New Jersey Resources (NYSE: NJR) today reported improved net

financial earnings for the first quarter of fiscal 2012 and

announced initial earnings guidance for fiscal 2012.

A reconciliation of net income to net financial earnings for the

first quarter of fiscal years 2012 and 2011 is provided below.

Three Months Ended December 31,

(Thousands)

2011 2010

Net income

$ 57,357 $ 24,509 Add: Unrealized (gain) loss

on derivative instruments and relatedtransactions, net of taxes

(17,372) 34,404 Effects of economic hedging related to

natural gas inventory, net of taxes

5,323

(29,783)

Net financial earnings $ 45,308 $

29,130

Weighted Average Shares Outstanding Basic

41,434 41,280 Diluted

41,651 41,510

Basic earnings per share $ 1.38 $ 0.59

Basic net financial earnings per share $ 1.09

$ 0.71

Net financial earnings is a financial measure not calculated in

accordance with generally accepted accounting principles (GAAP) of

the United States as it excludes all unrealized, and certain

realized, gains and losses associated with derivative instruments.

For further discussion of this financial measure, as well as

reconciliation to the most comparable GAAP measure, please see the

explanation below under “Additional Non-GAAP Financial

Information.”

- NJR Net Financial Earnings Per Share

Increase 54 Percent

First-quarter net financial earnings at NJR were $45.3 million,

or $1.09 per share, compared with $29.1 million, or $.71 per share,

during the same period last year. This increase is due primarily to

projects placed into service at NJR Clean Energy Ventures, the

company’s renewable energy subsidiary, continued growth at New

Jersey Natural Gas and improved results at NJR Energy Services.

“We are off to a strong start in fiscal 2012,” said Laurence M.

Downes, chairman and CEO of NJR. “Our renewable energy strategy is

taking hold and the results can be seen in strong earnings at NJR

Clean Energy Ventures. Increased gross margin at our regulated

business, New Jersey Natural Gas, also contributed to this

quarter’s performance. We remain committed to delivering consistent

returns to our shareowners.

“On behalf of our board of directors, I would like to thank all

our employees for their passion and commitment, which have always

been a key driver of our performance. And, with a new collective

bargaining agreement set in place this quarter, I believe we have a

solid foundation for future growth, as we continue to meet our

customers’ expectations for safety, reliability and service.”

- Fiscal 2012 Guidance

Announced

Subject to the risks and uncertainties identified below under

“Forward-Looking Statements,” NJR announced fiscal 2012 net

financial earnings guidance in a range of $2.60 to $2.80 per basic

share. As in the past, NJR expects New Jersey Natural Gas to be the

major contributor to fiscal 2012 net financial earnings. The

following chart represents the expected contributions from NJR’s

subsidiaries:

Company Expected Fiscal 2012 Net Financial

Earnings Contribution Percent

Amount per Share New Jersey Natural Gas 60 to 70

percent $1.62 - $1.89 NJR Clean Energy Ventures

15 to 25 percent $.41 - $.68 NJR Energy Services

5 to 15 percent $.14 - $.41 NJR Energy

Holdings 3 to 10 percent $.08 - $.27 NJR Home

Services 1 to 5 percent $.03 - $.14

- Earnings Remain Strong at New Jersey

Natural Gas

Net income at New Jersey Natural Gas (NJNG), the company’s

regulated utility subsidiary, increased 6.6 percent during the

first quarter of fiscal 2012 to $26 million, compared with $24.4

million during the same period last year. Steady customer growth,

accelerated infrastructure investments and gross margin from

incentive programs were the primary drivers.

NJNG added 2,001 new customers in the first quarter of fiscal

2012, compared with 1,640 in the same period last year. New

customer conversions totaled 1,314, up from 833 in the same period

last year. Additionally, 104 existing non-heat customers converted

to natural gas heat, compared with 92 in the first quarter of

fiscal 2011. NJNG expects these new customers and conversions to

contribute approximately $1.1 million annually to utility gross

margin. For more information on utility gross margin, please see

Non-GAAP Financial Information below.

