UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6623

Nuveen California Select Tax-Free Income Portfolio

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 917-7700

Date of fiscal year end: March 31

Date of reporting period: September 30, 2009

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW,

Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

LOGO: NUVEEN INVESTMENTS

Closed-End Funds

Nuveen Investments

Municipal Closed-End Funds

IT'S NOT WHAT YOU EARN, IT'S WHAT YOU KEEP.(R)

Semi-Annual Report September 30, 2009

----------------------- ------------------------- ------------------------

NUVEEN SELECT NUVEEN SELECT NUVEEN SELECT

TAX-FREE INCOME TAX-FREE INCOME TAX-FREE INCOME

PORTFOLIO PORTFOLIO 2 PORTFOLIO 3

NXP NXQ NXR

----------------------- -------------------------

NUVEEN CALIFORNIA NUVEEN NEW YORK

SELECT TAX-FREE SELECT TAX-FREE

INCOME PORTFOLIO INCOME PORTFOLIO

NXC NXN

SEPTEMBER 09

|

LIFE IS COMPLEX.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you'll receive

an e-mail as soon as your Nuveen Investments Fund information is ready. No more

waiting for delivery by regular mail. Just click on the link within the e-mail

to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

WWW.INVESTORDELIVERY.COM

If you receive your Nuveen Fund dividends and statements from your financial

advisor or brokerage account.

OR

WWW.NUVEEN.COM/ACCOUNTACCESS

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

LOGO: NUVEEN INVESTMENTS

[PHOTO OF ROBERT P. BREMNER]

Chairman's

Letter to Shareholders

DEAR SHAREHOLDER,

The financial markets in which your Fund operates continue to reflect the larger

economic crosscurrents. The illiquidity that infected global credit markets over

the last year appears to be slowly but steadily receding. The major institutions

that are the linchpin of the international financial system are strengthening

their capital structures, but many still struggle with losses in their various

portfolios. There are encouraging signs of recovery in European and Asian

economies, while the U.S. economy continues to feel the impact of job losses and

an over-borrowed consumer. Global trends include modestly increasing trade and

increased concern about the ability of the U.S. government to address its

substantial budgetary deficits. Identifying those developments that will define

the future is never easy, but rarely is it more difficult than at present.

After considerable volatility in the first few months of 2009, both the

fixed-income and equity markets have seen a partial recovery. A fundamental

component of a successful long-term investment program is a commitment to remain

invested during market downturns in order to be better positioned to benefit

from any recovery. Another component is to re-evaluate investment disciplines

and tactics and to confirm their validity following periods of extreme

volatility and market dislocation, such as we have recently experienced. Your

Board carried out an intensive review of investment performance with these

objectives in mind during April and May of this year as part of the annual

management contract renewal process. I encourage you to read the description of

this process in the Annual Investment Management Agreement Approval Process

section of this report.

Remaining invested through market downturns and reconfirming the appropriateness

of a long term investment strategy is as important for our shareholders as it is

for professional investment managers. For that reason, I again encourage you to

remain in communication with your financial consultant on these subjects. For

recent developments on all your Nuveen Funds, please visit the Nuveen web site:

www.nuveen.com.

On behalf of the other members of your Fund's Board, we look forward to

continuing to earn your trust in the months and years ahead.

Sincerely,

/s/ Robert P. Bremner

----------------------

Robert P. Bremner

Chairman of the Board

November 24, 2009

|

Nuveen Investments 1

Portfolio Managers' Comments

Nuveen Select Tax-Free Income Portfolio (NXP)

Nuveen Select Tax-Free Income Portfolio 2 (NXQ)

Nuveen Select Tax-Free Income Portfolio 3 (NXR)

Nuveen California Select Tax-Free Income Portfolio (NXC)

Nuveen New York Select Tax-Free Income Portfolio (NXN)

Portfolio managers Tom Spalding, Scott Romans and Cathryn Steeves review key

investment strategies and the six-month performance of the Nuveen Select

Portfolios. With 34 years of investment experience, Tom has managed the three

national Portfolios since 1999. Scott, who joined Nuveen in 2000, has managed

NXC since 2003, while Cathryn, who has been with Nuveen since 1996, assumed

portfolio management responsibility for NXN in 2006.

WHAT KEY STRATEGIES WERE USED TO MANAGE THE NUVEEN SELECT PORTFOLIOS DURING THE

SIX-MONTH REPORTING PERIOD ENDED SEPTEMBER 30, 2009?

During this reporting period, municipal bond prices generally rose, as strong

cash flows into municipal bond funds combined with tighter supply of new

tax-exempt issuance to provide favorable supply and demand conditions.

Given the restricted supply during the period, investment activity in the Select

Portfolios was more limited than usual. One reason for the supply reduction was

the introduction of the Build America Bond program. Build America Bonds are a

new class of taxable municipal debt created as part of the February 2009

economic stimulus package. These bonds offer municipal issuers a federal subsidy

equal to 35% of the security's interest payments, and therefore offer issuers an

attractive alternative to traditional tax-exempt debt. As of September 30, 2009,

approximately 20% of new bonds issued in the municipal market were issued as

taxable Build America Bonds totaling more than $33 billion. Since interest

payments from these bonds represent taxable income, we do not see them as a good

investment opportunity for the Select Portfolios. Another factor dampening

trading activity during this period was the limited liquidity of many insured

bonds due to concerns about the financial health of municipal bond insurers.

Overall, we continued to focus on relative value by taking a bottom-up approach

to discover undervalued sectors and individual credits with the potential to

perform well over the long term. In selected cases, we were able to take

advantage of opportunities to purchase lower-rated and non-rated securities that

we believed offered value at very attractive prices. In the national Portfolios,

we also found some opportunities to add essential services credits, including

bonds in the health care sector, where supply was more plentiful due to the fact

that hospitals generally do not qualify for the Build America Bond program and

therefore must continue to issue bonds in the tax-exempt municipal market. In

general, our focus in

CERTAIN STATEMENTS IN THIS REPORT ARE FORWARD-LOOKING STATEMENTS. DISCUSSIONS OF

SPECIFIC INVESTMENTS ARE FOR ILLUSTRATION ONLY AND ARE NOT INTENDED AS

RECOMMENDATIONS OF INDIVIDUAL INVESTMENTS. THE FORWARD-LOOKING STATEMENTS AND

OTHER VIEWS EXPRESSED HEREIN ARE THOSE OF THE PORTFOLIO MANAGERS AS OF THE DATE

OF THIS REPORT. ACTUAL FUTURE RESULTS OR OCCURRENCES MAY DIFFER SIGNIFICANTLY

FROM THOSE ANTICIPATED IN ANY FORWARD-LOOKING STATEMENTS, AND THE VIEWS

EXPRESSED HEREIN ARE SUBJECT TO CHANGE AT ANY TIME, DUE TO NUMEROUS MARKET AND

OTHER FACTORS. THE FUNDS DISCLAIM ANY OBLIGATION TO UPDATE PUBLICLY OR REVISE

ANY FORWARD-LOOKING STATEMENTS OR VIEWS EXPRESSED HEREIN.

2 Nuveen Investments

NXP, NXQ, and NXR was on bonds rated AA or A that could help to extend the

durations of these Portfolios.

Cash for new purchases during this period was generated by maturing or called

bonds. As with our investment activity, we were not active in trying to sell

portfolio holdings in a market environment where the majority of the bonds

available for reinvestment offered lower yields at higher dollar prices. NXN

also continued to maintain its cash reserves, which we had increased amid the

market uncertainty of the previous reporting period, in anticipation of

increased issuance during the last part of 2009.

We continued to use inverse floating rate securities(1) in all five of the

Select Portfolios. We employ inverse floaters as part of our management

strategies for a variety of reasons, including duration management, income

enhancement, and as a form of financial leverage. As of September 30, 2009, the

inverse floaters remained in place in all of the Portfolios.

HOW DID THE PORTFOLIOS PERFORM?

Individual results for the Nuveen Select Portfolios, as well as for relevant

indexes and peer groups, are presented in the accompanying table.

