A joint study by the 50+ Housing Council of the National

Association of Home Builders (NAHB) and the MetLife Mature Market

Institute shows the recession has made 55+ buyers more

practical when selecting a new home. Design considerations have

become less important, and financial concerns have become more

prominent.

Previous studies from these two organizations found that most

55+ buyers depended on home sale proceeds to finance a new

purchase. The most recent data shows that option diminished during

the economic downturn.

The study, “Housing Trends Update for the 55+ Market,” explores

recently released housing data from the Census Bureau’s 2009

American Housing Survey (AHS) on the 55+ demographic. The report

focuses especially on households living in active adult

communities, either age-qualified active adult communities where at

least one resident must be age 55+, other non-age-qualified 55+

owner-occupied communities (not explicitly restricted to 55+

households but nevertheless occupied primarily by people age 55+),

or age-restricted rental communities.

“By the year 2020, as Baby Boomers move into this age bracket,

almost 45 percent of all U.S. households will include someone at

least 55 years old,” said David Crowe, NAHB’s chief economist. “The

number of those households seeking housing better suited to their

changing needs will therefore rise dramatically.”

Crowe noted that about 54,000 housing starts are projected in

55+ communities this year, a 30 percent rise from estimated 2010

levels, but still relatively modest production. Starts in 55+

communities are projected to increase another 46 percent to roughly

79,000 housing units in 2012.

In 2009, only 55 percent of new age-qualified active adult home

buyers reported that their down payment came from a previous home

sale, significantly down from 100 percent of respondents in 2005

and 92 percent in 2007. In 2005 and 2007, no active adult community

buyers reported having to tap cash or savings for a down payment.

In 2009, 45 percent of the average buyer’s down payment came from

cash or savings.

Further analysis reveals other interesting developments. While

median prices for new 55+ homes remain lower than 2005’s peak, a

look at average home prices shows a big difference between buyers

in age-qualified active adult communities and other 55+ community

buyers. Average prices for 55+ homes dropped in 2007 and partially

rebounded in 2009. But prices for age-qualified communities more

than bounced back; they set a record with an average price of

$319,000. Buyers in that group were more affluent, with average

incomes of more than $80,000 a year. Twenty-seven percent reported

earning $100,000 or more compared to fewer than five percent of

such buyers in 2001.

“Most 55+ consumers – those who chose to move and those who stay

in their homes – report that they are happy with their homes and

communities,” said Dr. Sandra Timmermann, Ed.D., director of the

MetLife Mature Market Institute. “But those who did move to an

age-qualified community – about 3 percent – reported the greatest

satisfaction, rating their homes and communities at nine on a

one-to-ten scale.”

The desire to be near family and friends is the mature mover’s

overwhelming motivation, the report noted. The design, amenities

and appearance of the residence and the community remain important,

but less so than before the recession. 55+ buyers moving into

rental homes, both multi-family and single-family, cited a desire

for less expensive housing as second in importance to living near

friends and family.

Those who are able to buy are getting much more for less. In

2009, more than half of 55+ buyers said they were moving into

better homes, but fewer than half reported that their new homes

cost more than the old ones.

“Proximity to work” was more important than in the past for

those relocating to age-qualified, active adult communities – 12

percent in 2009 versus 2 percent in 2001 – underscoring the trend

toward delayed retirement in this age group. There was also a

reported increase in the share of 55+ single-family homeowners who

say they work at home – which may be a trend noteworthy to home

designers.

A small, but growing share of older households is taking

advantage of the ability to convert some of their home equity into

a reverse mortgage or home equity conversion mortgage. They tend to

be older, single-person households with lower household income and

longer housing tenure. Those with reverse or home equity conversion

mortgages represented more than 241,000 households in 2009, a 54

percent increase since 2007.

“Housing Trends Update for the 55+ Market” can be downloaded

from www.MatureMarketInstitute.com or from

www.nahb.org/55PlusResearch. It can also be ordered through Contact

Us on the MetLife Mature Market Institute Web site, or by writing

to: MetLife Mature Market Institute, 57 Greens Farms Road,

Westport, CT, 06880.

Methodology

The report was drawn from data in the 2009 American Housing

Survey (AHS), the most recent release of this ongoing data

collection, and reflects trends in the AHS between 2001 and 2009.

The AHS is designed by the U.S. Department of Housing and Urban

Development and the U.S. Census Bureau to capture a relatively

large amount of information about the physical characteristics of

the units in which Americans live. Characteristics are tabulated

not only by the age of the occupants and structure type, but by

community type. Based on the information available in the AHS,

three types of 55+ communities can be defined: age-qualified active

adult communities, other non-age-qualified 55+ owner-occupied

communities (those that are not explicitly age-restricted but

nevertheless are occupied by adults age 55 +), and age-restricted

rental communities. The AHS first began asking the relevant

questions on 55+ communities in 2001.

The MetLife Mature Market Institute®

The MetLife Mature Market Institute is MetLife’s center of

expertise in aging, longevity and the generations and is a

recognized thought leader by business, the media, opinion leaders

and the public. The Institute’s groundbreaking research, insights,

strategic partnerships and consumer education expand the knowledge

and choices for those in, approaching or working with the 40+

market.

The Institute supports MetLife’s long-standing commitment to

identifying emerging issues and innovative solutions for the

challenges of life. MetLife, Inc. is a leading global provider of

insurance, annuities and employee benefit programs, serving 90

million customers in over 60 countries. Through its subsidiaries

and affiliates, MetLife holds leading market positions in the

United States, Japan, Latin America, Asia Pacific, Europe and the

Middle East. For more information, please visit:

www.MatureMarketInstitute.com.

NAHB

The National Association of Home Builders is a Washington-based

trade association representing more than 160,000 members involved

in home building, remodeling, multifamily construction, property

management, subcontracting, design, housing finance, building

product manufacturing and other aspects of residential and light

commercial construction. NAHB is affiliated with 800 state and

local home builders associations around the country. NAHB’s builder

members will construct about 80 percent of the new housing units

projected for this year. Follow NAHB on Twitter at

www.twitter.com/NAHBMedia.

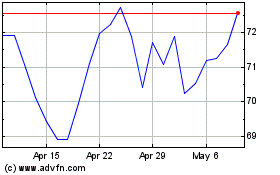

MetLife (NYSE:MET)

Historical Stock Chart

From Oct 2024 to Nov 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Nov 2023 to Nov 2024