- Current report filing (8-K)

September 23 2009 - 2:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

September 17, 2009

|

National Fuel Gas Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

New Jersey

|

1-3880

|

13-1086010

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

6363 Main Street, Williamsville, New York

|

|

14221

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

716-857-7000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 17, 2009, the Compensation Committee of the Board of Directors of National Fuel Gas Company (the "Company") awarded Matthew D. Cabell 35,000 shares of restricted stock of the Company under the Company’s 1997 Award and Option Plan (the "Plan"). Mr. Cabell is President of Seneca Resources Corporation, the Company’s natural gas and oil exploration and production subsidiary.

Vesting restrictions on the shares of restricted stock will lapse on March 20, 2018. Mr. Cabell will forfeit the shares if his employment with the Company and its subsidiaries terminates for any reason, except death or disability, prior to the expiration of the vesting restrictions. In the event of Mr. Cabell’s death or disability, all vesting restrictions will lapse on such date. In the event of a change in control of the Company or change in ownership of the Company, as defined in the Plan, all vesting restrictions will immediately lapse. Mr. Cabell will have the right to vote the shares of restricted stock and the right to receive cash dividends on the shares, as and when paid.

Also on September 17, 2009, the Board of Directors of the Company voted to provide to Mr. Cabell post-employment medical and prescription drug benefits, subject to certain conditions. As a threshold eligibility requirement, Mr. Cabell must be employed in good stead at Seneca Resources Corporation or another subsidiary of the Company until at least March 20, 2018. These benefits will be provided, if at all, at the time Mr.Cabell’s employment ceases, subject to the same terms and conditions, including at the same monthly cost to him and with the same levels and types of benefits, if any, as may then be applicable to retiring officers of the Company’s utility subsidiary. The Company may from time to time in its sole discretion revise or eliminate, in whole or in part, the benefits to be provided to Mr. Cabell in the same manner and to the same extent as the benefits to be provided to officers of the Company’s utility subsidiary. In addition, Mr. Cabell will forfeit these benefits if he resigns on or before March 20, 2018 or if the Company or one of its subsidiaries terminates his employment at any time.

Also on September 17, 2009, the Board of Directors of the Company approved a Life Insurance Premium Agreement (the "Agreement") between the Company and David F. Smith, the Company’s President and Chief Executive Officer. Under the Agreement, the Company will pay Mr. Smith $33,000 annually to be used by Mr. Smith to make premium payments on life insurance covering his life. The Agreement will terminate on the earliest of (i) Mr. Smith’s death, (ii) October 31, 2017, and (iii) the date that Mr. Smith’s employment with the Company is terminated for cause. The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which has been filed as an exhibit hereto and is expressly incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit 10.1 Life Insurance Premium Agreement, dated September 17, 2009, between the Company and David F. Smith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

National Fuel Gas Company

|

|

|

|

|

|

|

|

September 23, 2009

|

|

By:

|

|

/s/ James R. Peterson

|

|

|

|

|

|

|

|

|

|

|

|

Name: James R. Peterson

|

|

|

|

|

|

Title: Assistant Secretary

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Life Insurance Premium Agreement, dated September 17, 2009, between the Company and David F. Smith

|

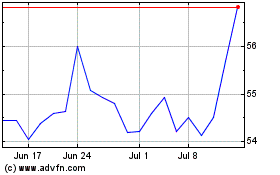

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From May 2024 to Jun 2024

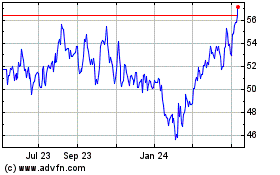

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Jun 2023 to Jun 2024