AVERAGE ANNUAL TOTAL RETURNS ON NET ASSET VALUE*

FOR PERIODS ENDED 9/30/09

SIX-MONTH 1-YEAR 5-YEAR 10-YEAR

-------------------------------------------------------------------------------------------------

NATIONAL PORTFOLIOS

NXP 8.73% 11.11% 4.32% 5.00%

NXQ 10.94% 10.48% 3.63% 4.42%

NXR 8.86% 12.19% 4.62% 4.98%

Standard & Poor's (S&P) National Municipal Bond Index(2) 10.95% 14.42% 4.70% 5.74%

Barclays Capital Municipal Bond Index(3) 9.38% 14.85% 4.78% 5.77%

Lipper General and Insured Unleveraged

Municipal Debt Funds Average(4) 13.14% 12.68% 4.13% 4.87%

CALIFORNIA PORTFOLIO

NXC 11.05% 12.96% 4.38% 4.93%

Standard & Poor's (S&P) California Municipal Bond Index(2) 11.81% 13.92% 4.65% 5.67%

Lipper California Municipal Debt Funds Average(4) 23.08% 17.96% 4.18% 6.07%

NEW YORK PORTFOLIO

NXN 8.82% 13.25% 4.42% 4.89%

Standard & Poor's (S&P) New York Municipal Bond Index(2) 10.14% 14.63% 4.89% 5.84%

Lipper New York Municipal Debt Funds Average(4) 20.33% 17.47% 4.03% 6.29%

|

For the six months ended September 30, 2009, the cumulative return on net asset

value for NXQ performed in line with the Standard & Poor's (S&P) National

Municipal Bond Index and outperformed the national Barclays Capital Municipal

Bond Index, while NXP and NXR lagged the returns on these two national indexes.

For this same period, NXC and NXN underperformed the returns on the S&P

California Municipal Bond Index and the S&P New York Municipal Bond Index,

respectively. All of the Portfolios underperformed the average returns for their

respective Lipper peer groups for this period.

* Six-month returns are cumulative; returns for one-year, five-year and

ten-year are annualized.

Past performance is not predictive of future results. Current performance

may be higher or lower than the data shown. Returns do not reflect the

deduction of taxes that shareholders may have to pay on Fund distributions

or upon the sale of Fund shares.

For additional information, see the individual Performance Overview for

your Portfolio in this report.

(1) An inverse floating rate security, also known as an inverse floater, is a

financial instrument designed to pay long-term tax-exempt interest at a

rate that varies inversely with a short-term tax-exempt interest rate

index. For the Nuveen Funds, the index typically used is the Securities

Industry and Financial Markets (SIFM) Municipal Swap Index (previously

referred to as the Bond Market Association Index or BMA). Inverse

floaters, including those inverse floating rate securities in which the

Portfolios invested during this reporting period, are further defined

within the Notes to Financial Statements and Glossary of Terms Used in

this Report sections of this report.

(2) The Standard & Poor's (S&P) National Municipal Bond Index is an

unleveraged, market value-weighted index designed to measure the

performance of the investment-grade U.S. municipal bond market. The S&P

Municipal Bond Indexes for California and New York are also unlever-aged

and market value-weighted and comprise a broad range of investment-grade

municipal bonds issued in California and New York, respectively. These

indexes do not reflect any initial or ongoing expenses and are not

available for direct investment.

(3) The Barclays Capital (formerly Lehman Brothers) Municipal Bond Index is an

unleveraged, unmanaged national index containing a broad range of

investment-grade municipal bonds. Results for the Barclays Capital index

do not reflect any expenses, and the index is not available for direct

investment.

(4) Each of the Lipper Municipal Debt Funds Averages shown in this report is

calculated using the returns of all closed-end funds in their respective

categories for each period as follows: Lipper General and Insured

Unleveraged category, six-months, 8 funds; 1-year, 8 funds; 5-year, 7

funds; and 10-year, 7 funds; Lipper California Municipal Debt Funds

Average, a category comprised of all California leveraged funds,

six-months, 24 funds; 1-year, 24 funds; five year, 23 funds; and 10-year,

12 funds; and Lipper New York Municipal Debt Funds Average, a category

comprised of all New York leveraged funds, six-months, 17; 1-year, 17

funds; 5-year, 16 funds; and 10-year, 6 funds. Portfolio and Lipper

returns assume reinvestment of dividends.

Nuveen Investments 3

Key management factors that influenced the Portfolios' returns during this

period included yield curve and duration positioning, credit exposure and sector

allocation.

During this period, we saw yields on tax-exempt bonds decline and bond

valuations in general increase, especially at the longer end of the municipal

yield curve. Bonds in the Barclays Capital Municipal Bond Index with maturities

longer than 15 years, particularly those with the longest maturities (22 years

and longer), benefited the most from this interest rate environment. These bonds

generally outperformed credits with shorter maturities, with bonds maturing in

one to two years posting the weakest returns for the period. Among the three

national Portfolios, NXQ benefited from having the longest durations, while the

performances of NXP and NXR were hampered by their greater exposure to the

shorter end of the yield curve. Overall, the net impact of duration and yield

curve positioning on performance was slightly negative in NXC and neutral in

NXN.

While duration played an important role in performance during this six months,

credit exposure was also a significant factor, especially in NXQ, NXC, and NXN.

As noted earlier, demand for municipal bonds increased among both institutional

and individual investors during this period. This increase was driven by a

variety of factors, including concerns about potential tax increases, the need

to rebalance portfolio allocations, and a growing appetite for additional risk.

At the same time, the supply of new municipal paper declined. As investors bid

up municipal bond prices, bonds rated BBB or below and non-rated bonds generally

outperformed those rated AAA. In this environment, the Portfolios' performances

benefited greatly from their allocations of bonds rated BBB and below and

non-rated bonds. Among the national Portfolios, these bonds accounted for

approximately 18% of NXQ's portfolio, compared with 14% of NXP and 14% of NXR.

In NXC, a 17% allocation of lower-rated and non-rated bonds, together with an

underweighting of the AAA category, made a strong contribution to this

Portfolio's performance, more than offsetting the slight negative impact of its

duration positioning. Although NXN had a good weighting (21%) in the lower-rated

credit categories, this Portfolio also was heavily weighted in the

underperforming AAA category. This, combined with underperformance from sector

exposure, counteracted the positive impact of NXN's credit exposure to some

degree.

Holdings that generally contributed to the Portfolios' performances included

industrial development revenue (IDR), health care, zero coupon, and special tax

bonds, all of which outperformed the general municipal market during this

period. Bonds backed by the 1998 master tobacco settlement agreement were also

among the strongest performers. As of September 30, 2009, NXP and NXQ each held

approximately 6% of their portfolios in lower-rated tobacco bonds, while NXC had

allocated 4%, NXR 4%, and NXN 2% to these credits.

Pre-refunded bonds, which are often backed by U.S. Treasury securities and which

had been one of the top performing segments of the municipal bond market over

the past two years, performed especially poorly during this period. This was due

primarily to their shorter effective maturities and higher credit quality. As of

September 30, 2009, NXP had the largest weighting of pre-refunded bonds among

the national Portfolios, while NXC and NXN held significantly smaller amounts of

these bonds, which lessened the negative impact on these two Portfolios.

Additional market segments that lagged the overall municipal market included

general obligation bonds and resource recovery and water and sewer credits.

4 Nuveen Investments

Dividend and Share Price Information

During the six-month reporting period ended September 30, 2009, NXP had one

increase in its monthly dividend, while the dividends of the four remaining

Select Portfolios remained stable throughout the period.

All of these Portfolios seek to pay stable dividends at rates that reflect each

Portfolio's past results and projected future performance. During certain

periods, each Portfolio may pay dividends at a rate that may be more or less

than the amount of net investment income actually earned by the Portfolio during

the period. If a Portfolio has cumulatively earned more than it has paid in

dividends, it holds the excess in reserve as undistributed net investment income

(UNII) as part of the Portfolio's NAV. Conversely, if a Portfolio has

cumulatively paid dividends in excess of its earnings, the excess constitutes

negative UNII that is likewise reflected in the Portfolio's NAV. Each Portfolio

will, over time, pay all of its net investment income as dividends to

shareholders. As of September 30, 2009, all the Portfolios had a positive UNII

balance, based upon our best estimate, for tax purposes. NXP, NXQ, NXR and NXC

had a positive UNII balance, and NXN had a negative UNII balances for financial

statement purposes.

