NextEra Energy Partners to Buy 1,388MW Portfolio for $1.275 Billion

September 05 2018 - 8:36AM

Dow Jones News

By Chris Wack

NextEra Energy Partners LP (NEP) has an agreement with a unit of

NextEra Energy Resources LLC to buy a portfolio of 11 wind and

solar projects consisting of about 1,388 megawatts.

In conjunction with the acquisition, NextEra Energy Partners

also has entered a $750 million convertible equity portfolio

financing with a fund managed by BlackRock Global Energy &

Power Infrastructure.

The Florida limited partnership expects to buy the portfolio for

$1.275 billion, plus the assumption of $930 million in tax equity

financing and $38 million of non-recourse project debt as of

year-end 2018. The acquisition is expected to contribute adjusted

EBITDA of $290 million to $310 million, and cash available for

distribution of $122 million to $132 million, each on a five-year

average annual run-rate basis, beginning Dec. 31, 2018. The deal is

seen closing in the fourth quarter.

NextEra Energy Partners intends to finance the portfolio

purchase using the $573 million proceeds from the sale earlier this

year of its Canadian assets as well as capacity under an existing

credit facility. Funds drawn under the credit facility are expected

to be immediately repaid with the BlackRock convertible equity

portfolio.

Under the terms of the financing, the BlackRock fund will pay

$750 million in exchange for an equity interest in the entity that

will own the 1,388-MW portfolio being acquired by NextEra Energy

Partners. The fund is expected to earn an effective coupon of 2.5%

over the initial three-year period, which represents the fund's

initial 15% allocation of distributable cash flow from the

portfolio.

During the fourth year of the agreement, NextEra Energy Partners

expects to exercise its right to buy out the fund's equity interest

for a fixed payment equal to $750 million, plus a fixed pre-tax

return of 7.75%. NextEra Energy Partners has the right to pay at

least 70% of the buyout amount in NextEra Energy Partners common

units, issued at no discount to the then-current market price, with

the balance paid in cash. Following the initial three-year period,

if NextEra Energy Partners hasn't exercised its buyout right, the

BlackRock fund's allocation of distributable cash flow from the

portfolio would increase to 80%.

Shares of NextEra Energy Partners were untraded at $48.38 a

share premarket Wednesday.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

September 05, 2018 08:21 ET (12:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

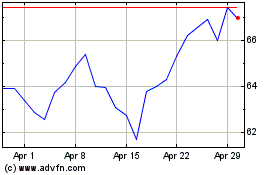

Nextera Energy (NYSE:NEE)

Historical Stock Chart

From Sep 2024 to Oct 2024

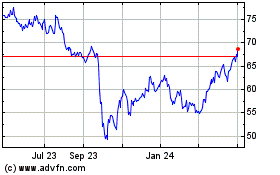

Nextera Energy (NYSE:NEE)

Historical Stock Chart

From Oct 2023 to Oct 2024