Current Report Filing (8-k)

October 16 2018 - 7:41AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

October 16, 2018

|

MGIC Investment Corporation

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Wisconsin

|

1-10816

|

39-1486475

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

250 E. Kilbourn Avenue, Milwaukee, Wisconsin

|

|

53202

|

|

________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

414-347-6480

|

|

|

|

|

|

|

|

|

Not Applicable

|

|

|

|

Former name or former address, if changed since last report

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

[ ] Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 8.01. Other Events.

Mortgage Guaranty Insurance Corporation (“MGIC”), the wholly owned subsidiary of MGIC Investment Corporation ("MTG"), intends to proceed with a capital markets-based reinsurance transaction with a newly-formed Bermuda special purpose insurer (the “Issuer”). In connection with the proposed transaction, (i) MGIC expects to purchase $318.6 million of excess of loss reinsurance protection from the Issuer, covering an existing portfolio of mortgage insurance policies and (ii) the Issuer will simultaneously issue a like amount of unregistered securities to third party capital markets investors that are linked to the reinsurance coverage. The Issuer is not a subsidiary or affiliate of MGIC.

The mortgage insurance-linked note offering

is expected to close by the end of October 2018, subject to market and other customary conditions. There can be no assurances that such offering or the related reinsurance transaction will be completed.

The securities described herein have not been and will not be registered under the U.S. Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. This report shall not constitute an offer to sell or a solicitation of an offer to buy any of the aforementioned securities and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which, or to any person to whom, such an offer, solicitation or sale would be unlawful.

Certain statements in this report may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act), and the U.S. Private Securities Litigation Reform Act of 1995 (PSLRA). The PSLRA provides a "safe harbor" for any forward-looking statements. These statements are based upon our current belief as to the outcome and timing of future events. All statements included in this report other than statements of historical fact, including all statements regarding the proposed offering of the notes, are forward-looking statements, including any statements about our expectations, outlook, beliefs, predictions, forecasts, objectives, assumptions or future events. All forward-looking statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that may turn out to be inaccurate and could cause actual results to differ materially from those expressed in them. Many risks and uncertainties are inherent in our industry and markets. These risks and uncertainties also include, but are not limited to, those set forth under the heading "Risk Factors" detailed in Exhibit 99 to MTG's Quarterly Report on Form 10-Q filed for the quarter ended June 30, 2018. All subsequent written and oral forward-looking statements attributable to MTG or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. We caution you not to place undue reliance on any forward-looking statement, which speaks only as of the date on which it is made, and we undertake no obligation to publicly update or revise any forward-looking statement to reflect new information, future events or circumstances that occur after the date on which the statement is made or to reflect the occurrence of unanticipated events except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MGIC INVESTMENT CORPORATION

|

|

|

|

|

|

|

|

|

|

Date:

|

October 16, 2018

|

By: s Timothy J. Mattke

|

|

|

|

|

|

|

|

Timothy J. Mattke

|

|

|

|

Executive Vice President and Chief Financial Officer

|

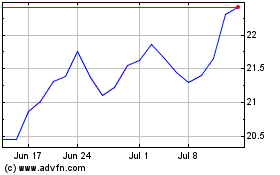

MGIC Investment (NYSE:MTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

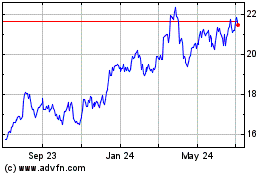

MGIC Investment (NYSE:MTG)

Historical Stock Chart

From Nov 2023 to Nov 2024