REPURCHASES AND SHARE PRICE INFORMATION

The Nuveen Funds' Board of Directors/Trustees approved an open-market share

repurchase program on July 30, 2008, under which each Fund may repurchase an

aggregate of up to 10% of its outstanding shares. Since the inception of the

Portfolios' repurchase program during July 2008, the Portfolios have not

repurchased any of their outstanding common shares.

As of September 30, 2009, the share prices of the Select Portfolios were trading

at premiums (+) or discounts (-) to their NAVs as shown in the accompanying

table:

SIX-MONTH

9/30/09 SIX-MONTH AVERAGE

PORTFOLIO (+) PREMIUM/(-) DISCOUNT (+) PREMIUM/(-) DISCOUNT

--------------------------------------------------------------------------------

NXP +2.09% +2.11%

NXQ +3.88% +2.79%

NXR +1.48% +2.22%

NXC -4.74% -5.82%

NXN +0.07% -0.77%

Nuveen Investments 5

|

NXP Performance OVERVIEW | Nuveen Select Tax-Free Income Portfolio as of

September 30, 2009

FUND SNAPSHOT

Share Price 14.64

--------------------------------------------------------------------------------

Net Asset Value 14.34

--------------------------------------------------------------------------------

Premium/(Discount) to NAV 2.09%

--------------------------------------------------------------------------------

Market Yield 4.88%

--------------------------------------------------------------------------------

Taxable-Equivalent Yield(1) 6.78%

--------------------------------------------------------------------------------

Net Assets ($000) $ 235,928

--------------------------------------------------------------------------------

Average Effective Maturity on Securities (Years) 12.24

--------------------------------------------------------------------------------

Modified Duration 4.78

--------------------------------------------------------------------------------

AVERAGE ANNUAL TOTAL RETURN

(Inception 3/19/92)

--------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

--------------------------------------------------------------------------------

6-Month

(Cumulative) 9.77% 8.73%

--------------------------------------------------------------------------------

1-Year 17.58% 11.11%

--------------------------------------------------------------------------------

5-Year 6.43% 4.32%

--------------------------------------------------------------------------------

10-Year 5.92% 5.00%

--------------------------------------------------------------------------------

STATES

(as a % of total municipal bonds)

--------------------------------------------------------------------------------

Illinois 13.3%

--------------------------------------------------------------------------------

Colorado 12.0%

--------------------------------------------------------------------------------

Texas 8.5%

--------------------------------------------------------------------------------

South Carolina 7.9%

--------------------------------------------------------------------------------

Florida 7.5%

--------------------------------------------------------------------------------

Washington 7.5%

--------------------------------------------------------------------------------

Indiana 6.9%

--------------------------------------------------------------------------------

California 5.8%

--------------------------------------------------------------------------------

Nevada 4.5%

--------------------------------------------------------------------------------

New Jersey 2.8%

--------------------------------------------------------------------------------

New Mexico 2.2%

--------------------------------------------------------------------------------

Massachusetts 2.1%

--------------------------------------------------------------------------------

Oklahoma 2.1%

--------------------------------------------------------------------------------

Alaska 2.0%

--------------------------------------------------------------------------------

Other 14.9%

--------------------------------------------------------------------------------

PORTFOLIO COMPOSITION

(as a % of total investments)

--------------------------------------------------------------------------------

U.S. Guaranteed 30.9%

--------------------------------------------------------------------------------

Health Care 22.6%

--------------------------------------------------------------------------------

Transportation 10.8%

--------------------------------------------------------------------------------

Tax Obligation/Limited 9.6%

--------------------------------------------------------------------------------

Utilities 9.0%

--------------------------------------------------------------------------------

Consumer Staples 6.1%

--------------------------------------------------------------------------------

Other 11.0%

--------------------------------------------------------------------------------

|

CREDIT QUALITY (AS A % OF TOTAL INVESTMENTS)(2)

[PIE CHART]

AAA/U.S.

Guaranteed 38%

AA 25%

A 23%

BBB 11%

BB or Lower 2%

N/R 1%

|

2008-2009 MONTHLY TAX-FREE DIVIDENDS PER SHARE

[BAR CHART]

Oct $ 0.057

Nov 0.057

Dec 0.057

Jan 0.057

Feb 0.057

Mar 0.057

Apr 0.057

May 0.057

Jun 0.057

Jul 0.057

Aug 0.057

Sep 0.0595

|

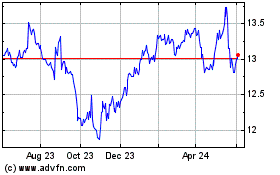

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

[LINE CHART]

10/01/08 $ 13.91

13.47

12.41

12.87

13.24

13.8

13.75

13.56

13.3

13.25

13.074

12.65

13.45

13.03

13.87

14

14

13.72

14.17

13.88

13.9599

13.3

13.97

13.83

13.66

13.6999

13.7

13.8392

14

13.7799

13.91

14.046

14.1

13.9

13.8824

14.0573

14.16

14.17

14.05

14.15

14.1

14.0067

14.06

14.25

14.33

14.36

14.0464

14.16

14.09

14.3

14.27

14.34

14.45

9/30/09 14.64

|

(1) Taxable-Equivalent Yield represents the yield that must be earned on a

fully taxable investment in order to equal the yield of the Fund on an

after-tax basis. It is based on a income tax rate of 28%. When comparing

this Fund to investments that generate qualified dividend income, the

Taxable-Equivalent Yield is lower.

(2) Excluding Common Stocks.

6 Nuveen Investments

NXQ Performance OVERVIEW | Nuveen Select Tax-Free Income Portfolio 2 as of

September 30, 2009

CREDIT QUALITY (AS A % OF TOTAL INVESTMENTS)(2)

[PIE CHART]

AAA/U.S.

Guaranteed 37%

AA 19%

A 26%

BBB 15%

BB or Lower 2%

N/R 1%

|

2008-2009 MONTHLY TAX-FREE DIVIDENDS PER SHARE

[BAR CHART]

Oct $ 0.0555

Nov 0.0555

Dec 0.0555

Jan 0.0555

Feb 0.0555

Mar 0.0555

Apr 0.0555

May 0.0555

Jun 0.0555

Jul 0.0555

Aug 0.0555

Sep 0.0555

|

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

[LINE CHART]

10/01/08 $ 13.19

13.1

11.5701

11.91

12.56

12.66

13.12

13.11

11.93

12.6

12.06

11.37

12.49

12.63

13.4

13.64

13.2

13.11

13.37

13.51

13.34

13.19

13.27

12.85

13.05

12.74

13.28

13.128

13.03

13.2201

13.2

13.33

13.43

13.41

13.4

13.45

13.4

13.16

13.25

13.15

13.2999

13.24

13.38

13.27

13.36

13.34

13.29

13.42

13.6399

13.7

13.691

13.57

13.79

9/30/09 14.19

FUND SNAPSHOT

--------------------------------------------------------------------------------

Share Price 14.19

--------------------------------------------------------------------------------

Net Asset Value 13.66

--------------------------------------------------------------------------------

Premium/(Discount) to NAV 3.88%

--------------------------------------------------------------------------------

Market Yield 4.69%

--------------------------------------------------------------------------------

Taxable-Equivalent Yield(1) 6.51%

--------------------------------------------------------------------------------

Net Assets ($000) $ 241,150

--------------------------------------------------------------------------------

Average Effective Maturity on Securities (Years) 14.14

--------------------------------------------------------------------------------

Modified Duration 5.22

--------------------------------------------------------------------------------

AVERAGE ANNUAL TOTAL RETURN

(Inception 5/21/92)

--------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

--------------------------------------------------------------------------------

6-Month

(Cumulative) 10.72% 10.94%

--------------------------------------------------------------------------------

1-Year 16.18% 10.48%

--------------------------------------------------------------------------------

5-Year 6.63% 3.63%

--------------------------------------------------------------------------------

10-Year 5.85% 4.42%

--------------------------------------------------------------------------------

STATES

(as a % of total municipal bonds)

