The Board of Directors of Natuzzi S.p.A. (NYSE:NTZ), Italy’s

largest furniture manufacturer and world’s leading manufacturer of

leather-upholstered furniture, today approved its consolidated

financial results for the third quarter and first nine months of

2011.

9 MONTHS 2011 CONSOLIDATED FINANCIAL RESULTS

- Net Loss of €3.6 million vs. a Net Loss

of €9.6 million in 9M 2010

- Negative EBIT of €17.0 million, vs. a

positive EBIT of €0.2 million in 9M 2010

- Gross profit was €117.2 million as

compared to €145.9 million in 9M 2010

- Total Net Sales were €356.8 million,

down 7.7% as compared to 9M 2010

3Q 2011 CONSOLIDATED FINANCIAL RESULTS

- Net Loss of €10.3 million vs. a Net

Loss of €5.5 million in 3Q 2010

- Negative EBIT of €9.0 million, vs. a

negative EBIT of €2.5 million in 3Q 2010

- Gross profit was €33.9 million as

compared to €42.6 million in 3Q 2010

- Total Net Sales were €114.4 million,

down 0.5% as compared to 3Q 2010

- Positive Net Financial Position of

€58.8, with a good improvement as compared to December 31,

2010.

9 MONTHS 2011 CONSOLIDATED FINANCIAL RESULTSTotal Net

Sales (including raw materials and semi-finished products sold

to third parties) were €356.8 million, decreasing by 7.7% with

respect to 2010.

Total upholstery sales totalled €310.7 million with a decline of

9.9% over the same period in 2010.

In particular, the Natuzzi brand was down 6.1%, while all other

brands marked a decrease of 12.6%. Within the Natuzzi brand, the

decline is mainly concentrated in Europe, while there is positive

performance in the Rest of the World and a slight improved

performance in Americas.

Sales of all other brand (-12.6%) were affected in particular by

the decline in North America (-19.2%), due to the impact of the

relocation of existing production sites in China to a new plant

that generated delays in production, today returned to normal, but

whose positive effects will be visible in subsequent quarters.The

Rest of the world recorded, instead, still a positive performance

of 10.5%.

Other sales have registered a total increase of 10.0%

mainly due to strong sales of accessories.

Gross profit, 32.8% of sales compared to 37.7% in the

first nine months of 2010, reflects the further increase in prices

of raw materials and labour cost mainly in China and Romania.

Transportation costs, showed a favourable decline in

absolute terms of €3.8 million and in a percentage of sales that

went from 9.7% in 2010 to 9.4% in the first nine months of

2011.

Commissions, as well as advertising costs, registered a

reduction versus the first nine months of 2010, of €3.8 million

(0.6% on sales).

Commercial and administrative costs (SG&A) allowed a

significant improvement in absolute terms and amounted to €3.9

million as compared to the first nine months of 2010, but a slight

worsening as a percentage on net sales (0.7%).

Both EBITDA and EBIT for the first nine months of

2011 were negative, €2.0 million and €17.0 million, respectively,

as a result of lower sales and, increasing cost of goods sold,

partly offset by commercial and administrative cost reductions.

Finally, the net consolidated result for the first nine

months of 2011 recorded a loss amounted to €3.6 million as compared

to a loss of €9.6 million in the first 9 months of 2010, thanks to

extraordinary income deriving from the compensation obtained by the

Chinese authorities for the relocation of the major factory of the

Group located in China.

3Q 2011 CONSOLIDATED FINANCIAL RESULTS

Total Net Sales for €114.4 (including raw materials and

semi-finished products sold to third parties) recorded a marginal

decrease of 0.5% with respect to 3Q 2010.

Total upholstery sales recorded a decline of 2.8% over

the same period of 2010, but were almost completely offset by

growth in other sales of 18.5% vs. the third quarter of 2010.

The break-down of upholstery net sales by geographic area was as

follows: Europe (excluding Italy) 34.4%, the Americas 41.7%, Italy

8.1% and Rest of the World 15.8%, emphasizing a continuous and

constant shifting of the Group revenues into the Rest of the

World.

Gross profit represented 29.6% on sales compared to 37.0%

in the third quarter of 2010, mainly reflects the further increase

in prices of raw materials and the growth of labour cost recorded

in China and in Romania.

Transportation costs have declined significantly

registering a reduction in absolute term of €0.7 million.