“With heating oil prices in the Northeast that are more than

double the projected cost of natural gas on a relative basis, the

conversion market at New Jersey Natural Gas is poised for continued

growth,” said Downes. “In the first quarter of fiscal 2012, oil

heat customers accounted for 64 percent of conversions.

“Additionally,” continued Downes, “electric prices in New Jersey

remain among the highest in the country. The favorable price

advantage of clean natural gas, coupled with energy-efficiency

incentives, will help sustain continued steady customer growth and

go a long way toward supporting the state’s goals to reduce both

greenhouse gas emissions and energy costs for its residents.”

NJNG expects to add, in total, approximately 12,000 to 14,000

new customers during fiscal 2012 and 2013, which would represent a

growth rate of 1.3 percent.

- New Jersey Natural Gas Supply

Incentive Program Update

During the first three months of fiscal 2012, NJNG’s gross

margin-sharing incentive programs, which include off-system sales,

capacity release, storage optimization and financial risk

management programs, generated utility gross margin of $2.8

million, compared with $2.7 million for the same period last year.

NJNG shares the gross margin earned from these incentive programs

with customers and shareowners according to a gross margin-sharing

formula authorized by the New Jersey Board of Public Utilities

(BPU) and in place through October 31, 2015. Since inception in

1992, these incentive programs have saved customers over $556

million.

- Accelerated Infrastructure Program

Ensures Reliability, Bolsters State Economy

The second phase of NJNG’s Accelerated Infrastructure Program

(AIP II), designed to expedite previously planned capital

expenditures, continues to help ensure the safety and integrity of

the company’s distribution system. All nine AIP II projects are in

the design or construction phase including the largest project, an

$18 million investment in Monmouth County, which began in November

2011. NJNG expects all projects under AIP II to be completed by

October 2012. NJNG’s $60.2 million investment in the nine AIP II

projects is authorized by the BPU to earn an overall return of 7.12

percent, which includes a 10.3 percent return on equity.

AIP projects also help grow the state’s economy through job

creation. According to a study by the Rutgers’ Bloustein School of

Planning and Public Policy on the “Economic Impacts of Energy

Infrastructure Investments,” commissioned by NJNG, 7.8 jobs are

created for every $1 million the company spends on AIP

projects.

- The SAVEGREEN Project®

Extended

On January 18, 2012, the BPU extended NJNG’s highly successful

SAVEGREEN Project through December 31, 2012, approving an

additional $19.4 million in incentives and rebates for customers

who make energy-efficiency home improvements. No immediate rate

change will result from this approval and the company will earn an

overall return of 7.10 percent, which includes a 10.3 percent

return on equity, on $18.4 million of the incentives and rebates.

Additionally, NJNG will recover $1 million of incentives related to

customer conversions over a five-year period.

In the first quarter of 2012, SAVEGREEN performed 1,651 home

energy audits and paid $2.3 million in rebates and incentives to

customers. Over 1,000 additional audits are scheduled through

February 2012. The energy-efficiency rebates, incentives and

repayment options offered through The SAVEGREEN Project help

customers make the switch to clean, energy-efficient natural gas,

advancing the state’s environmental goals and its mandate to reduce

energy costs for residents. Additionally, since its inception in

2009, over 1,000 contractors have participated in The SAVEGREEN

Project. These local contractors have reaped the benefits of a

capital investment of more than $88 million to date.

- NJR Clean Energy Ventures Places

Four Commercial Solar Projects into Service; Expands Residential

Solar Program

Entering its second year of operations, net income for the first

quarter of fiscal 2012 at NJR Clean Energy Ventures (NJRCEV), NJR’s

renewable energy subsidiary, was $10.1 million compared with

$54,000, in the same period last year. NJRCEV completed several

projects in the first quarter of fiscal 2012, including the 3.6

megawatt project at the Village of Manalapan, the remaining 25

percent of a 4.7 megawatt system in Vineland, New Jersey and the

1.3 megawatt system across two rooftops in Edison, New Jersey.

NJRCEV also placed into service a 14.1 megawatt solar system

built on McGraw-Hill’s East Windsor, New Jersey campus. This $59.5

million project, originally scheduled for completion in March of

2012, is NJRCEV’s largest single investment to date.