--------------------------------------------------------------------------------

Illinois 14.2%

--------------------------------------------------------------------------------

Texas 12.4%

--------------------------------------------------------------------------------

Colorado 10.9%

--------------------------------------------------------------------------------

California 7.3%

--------------------------------------------------------------------------------

South Carolina 5.7%

--------------------------------------------------------------------------------

New York 4.5%

--------------------------------------------------------------------------------

Indiana 3.9%

--------------------------------------------------------------------------------

Massachusetts 3.6%

--------------------------------------------------------------------------------

Iowa 3.5%

--------------------------------------------------------------------------------

New Mexico 3.1%

--------------------------------------------------------------------------------

Washington 3.0%

--------------------------------------------------------------------------------

Rhode Island 2.4%

--------------------------------------------------------------------------------

Florida 2.4%

--------------------------------------------------------------------------------

Louisiana 2.4%

--------------------------------------------------------------------------------

Ohio 2.1%

--------------------------------------------------------------------------------

Nevada 2.0%

--------------------------------------------------------------------------------

Pennsylvania 1.9%

--------------------------------------------------------------------------------

Other 14.7%

--------------------------------------------------------------------------------

PORTFOLIO COMPOSITION

(as a % of total investments)

--------------------------------------------------------------------------------

U.S. Guaranteed 23.1%

--------------------------------------------------------------------------------

Health Care 19.6%

--------------------------------------------------------------------------------

Transportation 12.8%

--------------------------------------------------------------------------------

Tax Obligation/Limited 10.4%

--------------------------------------------------------------------------------

Utilities 9.6%

--------------------------------------------------------------------------------

Consumer Staples 6.2%

--------------------------------------------------------------------------------

Tax Obligation/General 5.8%

--------------------------------------------------------------------------------

Other 12.5%

--------------------------------------------------------------------------------

|

(1) Taxable-Equivalent Yield represents the yield that must be earned on a

fully taxable investment in order to equal the yield of the Fund on an

after-tax basis. It is based on a income tax rate of 28%. When comparing

this Fund to investments that generate qualified dividend income, the

Taxable-Equivalent Yield is lower.

(2) Excluding Common Stocks.

Nuveen Investments 7

NXR Performance OVERVIEW | Nuveen Select Tax-Free Income Portfolio 3 as of

September 30, 2009

FUND SNAPSHOT

Share Price 14.44

--------------------------------------------------------------------------------

Net Asset Value 14.23

--------------------------------------------------------------------------------

Premium/(Discount) to NAV 1.48%

--------------------------------------------------------------------------------

Market Yield 4.45%

--------------------------------------------------------------------------------

Taxable-Equivalent Yield(1) 6.18%

--------------------------------------------------------------------------------

Net Assets ($000) $ 184,839

--------------------------------------------------------------------------------

Average Effective Maturity on Securities (Years) 12.54

--------------------------------------------------------------------------------

Modified Duration 4.28

--------------------------------------------------------------------------------

AVERAGE ANNUAL TOTAL RETURN

(Inception 7/24/92)

--------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

--------------------------------------------------------------------------------

6-Month

(Cumulative) 8.88% 8.86%

--------------------------------------------------------------------------------

1-Year 19.80% 12.19%

--------------------------------------------------------------------------------

5-Year 6.89% 4.62%

--------------------------------------------------------------------------------

10-Year 6.58% 4.98%

--------------------------------------------------------------------------------

STATES

(as a % of total municipal bonds)

--------------------------------------------------------------------------------

Illinois 19.2%

--------------------------------------------------------------------------------

California 10.1%

--------------------------------------------------------------------------------

Texas 10.1%

--------------------------------------------------------------------------------

Colorado 7.0%

--------------------------------------------------------------------------------

Indiana 6.3%

--------------------------------------------------------------------------------

Florida 5.6%

--------------------------------------------------------------------------------

Iowa 5.5%

--------------------------------------------------------------------------------

North Carolina 4.3%

--------------------------------------------------------------------------------

South Carolina 3.3%

--------------------------------------------------------------------------------

New York 3.2%

--------------------------------------------------------------------------------

Nevada 3.1%

--------------------------------------------------------------------------------

New Mexico 2.8%

--------------------------------------------------------------------------------

Michigan 2.7%

--------------------------------------------------------------------------------

Pennsylvania 2.4%

--------------------------------------------------------------------------------

Other 14.4%

--------------------------------------------------------------------------------

PORTFOLIO COMPOSITION

(as a % of total investments)

--------------------------------------------------------------------------------

U.S. Guaranteed 23.0%

--------------------------------------------------------------------------------

Health Care 19.9%

--------------------------------------------------------------------------------

Utilities 17.4%

--------------------------------------------------------------------------------

Tax Obligation/Limited 12.8%

--------------------------------------------------------------------------------

Transportation 7.0%

--------------------------------------------------------------------------------

Tax Obligation/General 5.5%

--------------------------------------------------------------------------------

Euro Dollar Time Deposit 0.2%

--------------------------------------------------------------------------------

Other 14.2%

--------------------------------------------------------------------------------

|

CREDIT QUALITY (AS A % OF TOTAL INVESTMENTS)(2)

[PIE CHART]

AAA/U.S.

Guaranteed 40%

AA 24%

A 22%

BBB 12%

BB or Lower 2%

N/R --%*

|

* Rounds to less than 1%.

2008-2009 MONTHLY TAX-FREE DIVIDENDS PER SHARE

[BAR CHART]

Oct $ 0.0535

Nov 0.0535

Dec 0.0535

Jan 0.0535

Feb 0.0535

Mar 0.0535

Apr 0.0535

May 0.0535

Jun 0.0535

Jul 0.0535

Aug 0.0535

Sep 0.0535

|

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

[LINE CHART]

10/01/08 $ 13.18

13.28

11.97

12.15

12.79

12.97

12.99

12.97

12.29

12.7

12.47

11.91

12.84

13.08

13.77

13.955

13.74

13.6

13.86

13.8

13.98

13.57

13.75

13.48

13.62

13.388

13.69

14.05

13.864

13.78

13.9

13.74

13.88

13.9

13.83

13.702

13.95

14

13.9475

13.99

13.9308

13.88

14.3

14.03

14.1382

14.0901

14.15

14.14

14.04

14.09

14.07

14.74

14.27

9/30/09 14.442

|

(1) Taxable-Equivalent Yield represents the yield that must be earned on a

fully taxable investment in order to equal the yield of the Fund on an

after-tax basis. It is based on a income tax rate of 28%. When comparing

this Fund to investments that generate qualified dividend income, the

Taxable-Equivalent Yield is lower.

(2) Excluding Common Stocks and Euro Dollar Time Deposit.

8 Nuveen Investments

NXC Performance OVERVIEW | Nuveen California Select Tax-Free Income Portfolio as

of September 30, 2009

CREDIT QUALITY (AS A % OF TOTAL INVESTMENTS)(2)

[PIE CHART]

AAA/U.S.

Guaranteed 20%

AA 22%

A 41%

BBB 13%

BB or Lower 1%

N/R 3%

|

2008-2009 MONTHLY TAX-FREE DIVIDENDS PER SHARE

[BAR CHART]

Oct $ 0.0555

Nov 0.0555

Dec 0.0555

Jan 0.0555

Feb 0.0555

Mar 0.0555

Apr 0.0555

May 0.0555

Jun 0.0555

Jul 0.0555

Aug 0.0555

Sep 0.0555

|

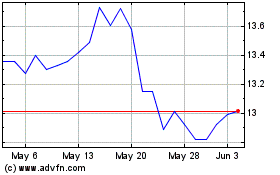

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

[LINE CHART]

10/01/08 $ 13.0499

13.99

10.8

11.8

12.89

12.89

12.91

12.8

12.15

11.75

12.15

11.54

11.9

11.49

12.62

12.81

12.55

12.43

12.76

13.07

13.36

12.36

12.54

12.05

12.2342

12.03

12.06

12.0401

12.15

12.22

12.89

12.85

12.92

12.8701

13.06

12.99

13.05

12.18

12.667

12.05

12.09

12.22

12.75

12.67

13.138

13.09

12.7

13.04

13.1

13.25

13.4999

13.76

13.64

9/30/09 13.67

FUND SNAPSHOT

--------------------------------------------------------------------------------

Share Price 13.67

--------------------------------------------------------------------------------

Net Asset Value 14.35

--------------------------------------------------------------------------------

Premium/(Discount) to NAV -4.74%

--------------------------------------------------------------------------------

Market Yield 4.87%

--------------------------------------------------------------------------------

Taxable-Equivalent Yield(1) 7.48%

--------------------------------------------------------------------------------

Net Assets ($000) $ 89,961

--------------------------------------------------------------------------------

Average Effective Maturity on Securities (Years) 14.47

--------------------------------------------------------------------------------

Modified Duration 5.83

--------------------------------------------------------------------------------

AVERAGE ANNUAL TOTAL RETURN

(Inception 6/19/92)

