Caregiving Costs Americans $3 Trillion in Lost Wages, Pension and Social Security Benefits

June 14 2011 - 10:00AM

Business Wire

Americans who provide care for their aging parents lose an

estimated three trillion dollars in wages, pension and Social

Security benefits when they take time off to do so, according to

“The MetLife Study of Caregiving Costs to Working Caregivers:

Double Jeopardy for Baby Boomers Caring for Their Parents.”

Produced by the MetLife Mature Market Institute in conjunction with

the National Alliance for Caregiving and the Center for Long Term

Care Research and Policy at New York Medical College, the study

reports that individually, average losses equal $324,044 for women

and $283,716 for men. The percentage of adults providing care to a

parent has tripled since 1994.

The researchers analyzed data from the National Health and

Retirement Study (HRS) to determine the extent to which older adult

children provide care to their parents. They also studied gender

roles, the impact of caregiving on careers and the potential cost

to the caregiver in lost wages and future retirement income.

“Nearly 10 million adult children over the age of 50 care for

their aging parents,” said Sandra Timmermann, Ed.D., director of

the MetLife Mature Market Institute. “Assessing the long-term

financial impact of caregiving for aging parents on caregivers

themselves, especially those who must curtail their working careers

to do so, is especially important, since it can jeopardize their

future financial security.”

In addition, the study found that:

- Adult children age 50+ who work and

provide care to a parent are more likely than those who do not

provide care, to report that their health is fair or poor.

- The percentage of adult children

providing personal care and/or financial assistance to a parent has

more than tripled over the past 15 years and currently represents a

quarter of adult children, mainly Baby Boomers. Working and

non-working adult children are almost equally likely to provide

care to parents in need.

- Overall, caregiving sons and daughters

provide comparable care in many respects, but daughters are more

likely to provide basic care (i.e., help with dressing, feeding and

bathing) and sons are more likely to provide financial assistance

defined as providing $500 or more within the past two years.

Twenty-eight percent of women provide basic care, compared with 17%

of men.

- For women, the total individual amount

of lost wages due to leaving the labor force early because of

caregiving responsibilities equals $142,693. The estimated impact

of caregiving on lost Social Security benefits is $131,351. A very

conservative estimated impact on pensions is approximately $50,000.

Thus, in total, the cost impact of caregiving on the individual

female caregiver in terms of lost wages and Social Security

benefits equals $324,044.

- For men, the total individual amount of

lost wages due to leaving the labor force early because of

caregiving responsibilities equals $89,107. The estimated impact of

caregiving on lost Social Security benefits is $144,609. Adding in

a conservative estimate of the impact on pensions at $50,000, the

total impact equals $283,716 for men, or an average of $303,880 for

male or female caregivers age 50+ who care for a parent.

“These family caregivers, the celebrated members of the sandwich

generation, are juggling their responsibilities to their own

families and to their parents,” said Gail Hunt, president and CEO

of the National Alliance for Caregiving. “There is also evidence

that caregivers experience considerable health issues as a result

of their focus on caring for others. The need for flexibility in

the workplace and in policies that would benefit working caregivers

is likely to increase in importance as more working caregivers

approach their own retirement, while still caring for their loved

ones.”

“As the percentage of employees who are caregivers continues to

grow, there will be greater demand on employers for help and

support. There are many workplace resources and programs that can

be made available that benefit all stakeholders since financial

stress can negatively impact physical health and workplace

productivity,” adds Timmermann.

The study contains implications for individuals, employers and

policymakers. It points out that employers can provide retirement

planning and stress management information and can assist employees

with accommodations like flex-time and family leave. Individuals,

it says, should consider their own health when caregiving and

should prepare financially for their own retirement. Policymakers

are made aware of the fact that more states are considering paid

family leave, especially as it is accrued through workers’

compensation funds. On the federal level, a voluntary long-term

care insurance program is part of the Affordable Care Act and will

likely increase public awareness of the issue.

The MetLife Study of Caregiving Costs to Working Caregivers

provides updated information first reported in two MetLife studies:

Sons at Work: Balancing Employment and Eldercare (2003) and The

MetLife Juggling Act Study: Balancing Caregiving with Work and the

Costs Involved (1999).

Methodology

The study uses data from the Health and Retirement Study (HRS)

conducted biannually by the University of Michigan with funding

from the National Institute on Aging. First fielded in 1992, the

HRS, a nationally representative sample, surveys adults over the

age of 50 and provides extensive information on this population,

including data on income, work and health status, and whether

respondents provide basic, personal care and/or financial

assistance to their parents. After cases with missing data were

eliminated from the 2008 panel, the sample was restricted to 1,112

men and women who had a parent living.

The MetLife Study of Caregiving Costs to Working Caregivers:

Double Jeopardy for Baby Boomers Caring for Their Parents can be

downloaded from www.MatureMarketInstitute.com. It can also be

ordered through Contact Us on the MetLife Mature Market Institute

Web site, or by writing to: MetLife Mature Market Institute, 57

Greens Farms Road, Westport, CT 06880 or

MatureMarketInstitute@metlife.com.

The MetLife Mature Market Institute®

The MetLife Mature Market Institute is MetLife’s center of

expertise in aging, longevity and the generations and is a

recognized thought leader by business, the media, opinion leaders

and the public. The Institute’s groundbreaking research, insights,

strategic partnerships and consumer education expand the knowledge

and choices for those in, approaching or working with the mature

market.

The Institute supports MetLife’s long-standing commitment to

identifying emerging issues and innovative solutions for the

challenges of life. MetLife, Inc. is a leading global provider of

insurance, annuities and employee benefit programs, serving 90

million customers in over 60 countries. Through its subsidiaries

and affiliates, MetLife holds leading market positions in the

United States, Japan, Latin America, Asia Pacific, Europe and the

Middle East. For more information, please visit:

www.MatureMarketInstitute.com.

National Alliance for Caregiving

Established in 1996, The National Alliance for Caregiving is a

non-profit coalition of national organizations focusing on issues

of family caregiving. The Alliance was created to conduct research,

do policy analysis, develop national programs, and increase public

awareness of family caregiving issues. Recognizing that family

caregivers make important societal and financial contributions

toward maintaining the well-being of those for whom they care, the

Alliance's mission is to be the objective national resource on

family caregiving with the goal of improving the quality of life

for families and care recipients. www.caregiving.org

Center for Long Term Care Research and Policy, New York

Medical College

The Center for Long Term Care Research and Policy at the School

of Health Sciences and Practice, New York Medical College, was

established to engage in research, education and public policy

development to improve long term care for all Americans. The

Center’s work focuses on health care disparities, health care needs

and caregiving across the lifespan and to promote fair and

equitable financing of long-term care in the United States.

Research and analysis in this report is provided by Peter S. Arno,

PhD, and Deborah Viola, PhD with statistical support from Qiuhu

Shi, PhD. www.nymc.edu/shsp/CLTC/index.html

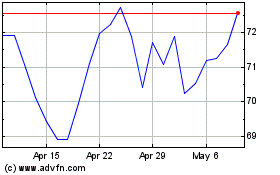

MetLife (NYSE:MET)

Historical Stock Chart

From Oct 2024 to Nov 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Nov 2023 to Nov 2024