Mastercard Renews Effort to Enter Chinese Market

February 22 2019 - 10:40AM

Dow Jones News

By Chao Deng and Stella Yifan Xie

BEIJING -- Mastercard Inc., after years of frustrated attempts

to enter the Chinese market, is trying again by joining with a

Chinese company close to the regulator in charge of approving

credit card businesses.

The American card network plans to set up a joint venture with

NetsUnion Clearing Corp., a clearing house for online payments more

commonly known as Wanglian, according to a person familiar with the

matter. The person said Mastercard will then refile its application

with the People's Bank of China, which is in charge of approving

card-clearing services.

Mastercard has had a separate application, with different

Chinese partners, pending with the central bank for about a year.

Its effort to refile with a new partner highlights the difficulties

foreign companies face in gaining access to the Chinese market,

despite years of promises from Beijing to let them do so.

American Express Co. won approval last year to set up

card-clearing services, also as a joint venture with a domestic

fintech firm instead of as a wholly-owned business.

The U.S. has tried to get China to open up its financial

services sector for more than a decade, and progress has been slow.

In the continuing U.S.-China trade talks, the Trump administration

is again urging China to make structural changes to its

economy.

Analysts aren't expecting much change, including in

card-clearing services. Beijing largely ignored a World Trade

Organization ruling in 2012 that China discriminated against

foreign card companies. The Trump administration got Beijing to

pledge anew in 2017 to grant full access to card-clearing

services.

Mastercard previously applied to enter the market with Chinese

partners in a consortium called Wanlian. Its year-old application

languished at the central bank, according to the person familiar

with the matter. The person said Mastercard decided to switch tack

as it became clear regulators didn't want that partnership to move

forward.

In its new proposed venture, Mastercard plans to hold a majority

stake, the person said, versus 39% in the previous collaboration.

AmEx and its Chinese partner have equal ownership in their approved

venture.

NetsUnion, or Wanglian, was set up in 2017 by the People's Bank

of China as an internet payment system for nonbanks, akin to the

central bank's monopoly payment-processing system for banks, known

as China UnionPay.

Authorities designed Wanglian to allow them to obtain data on

all mobile transactions, which totaled more than 123 trillion yuan

($18 trillion) in the first nine months of 2018, according to

research firm Analysys. The People's Bank of China and its State

Administration of Foreign Exchange are the largest shareholders in

the clearing house, with a combined 22% stake. China's largest

payment-services platforms -- Ant Financial Services Group's Alipay

and Tencent Holdings Ltd.'s WeChat Pay -- are the third and fourth

largest shareholders respectively. Each owns a nearly 10%

stake.

Mastercard and Wanglian have yet to sign a formal agreement, but

shareholders of Wanglian recently approved the tie-up, according to

the person familiar with the matter. Mastercard said in a January

press release that it was in "active discussions to explore

different solutions" to secure a China license.

Write to Chao Deng at Chao.Deng@wsj.com and Stella Yifan Xie at

stella.xie@wsj.com

(END) Dow Jones Newswires

February 22, 2019 10:25 ET (15:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

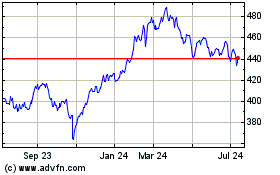

MasterCard (NYSE:MA)

Historical Stock Chart

From Jun 2024 to Jul 2024

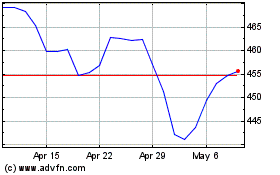

MasterCard (NYSE:MA)

Historical Stock Chart

From Jul 2023 to Jul 2024