--------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

--------------------------------------------------------------------------------

6-Month

(Cumulative) 16.87% 11.05%

--------------------------------------------------------------------------------

1-Year 18.19% 12.96%

--------------------------------------------------------------------------------

5-Year 5.34% 4.38%

--------------------------------------------------------------------------------

10-Year 5.04% 4.93%

--------------------------------------------------------------------------------

PORTFOLIO COMPOSITION

(as a % of total investments)

--------------------------------------------------------------------------------

Tax Obligation/General 21.6%

--------------------------------------------------------------------------------

Tax Obligation/Limited 20.0%

--------------------------------------------------------------------------------

U.S. Guaranteed 13.4%

--------------------------------------------------------------------------------

Health Care 12.0%

--------------------------------------------------------------------------------

Education and Civic Organizations 9.4%

--------------------------------------------------------------------------------

Utilities 5.7%

--------------------------------------------------------------------------------

Transportation 5.6%

--------------------------------------------------------------------------------

Euro Dollar Time Deposit 0.5%

--------------------------------------------------------------------------------

Other 11.8%

--------------------------------------------------------------------------------

|

(1) Taxable-Equivalent Yield represents the yield that must be earned on a

fully taxable investment in order to equal the yield of the Fund on an

after-tax basis. It is based on a combined federal and state income tax

rate of 34.9%. When comparing this Fund to investments that generate

qualified dividend income, the Taxable-Equivalent Yield is lower.

(2) Excluding Euro Dollar Time Deposit.

Nuveen Investments 9

NXN Performance OVERVIEW | Nuveen New York Select Tax-Free Income Portfolio as

of September 30, 2009

FUND SNAPSHOT

Share Price 14.24

--------------------------------------------------------------------------------

Net Asset Value 14.23

--------------------------------------------------------------------------------

Premium/(Discount) to NAV 0.07%

--------------------------------------------------------------------------------

Market Yield 4.30%

--------------------------------------------------------------------------------

Taxable-Equivalent Yield(1) 6.41%

--------------------------------------------------------------------------------

Net Assets ($000) $ 55,653

--------------------------------------------------------------------------------

Average Effective Maturity on Securities (Years) 14.85

--------------------------------------------------------------------------------

Modified Duration 4.24

--------------------------------------------------------------------------------

AVERAGE ANNUAL TOTAL RETURN

(Inception 6/19/92)

--------------------------------------------------------------------------------

ON SHARE PRICE ON NAV

--------------------------------------------------------------------------------

6-Month

(Cumulative) 11.33% 8.82%

--------------------------------------------------------------------------------

1-Year 18.81% 13.25%

--------------------------------------------------------------------------------

5-Year 6.00% 4.42%

--------------------------------------------------------------------------------

10-Year 5.80% 4.89%

--------------------------------------------------------------------------------

PORTFOLIO COMPOSITION

(as a % of total investments)

--------------------------------------------------------------------------------

Tax Obligation/Limited 18.4%

--------------------------------------------------------------------------------

Health Care 13.3%

--------------------------------------------------------------------------------

Water and Sewer 12.1%

--------------------------------------------------------------------------------

Long-Term Care 11.5%

--------------------------------------------------------------------------------

Education and Civic Organizations 9.9%

--------------------------------------------------------------------------------

Tax Obligation/General 8.4%

--------------------------------------------------------------------------------

Housing/Single Family 8.1%

--------------------------------------------------------------------------------

U.S. Guaranteed 7.5%

--------------------------------------------------------------------------------

Euro Dollar Time Deposit 2.1%

--------------------------------------------------------------------------------

Other 8.7%

--------------------------------------------------------------------------------

|

CREDIT QUALITY (AS A % OF TOTAL INVESTMENTS)(2)

[PIE CHART]

AAA/U.S.

Guaranteed 45%

AA 24%

A 12%

BBB 11%

BB or Lower 1%

N/R 7%

|

2008-2009 MONTHLY TAX-FREE DIVIDENDS PER SHARE

[BAR CHART]

Oct $ 0.051

Nov 0.051

Dec 0.051

Jan 0.051

Feb 0.051

Mar 0.051

Apr 0.051

May 0.051

Jun 0.051

Jul 0.051

Aug 0.051

Sep 0.051

|

SHARE PRICE PERFORMANCE -- WEEKLY CLOSING PRICE

[LINE CHART]

10/01/08 $ 12.54

12.414

12.62

11.45

12.37

12.27

12.65

12.4274

11.46

11.6625

11.6301

11.53

11.58

11.7

12.66

12.86

12.97

13.24

12.9499

13

13.28

12.634

12.85

12.7501

13.0099

13.2

13.33

13.02

12.9701

13.18

13.35

13.47

13.719

13.47

13.55

13.54

13.54

13.3

13.1201

13.19

13.2

13.35

13.55

13.4

13.6

13.8

13.7301

13.7516

14.16

14

14.2744

14.12

14.17

9/30/09 14.2404

|

(1) Taxable-Equivalent Yield represents the yield that must be earned on a

fully taxable investment in order to equal the yield of the Fund on an

after-tax basis. It is based on a combined federal and state income tax

rate of 32.9%. When comparing this Fund to investments that generate

qualified dividend income, the Taxable-Equivalent Yield is lower.

(2) Excluding Euro Dollar Time Deposit.

10 Nuveen Investments

NXP NXQ NXR | Shareholder Meeting Report

The annual meeting of shareholders was held on July 28, 2009, in the Lobby

Conference Room, 333 West Wacker Drive, Chicago, IL 60606; at this meeting the

shareholders were asked to vote on the election of Board Members.

NXP NXQ NXR

--------------------------------------------------------------------------------------------

APPROVAL OF THE BOARD MEMBERS WAS REACHED AS FOLLOWS:

Robert P. Bremner

For 14,242,465 14,468,097 10,841,539

Withhold 494,538 441,762 249,500

--------------------------------------------------------------------------------------------

Total 14,737,003 14,909,859 11,091,039

============================================================================================

Jack B. Evans

For 14,231,195 14,494,089 10,823,376

Withhold 505,808 415,770 267,663

--------------------------------------------------------------------------------------------

Total 14,737,003 14,909,859 11,091,039

============================================================================================

William J. Schneider

For 14,235,603 14,490,631 10,840,070

Withhold 501,400 419,228 250,969

--------------------------------------------------------------------------------------------

Total 14,737,003 14,909,859 11,091,039

============================================================================================

|

Nuveen Investments 11

NXC NXN | Shareholder Meeting Report (continued)

NXC NXN

--------------------------------------------------------------------------------

APPROVAL OF THE BOARD MEMBERS WAS REACHED AS FOLLOWS:

Robert P. Bremner

For 5,172,944 3,322,862

Withhold 125,084 79,092

--------------------------------------------------------------------------------

Total 5,298,028 3,401,954

================================================================================

Jack B. Evans

For 5,163,207 3,313,616

Withhold 134,821 88,338

--------------------------------------------------------------------------------

Total 5,298,028 3,401,954

================================================================================

William J. Schneider

For 5,174,628 3,324,411

Withhold 123,400 77,543

--------------------------------------------------------------------------------

Total 5,298,028 3,401,954

================================================================================

12 Nuveen Investments

|

NXP | Nuveen Select Tax-Free Income Portfolio

| Portfolio of Investments September 30, 2009 (Unaudited)

PRINCIPAL OPTIONAL CALL

AMOUNT (000) DESCRIPTION (1) PROVISIONS (2) RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------------

MUNICIPAL BONDS - 98.7%

ALASKA - 2.0%

$ 2,475 Alaska Municipal Bond Bank Authority, General Obligation 12/13 at 100.00 A+ (4) $ 2,868,401