These solar installations are the latest commercial projects

completed by NJRCEV. The company has invested approximately $123

million in rooftop and ground-mounted solar systems with a total

capacity of 27.6 megawatts in Monmouth, Mercer, Middlesex and

Cumberland counties in New Jersey.

“New Jersey recognizes the benefits of renewable energy and so

does NJR,” said Downes. “It’s consistent with our core energy

strategy, our commitment to the environment and our mission to

reduce energy usage and lower prices for our customers. Both

residential and commercial customers will benefit from the projects

and programs NJR Clean Energy Ventures has put into place and our

shareowners are benefiting from these investments as well.”

In the first quarter of fiscal 2012, The Sunlight AdvantageTM,

NJRCEV’s residential solar lease program, added 140 customers

bringing the total number of customers to 489 since inception. The

Sunlight Advantage provides simple, solar savings to eligible

homeowners through a roof-mounted solar system with no upfront

installation or maintenance costs. NJRCEV expects to invest

approximately $14.2 million in residential solar systems in fiscal

2012.

NJR’s effective tax rate is significantly impacted by the amount

of investment tax credits (ITCs) earned during the fiscal year.

GAAP requires NJR to estimate its annual effective tax rate and use

this rate to calculate its year-to-date tax expense/benefit. Based

on the commercial projects completed in the first quarter and

NJRCEV’s forecast for residential projects for the balance of the

fiscal year, NJR used an effective tax rate of 21.9 percent in the

first quarter of fiscal 2012. Accordingly, $11.3 million related to

ITCs was recognized in the first fiscal quarter.

The estimate is based on information and assumptions that are

subject to change, and may have a material impact on quarterly and

annual net financial earnings. Factors considered by management in

estimating completion of projects during the fiscal year include,

but are not limited to, board of directors’ approval, execution of

various contracts, including power purchase agreements,

construction logistics, permitting and interconnection completion.

See the “Forward-Looking Statements” section of this news release

for further information regarding the inherent risks associated

with solar investments.

- NJR Energy Services Reports First

Quarter Results

Net financial earnings at NJR Energy Services (NJRES), the

wholesale energy services subsidiary of NJR, were $7.6 million

during the first quarter of fiscal 2012, compared with $3.2 million

in the same period last year. The increase was due primarily to

higher revenue from fee-based elements of transactions executed

with producers in the Marcellus Shale region, and an improvement in

transportation arbitrage opportunities, as compared with the prior

year. However, as indicated in NJRES’ earnings guidance above,

relatively low natural gas prices and reduced volatility in the

wholesale markets are expected to negatively impact comparable

results over the balance of the fiscal year.

NJRES develops and manages a diverse portfolio of over 36.5 Bcf

of firm storage capacity and 1.1 Bcf/day of firm transportation.

With the value of capacity and storage affected by abundant supply

and historically low prices, NJRES continues to focus on providing

producer services in the Marcellus Shale and other natural gas

producing regions. By using its extensive transportation and

storage assets, and expanding expertise in the natural gas liquids

arena, NJRES offers producers the opportunity to increase the value

of their product while enhancing its profitability.

- NJR Energy Holdings Update

NJR Energy Holdings, which owns the company’s natural gas

storage and transportation pipeline investments, including NJR’s 50

percent equity ownership in Steckman Ridge and its 5.53 percent

equity investment in the Iroquois Pipeline, reported net income in

the first quarter of fiscal 2012 of $1.8 million, compared with

$1.7 million in the same period last year.

Steckman Ridge, a 12 Bcf working natural gas storage facility in

southwestern Pennsylvania with Spectra Energy, generated $1.1

million in earnings for the first quarter of fiscal 2012, slightly

higher than the first quarter of fiscal 2011. NJR’s equity

investment in the Iroquois Pipeline, which brings natural gas from

eastern Canada to the metropolitan region, contributed $715,000 to

first-quarter 2012 earnings, compared with $662,000 in the same

period last year.

