UPDATE: Dish, EchoStar To Pay $500 Million In TiVo Settlement

May 02 2011 - 9:19AM

Dow Jones News

Dish Network Corp. (DISH) and its former unit EchoStar Corp.

(STATS) agreed to pay TiVo Inc. (TIVO) $500 million to settle all

the ongoing patent litigation over digital video recorder

technology.

The settlement was announced Monday along with Dish's

first-quarter results, in which the second-largest U.S.

satellite-television provider said its first-quarter profit more

than doubled from a year earlier as prior-year litigation expenses

were supplanted by a $340.7 million credit.

News of the settlement sent TiVo shares soaring 22% to $11.65 in

premarket trading. Dish's class A shares rose 9% to $27.28.

"We are pleased to put this litigation behind us and move

forward," Dish Chairman and Chief Executive Charlie Ergen said in a

press release.

Under the terms of the settlement, DISH and EchoStar will

provide an initial payment of $300 million with the remaining $200

million distributed in six annual installments between 2012 and

2017. All companies agreed to dismiss pending litigation and

dissolve injunctions.

TiVo has been embroiled in patent litigation for years regarding

its DVR technology. TiVo initially sued Dish and EchoStar in 2004

for infringing on patents pertaining to its "Time Warp" DVR

technology. Tivo also has filed patent lawsuits against AT&T

Inc. (T) and Verizon Communications Inc. (VZ) in recent years and

in February was sued by Motorola Mobility Holdings Inc. (MMI) in a

matter involving DVRs.

TiVo said Monday that it granted Dish a license under its Time

Warp patent and other related patents until they conclude. TiVo

also is granting EchoStar a license to design and make some

DVR-enabled products solely for Dish and two international

customers. Meanwhile, EchoStar granted TiVo a license under certain

DVR-related patents, the companies said.

For Dish, the suit ends years of litigation and should enable

the company to narrow its focus on adding subscribers. Dish

recently shifted its strategy, attempting to attract more affluent

customers who are willing to spend more each month on video and

less likely to cancel their service, emulating rival DirecTV Group

Inc. (DTV). Earlier, Dish targeted lower-end customers, many of

whom were hit hard by the economic downturn.

The strategy is yielding early benefits. The company gained a

net 58,000 subscribers during the first quarter, snapping a streak

of quarterly subscriber losses that had started in 2010's second

quarter. It ended the latest period with 14.2 million

customers.

Dish also said Michael Kelly, executive vice president for

commercial and business services, was named president of

Blockbuster. Dish won last month's bankruptcy court auction for the

video rental business' assets with a bid it said was valued at

about $320 million. Earlier, it agreed to buy DBSD North America

Inc. out of bankruptcy for about $1 billion.

Dish reported a first-quarter profit of $549 million, or $1.22 a

share, up from $231 million, or 52 cents a share, a year earlier.

Revenue rose 5.5% to $3.22 billion.

Costs plunged 14% amid the litigation impacts.

Analysts polled by Thomson Reuters had forecast a profit of 68

cents a share on $3.23 billion in revenue.

Meanwhile, EchoStar--the maker of set-top boxes that was spun

off from Dish at the beginning of 2008--posted a profit of $17

million, or 19 cents a share, down from $72 million, or 84 cents a

share, a year earlier. Revenue fell 23% to $480 million.

EchoStar shares closed Friday at $37.08 and was inactive in

recent premarket trading.

-By Steven Russolillo, Dow Jones Newswires; 212-416-2180;

steven.russolillo@dowjones.com

--Matt Jarzemsky contributed to this report.

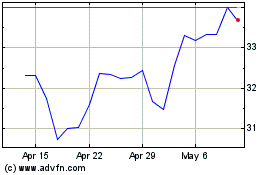

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

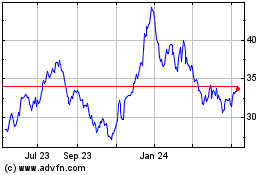

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jul 2023 to Jul 2024