Bonds, Series 2003E, 5.250%, 12/01/23 (Pre-refunded

12/01/13) - MBIA Insured

2,500 Northern Tobacco Securitization Corporation, Alaska, Tobacco 6/14 at 100.00 Baa3 1,780,850

Settlement Asset-Backed Bonds, Series 2006A, 5.000%,

6/01/46

-----------------------------------------------------------------------------------------------------------------------------------

4,975 Total Alaska 4,649,251

-----------------------------------------------------------------------------------------------------------------------------------

ARKANSAS - 0.4%

5,915 Arkansas Development Finance Authority, Tobacco Settlement No Opt. Call Aa3 911,738

Revenue Bonds, Arkansas Cancer Research Center Project,

Series 2006, 0.000%, 7/01/46 - AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

CALIFORNIA - 5.7%

2,000 Alameda Corridor Transportation Authority, California, 10/17 at 100.00 A- 1,594,840

Subordinate Lien Revenue Bonds, Series 2004A, 0.000%,

10/01/25 - AMBAC Insured

3,325 California Department of Water Resources, Power Supply 5/12 at 101.00 Aa3 3,733,011

Revenue Bonds, Series 2002A, 6.000%, 5/01/14

1,000 California Statewide Community Development Authority, Revenue 8/19 at 100.00 AA 1,100,280

Bonds, Methodist Hospital Project, Series 2009, 6.750%,

2/01/38

2,645 Cypress Elementary School District, San Bernardino County, No Opt. Call AAA 615,333

California, General Obligation Bonds, Series 2009A,

0.000%, 5/01/34 - FSA Insured

3,000 Golden State Tobacco Securitization Corporation, California, 6/13 at 100.00 AAA 3,550,170

Tobacco Settlement Asset-Backed Bonds, Series 2003A-1,

6.750%, 6/01/39 (Pre-refunded 6/01/13)

1,130 Los Angeles Department of Water and Power, California, 7/11 at 100.00 AA 1,150,035

Waterworks Revenue Refunding Bonds, Series 2001A, 5.125%,

7/01/41 - FGIC Insured

365 Los Angeles, California, Parking System Revenue Bonds, Series 5/10 at 100.00 A+ 369,347

1999A, 5.250%, 5/01/29 - AMBAC Insured

1,000 Moreno Valley Unified School District, Riverside County, No Opt. Call A 488,400

California, General Obligation Bonds, Series 2007, 0.000%,

8/01/23 - NPFG Insured

750 Tobacco Securitization Authority of Northern California, 6/15 at 100.00 BBB 604,658

Tobacco Settlement Asset-Backed Bonds, Series 2005A-1,

5.500%, 6/01/45

1,150 Woodside Elementary School District, San Mateo County, No Opt. Call AA+ 340,550

California, General Obligation Bonds, Series 2007, 0.000%,

10/01/30 - AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

16,365 Total California 13,546,624

-----------------------------------------------------------------------------------------------------------------------------------

COLORADO - 11.9%

1,700 Colorado Health Facilities Authority, Revenue Bonds, Catholic 3/12 at 100.00 AA (4) 1,871,428

Health Initiatives, Series 2002A, 5.500%, 3/01/22 (ETM)

690 Colorado Health Facilities Authority, Revenue Bonds, Catholic 3/12 at 100.00 AA (4) 762,022

Health Initiatives, Series 2002A, 5.500%, 3/01/22

(Pre-refunded 3/01/12)

390 Colorado Water Resources and Power Development Authority, 11/10 at 100.00 A 395,164

Small Water Resources Revenue Bonds, Series 2000A, 5.800%,

11/01/20 - FGIC Insured

8,225 Denver City and County, Colorado, Airport System Revenue No Opt. Call A+ 9,114,781

Bonds, Series 1991D, 7.750%, 11/15/13 (Alternative Minimum

Tax)

5,000 Denver City and County, Colorado, Airport System Revenue 11/11 at 100.00 A+ 5,201,250

Refunding Bonds, Series 2001A, 5.625%, 11/15/17 - FGIC

Insured (Alternative Minimum Tax)

3,000 Denver Convention Center Hotel Authority, Colorado, Senior 12/13 at 100.00 N/R (4) 3,360,900

Revenue Bonds, Convention Center Hotel, Series 2003A,

5.000%, 12/01/23 (Pre-refunded 12/01/13) - SYNCORA GTY

Insured

500 Denver, Colorado, Airport System Revenue Refunding Bonds, 11/13 at 100.00 A+ 510,235

Series 2003B, 5.000%, 11/15/33 - SYNCORA GTY Insured

5,000 E-470 Public Highway Authority, Colorado, Senior Revenue 9/10 at 31.42 Aaa 1,560,300

Bonds, Series 2000B, 0.000%, 9/01/28 (Pre-refunded

9/01/10) - NPFG Insured

|

Nuveen Investments 13

NXP | Nuveen Select Tax-Free Income Portfolio (continued)

| Portfolio of Investments September 30, 2009 (Unaudited)

PRINCIPAL OPTIONAL CALL

AMOUNT (000) DESCRIPTION (1) PROVISIONS (2) RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------------

COLORADO (continued)

$ 12,500 E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, 9/26 at 54.77 A $ 1,800,375

Series 2006A, 0.000%, 9/01/38 - NPFG Insured

3,160 Northwest Parkway Public Highway Authority, Colorado, Revenue 6/11 at 102.00 N/R (4) 3,462,918

Bonds, Senior Series 2001A, 5.500%, 6/15/20 (Pre-refunded

6/15/11) - AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

40,165 Total Colorado 28,039,373

-----------------------------------------------------------------------------------------------------------------------------------

DISTRICT OF COLUMBIA - 0.0%

60 District of Columbia, Revenue Bonds, Catholic University of 10/09 at 101.00 A 60,648

America, Series 1999, 5.625%, 10/01/29 - AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

FLORIDA - 7.4%

2,000 Halifax Hospital Medical Center, Florida, Revenue Bonds, 6/16 at 100.00 A- 1,935,520

Series 2006, 5.375%, 6/01/46

5,000 Jacksonville Health Facilities Authority, Florida, Revenue 11/12 at 101.00 Aa1 5,169,900

Bonds, Ascension Health, Series 2002A, 5.250%, 11/15/32

10,000 JEA St. John's River Power Park System, Florida, Revenue 10/11 at 100.00 Aa2 10,350,400

Refunding Bonds, Issue 2, Series 2002-17, 5.000%, 10/01/17

-----------------------------------------------------------------------------------------------------------------------------------

17,000 Total Florida 17,455,820

-----------------------------------------------------------------------------------------------------------------------------------

HAWAII - 0.6%

1,330 Hawaii, Certificates of Participation, Kapolei State Office 11/09 at 100.50 N/R 1,346,891

Building, Series 1998A, 5.000%, 5/01/17 - AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

ILLINOIS - 13.1%

1,965 Board of Trustees of Southern Illinois University, Housing No Opt. Call A1 1,251,764

and Auxiliary Facilities System Revenue Bonds, Series

1999A, 0.000%, 4/01/20 - NPFG Insured

2,600 Chicago Heights, Illinois, General Obligation Corporate 12/09 at 100.00 A 2,621,268

Purpose Bonds, Series 1993, 5.650%, 12/01/17 - FGIC Insured

195 DuPage County Community School District 200, Wheaton, 11/13 at 100.00 Aa3 216,824

Illinois, General Obligation Bonds, Series 2003B, 5.250%,

11/01/20 - FSA Insured

805 DuPage County Community School District 200, Wheaton, 11/13 at 100.00 Aa3 (4) 924,478

Illinois, General Obligation Bonds, Series 2003B, 5.250%,

11/01/20 (Pre-refunded 11/01/13) - FSA Insured

600 Illinois Educational Facilities Authority, Student Housing 5/12 at 101.00 Aaa 683,490

Revenue Bonds, Educational Advancement Foundation Fund,

University Center Project, Series 2002, 6.000%, 5/01/22

(Pre-refunded 5/01/12)

1,050 Illinois Finance Authority, Revenue Bonds, Loyola University 7/17 at 100.00 AA 1,150,853

of Chicago, Tender Option Bond Trust 1137, 8.932%, 7/01/46

(IF)