The optimization processes in the of Commercial and

Administrative areas allowed a further improvement in absolute

terms amounted to €1.0 million compared to third quarter 2010.

Consequently, the impact of SG&A on net sales went from 22.0%

in the third quarter of 2010 to 21.1% in the third quarter of

2011.

EBITDA amounted to a negative €4.2 million in the third

quarter of 2011 versus a positive €3.4 million in the third quarter

of 2010, and EBIT was negative by €9.0 million in the third

quarter of 2011 compared to a negative margin of €2.5 million in

the same period of last year.

Finally, the net result of the Group for the third

quarter of 2011 recorded a loss amounted to €10.3 million compared

to a loss of €5.5 million in the third quarter of 2010.

BALANCE SHEET

Net financial position rose from €45.6 million at December 31,

2010 to €58.8 million as at September 30, 2011.

Pasquale Natuzzi, Chairman and Chief Executive Officer of

Natuzzi SpA, commented: "This third quarter of 2011 was

characterized by uncertain and volatile markets. This condition

negatively affects GDP growth in mature markets and in particular

the demand for consumer durables, which in fact remains weak and

volatile. These macroeconomic results coupled with factors

pertaining to the Natuzzi Group, resulted in an overall drop in

sales of 7.7% in the first nine months of 2011. In line with the

macro-economic framework, mature markets suffered the most while

emerging markets continued to show encouraging results.

Specifically, the rest of the world has shown an overall +8.7% over

the same period last year.

The Group’s financial performance was still negatively affected

by delays in Chinese production impacting mainly North America,

consequent to the relocation of the factory in China. This problem

has now been overcome but results won’t be evident until the coming

quarters.

We are aware of the continuing difficulties of the Western

economies linked to sovereign debt in Europe and North America.

However, commercial actions, taken to regain share in mature

markets such as the important European and North American markets,

the expansion in emerging markets of China, India and Brazil, and

structural actions to increase internal efficiency, make us

confident on a better scenarios for the near future of the

Group”.

The Company will host a conference call on November 28th, 2011

at 10:00 a.m. Eastern Time (4.00 pm European Continental time) to

discuss third quarter and nine months 2011 financial results. To

participate, dial in toll-free 1-888-312-9849 and toll

International 1-719-325-2326. A live web cast of the conference

call will be available online at www.natuzzi.com under the Investor

Relations section.

A replay of the call will be available shortly after the

completion of the conference call through December 28th. To access

the telephone replay, participants should dial 1-877-870-5176 for

domestic calls and 1-858-384-5517 for international calls. The

access code for the replay is: 5948061.

About Natuzzi

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. designs and

manufactures a broad collection of residential upholstered

furniture. With consolidated revenues of EUR 518.6 million in 2010.

Natuzzi is Italy's largest furniture manufacturer. Natuzzi Group

exports its innovative high-quality sofas and armchairs to 130

markets on five continents under two brands, Natuzzi and Italsofa.

Cutting-edge design, superior Italian craftsmanship and advanced,

vertically integrated manufacturing operations underpin the

Company's market leadership. Natuzzi S.p.A. has been listed on the

New York Stock Exchange since May 1993. The Company is ISO 9001 and

14001

Attached Financial Statements

Natuzzi S.p.A. and Subsidiaries Unaudited

Consolidated Profit & Loss for the quarter ended on September

30, 2011 on the basis of Italian GAAP (expressed in millions

Euro except for share data)

Three months ended on

Change Percent of Sales 30-Sep-11

30-Sep-10 % 30-Sep-11 30-Sep-10

Upholstery net sales 99.7 102.6 -2.8% 87.2% 89.2% Other sales 14.7

12.4 18.5% 12.8% 10.8%

Total Net Sales 114.4

115.0 -0.5% 100.0% 100.0%

Consumption (*) (53.9) (48.3) 11.6% -47.1% 42.0% Labor (18.9)

(16.8) 12.5% -16.5% 14.6% Industrial Costs (7.7) (7.3) 5.5% -6.7%

6.3% of which Depreciation, Amortization (2.4) (2.9)

Cost of Sales (80.5) (72.4)

11.2% 70.4% 63.0%

Industrial Margin 33.9 42.6

-20.4% 29.6% 37.0% Selling

Expenses (18.7) (19.9) Transportation (11.6)

