New Jersey Resources (NYSE:NJR) today reported a 14 percent

increase in year-to-date earnings for fiscal 2008. For the six

months ended March 31, 2008, NJR reported net income of $42.7

million, or $1.02 per basic share, compared with $37.4 million, or

$.90 per basic share during the same period last year. During the

second quarter of fiscal 2008, the company reported net income of

$12.6 million, or $.30 per basic share, compared with $7.9 million,

or $.19 per basic share, last year. For the same 6-month period,

net financial earnings rose 5.2 percent to $114.3 million, or $2.74

per basic share, compared with $108.7 million, or $2.61 per basic

share, last year. Net financial earnings during the second quarter

were $78 million, or $1.86 per basic share, compared with $80.5

million, or $1.92 per basic share, for the same period last year.

Changes in net financial earnings were driven by results at NJR

Energy Services (NJRES), the company�s wholesale energy services

subsidiary. �We are pleased by our 6-month financial performance

and remain on track to meet our net financial earnings guidance for

fiscal 2008, which we increased earlier this year,� said Laurence

M. Downes, chairman and CEO of NJR. Net financial earnings is a

financial measure not calculated in accordance with generally

accepted accounting principles (GAAP) of the United States as it

excludes all unrealized, and certain realized, gains and losses

associated with derivative instruments. Management believes this

measure is more reflective of NJR�s operations, provides

transparency to investors and enables period-to-period

comparability of financial performance. A complete discussion of

net financial earnings and other non-GAAP measures, along with

reconciliation to the most comparable GAAP amounts are included

below. Financial and operating highlights at NJR�s subsidiaries

include: New Jersey Natural Gas Fiscal 2008 year-to-date earnings

at New Jersey Natural Gas (NJNG) were $50.8 million, compared with

$53.1 million last year. Earnings were lower during the 6-month

period due primarily to lower gross margin from incentive-based

programs and higher operation and maintenance expenses. Earnings

rose slightly during the three months ended March 31, 2008 to $34.2

million, compared with $33.2 million last year. The increase was

due primarily to higher utility gross margin from additional

customers, as well as incentive-based programs. NJNG is seeking an

increase of $58.4 million to its base rates based on a request

filed with the New Jersey Board of Public Utilities (BPU) in

November 2007. NJNG believes the review process is progressing on

schedule, but any increase in rates is unlikely to affect earnings

in fiscal 2008. Weather during the 6-month period ended March 31,

2008 was 7.3 percent warmer than normal and 0.3 percent colder than

last year. �Normal� weather is based on 20-year average

temperatures as calculated based on three reference areas

representative of NJNG�s service territory. The impact of weather

is significantly offset by the Conservation Incentive Program

(CIP), which is designed to normalize year-to-year fluctuations on

both NJNG�s gross margin and customers� bills that may result from

changing weather and usage patterns. Included in year-to-date

utility gross margin for fiscal 2008 was $16.2 million related to

the CIP. This accrual includes $7.4 million associated with the

warmer-than-normal weather and $8.8 million associated with

non-weather factors. In the six months ended March 31, 2008,

customers realized commodity cost savings of approximately $35.5

million due to their reduced natural gas usage. In addition,

customers will continue to receive annual savings of $10.6 million

in fixed-cost reductions as a result of lower demand fee charges.

BPU-approved incentive programs allow NJNG and its customers to

share utility gross margin earned according to utility gross

margin-sharing formulas. These include off-system sales, capacity

release, storage optimization and financial risk management

programs. Year-to-date utility gross margin from these programs

totaled $3.6 million, compared with $4.2 million for the same

period last year. During the second quarter of fiscal 2008, utility

gross margin totaled $2.2 million, compared with $905,000 for the

same period last year. To date, customers have saved approximately

$358 million since the programs� inception in 1992. NJNG added

3,125 new customers during the first six months of fiscal 2008,

which are expected to contribute approximately $1.7 million to

utility gross margin annually. NJNG expects to achieve a new

customer growth rate of approximately 1.6 percent in fiscal 2008.