4,000 Illinois Finance Authority, Revenue Bonds, Northwestern 8/14 at 100.00 N/R (4) 4,695,480

Memorial Hospital, Series 2004A, 5.500%, 8/15/43

(Pre-refunded 8/15/14)

1,000 Illinois Finance Authority, Revenue Bonds, Silver Cross 8/19 at 100.00 BBB 1,072,100

Hospital and Medical Centers, Series 2009, 6.875%, 8/15/38

1,320 Illinois Health Facilities Authority, Revenue Bonds, Decatur 10/11 at 100.00 A 1,352,472

Memorial Hospital, Series 2001, 5.600%, 10/01/16

2,950 Illinois Health Facilities Authority, Revenue Bonds, Lake 7/12 at 100.00 A- 3,060,035

Forest Hospital, Series 2002A, 6.000%, 7/01/17

2,275 Illinois Health Facilities Authority, Revenue Refunding 1/13 at 100.00 Baa1 2,359,880

Bonds, Elmhurst Memorial Healthcare, Series 2002, 6.250%,

1/01/17

75 Illinois Health Facilities Authority, Revenue Refunding 11/09 at 100.00 N/R 73,659

Bonds, Rockford Health System, Series 1997, 5.000%,

8/15/21 - AMBAC Insured

3,125 Metropolitan Pier and Exposition Authority, Illinois, Revenue No Opt. Call A 2,361,031

Bonds, McCormick Place Expansion Project, Series 1992A,

0.000%, 6/15/17 - FGIC Insured

810 Metropolitan Pier and Exposition Authority, Illinois, Revenue No Opt. Call AAA 279,766

Bonds, McCormick Place Expansion Project, Series 2002A,

0.000%, 6/15/30 - NPFG Insured

5,000 Metropolitan Pier and Exposition Authority, Illinois, Revenue 6/12 at 101.00 AAA 5,273,100

Refunding Bonds, McCormick Place Expansion Project, Series

2002B, 5.000%, 6/15/21 - NPFG Insured

|

14 Nuveen Investments

PRINCIPAL OPTIONAL CALL

AMOUNT (000) DESCRIPTION (1) PROVISIONS (2) RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------------

ILLINOIS (continued)

$ 1,300 Schaumburg, Illinois, General Obligation Bonds, Series 2004B, 12/14 at 100.00 AA+ $ 1,370,785

5.250%, 12/01/34 - FGIC Insured

Yorkville, Illinois, General Obligation Debt Certificates,

Series 2003:

1,000 5.000%, 12/15/19 (Pre-refunded 12/15/11) - RAAI Insured 12/11 at 100.00 BBB- (4) 1,093,220

1,000 5.000%, 12/15/20 (Pre-refunded 12/15/11) - RAAI Insured 12/11 at 100.00 BBB- (4) 1,093,220

-----------------------------------------------------------------------------------------------------------------------------------

31,070 Total Illinois 30,933,425

-----------------------------------------------------------------------------------------------------------------------------------

INDIANA - 6.8%

1,000 Franklin Community Multi-School Building Corporation, Marion 7/14 at 100.00 A (4) 1,156,700

County, Indiana, First Mortgage Revenue Bonds, Series

2004, 5.000%, 7/15/22 (Pre-refunded 7/15/14) - FGIC Insured

1,770 Indiana Health Facility Financing Authority, Hospital Revenue No Opt. Call AAA 2,045,766

Refunding Bonds, Columbus Regional Hospital, Series 1993,

7.000%, 8/15/15 - FSA Insured

1,000 Indiana Health Facility Financing Authority, Revenue Bonds, 3/17 at 100.00 BBB 990,170

Community Foundation of Northwest Indiana, Series 2007,

5.500%, 3/01/37

9,855 Indianapolis Local Public Improvement Bond Bank, Indiana, 7/12 at 100.00 AAA 10,960,238

Waterworks Project, Series 2002A, 5.125%, 7/01/21

(Pre-refunded 7/01/12) - MBIA Insured

750 West Clark 2000 School Building Corporation, Clark County, 1/15 at 100.00 AA+ 802,305

Indiana, First Mortgage Bonds, Series 2005, 5.000%,

7/15/22 - NPFG Insured

-----------------------------------------------------------------------------------------------------------------------------------

14,375 Total Indiana 15,955,179

-----------------------------------------------------------------------------------------------------------------------------------

IOWA - 1.9%

1,000 Iowa Tobacco Settlement Authority, Asset Backed Settlement 6/15 at 100.00 BBB 769,950

Revenue Bonds, Series 2005C, 5.375%, 6/01/38

4,000 Iowa Tobacco Settlement Authority, Tobacco Asset-Backed 6/17 at 100.00 BBB 3,646,720

Revenue Bonds, Series 2005B, 5.600%, 6/01/34

-----------------------------------------------------------------------------------------------------------------------------------

5,000 Total Iowa 4,416,670

-----------------------------------------------------------------------------------------------------------------------------------

KANSAS - 0.5%

500 Lawrence, Kansas, Hospital Revenue Bonds, Lawrence Memorial 7/16 at 100.00 A3 462,370

Hospital, Series 2006, 4.875%, 7/01/36

750 Wamego, Kansas, Pollution Control Revenue Bonds, Kansas Gas 6/14 at 100.00 A 769,883

and Electric Company, Series 2004, 5.300%, 6/01/31 - NPFG

Insured

-----------------------------------------------------------------------------------------------------------------------------------

1,250 Total Kansas 1,232,253

-----------------------------------------------------------------------------------------------------------------------------------

KENTUCKY - 0.5%

1,100 Jefferson County, Kentucky, Health System Revenue Bonds, 10/09 at 100.50 A (4) 1,109,262

Alliant Health System Inc., Series 1998, 5.125%, 10/01/18

- MBIA Insured (ETM)

-----------------------------------------------------------------------------------------------------------------------------------

LOUISIANA - 0.4%

1,100 Tobacco Settlement Financing Corporation, Louisiana, Tobacco 5/11 at 101.00 BBB 1,070,586

Settlement Asset-Backed Bonds, Series 2001B, 5.875%,

5/15/39

-----------------------------------------------------------------------------------------------------------------------------------

MASSACHUSETTS - 2.1%

500 Massachusetts Health and Educational Facilities Authority, 7/18 at 100.00 A3 502,780

Revenue Bonds, CareGroup Inc., Series 2008E-1, 5.000%,

7/01/28

20 Massachusetts Health and Educational Facilities Authority, 7/11 at 101.00 AA 21,551

Revenue Bonds, Partners HealthCare System Inc., Series

2001C, 6.000%, 7/01/17

480 Massachusetts Health and Educational Facilities Authority, 7/11 at 101.00 AAA 529,469

Revenue Bonds, Partners HealthCare System Inc., Series

2001C, 6.000%, 7/01/17 (Pre-refunded 7/01/11)

2,000 Massachusetts Housing Finance Agency, Housing Bonds, Series 12/18 at 100.00 AA- 2,024,020

2009F, 5.700%, 6/01/40

1,055 Massachusetts Turnpike Authority, Metropolitan Highway System 1/10 at 100.00 A 1,054,937

Revenue Bonds, Senior Series 1997A, 5.000%, 1/01/37 - NPFG

Insured

830 Massachusetts Turnpike Authority, Metropolitan Highway System 1/10 at 100.00 AA 830,125

Revenue Bonds, Subordinate Series 1999A, 5.000%, 1/01/39 -

AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

4,885 Total Massachusetts 4,962,882

-----------------------------------------------------------------------------------------------------------------------------------

|

Nuveen Investments 15

NXP | Nuveen Select Tax-Free Income Portfolio (continued)

| Portfolio of Investments September 30, 2009 (Unaudited)

PRINCIPAL OPTIONAL CALL

AMOUNT (000) DESCRIPTION (1) PROVISIONS (2) RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------------

MICHIGAN - 1.6%

$ 1,000 Michigan State Hospital Finance Authority, Hospital Revenue 2/10 at 100.00 BB- $ 825,250

Bonds, Detroit Medical Center Obligated Group, Series

1998A, 5.125%, 8/15/18

2,900 Michigan State Hospital Finance Authority, Hospital Revenue 12/12 at 100.00 AA 2,959,392