(12.3) 10.1% 10.7% Commissions (2.1) (1.9) 1.8% 1.7% Advertising

(5.0) (5.7) 4.4% 5.0%

Other Selling and G&A

(24.2) (25.2) 21.1% 22.0% of which Depreciation,

Amortization (2.4) (3.0)

EBITDA (4.2) 3.4 -3.7%

3.0% EBIT

(9.0) (2.5) -7.9% -2.2%

Interest Income/(Costs), Net 0.1 (0.3) Foreign Exchange, Net (0.9)

(1.6) Other Income/(Cost), Net (0.7) (0.8)

Earning before Income Taxes

(10.6) (5.2) -9.2% -4.5%

Current taxes 0.3 (0.4) 0.3% -0.3%

Net result (10.3) (5.6)

-9.0% -4.9% Minority interest 0.0 0.1

Net Group Result

(10.3) (5.5) -9.0% -4.8%

Net Group Result per

Share (0.19) (0.10)

Key Figures in U.S.

dollars Three months ended on Change Percent

of Sales (millions)

30-Sep-11 30-Sep-10 %

30-Sep-11 30-Sep-10 Total Net Sales

161.6 162.5

-0.5% 100.0% 100.0%

Industrial Profit 47.9 60.2

-20.4%

29.6% 37.0% EBIT (12.7) (3.5)

-7.9% -2.2% Net Group Result (14.5)

(7.8)

-9.0% -4.8% Net Group Result per Share

(0.3) (0.1)

Average exchange rate (U.S.$ per

€) 1.4128

(*) Purchases plus beginning stock minus final stock and

leather processing

UPHOLSTERY NET SALES

BREAKDOWN Geographic

breakdown Net sales million euro Net sales seats

three months

ended on three months ended on

30/09/2011

30/09/2010 Change % 30/09/2011

30/09/2010 Change % Americas

41.5 41.7% 42.6 41.5% -2.6%

223,058 50.4% 222,078 50.1% 0.4%

Natuzzi 4.0 4.0% 4.4 4.3% -9.1% 10,958 2.5% 10,953 2.5% 0.0% All

brands (*) 37.5 37.6% 38.2 37.2% -1.8% 212,100 47.9% 211,125 47.6%

0.5%

Europe 34.3 34.4% 36.8

35.9% -6.8% 132,974 30.0%

137,752 31.1% -3.5% Natuzzi 14.2 14.2% 17.5

17.1% -18.9% 28,801 6.5% 36,429 8.2% -20.9% All brands (*) 20.1

20.2% 19.3 18.8% 4.1% 104,173 23.5% 101,323 22.9% 2.8%

Italy (Natuzzi) 8.1 8.1% 9.8

9.5% -17.3% 27,376 6.2% 30,930

7.0% -11.5% Rest of the world

15.8 15.8% 13.4 13.1% 17.9%

59,135 13.4% 52,392 11.8% 12.9%

Natuzzi 7.9 7.9% 6.6 6.4% 19.7% 18,139 4.1% 14,508 7.0%

25.0% All brands (*) 7.9 7.9% 6.8 6.6% 16.2% 40,996 9.3%

37,884 8.5% 8.2%

Total 99.7 100.0% 102.6 100.0%

-2.8% 442,543 100.0% 443,152

100.0% -0.1%

Brands breakdown Net sales million

euro Net sales seats

three months ended on three months ended

on

30/09/2011 30/09/2010 Change %

30/09/2011 30/09/2010 Change %

Natuzzi 34.2 34.3% 38.3 37.3%

-10.7% 85,274 19.3% 92,820 20.9%

-8.1% All brands (*) 65.5 65.7%

64.3 62.7% 1.9% 357,269 80.7%

350,332 79.1% 2.0%

Total 99.7 100.0%

102.6 100.0% -2.8% 442,543

100.0% 443,152 100.0% -0.1%

(*) Italsofa,

Natuzzi Editions, Editions and unbranded

Natuzzi S.p.A.

and Subsidiaries Unaudited Consolidated Profit

& Loss for the quarter ended on September 30, 2011 on the basis

of Italian GAAP (expressed in millions Euro except for share

data)

Nine months ended on Change Percent of

Sales 30-Sep-11 30-Sep-10 %

30-Sep-11 30-Sep-10 Upholstery net sales 310.7

344.8 -9.9% 87.1% 89.2% Other sales 46.1 41.9 10.0% 12.9%

10.8%

Total Net Sales 356.8 386.7 -7.7%

100.0% 100.0% Consumption (*) (157.0)

