U.K.'s Ofgem Unveils Stricter Pricing Approach for Energy Companies

May 24 2019 - 3:07AM

Dow Jones News

By Carlo Martuscelli

The U.K.'s Office of Gas and Electricity Markets said Friday

that it was looking to cut the costs that energy companies passed

on to consumers by 6 billion pounds ($7.6 billion) over the next

five years through stricter price controls.

The energy watchdog said it would do this by lowering the cap on

how much money utilities could get back from their investments. The

proposed new controls would allow a baseline return on equity of

4.3%, with a range of 4.0%-5.6%.

It said that this is nearly a halving of the returns allowed

under the previous price control regime. As part of the new

framework, it would also increase the support that energy companies

provided to more vulnerable consumers, Ofgem said.

FTSE-100 listed utility National Grid PLC (NG.LN) called the

proposed new controls disappointing.

"We remain disappointed with the proposed range, which we

believe does not fairly reflect the level of risk borne by

networks," it said.

The new framework is due to start in 2021, with the final

pricing decisions made by November 2020.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

May 24, 2019 02:52 ET (06:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

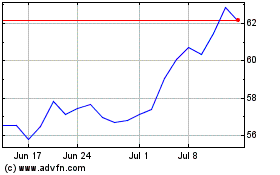

National Grid (NYSE:NGG)

Historical Stock Chart

From Aug 2024 to Sep 2024

National Grid (NYSE:NGG)

Historical Stock Chart

From Sep 2023 to Sep 2024