NJR Energy Services Net financial earnings at NJRES for the six

months ended March 31, 2008 totaled $62.6 million, compared with

$55 million in the same period last year. The increase was due

primarily to higher financial margin and lower taxes. During the

second quarter of fiscal 2008, net financial earnings were $43.5

million, compared with $47.2 million during the same 3-month period

last year. The decrease in quarterly earnings is due primarily to

lower financial margin, partially offset by lower taxes.

Year-to-date financial margin at NJRES increased $5.2 million to

$109.1 million, compared with $103.9 million for the same period

last year. The increase is due primarily to new transportation

capacity contracts acquired during the first quarter of fiscal

2008. These new capacity contracts enabled NJRES to transport

higher volumes within those market regions, which also experienced

favorable pricing spreads. These spreads are the difference between

the market price of the natural gas and the cost to acquire and

transport it. Financial margin at NJRES decreased $12.5 million to

$73.3 million for the three months ended March 31, 2008, compared

with $85.8 million during the same period last year, due primarily

to fewer arbitrage opportunities to optimize existing assets. This

decrease was partially offset by the new capacity contracts noted

above. The relatively mild winter season provided minimal

opportunity to capture additional margins on market positions

compared with the same period during the previous fiscal year.

NJRES� effective tax rate decreased in fiscal 2008 due to a change

in the apportionment of its taxable income for state tax purposes.

The impact, which was recognized in the second fiscal quarter,

included a one-time reduction of $1.8 million associated with

deferred tax liabilities as of the end of fiscal 2007 and a

reduction of $2.2 million associated with year-to-date fiscal 2008

operations. Excluding the one-time benefit, NJRES has an estimated

statutory tax rate of 38.9 percent in fiscal 2008, compared with

41.1 percent in fiscal 2007. Management utilizes financial margin,

a non-GAAP financial measure, to analyze NJRES� operating results.

NJR calculates financial margin by excluding from gross margin the

impact of unrealized gains or losses from derivative financial

instruments and certain realized gains or losses from derivative

financial instruments that are designed to economically protect

natural gas that has been purchased and stored, but has yet to be

sold. Management believes that financial margin better reflects the

economic performance of NJRES prior to the actual settlement of

certain forecasted transactions and related derivative financial

instruments. Retail and Other Retail and Other consists of NJR Home

Services, which provides service, sales and installation of

appliances to over 145,000 customers and Commercial Realty &

Resources, which develops commercial real estate. Also included is

NJR Energy Holdings, which consists primarily of a 5.53 percent

equity investment in Iroquois Gas Transmission System, L.P., owner

of an interstate natural gas pipeline in the Northeast, and a 50

percent equity investment, through two wholly-owned subsidiaries,

Steckman Ridge GP, LLC and Steckman Ridge, LP, in a natural gas

storage facility under joint development with a partner in western

Pennsylvania, which is expected to contribute to earnings beginning

in fiscal 2010. Earnings for the six months ended March 31, 2008

were $4.7 million, compared with $720,000 for the same period last

year. For the three months ended March 31, 2008, this segment

earned $4.3 million, compared with $2.7 million during the fiscal

2007 second quarter. Both increases are the result of greater

after-tax unrealized gains on two long-term natural gas contracts

at NJR Energy Corporation of $3.8 million and $202,000 for the six

months ended March 31, 2008 and March 31, 2007, respectively. The

unrealized gains resulted from changing natural gas prices. Fiscal

2008 Net Financial Earnings Guidance Assuming stable economic

conditions, continued customer growth at NJNG, continued volatility

in the wholesale natural gas markets affecting NJRES and subject to

the factors discussed below under �Forward-Looking Statements,� NJR

reiterates its fiscal 2008 net financial earnings guidance to a

range of $2.17 to $2.23 per basic share. Webcast Information NJR

will host a live webcast to discuss its financial results today at

3 p.m. ET. A few minutes prior to the webcast, go to njliving.com

and select �New Jersey Resources� from the top navigation bar.