- NJR Home Services Reports Growth;

Generator Sales, Solar Business and Service Plans Increase

Earnings at NJR’s Retail and Other operation, which consists

primarily of NJR Home Services (NJRHS), the company’s appliance

service subsidiary, improved slightly in the first quarter of

fiscal 2012. Revenue for NJRHS in the first quarter of fiscal 2012

was $8.4 million, a 12 percent increase over the same period last

year. These improved results were due primarily to growth in its

backup generator business, equipment sales and solar installations,

as well as the continued growth of its Premier Heating and Cooling

Plans. NJRHS serves over 130,000 customers.

NJR purchased 83,600 shares of common stock under its share

repurchase plan during the first quarter of fiscal 2012 at a cost

of $3.7 million. The plan authorizes NJR to purchase its shares on

the open market or in negotiated transactions, based on market and

other financial conditions. Since its inception in September 1996,

NJR has invested nearly $222 million to repurchase 7.4 million

shares at a split-adjusted, average price of $30.10. Approximately

1.4 million shares remain authorized for purchase under the

repurchase plan.

Webcast Information

NJR will host a live webcast to discuss its financial results

today at 9 a.m. ET. A few minutes prior to the webcast, go to

www.njresources.com and select “Investor Relations,” then scroll

down to the “Events & Presentations” section and click on the

webcast link.

Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

NJR cautions readers that the assumptions forming the basis for

forward-looking statements include many factors that are beyond

NJR’s ability to control or estimate precisely, such as estimates

of future market conditions and the behavior of other market

participants. Other factors that could cause actual results to

differ materially from the company’s expectations include, but are

not limited to, weather and economic conditions; demographic

changes in NJNG’s service territory and their effect on NJNG

customer growth; volatility of natural gas and other commodity

prices and their impact on NJNG customer usage, NJNG's incentive

programs, NJRES' operations and on NJR’s risk management efforts;

changes in rating agency requirements and/or credit ratings and

their effect on availability and cost of capital to NJR; the impact

of volatility in the credit markets; the ability to comply with

debt covenants; the impact to the asset values and resulting higher

costs and funding obligations of NJR's pension and postemployment

benefit plans as a result of downturns in the financial markets,

and impacts associated with the Patient Protection and Affordable

Care Act; accounting effects and other risks associated with

hedging activities and use of derivatives contracts; commercial and

wholesale credit risks, including the availability of creditworthy

customers and counterparties, liquidity in the wholesale energy

trading market and the company’s ability to recover all of NJRES’

funds in the MF Global liquidation proceedings; the ability to

obtain governmental approvals and/or financing for the

construction, development and operation of certain non-regulated

energy investments; risks associated with the management of NJR's

joint ventures and partnerships; risks associated with our

investments in solar energy projects, including the availability of

regulatory and tax incentives, logistical risks and potential

delays related to construction, permitting, regulatory approvals

and electric grid interconnection, the availability of viable

projects, NJR's eligibility for Investment Tax Credits (ITCs) and

the future market for Solar Renewable Energy Certificates (SRECs);

timing of qualifying for ITCs due to delays or failures to complete

planned solar energy projects and the resulting effect on our

effective tax rate and earnings; the level and rate at which NJNG's

costs and expenses are incurred and the extent to which they are

allowed to be recovered from customers through the regulatory

process; access to adequate supplies of natural gas and dependence

on third-party storage and transportation facilities for natural

gas supply; operating risks incidental to handling, storing,

transporting and providing customers with natural gas; risks

related to our employee workforce; the regulatory and pricing

policies of federal and state regulatory agencies; the costs of

compliance with the proposed regulatory framework for

over-the-counter derivatives; the costs of compliance with present

and future environmental laws, including potential climate

change-related legislation; risks related to changes in accounting

standards; the disallowance of recovery of environmental-related

expenditures and other regulatory changes; environmental-related

and other litigation and other uncertainties; and the impact of

natural disasters, terrorist activities, and other extreme events.

NJR does not, by including this paragraph, assume any obligation to

review or revise any particular forward-looking statement

referenced herein in light of future events. More detailed

information about these factors is set forth under the heading

“Risk Factors” in NJR’s filings with the Securities and Exchange

Commission (SEC) including its most recent Form 10-K.

