Setback For Nokia-Seimens - Analyst Blog

August 01 2011 - 4:00AM

Zacks

Nokia Siemens Networks (NSN), a

50-50 joint venture between Nokia Corp. (NOK) and

Siemens AG (SI), recently suffered a massive blow.

On July 29, the upcoming wholesale 4G LTE (Long Term Evolution)

wireless network operator LightSquared announced that it has

decided to outsource a majority of its network to Sprint

Nextel Corp. (S) instead of Nokia Siemens Networks,

declared earlier.

The deal between NSN and

LightSquared was first announced in July 20, 2010. The 8-year

agreement valued at more than $7 billion was considered the biggest

ever wireless network infrastructure contract throughout the world.

NSN was initially chosen by LightSquared to install radio access

network (RAN), core network equipment, and several associated

services. NSN had given the task to install and maintain a new U.S.

4G LTE mobile broadband network with around 40,000 base stations

that will extend to 92% of the U.S. population by 2015.

Recently, LightSquared entered into

a new 11-year agreement with Sprint Nextel for a total

consideration of $13.5 billion ($9 billion in cash and $4.5 billion

in credit) to deploy and operate a nationwide LTE network. Sprint

Nextel has been given the task to deploy the most important RAN for

LightSquared wholesale network. For this, Sprint Nextel has already

chosen three vendors, namely, LM Ericsson (ERIC),

Alcatel-Lucent (ALU), and Samsung Electronics Co.

Ltd.

As a result, NSN will be left with

just a truncated deal with LightSquared to install core network,

which includes evolved packet core, packet transport, and some

service provider information technology deals. Although the size of

this reduced deal is not confirmed, several analysts have predicted

that this will be just a fraction of the original

agreement.

After acquiring the wireless

network infrastructure assets of Motorola Solutions

Inc. (MSI) in April 2011, NSN was desperately looking for

a foothold in the lucrative North American markets, which is its

weakest spot. However, the company faced two major blows within the

next 4 months. In addition to the LightSquared setback, if the

proposed merger of AT&T (T) and T-Mobile USA

get regulatory approval, NSN may lose its largest customer in North

America, T-Mobile USA.

The acquisition of T-Mobile by

AT&T may eliminate NSN as a vendor for the merged entities. LM

Ericsson and Alcatel-Lucent are the two established vendors of

AT&T. We believe AT&T may find it quite hard to eliminate

Ericsson or Alcatel-Lucent and may dump Nokia Siemens Networks to

generate cost synergies.

Last month, NSN abandoned its

equity disinvestment plan at least for the time being. For the last

12 months, NSN was looking for a third party investor in order to

inject funds, thereby reducing the stake of both Nokia and Siemens.

Two major U.S. private equity groups, Kohlberg Kravis Roberts and

TPG, have backed out from their bidding for a significant stake in

NSN. The departure of these two private equity groups primarily

resulted from the disagreement between the firms and NSN over price

and controlling stake in the venture.

ALCATEL ADS (ALU): Free Stock Analysis Report

ERICSSON LM ADR (ERIC): Free Stock Analysis Report

MOTOROLA SOLUTN (MSI): Free Stock Analysis Report

NOKIA CP-ADR A (NOK): Free Stock Analysis Report

SPRINT NEXTEL (S): Free Stock Analysis Report

SIEMENS AG-ADR (SI): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

Zacks Investment Research

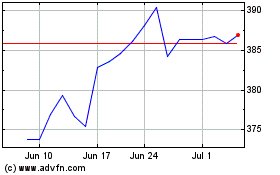

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From May 2024 to Jun 2024

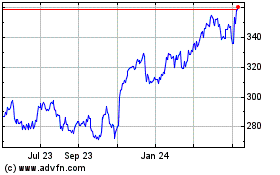

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Jun 2023 to Jun 2024