Choose �Investor Relations,� then click just below the microphone

under the heading �Latest Webcast� on the Investor Relations home

page. Additional Non-GAAP Financial Information Financial margin,

net financial earnings, NJNG�s utility gross margin and NJRES�

gross margin are non-GAAP financial measures that are included as

supplemental disclosures because such items are important financial

measures used by management in analyzing the results of their

operations. NJNG�s utility gross margin represents the results of

revenues less natural gas costs, sales and other taxes and

regulatory rider expenses, which are key components of our

operations that move in relation to each other. Management believes

that NJNG�s utility gross margin provides a more meaningful basis

for evaluating utility operations than revenue, as natural gas

costs, sales and other taxes and regulatory rider expenses are

passed through to customers, and therefore have no effect on gross

margin and revenues and natural gas costs can be dramatically

influenced by changes in the wholesale price of natural gas. NJRES

and NJR Energy Corporation use financial instruments to

economically hedge their forecasted gas purchases and sales. These

derivative financial instruments, which are natural gas futures,

forwards and swaps, change in value over the time that they are

economically hedging the underlying forecasted natural gas sale or

purchase. The change in value associated with these financial

instruments is recorded in the income statement as part of gas

purchases or operating revenues, as appropriate. For changes in

value associated with transactions that have not settled, these are

commonly referred to as unrealized gains or losses. Changes in

value associated with settled transactions related to purchased

natural gas that has been placed into storage inventory and that

has not yet been sold are commonly referred to as realized gains or

losses. NJRES also has certain physical commodity contracts that

represent natural gas purchases or sales. Effective October 1,

2007, for all physical commodity contracts that NJRES enters into,

it will account for those contracts as derivative financial

instruments. As a derivative instrument, the change in value over

the time that the contracts remain unsettled is recorded in the

income statement as part of gas purchases. These changes in value

are also commonly referred to as unrealized gains or losses.

Volatility associated with the change in value of these financial

and physical commodity contracts is reported in the income

statement in the current period. This volatility does not change

the economic result of the financial or physical contract in

relation to the planned purchase or sale transaction at NJRES,

rather it shows changes in value currently as opposed to when the

planned transaction ultimately is settled. In order to manage its

business, NJR views its results without the impacts of the

unrealized gains and losses, and certain realized gains and losses,

caused by changes in value of these financial instruments and

physical commodity contracts prior to the completion of the planned

transaction. Management�s definition of these non-GAAP measures may

not be comparable to the definitions used by other companies in

either the natural gas distribution business or other industries.