Non-GAAP Financial

Information

This press release includes the non-GAAP measures net financial

earnings (losses), financial margin and utility gross margin. A

reconciliation of these non-GAAP financial measures to the most

directly comparable financial measures calculated and reported in

accordance with GAAP, can be found below. As an indicator of the

company’s operating performance, these measures should not be

considered an alternative to, or more meaningful than, operating

income as determined in accordance with GAAP.

Net financial earnings (losses) and financial margin exclude

unrealized gains or losses on derivative instruments related to the

company’s unregulated subsidiaries and certain realized gains and

losses on derivative instruments related to natural gas that has

been placed into storage at NJRES. Volatility associated with the

change in value of these financial and physical commodity contracts

is reported in the income statement in the current period. In order

to manage its business, NJR views its results without the impacts

of the unrealized gains and losses, and certain realized gains and

losses, caused by changes in value of these financial instruments

and physical commodity contracts prior to the completion of the

planned transaction because it shows changes in value currently as

opposed to when the planned transaction ultimately is settled.

NJNG’s utility gross margin represents the results of revenues less

natural gas costs, sales and other taxes and regulatory rider

expenses, which are key components of the company’s operations that

move in relation to each other. Natural gas costs, sales and other

taxes and regulatory rider expenses are passed through to customers

and therefore have no effect on gross margin. Management uses these

non-GAAP financial measures as supplemental measures to other GAAP

results to provide a more complete understanding of the company’s

performance. Management believes these non-GAAP measures are more

reflective of the company’s business model, provide transparency to

investors and enable period-to-period comparability of financial

performance. A reconciliation of all non-GAAP financial measures to

the most directly comparable financial measures calculated and

reported in accordance with GAAP, can be found below. For a full

discussion of NJR’s non-GAAP financial measures, please see NJR’s

most recent Form 10-K, Item 7.

About New Jersey

Resources

New Jersey Resources, a Fortune 1000 company, provides safe and

reliable natural gas and renewable energy services, including

transportation, distribution and asset management in states from

the Gulf Coast to the New England regions, including the

Mid-Continent region, the West Coast and Canada, while investing in

and maintaining an extensive infrastructure to support future

growth. With $3 billion in annual revenues, NJR safely and reliably

operates and maintains 6,800 miles of natural gas transportation

and distribution infrastructure to serve nearly half a million

customers; develops and manages a diverse portfolio of 3.2 Bcf/day

of firm transportation and over 62 Bcf of firm storage capacity;

offers low-carbon, clean energy solutions through its commercial

and residential solar programs and provides appliance installation,

repair and contract service to nearly 150,000 homes and businesses.

Additionally, NJR holds investments in midstream assets through

equity partnerships including Steckman Ridge and Iroquois. Through

Conserve to Preserve®, NJR is helping customers save energy and

money by promoting conservation and encouraging efficiency. For

more information about NJR, visit www.njresources.com.

RECONCILIATION OF NON-GAAP PERFORMANCE

MEASURES NEW JERSEY RESOURCES A reconciliation

of Net income at NJR to Net financial earnings, is as follows:

Three Months Ended December 31, (Thousands)

2011 2010 Net income

$ 57,357 $ 24,509 Add:

Unrealized (gain) loss on derivative instruments and related

transactions, net of taxes

(17,372 ) 34,404 Effects

of economic hedging related to natural gas, net of taxes

5,323 (29,783 )

Net financial earnings

$ 45,308 $ 29,130

Weighted

Average Shares Outstanding Basic

41,434 41,280 Diluted

41,651 41,510

Basic

net financial earnings per share $ 1.09 $

0.71

NJR ENERGY

SERVICES The following table is a computation of

Financial margin at Energy Services: Three Months

Ended December 31, (Thousands)

2011 2010

Operating revenues

$ 442,000 $ 430,774 Less: Gas

purchases

406,763 429,315 Add: Unrealized (gain) loss on

derivative instruments and related transactions

(27,661

) 54,407 Effects of economic hedging related to natural gas

inventory

8,418 (47,101 )

Financial

margin $ 15,994 $ 8,765

A

reconciliation of Operating income at Energy Services, the closest

GAAP financial measurement, to Financial margin is as follows:

Three Months Ended December 31, (Thousands)

2011 2010 Operating income (loss)

