ii)

reduction in contracts in the Regulated Marketing

Environment in the (ACR);

(iii)

reduction in contracts in the Free Marketing Environment

(ACL) at the Chamber of Commercialization of Electric Energy (CCEE);

(iv)

lower volume of electricity generation due to lower

load on the Electric System and better hydrological conditions.

For the period Jan-Sep/2020, the

operating income was US$ 913 million, lower than for the period Jan-Sep/2019, due to the US$ 5,458 million gain from the sale

of a 90% interest in TAG in June 2019 and due to higher selling expenses with payment of TAG’s tariff in the period Jan-Sep/2020.

Operational information

|

|

Jan-Sep/2020

|

Jan-Sep/2019

|

Change (%)

|

|

Regulated contracting market sales (Availability) – average MW

|

2,404

|

2,788

|

(13.8)

|

|

Free contracting market electricity sales and sales for domestic consumption - average MW

|

766

|

1,167

|

(34.4)

|

|

Electricity generation - average MW

|

1,179

|

1,856

|

(36.5)

|

|

Difference settlement prices – US$/MWh

|

23

|

54

|

(57.4)

|

|

National gas delivered - million m³/day

|

45

|

50

|

(10.0)

|

|

Regasification of liquefied natural gas - million m³/day

|

3

|

9

|

(66.7)

|

|

Natural gas imports - million m³/day

|

16

|

15

|

6.7

|

|

Natural gas sales - million m³/day

|

64

|

75

|

(14.7)

|

For the period Jan-Sep/2020, the

ACR and ACL sales decreased by 13.8% and 34.4%, respectively, when compared to the period Jan-Sep/2019, due to reduction in contracts

in December 2019.

The volume of electricity generation

varied negatively by 36.5% due to better hydrologic conditions and COVID-19 pandemic.

Lower volume of natural gas sold due to

impact of COVID-19 pandemic, which also affected the non-thermoelectric and thermoelectric segments. As a result, there was a reduction

in production of national natural gas and regasification of liquefied natural gas (LNG).

|

GLOSSARY

Adjusted Cash and Cash equivalents -

Sum of cash and cash equivalents, government bonds and time deposits from highly rated financial institutions abroad with maturities

of more than 3 months from the date of acquisition, considering the expected realization of those financial investments in the

short-term. This measure is not defined under the International Financial Reporting Standards – IFRS and should not be considered

in isolation or as a substitute for cash and cash equivalents computed in accordance with IFRS. It may not be comparable to adjusted

cash and cash equivalents of other companies, however management believes that it is an appropriate supplemental measure to assess

our liquidity and supports leverage management.

Adjusted EBITDA – Net income

plus net finance income (expense); income taxes; depreciation, depletion and amortization; results in equity-accounted investments;

impairment, cumulative translation adjustment and gains/losses on disposal/write-offs of assets. Adjusted EBITDA is not a measure

defined by IFRS and it is possible that it may not be comparable to similar measures reported by other companies. However, management

believes that it is an appropriate supplemental measure to assess our liquidity and supports leverage management.

Adjusted EBITDA from continuing operations

– Net income plus net finance income (expense); income taxes; depreciation, depletion and amortization; results in equity-accounted

investments; impairment, cumulative translation adjustment and gains/losses on disposal/write-offs of assets, excluding the discontinued

operation relating to the Distribution segment, which is presented in separate line items.

ANP - Brazilian National Petroleum,

Natural Gas and Biofuels Agency.

Capital Expenditures –

Capital expenditures based on the cost assumptions and financial methodology adopted in our Business and Management Plan, which

include acquisition of PP&E, including expenses with leasing, intangibles assets, investment in investees and other items that

do not necessarily qualify as cash flows used in investing activities, primarily geological and geophysical expenses, research

and development expenses, pre-operating charges, purchase of property, plant and equipment on credit and borrowing costs directly

attributable to works in progress.

CTA – Cumulative translation

adjustment – The cumulative amount of exchange variation arising on translation of foreign operations that is recognized

in Shareholders’ Equity and will be transferred to profit or loss on the disposal of the investment.

EBITDA - net income before net finance

income (expense), income taxes, depreciation, depletion and amortization. EBITDA is not a measure defined by IFRS and it is possible

that it may not be comparable to similar measures reported by other companies. However, management believes that it is an appropriate

supplemental measure to assess our liquidity and supports leverage management.