Management uses these non-GAAP financial measures as supplemental

measures to other GAAP results to provide a more complete

understanding of our performance. Management believes these

non-GAAP measures are more reflective of our business model,

provide transparency to investors and enable period-to-period

comparability of financial performance. As an indicator of our

operating performance, these measures should not be considered an

alternative to, or more meaningful than, operating income as

determined in accordance with GAAP. A reconciliation of all

non-GAAP financial measures to the most directly comparable

financial measures calculated and reported in accordance with GAAP,

can be found below. Forward-Looking Statements This news release

contains estimates, net financial earnings guidance and other

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. NJR cautions readers that

the assumptions forming the basis for forward-looking statements

include many factors that are beyond NJR�s ability to control or

estimate precisely, such as estimates of future market conditions

and the behavior of other market participants. Other factors that

could cause actual results, including gross margin, earnings and

customer growth, to differ materially from the company�s

expectations include, but are not limited to, weather, economic

conditions and demographic changes in NJNG�s service territory,

rate of customer growth, volatility of natural gas commodity prices

and its impact on customer usage, and NJRES operations, changes in

rating agency requirements and/or credit ratings and their effect

on availability and cost of capital to the company, increased

interest costs resulting from failures in the market for auction

rate securities, the impact of the company�s risk management

efforts, including commercial and wholesale credit risks, the

company�s ability to obtain governmental approvals, property rights

and/or financing for the construction, development and operation of

its non-regulated energy investments, risks associated with the

management of the company�s joint ventures and partnerships, the

impact of regulation (including the regulation of rates), the

outcome of any future base rate cases, fluctuations in

energy-related commodity prices, customer conversions, other

marketing efforts, actual energy usage patterns of NJNG�s

customers, the pace of deregulation of retail gas markets, access

to adequate supplies of natural gas, the regulatory and pricing

policies of federal and state regulatory agencies, changes due to

legislation at the federal and state level, an adequate number of

appropriate counterparties, sufficient liquidity in the energy

trading market and continued access to the capital markets, the

disallowance of recovery of environmental-related expenditures and

other regulatory changes, environmental and other litigation and

other uncertainties, the effects and impacts of inflation, change

in accounting pronouncements issued by the appropriate standard

setting bodies; and terrorist attacks or threatened attacks on

energy facilities or unrelated energy companies. More detailed

information about these factors is set forth in NJR�s filings with

the Securities and Exchange Commission (SEC), including its annual

report on Form 10-K filed on December 10, 2007 and quarterly report

on Form 10-Q filed on February 6, 2008. NJR�s SEC documents are

available at www.sec.gov. NJR does not, by including this

paragraph, assume any obligation to review or revise any particular

forward-looking statement referenced herein in light of future

events. About New Jersey Resources New Jersey Resources (NYSE:NJR),

a Fortune 1000 company, provides reliable retail and wholesale

energy services to customers in New Jersey and in states from the

Gulf Coast to New England, and Canada. Its principal subsidiary,

New Jersey Natural Gas, serves more than 482,000 customers in

central and northern New Jersey. Other major NJR subsidiaries

include NJR Energy Services and NJR Home Services. NJR Energy

Services provides customer service and management of natural gas

storage and capacity assets in the energy services market. NJR Home

Services offers retail customers heating, air conditioning and

appliance services. NJR�s progress is a tribute to the more than

5,000 dedicated employees who have shared their expertise and focus

on quality through more than 50 years of serving customers and the

community to make NJR a leader in the competitive energy

marketplace. For more information, visit NJR�s Web site at

njliving.com. Reconciliation of Non-GAAP Performance Measures NEW

JERSEY RESOURCES The following table is a computation of financial

margin at NJR: � � � Three Months Ended Six Months Ended

(Unaudited) March 31, March 31, (Thousands, except per share data)