Refunding Bonds, Trinity Health Credit Group, Series

2002C, 5.375%, 12/01/30

-----------------------------------------------------------------------------------------------------------------------------------

3,900 Total Michigan 3,784,642

-----------------------------------------------------------------------------------------------------------------------------------

MINNESOTA - 0.1%

220 Minnesota Housing Finance Agency, Single Family Mortgage 1/10 at 100.50 AA+ 221,976

Revenue Bonds, Series 1995A, 5.200%, 1/01/17

-----------------------------------------------------------------------------------------------------------------------------------

MISSOURI - 0.7%

5,000 Kansas City Municipal Assistance Corporation, Missouri, No Opt. Call AA- 1,583,950

Leasehold Revenue Bonds, Series 2004B-1, 0.000%, 4/15/30 -

AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

NEVADA - 4.5%

2,500 Clark County, Nevada, Motor Vehicle Fuel Tax Highway 7/13 at 100.00 AA- 2,596,775

Improvement Revenue Bonds, Series 2003, 5.000%, 7/01/23 -

AMBAC Insured

Director of Nevada State Department of Business and

Industry, Revenue Bonds, Las Vegas Monorail Project,

First Tier, Series 2000:

2,360 0.000%, 1/01/21 - AMBAC Insured No Opt. Call Caa2 221,557

4,070 0.000%, 1/01/22 - AMBAC Insured No Opt. Call Caa2 381,318

6,025 5.375%, 1/01/40 - AMBAC Insured 1/10 at 100.00 Caa2 1,222,412

1,500 Las Vegas Redevelopment Agency, Nevada, Tax Increment Revenue 6/19 at 100.00 A 1,707,465

Bonds, Series 2009A, 8.000%, 6/15/30

1,515 Reno, Nevada, Capital Improvement Revenue Bonds, Series 2002, 6/12 at 100.00 A 1,542,725

5.500%, 6/01/21 - FGIC Insured

2,555 Reno, Nevada, Capital Improvement Revenue Bonds, Series 2002, 6/12 at 100.00 Baa1 (4) 2,853,628

5.500%, 6/01/21 (Pre-refunded 6/01/12) - FGIC Insured

-----------------------------------------------------------------------------------------------------------------------------------

20,525 Total Nevada 10,525,880

-----------------------------------------------------------------------------------------------------------------------------------

NEW HAMPSHIRE - 0.2%

380 New Hampshire Housing Finance Authority, Single Family 5/11 at 100.00 Aa2 385,464

Mortgage Acquisition Bonds, Series 2001A, 5.600%, 7/01/21

(Alternative Minimum Tax)

-----------------------------------------------------------------------------------------------------------------------------------

NEW JERSEY - 2.8%

2,500 New Jersey Health Care Facilities Financing Authority, 7/13 at 100.00 Ba2 2,034,425

Revenue Bonds, Somerset Medical Center, Series 2003,

5.500%, 7/01/23

Tobacco Settlement Financing Corporation, New Jersey, Tobacco

Settlement Asset-Backed Bonds, Series 2002:

1,325 5.750%, 6/01/32 (Pre-refunded 6/01/12) 6/12 at 100.00 AAA 1,448,132

1,000 6.000%, 6/01/37 (Pre-refunded 6/01/12) 6/12 at 100.00 AAA 1,129,160

2,500 Tobacco Settlement Financing Corporation, New Jersey, Tobacco 6/17 at 100.00 BBB 1,896,825

Settlement Asset-Backed Bonds, Series 2007-1A, 5.000%,

6/01/41

-----------------------------------------------------------------------------------------------------------------------------------

7,325 Total New Jersey 6,508,542

-----------------------------------------------------------------------------------------------------------------------------------

NEW MEXICO - 2.1%

1,000 New Mexico Mortgage Finance Authority, Multifamily Housing 9/17 at 100.00 AAA 998,400

Revenue Bonds, St Anthony, Series 2007A, 5.250%, 9/01/42

(Alternative Minimum Tax)

4,000 University of New Mexico, FHA-Insured Mortgage Hospital 7/14 at 100.00 AAA 4,082,680

Revenue Bonds, Series 2004, 4.625%, 7/01/25 - FSA Insured

-----------------------------------------------------------------------------------------------------------------------------------

5,000 Total New Mexico 5,081,080

-----------------------------------------------------------------------------------------------------------------------------------

NEW YORK - 1.2%

1,000 Dormitory Authority of the State of New York, FHA-Insured 2/14 at 100.00 AAA 1,072,190

Mortgage Revenue Bonds, Kaleida Health, Series 2004,

5.050%, 2/15/25

1,215 Dormitory Authority of the State of New York, Revenue Bonds, 7/10 at 101.00 A2 1,250,016

Mount Sinai NYU Health Obligated Group, Series 2000A,

6.500%, 7/01/17

385 Dormitory Authority of the State of New York, Revenue Bonds, 7/10 at 101.00 A2 (4) 404,277

Mount Sinai NYU Health Obligated Group, Series 2000A,

6.500%, 7/01/17 (Pre-refunded 7/01/10)

-----------------------------------------------------------------------------------------------------------------------------------

2,600 Total New York 2,726,483

-----------------------------------------------------------------------------------------------------------------------------------

|

16 Nuveen Investments

PRINCIPAL OPTIONAL CALL

AMOUNT (000) DESCRIPTION (1) PROVISIONS (2) RATINGS (3) VALUE

-----------------------------------------------------------------------------------------------------------------------------------

NORTH CAROLINA - 1.7%

$ 1,000 North Carolina Eastern Municipal Power Agency, Power System 1/19 at 100.00 A- $ 1,190,370

Revenue Bonds, Series 2008C, 6.750%, 1/01/24

2,195 North Carolina Eastern Municipal Power Agency, Power System 11/09 at 100.00 A- 2,197,546

Revenue Refunding Bonds, Series 1993B, 5.500%, 1/01/21

500 Raleigh Durham Airport Authority, North Carolina, Airport 5/11 at 101.00 Aa3 520,915

Revenue Bonds, Series 2001A, 5.250%, 11/01/17 - FGIC

Insured

-----------------------------------------------------------------------------------------------------------------------------------

3,695 Total North Carolina 3,908,831

-----------------------------------------------------------------------------------------------------------------------------------

OHIO - 0.7%

1,500 Buckeye Tobacco Settlement Financing Authority, Ohio, Tobacco 6/17 at 100.00 BBB 1,268,070

Settlement Asset-Backed Revenue Bonds, Senior Lien, Series

2007A-2, 6.000%, 6/01/42

300 Lebanon, Ohio, Electric System Mortgage Revenue Bonds, Series 12/10 at 101.00 A2 (4) 320,883

2001, 5.500%, 12/01/17(Pre-refunded 12/01/10) - AMBAC

Insured

-----------------------------------------------------------------------------------------------------------------------------------

1,800 Total Ohio 1,588,953

-----------------------------------------------------------------------------------------------------------------------------------

OKLAHOMA - 2.0%

1,000 Norman Regional Hospital Authority, Oklahoma, Hospital 9/16 at 100.00 BBB- 808,310

Revenue Bonds, Series 2005, 5.375%, 9/01/36

4,000 Oklahoma Development Finance Authority, Revenue Bonds, St. 2/14 at 100.00 A 4,038,880

John Health System, Series 2004, 5.000%, 2/15/24

-----------------------------------------------------------------------------------------------------------------------------------

5,000 Total Oklahoma 4,847,190

-----------------------------------------------------------------------------------------------------------------------------------

PENNSYLVANIA - 0.5%

500 Pennsylvania Higher Educational Facilities Authority, Revenue 7/13 at 100.00 BBB+ 505,070

Bonds, Widener University, Series 2003, 5.250%, 7/15/24

700 Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, 12/14 at 100.00 Aa3 755,405

Series 2004A, 5.500%, 12/01/31 - AMBAC Insured

-----------------------------------------------------------------------------------------------------------------------------------

1,200 Total Pennsylvania 1,260,475

-----------------------------------------------------------------------------------------------------------------------------------

PUERTO RICO - 0.5%

1,000 Puerto Rico Sales Tax Financing Corporation, Sales Tax 8/19 at 100.00 A+ 1,102,200

Revenue Bonds, First Subordinate Series 2009A, 6.000%,

8/01/42