(160.4) -2.1% 44.0% 41.5% Labor (59.0) (56.9) 3.7% 16.5% 14.7%

Industrial Costs (23.6) (23.5) 0.4% 6.6% 6.1% of which

Depreciation, Amortization (7.5) (8.8)

Cost of Sales (239.6) (240.8) -0.5%

67.2% 62.3%

Industrial Margin 117.2 145.9

-19.7% 32.8% 37.7% Selling

Expenses (55.7) (63.3) Transportation (33.6)

(37.4) 9.4% 9.7% Commissions (6.3) (7.5) 1.8% 2.0% Advertising

(15.8) (18.4) 4.4% 4.8%

Other Selling and G&A

(78.5) (82.4) 22.0% 21.3% of which Depreciation, Amortization (7.5)

(9.3)

EBITDA (2.0) 18.3 -0.6%

4.7%

EBIT (17.0) 0.2 -4.8%

0.1% Interest Income/(Costs), Net (0.3) (0.9) Foreign

Exchange, Net (1.2) 0.5 Other Income/(Cost), Net 16.7 (3.2)

Earning before Income

Taxes (1.8) (3.4) -0.5%

-0.9% Current taxes (0.9) (6.2) -0.3% -1.6%

Net result

(2.7) (9.6) -0.8% -2.5%

Minority interest (0.9) (0.0)

Net Group Result (3.6)

(9.6) -1.0% -2.5%

Net Group Result per

Share (0.07) (0.18)

Key

Figures in U.S. dollars Nine months ended on

Change Percent of Sales (millions)

30-Sep-11

30-Sep-10 % 30-Sep-11 30-Sep-10

Total Net Sales 502.2 544.3

-7.7%

100.0% 100.0% Industrial Profit 165.0

205.4

-19.7% 32.8% 37.7% EBIT

(23.9) 0.3

-4.8% 0.1% Net Group Result

(5.1) (13.5)

-1.0% -2.5% Net Group Result

per Share (0.1) (0.2)

Average exchange rate

(U.S.$ per €) 1.4075

(*) Purchases plus beginning stock minus final

stock and leather processing

UPHOLSTERY NET SALES

BREAKDOWN Geographic

breakdown Net sales million euro Net sales seats

Nine months

ended on Nine months ended on

30/09/2011

30/09/2010 Change % 30/09/2011

30/09/2010 Change % Americas

105.3 33.9% 127.4 36.9% -17.3%

576,081 44.0% 679,201 46.7%

-15.2% Natuzzi 12.1 3.9% 12.0 3.5% 0.8% 35,328 2.7% 30,734

2.1% 14.9% All brands (*) 93.2 30.0% 115.4 33.5% -19.2% 540,753

41.3% 648,467 44.5% -16.6%

Europe 124.7

40.1% 136.5 39.6% -8.6% 452,617

34.6% 498,711 34.3% -9.2% Natuzzi 62.0

20.0% 68.6 19.9% -9.6% 133,647 10.2% 150,415 10.3% -11.1% All

brands (*) 62.7 20.1% 67.9 19.7% -7.7% 318,970 24.4% 348,296 23.9%

-8.4%

Italy (Natuzzi) 34.7 11.2%

38.6 11.2% -10.1% 109,383 8.4%

117,887 8.1% -7.2% Rest of the

world 46.0 14.8% 42.3 12.3%

8.7% 171,534 13.1% 160,115 11.0%

7.1% Natuzzi 25.0 8.0% 23.3 6.8% 7.3% 59,296 4.5% 53,691

8.1%

10.4% All brands (*) 21.0 6.1% 19.0 5.5% 10.5% 112,238

8.6% 106,424 7.3% 5.5%

Total 310.7 100.0% 344.8

100.0% -9.9% 1,309,615 100.0%

1,455,914 100.0% -10.0%

Brands breakdown Net

sales million euro Net sales seats

Nine months ended on Nine

months ended on

30/09/2011 30/09/2010 Change %

30/09/2011 30/09/2010 Change %

Natuzzi 133.8 43.1% 142.5 41.3%

-6.1% 337,654 25.8% 352,727

24.2% -4.3% All brands (*) 176.9

56.9% 202.3 58.7% -12.6% 971,961

74.2% 1,103,187 75.8% -11.9%

Total 310.7

100.0% 344.8 100.0% -9.9%

1,309,615 100.0% 1,455,914 100.0%

-10.0%

(*) Italsofa, Natuzzi Editions, Editions and unbranded

Natuzzi S.p.A. and Subsidiaries Unaudited

Consolidated Balance Sheets at September 30, 2011 on the basis of

Italian GAAP (Expressed in millions of euro)