� � 2008 � � � 2007 � � 2008 � � � 2007 Operating revenues $

1,177,545 � $ 1,029,043 $ 1,988,683 $ 1,766,444 Less: Gas purchases

1,065,925 923,046 1,750,619 1,544,981 Add: Unrealized loss on

derivative instruments 112,428 121,976 120,558 117,524 Net realized

(gain) loss from derivative instruments relatedto natural gas

inventory � � (5,889 ) � � 1,194 � � (3,629 ) � � 2,960 Financial

margin � $ 218,159 � � $ 229,167 � $ 354,993 � � $ 341,947 � � A

reconciliation of Operating income at NJR, the closest GAAP

financial measure, to the financial margin is as follows: � Three

Months Ended Six Months Ended March 31, March 31, (Thousands) � �

2008 � � � 2007 � � 2008 � � � 2007 Operating income $ 20,335 $

16,271 $ 74,872 $ 71,101 Add: Operation and maintenance expense

34,605 32,337 66,784 60,653 Regulatory rider expenses 17,789 18,135

29,954 27,601 Depreciation and amortization 9,517 8,986 18,920

17,888 Other taxes � � 29,374 � � � 30,268 � � 47,534 � � � 44,220

Subtotal � Gross margin � $ 111,620 � � $ 105,997 � $ 238,064 � � $

221,463 Add: Unrealized loss on derivative instruments 112,428

121,976 120,558 117,524 Net realized (gain) loss from derivative

instruments relatedto natural gas inventory � � (5,889 ) � � 1,194

� � (3,629 ) � � 2,960 Financial margin � $ 218,159 � � $ 229,167 �

$ 354,993 � � $ 341,947 � � A reconciliation of Net income at NJR

to net financial earnings, is as follows: Three Months Ended Six

Months Ended March 31, March 31, (Thousands) � � 2008 � � � 2007 �

� 2008 � � � 2007 Net income $ 12,535 $ 7,961 $ 42,720 $ 37,395

Add: Unrealized loss on derivative instruments, net of taxes 69,012

71,862 73,802 69,512 Realized (gain) loss from derivative

instruments related to naturalgas inventory, net of taxes � �

(3,549 ) � � 704 � � (2,217 ) � � 1,744 Net financial earnings � $

77,998 � � $ 80,527 � $ 114,305 � � $ 108,651 � WEIGHTED AVERAGE

SHARES OUTSTANDING BASIC 41,840 41,839 41,758 41,705 DILUTED � �

42,099 � � � 42,071 � � 42,018 � � � 41,939 � Net financial

earnings per share $ 1.86 � � $ 1.92 � $ 2.74 � � $ 2.61 The

following table is a computation of financial margin at NJRES: �

Three Months Ended � Six Months Ended March 31, March 31,

(Thousands) � � 2008 � � � 2007 � � � 2008 � � � 2007 � Operating

revenues $ 687,912 � $ 568,388 $ 1,208,123 � $ 1,064,175 Less: Gas

purchases 727,937 610,183 1,222,483 1,081,125 Add: Unrealized loss

on derivative instruments 119,218 126,383 127,043 117,867 Net

realized (gain) loss from derivative instruments related to natural

gas inventory � � (5,889 ) � � 1,194 � � � (3,629 ) � � 2,960 �

Financial margin � $ 73,304 � � $ 85,782 � � $ 109,054 � � $

103,877 � � � A reconciliation of Operating income at NJRES, the

closest GAAP financial measurement, to the financial margin is as

follows: Three Months Ended Six Months Ended March 31, March 31,

(Thousands) � � 2008 � � � 2007 � � � 2008 � � � 2007 � Operating

income ($45,303 ) ($46,167 ) ($22,740 ) ($24,571 ) Add: Operation

and maintenance expense 5,026 4,150 7,866 7,153 Regulatory rider

expenses 0 0 0 0 Depreciation and amortization 53 54 106 108 Other

taxes � � 199 � � � 168 � � � 408 � � � 360 � Subtotal � Gross

margin � � ($40,025 ) � � ($41,795 ) � � ($14,360 ) � � ($16,950 )

Add: Unrealized loss on derivative instruments 119,218 126,383

127,043 117,867 Net realized (gain) loss from derivative

instruments relatedto natural gas inventory � � (5,889 ) � � 1,194

� � � (3,629 ) � � 2,960 � Financial margin � $ 73,304 � � $ 85,782

� � $ 109,054 � � $ 103,877 � � � A reconciliation of NJRES Net

income to net financial earnings, is as follows: Three Months Ended

Six Months Ended March 31, March 31, (Thousands) � � 2008 � � �

2007 � � � 2008 � � � 2007 � Net income ($25,947 ) ($27,983 )

($12,797 ) ($16,459 ) Add: Unrealized loss on derivative

instruments, net of taxes 73,013 74,459 77,623 69,714 Realized

(gain) loss from derivative instruments relatedto natural gas

inventory, net of taxes � � (3,549 ) � � 704 � � � (2,217 ) � �

1,744 � Net financial earnings � $ 43,517 � � $ 47,180 � � $ 62,609

� � $ 54,999 � NEW JERSEY RESOURCES CONSOLIDATED STATEMENTS OF

INCOME � � Three Months Ended � � Six Months Ended (Unaudited)

March 31, March 31, (Thousands, except per share data) � � 2008 � �

2007 � � � 2008 � � 2007 OPERATING REVENUES � $ 1,177,545 � $

1,029,043 � � $ 1,988,683 � $ 1,766,444 � � OPERATING EXPENSES Gas

purchases 1,065,925 923,046 1,750,619 1,544,981 Operation and

maintenance 34,605 32,337 66,784 60,653 Regulatory rider expenses

17,789 18,135 29,954 27,601 Depreciation and amortization 9,517

8,986 18,920 17,888 Energy and other taxes � � 29,374 � � 30,268 �

� � 47,534 � � 44,220 Total operating expenses � � 1,157,210 � �

1,012,772 � � � 1,913,811 � � 1,695,343 � OPERATING INCOME 20,335

16,271 74,872 71,101 � Other income 1,540 855 3,068 2,151 �

Interest charges, net � � 6,692 � � 7,091 � � � 14,502 � � 14,966 �

INCOME BEFORE INCOME TAXES 15,183 10,035 63,438 58,286 � Income tax

provision 3,394 2,552 21,888 21,786 � Equity in earnings, net of

tax � � 746 � � 478 � � � 1,170 � � 895 � NET INCOME � $ 12,535 � $

7,961 � � $ 42,720 � $ 37,395 � EARNINGS PER COMMON SHARE BASIC $

0.30 $ 0.19 $ 1.02 $ 0.90 DILUTED � $ 0.30 � $ 0.19 � � $ 1.02 � $

0.89 � DIVIDENDS PER COMMON SHARE � $ 0.28 � $ 0.25 � � $ 0.55 � $

0.50 � AVERAGE SHARES OUTSTANDING BASIC 41,840 41,839 41,758 41,705

DILUTED � � 42,099 � � 42,071 � � � 42,018 � � 41,939 NEW JERSEY

RESOURCES � � Three Months Ended � � Six Months Ended (Unaudited)

