Analysts Seek To Divine Which Banks Will Be Unchained By Fed

March 17 2011 - 5:00PM

Dow Jones News

For the 19 largest U.S. banks, formal notification Friday of

stress test results will mean some--not all--will be unchained from

restrictions on dividends or repaying bailout funds.

Banks can't--and the Fed won't--disclose the results of the

stress tests. But some boards will finally be free of restraints if

they are judged to have sufficient capital; some may announce plans

Friday or Monday.

Wall Street has been working overtime to figure out which banks

will take what actions.

Analysts broadly agree that J.P. Morgan Chase & Co. (JPM),

Wells Fargo & Co. (WFC), and US Bancorp (USB) will be among the

first of 19 to announce modest dividend increases after receiving

results of capital plans they submitted to the Fed in early

January.

Citigroup Inc. (C), on the other hand, has already said it won't

reinstall its dividend until next year.

This is the second round of special stress tests by the Fed

applying to those banks, which have been deemed systemically

important. The first round, in spring 2009, acted as a public

confidence-boosting exercise and the beginning point at which banks

could repay money they received from the Treasury Department's

Troubled Asset Relief Program.

Three big regional banks, KeyCorp (KEY), SunTrust Banks Inc.

(STI), Regions Financial Inc. (RF), still haven't repaid their TARP

funds, which they likely must do before boosting dividends. The

test is also expected to reveal how much capital they have to raise

to be allowed to repay the funds.

KeyCorp, considered by some analysts to have a good chance of

paying back its bailout funds, has said its capital plan submitted

to the Fed in accordance with the stress test included a proposal

to pay back its $2.5 billion outstanding TARP funds. KeyCorp has

said it is on more solid footing than some competitors so it

shouldn't have to raise much capital to repay the funds.

Fifth Third Bancorp (FITB), another large regional, has repaid

its TARP funds. Fifth Third Chief Financial Officer Daniel Poston

said at a conference earlier this month the bank intends to "return

in the near term" to a more normal dividend.

Some of the 19 likely to be granted permission for a dividend

raise, analysts say, include PNC Financial Services Group Inc.

(PNC), American Express Co. (AXP), Bank of New York Mellon Corp.

(BK) and State Street Corp. (STT).

BB&T Corp. (BBT) said earlier this month that it should be

in the first group approved for a dividend increase.

"By permitting selected banks to increase dividends, the Federal

Reserve is signaling the banking industry's capital strength has

made a remarkable comeback," Gerard Cassidy, a banking analyst with

RBC Capital Markets, said in a note to clients.

Banks are likely to restore dividends to payout ratios of 20% to

30% of earnings, according to analysts. J.P. Morgan CEO Jamie Dimon

said he hoped to achieve a payout ratio of 35% eventually, but

added "J.P. Morgan won't rush into anything."

For many banks, a dividend boost could be a welcome event for

investors knocked down by share price erosion in the last few

years. Bank of America Corp.'s (BAC) shares, at $13.98 on Thursday,

are down nearly 60% from June 2008. The bank has slashed its

dividend twice since the crisis in the autumn of 2008, cutting it

to 1 cent a quarter in March 2009.

Bank of America has said it doesn't plan a dividend increase

until the middle of 2011.

Card issuer Capital One Financial Corp. (COF) is likely to raise

its dividend in mid-2011, analysts say.

Investment banks Goldman Sachs Group Inc. (GS) and Morgan

Stanley (MS) aren't in the same category. Goldman Chief Financial

Officer David Viniar recently told analysts the firm is more

inclined to buy back its shares. Goldman is looking for a green

light from the Fed to pay back a $5 billion investment from Warren

Buffett's Berkshire Hathaway Inc. (BRKA, BRKB) made during the

financial crisis.

Morgan Stanley hasn't publicly discussed raising its dividend,

but is instead focused on buying from Citigroup the remaining stake

of its brokerage joint venture with Smith Barney and reallocating

its capital in client businesses.

MetLife Inc. (MET), the only insurer to be included in the

stress test, has historically paid an annual dividend in the fourth

quarter. But Chief Financial Officer Bill Wheeler said at an

investor conference in February the company couldn't move forward

on any capital management actions, including buybacks, until

passing the stress test. Assuming MetLife passes the stress test,

Wheeler said, "I think we'll be more aggressive on sort of an

annual dividend now and relatively less aggressive on buyback

activity."

The Wall Street Journal reported Thursday that Ally Financial,

the auto lender among the 19 largest banks, still on the hook for

billions in U.S. aid, won't get a definitive answer from the Fed

for some months.

-By Brett Philbin, Matthias Rieker, David Benoit, and Liz Moyer,

Dow Jones Newswires; 212-416-2173; brett.philbin@dowjones.com

--Erik Holm contributed to this article.

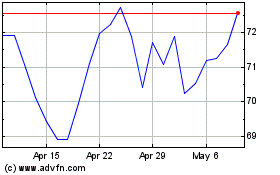

MetLife (NYSE:MET)

Historical Stock Chart

From Oct 2024 to Nov 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Nov 2023 to Nov 2024