Effect of average cost in the Cost of

Sales – In view of the average inventory term of 60 days, the crude oil and oil products international prices movement,

as well as foreign exchange effect over imports, production taxes and other factors that impact costs, do not entirely influence

the cost of sales in the current period, having their total effects only in the following period.

Free Cash Flow - Net cash provided

by operating activities less acquisition of PP&E, intangibles assets (except for signature bonus, including the bidding for

oil surplus of the Transfer of Rights Agreement, paid for obtaining concessions for exploration of crude oil and natural gas) and

investments in investees. Free cash flow is not defined under the IFRS and should not be considered in isolation or as a substitute

for cash and cash equivalents calculated in accordance with IFRS. It may not be comparable to free cash flow of other companies.

However, management believes that it is an appropriate supplemental measure to assess our liquidity and supports leverage management.

|

|

Gross Debt – Sum of current

and non-current finance debt and lease liability, this measure is not defined under the IFRS. However, the global adverse scenario

encouraged the Company to revise its top metric relating to indebtedness, contained in the Strategic Plan 2020-2024, replacing

the Net debt / Adjusted EBITDA ratio with the Gross debt.

The target approved for the Gross debt

for 2020 is US$ 87 billion, the same level as 2019.

Leverage – Ratio between the

Net Debt and the sum of Net Debt and Shareholders’ Equity. Leverage is not a measure defined in the IFRS and it is possible

that it may not be comparable to similar measures reported by other companies, however management believes that it is an appropriate

supplemental measure to assess our liquidity.

Lifting Cost - Crude oil and natural

gas lifting cost indicator, which considers expenditures occurred in the period.

LTM Adjusted EBITDA – Adjusted

EBITDA for the last twelve months.

LTM Adjusted EBITDA from continuing

operations - LTM Adjusted EBITDA, excluding the discontinued operation relating to the Distribution segment, which is presented

in separate line items.

LTM Adjusted EBITDA from discontinued

operation - LTM Adjusted EBITDA relating to the Distribution segment, which was discontinued in July 2019.

OCF - Net Cash provided by (used

in) operating activities (operating cash flow)

Operating income (loss) - Net income

(loss) before finance income (expense), results in equity-accounted investments and income taxes.

Net Debt – Gross Debt less

Adjusted Cash and Cash Equivalents. Net debt is not a measure defined in the IFRS and should not be considered in isolation or

as a substitute for total long-term debt calculated in accordance with IFRS. Our calculation of net debt may not be comparable

to the calculation of net debt by other companies. Management believes that net debt is an appropriate supplemental measure that

helps investors assess our liquidity and supports leverage management.

Results by Business Segment – The

information by the company's business segment is prepared based on available financial information that is directly attributable

to the segment or that can be allocated on a reasonable basis, being presented by business activities used by the Executive Board

to make resource allocation decisions and performance evaluation.

When calculating segmented results,

transactions with third parties, including jointly controlled and associated companies, and transfers between business segments

are considered. Transactions between business segments are valued at internal transfer prices calculated based on methodologies

that take into account market parameters, and these transactions are eliminated, outside the business segments, for the purpose

of reconciling the segmented information with the consolidated financial statements of the company.

As a result of the divestments in 2019, the strategy

of repositioning its portfolio foreseen in the Strategic Plan 2020-2024, approved on November 27, 2019, as well as the materiality

of the remaining businesses, the company reassessed the presentation of the Distribution and Biofuels businesses, which are now

included in the Corporate and other businesses. Thus, comparative information has been reclassified.

PLD (differences settlement price) -

Electricity price in the spot market. Weekly weighed prices per output level (light, medium and heavy), number of hours and related

market capacity.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 17, 2020

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea Marques de Almeida

Chief Financial Officer and Investor Relations Officer

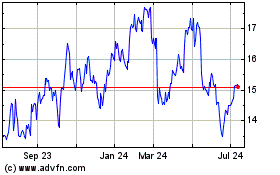

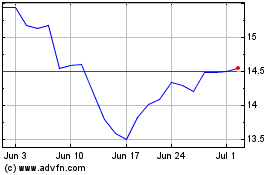

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Sep 2023 to Sep 2024