March 31, March 31, (Thousands, except per share data) � � 2008 � �

� 2007 � � � � 2008 � � � 2007 � Operating Revenues � � New Jersey

Natural Gas $ 476,818 $ 450,811 $ 761,178 $ 690,218 NJR Energy

Services 687,912 568,388 1,208,123 1,064,175 NJR Home Services and

Other � 12,859 � � � 9,915 � � � � 19,490 � � � 12,191 � Sub-total

� 1,177,589 � � � 1,029,114 � � � � 1,988,791 � � � 1,766,584 �

Intercompany Eliminations � (44 ) � � (71 ) � � � (108 ) � � (140 )

Total $ 1,177,545 � � $ 1,029,043 � � � $ 1,988,683 � � $ 1,766,444

� � � � � � � � � � � Operating Income (Loss) New Jersey Natural

Gas $ 59,211 $ 58,736 $ 90,813 $ 95,452 NJR Energy Services (45,303

) (46,167 ) (22,740 ) (24,571 ) NJR Home Services and Other � 6,427

� � � 3,702 � � � � 6,799 � � � 220 � Total $ 20,335 � � $ 16,271 �

� � $ 74,872 � � $ 71,101 � � � � � � � � � � � Net Income (Loss)

New Jersey Natural Gas $ 34,170 $ 33,226 $ 50,840 $ 53,134 NJR

Energy Services (25,947 ) (27,983 ) (12,797 ) (16,459 ) NJR Home

Services and Other � 4,312 � � � 2,718 � � � � 4,677 � � � 720 �

Total $ 12,535 � � $ 7,961 � � � $ 42,720 � � $ 37,395 � � � � � �

� � � � � Throughput (Bcf) NJNG, Core Customers 28.5 30.7 48.4 47.6

NJNG, Off System/Capacity Management 11.5 9.8 21.2 20.3 NJRES Fuel

Mgmt. and Wholesale Sales � 76.0 � � � 69.3 � � � � 143.1 � � �

133.9 � Total � 116.0 � � � 109.8 � � � � 212.7 � � � 201.8 � � � �

� � � � � � � Common Stock Data Yield at March 31 3.6 % 3.0 % 3.6 %

3.0 % Market Price High $ 33.50 $ 34.07 $ 34.71 $ 35.44 Low $ 29.22

$ 30.87 $ 29.22 $ 30.87 Close at March 31 $ 31.05 $ 33.37 $ 31.05 $

33.37 Shares Out. at March 31 41,852 41,910 41,852 41,910 Market

Cap. at March 31 $ 1,299,505 $ 1,398,397 $ 1,299,505 $ 1,398,397

NEW JERSEY NATURAL GAS � � � � � � � � � � � Three Months Ended Six

Months Ended (Unaudited) March 31, March 31, (Thousands, except

customer & weather data) � � 2008 � � � 2007 � � � 2008 � � �

2007 � Utility Gross Margin Operating revenues $ 476,818 $ 450,811

$ 761,178 $ 690,218 Less: Gas purchases 337,988 312,863 528,136

463,856 Energy and other taxes 27,744 28,778 44,107 41,298

Regulatory rider expense � 17,788 � � � 18,135 � � � 29,953 � � �

27,601 � Total Utility Gross Margin $ 93,298 � � $ 91,035 � � $

158,982 � � $ 157,463 � � � � � � � � � � Utility Gross Margin and

Operating Income Residential & Commercial $ 85,414 $ 84,847 $

144,610 $ 143,214 Firm Transportation � 5,865 � � � 5,181 � � �

10,799 � � � 9,747 � Total Firm Margin 91,279 90,028 155,409

152,961 Interruptible � 128 � � � 102 � � � 262 � � � 318 � Total

System Margin � 91,407 � � � 90,130 � � � 155,671 � � � 153,279 �

Off System/Capacity Management/FRM 2,191 905 3,611 4,184 BPU