$ 31,530 $

(2,022 ) Add: Operation and maintenance expense

3,341 3,171

Depreciation and amortization

16 16 Other taxes

350 294 Subtotal – Gross margin

35,237 1,459 Add: Unrealized (gain) loss on derivative

instruments and related transactions

(27,661 ) 54,407

Effects of economic hedging related to natural gas inventory

8,418 (47,101 )

Financial margin

$ 15,994 $ 8,765

A

reconciliation of Energy Services Net income to Net financial

earnings, is as follows: Three Months Ended

December 31, (Thousands)

2011 2010 Net income (loss)

$ 19,783 $ (1,452 ) Add: Unrealized (gain) loss on

derivative instruments and related transactions, net of taxes

(17,491 ) 34,402 Effects of economic hedging related

to natural gas, net of taxes

5,323

(29,783 )

Net financial earnings $ 7,615

$ 3,167

NEW JERSEY RESOURCES

CONSOLIDATED STATEMENTS OF INCOME Three

Months Ended December 31, (Thousands, except per share

data)

2011 2010

OPERATING REVENUES Utility

$

191,374 $ 290,676 Nonutility

451,037

422,476 Total operating revenues

642,411

713,152

OPERATING EXPENSES Gas purchases Utility

85,630 160,449 Nonutility

406,417 429,247 Operation

and maintenance

38,945 37,416 Regulatory rider expenses

12,543 16,698 Depreciation and amortization

9,600

8,454 Energy and other taxes

14,058 20,625

Total operating expenses

567,193 672,889

OPERATING INCOME 75,218 40,263 Other income

527 445 Interest expense, net

5,005

5,263

INCOME BEFORE INCOME TAXES AND EQUITY IN EARNINGS OF

AFFILIATES 70,740 35,445 Income tax provision

16,037 13,853 Equity in earnings of affiliates

2,654 2,917

NET INCOME $ 57,357

$ 24,509

EARNINGS PER COMMON SHARE BASIC

$

1.38 $ 0.59 DILUTED

$ 1.38 $ 0.59

DIVIDENDS PER COMMON SHARE $ 0.38 $ 0.36

AVERAGE SHARES OUTSTANDING BASIC

41,434 41,280

DILUTED

41,651 41,510

NEW JERSEY RESOURCES Three Months Ended

December 31, (Thousands, except per share data)

2011

2010

Operating Revenues Natural Gas Distribution

$

191,374 $ 290,676 Energy Services

442,000 430,774

Clean Energy Ventures

380 - Energy Holdings

- -

Retail and Other

9,031 8,126

Sub-total 642,785 729,576 Eliminations

(374 ) (16,424 )

Total $

642,411 $ 713,152

Operating Income (Loss) Natural Gas

Distribution

$ 44,983 $ 42,669 Energy Services

31,530 (2,022 ) Clean Energy Ventures

(1,932 )

(581 ) Energy Holdings

(133 ) (143 ) Retail and Other

(224 ) (587 )

Sub-total

74,224 39,336 Eliminations

994

927

Total $ 75,218 $ 40,263

Equity

in Earnings of Affiliates Energy Holdings

$ 3,615

$ 3,620 Eliminations

(961 ) (703 )

Total $ 2,654 $ 2,917

Net Income (Loss)

Natural Gas Distribution

$ 25,974 $ 24,356 Energy

Services

19,783 (1,452 ) Clean Energy Ventures

10,097

54 Energy Holdings

1,783 1,713 Retail and Other

(146 ) (160 )

Sub-total 57,491

24,511 Eliminations

(134 ) (2 )

Total $ 57,357 $ 24,509

Net Financial Earnings

(Loss) Natural Gas Distribution

$ 25,974 $ 24,356

Energy Services

7,615 3,167 Clean Energy Ventures

10,097 54 Energy Holdings

1,783 1,713 Retail and

Other

(146 ) (160 )

Sub-total

45,323 29,130 Eliminations

(15 )