ASSETS 30-Sep-11 31-Dec-10 Current

assets: Cash and cash equivalents 98.6 61.1 Marketable debt

securities 0.0 0.0 Trade receivables, net 88.4 95.8 Other

receivables 56.3 51.7 Inventories 90.2 87.4 Unrealized foreign

exchange gains 0.0 0.2 Prepaid expenses and accrued income 2.3 1.3

Deferred income taxes 1.7 1.1

Total current

assets 337.5 298.6 Non current

assets: Net property, plant and equipment 169.7 196 Other

assets 5.9 9.3

Total non current assets

175.6 205.3 TOTAL ASSETS 513.1

503.9 LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Short-term

borrowings 24.4 0.1 Current portion of long-term debt 3.7 2.6

Accounts payable-trade 63.4 64.3 Accounts payable-other 23 27.9

Unrealized foreign exchange losses 0.3 1.1 Income taxes 1.1 2.9

Salaries, wages and related liabilities 10.2 9.9

Total current liabilities 126.1 108.8

Long-term liabilities: Employees' leaving entitlement

27.4 28.4 Long-term debt 11.7 12.8 Deferred income for capital

grants 10 10.4 Other liabilities 14 18.2

Total long-term liabilities 63.1 69.8

Minority interest 3.1 2.1

Shareholders' equity: Share capital 54.8 54.9 Reserves 12.0

12.0 Additional paid-in capital 9.3 9.3 Retained earnings 244.7

247.0

Total shareholders' equity

320.8 323.2 TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY 513.1 503.9 Natuzzi S.p.A.

and Subsidiaries

Consolidated Statements of Cash

Flows (Expressed in million of euro)

30-Sep-11

31-Dec-10 Cash flows from operating activities:

Net earnings (loss) (3.6) (11.1)

Adjustments to reconcile net income to net cash provided

by operating activities: Depreciation and amortization 15.0

23.4 Employees' leaving entitlement 4.0 (1.2) Deferred income taxes

(0.6) (0.4) Minority interest 0.9 0.1 (Gain) loss on disposal of

assets (24.6) 0.6 Unrealized foreign exchange losses and gains

(0.6) 0.8 Impairment of long lived assets - - Deferred income for

capital grants (0.4) (0.7)

Non monetary operating costs

(6.3) 22.6 Change in assets and

liabilities: Receivables, net 7.4 1.2 Inventories (2.8) (5.8)

Prepaid expenses and accrued income (0.9) 0.1 Other assets (4.6)

2.8 Accounts payable (1.0) (2.2) Income taxes (1.8) (0.7) Salaries,

wages and related liabilities 0.2 (5.1) Other liabilities (4.0)

(0.2)

Net working capital (7.5) (9.9)

Net cash provided by operating activities

(17.4) 1.6 Cash flows from investing

activities: Property, plant and equipment: Additions (14.7)

(17.9) Disposals 0.1 0.2 Proceeds from sales 45.0 Marketable debt

securities: -

Net cash used in investing activities

30.4 (17.7) Cash flows from financing

activities: Long-term debt: Proceeds 1.0 9.8 Repayments

(1.0) (1.3) Short-term borrowings 24.4 (0.7) Capital injection - -

Dividends paid to minority interests - -

Net cash used in

financing activities 24.4 7.8 Effect of

translation adjustments on cash 0.2 3.1

Increase

(decrease) in cash and cash equivalents 37.5

(5.2) Cash and cash equivalents, beginning of the

year 61.1 66.3 Cash and cash

equivalents, end of the year 98.6 61.1

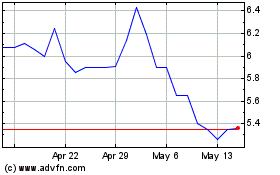

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From May 2024 to Jun 2024

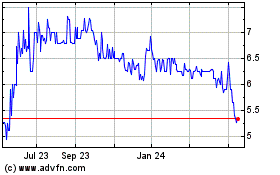

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jun 2023 to Jun 2024