Settlement � (300 ) � � 0 � � � (300 ) � � 0 � TOTAL UTILITY GROSS

MARGIN � 93,298 � � � 91,035 � � � 158,982 � � � 157,463 �

Operation and maintenance expense 23,901 22,692 47,780 42,947

Depreciation and amortization 9,332 8,848 18,565 17,586 Other taxes

not reflected in gross margin � 854 � � � 759 � � � 1,824 � � �

1,478 � OPERATING INCOME $ 59,211 � � $ 58,736 � � $ 90,813 � � $

95,452 � � � � � � � � � � Throughput (Bcf) Residential &

Commercial 23.7 26.1 39.2 39.4 Firm Transportation � 3.8 � � � 3.8

� � � 6.6 � � � 6.3 � Total Firm Throughput 27.5 29.9 45.8 45.7

Interruptible � 1.0 � � � 0.8 � � � 2.6 � � � 1.9 � Total System

Throughput � 28.5 � � � 30.7 � � � 48.4 � � � 47.6 � Off

System/Capacity Management � 11.5 � � � 9.8 � � � 21.2 � � � 20.3 �

TOTAL THROUGHPUT � 40.0 � � � 40.5 � � � 69.6 � � � 67.9 � � � � �

� � � � � Customers Residential & Commercial 466,736 463,645

466,736 463,645 Firm Transportation � 15,293 � � � 13,159 � � �

15,293 � � � 13,159 � Total Firm Customers 482,029 476,804 482,029

476,804 Interruptible � 44 � � � 46 � � � 44 � � � 46 � Total

System Customers � 482,073 � � � 476,850 � � � 482,073 � � �

476,850 � Off System/Capacity Management � 32 � � � 43 � � � 32 � �

� 43 � TOTAL CUSTOMERS � 482,105 � � � 476,893 � � � 482,105 � � �

476,893 � � � � � � � � � � Degree Days Actual 2,348 2,517 3,893

3,880 Normal � 2,519 � � � 2,485 � � � 4,201 � � � 4,154 � Percent

of Normal � 93.2 % � � 101.3 % � � 92.7 % � � 93.4 % NJR ENERGY

SERVICES � � Three Months Ended � Six Months Ended (Unaudited)

March 31, March 31, (Thousands, except customer) � � 2008 � � �

2007 � � � � 2008 � � � 2007 � Operating Revenues $ 687,912 � $

568,388 $ 1,208,123 � $ 1,064,175 Gas Purchases � 727,937 � � �

610,183 � � � � 1,222,483 � � � 1,081,125 � Gross (Loss) (40,025 )

(41,795 ) (14,360 ) (16,950 ) Operation and maintenance expense

5,026 4,150 7,866 7,153 Depreciation and amortization 53 54 106 108

Energy and other taxes � 199 � � � 168 � � � � 408 � � � 360 �

Operating (Loss) � ($45,303 ) � � ($46,167 ) � � � ($22,740 ) � �

($24,571 ) � Net Loss � ($25,947 ) � � ($27,983 ) � � � ($12,797 )

� � ($16,459 ) � Gas Sold and Managed (Bcf) � 76.0 � � � 69.3 � � �

� 143.1 � � � 133.9 � � � � � � � � � � � � NJR HOME SERVICES AND

OTHER � � � � � � � � � � Operating Revenues $ 12,859 � � $ 9,915 �

� � $ 19,490 � � $ 12,191 � � Operating Income $ 6,427 � � $ 3,702

� � � $ 6,799 � � $ 220 � � Net Income $ 4,312 � � $ 2,718 � � � $

4,677 � � $ 720 � � Total Customers at March 31 � 145,032 � � �

144,371 � � � � 145,032 � � � 144,371 �

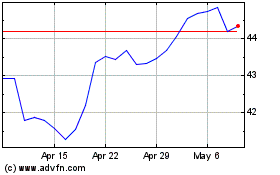

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From May 2024 to Jun 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Jun 2023 to Jun 2024