-

Total $ 45,308 $ 29,130

Throughput

(Bcf) NJNG, Core Customers

17.7 21.8 NJNG, Off

System/Capacity Management

25.6 27.3 NJRES Fuel Mgmt. and

Wholesale Sales

123.8 109.6

Total 167.1 158.7

Common Stock Data

Yield at December 31

3.1 % 3.3 % Market Price High

$ 50.48 $ 44.10 Low

$ 40.10 $ 38.94

Close at December 31

$ 49.20 $ 43.11 Shares Out. at

December 31

41,434 41,361 Market Cap. at December 31

$ 2,038,553 $ 1,783,073

NATURAL GAS DISTRIBUTION

Three Months Ended

(Unaudited)

December 31,

(Thousands, except customer & weather data)

2011 2010

Utility Gross Margin Operating revenues

$

191,374 $ 290,676 Less: Gas purchases

86,487 177,651

Energy and other taxes

11,883 18,482 Regulatory rider

expense

12,543 16,698

Total

Utility Gross Margin $ 80,461 $ 77,845

Utility Gross Margin,

Operating Income and Net Income Residential

$

51,230 $ 50,846 Commercial, Industrial & Other

13,110 12,990 Firm Transportation

13,180

11,195

Total Firm Margin 77,520

75,031 Interruptible

102 90

Total System Margin 77,622 75,121 Off System/Capacity

Management/FRM/Storage Incentive

2,839

2,724

Total Utility Gross Margin 80,461 77,845

Operation and maintenance expense

25,940 25,874 Depreciation

and amortization

8,632 8,223 Other taxes not reflected in

gross margin

906 1,079

Operating Income $ 44,983 $ 42,669

Net Income $ 25,974 $

24,356

Throughput

(Bcf) Residential

10.2 13.7 Commercial, Industrial &

Other

2.0 2.7 Firm Transportation

3.4

4.0

Total Firm Throughput 15.6 20.4

Interruptible

2.1 1.4

Total

System Throughput 17.7 21.8 Off System/Capacity

Management

25.6 27.3

Total

Throughput 43.3 49.1

Customers Residential

428,256 434,967 Commercial, Industrial & Other

26,877 27,537 Firm Transportation

42,580

30,934

Total Firm Customers

497,713 493,438 Interruptible

42

42

Total System Customers 497,755 493,480 Off

System/Capacity Management*

41 42

Total Customers 497,796

493,522 *The number of customers represents those active

during the last month of the period.

Degree Days Actual

1,326 1,763 Normal

1,651 1,636

Percent of Normal

80.3 % 107.8 %

ENERGY SERVICES

Three Months Ended

(Unaudited)

December 31,

(Thousands, except customer and megawatt)

2011 2010

Operating Income Operating Revenues

$ 442,000

$ 430,774 Gas Purchases

406,763 429,315

Gross Margin 35,237 1,459 Operation and

maintenance expense

3,341 3,171 Depreciation and

amortization

16 16 Energy and other taxes

350

294

Operating Income (Loss) $

31,530 $ (2,022 )

Net Income (Loss)

$ 19,783 $ (1,452 )

Financial

Margin $ 15,994 $ 8,765

Net Financial Earnings $ 7,615 $ 3,167

Gas Sold and Managed (Bcf) 123.8

109.6

CLEAN ENERGY VENTURES

Operating Revenues $ 380 $ -

Operating (Loss) $ (1,932 ) $

(581 )

Income Tax Benefit $ 12,171

$ 639

Net Income $ 10,097

$ 54

Solar Renewable Energy Certificates

Generated 989 -

Solar Renewable Energy Certificates Sold 1,323

-

Megawatts Installed

21.2 -

Megawatts Under

Construction 0.425 2

ENERGY HOLDINGS

Equity in Earnings of Affiliates

$ 3,615 $ 3,620

Operation and

Maintenance $ 118 $ 142

Interest Expense $ 714 $ 808

Net Income $ 1,783 $ 1,713

RETAIL AND OTHER

Operating Revenues

$ 9,031 $ 8,126

Operating

(Loss) $ (224 ) $ (587 )

Net

(Loss) $ (146 ) $ (160 )

Total

Customers at December 31, 130,430

133,007

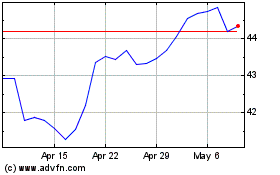

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Apr 2024 to May 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From May 2023 to May 2024