UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2024

Commission File Number: 001-35627

MANCHESTER UNITED PLC

(Translation of registrant’s name into English)

Old Trafford

Manchester M16 0RA

United Kingdom

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1). ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7). ¨

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 17, 2024

| |

MANCHESTER UNITED PLC |

| |

|

| |

By: |

/s/ Cliff Baty |

| |

Name: |

Cliff Baty |

| |

Title: |

Chief Financial Officer |

EXHIBIT INDEX

Exhibit 99.1

|

|

| |

|

| CORPORATE RELEASE | 17

January 2024 |

Manchester United

PLC Reports First Quarter Fiscal 2024 Results

Key Points

| · | Achieved

record total first quarter revenue driven by record Matchday and Commercial revenue |

| · | Club

continues to achieve record ticket sales and attendance while paid global memberships recently

surpassed a record 400K, the largest membership program of any global sports team |

| · | Signed

a new multi-year global partnership with WOW HYDRATE, and renewed partnerships with Konami,

Concho Y Toro and Mlily |

| · | Achieved

record Megastore turnover during the quarter driven by a strong finish to the 2022/23 season

and record 2023/24 kit launches |

| · | Club

opened expanded Women’s facilities at the Carrington Training Complex |

| · | Club

launched an online Official Supporters’ Club Hub during the first quarter |

MANCHESTER, England

– 17 January 2024 – Manchester United (NYSE: MANU; the “Company” and the “Group”) – one

of the most popular and successful sports teams in the world - today announced financial results for the 2024 fiscal first quarter ended

30 September 2023.

Outlook

For fiscal 2024,

the Company is forecasting revenue guidance to be within a range of £635 million to £665 million from prior guidance of £650

million to £680 million and adjusted EBITDA guidance to be within a range of £125 million to £150 million from prior

guidance of £140 million to £165 million, owing to the early Champions League exit and related reduction in Broadcasting

revenues.

| Phasing of

Premier League games | |

Quarter

1 | | |

Quarter

2 | | |

Quarter

3 | | |

Quarter

4 | | |

Total | |

| 2023/24 season | |

| 7 | | |

| 13 | | |

| 10 | | |

| 8 | | |

| 38 | |

| 2022/23 season | |

| 6 | | |

| 10 | | |

| 10 | | |

| 12 | | |

| 38 | |

| 2021/22 season | |

| 6 | | |

| 12 | | |

| 11 | | |

| 9 | | |

| 38 | |

Key Financials (unaudited)

| £ million

(except loss per share) | |

Three

months ended 30

September | | |

| |

| | |

2023 | | |

2022 | | |

Change | |

| Commercial revenue | |

| 90.4 | | |

| 87.4 | | |

| 3.4 | % |

| Broadcasting revenue | |

| 39.3 | | |

| 35.0 | | |

| 12.3 | % |

| Matchday revenue | |

| 27.4 | | |

| 21.3 | | |

| 28.6 | % |

| Total revenue | |

| 157.1 | | |

| 143.7 | | |

| 9.3 | % |

| Adjusted EBITDA(1) | |

| 23.3 | | |

| 23.6 | | |

| (1.3 | )% |

| Operating profit/(loss) | |

| 1.9 | | |

| (3.4 | ) | |

| 155.9 | % |

| | |

| | | |

| | | |

| | |

| Loss for the period (i.e. net

loss) | |

| (25.8 | ) | |

| (26.5 | ) | |

| 2.6 | % |

| Basic loss per share (pence) | |

| (15.79 | ) | |

| (16.26 | ) | |

| 2.9 | % |

| Adjusted loss for the period

(i.e. adjusted net loss)(1) | |

| (8.6 | ) | |

| (9.9 | ) | |

| 13.1 | % |

| Adjusted basic loss per share (pence)(1) | |

| (5.27 | ) | |

| (6.08 | ) | |

| 13.3 | % |

| | |

| | | |

| | | |

| | |

| Non-current borrowings in USD

(contractual currency) (2) | |

$ | 650.0 | | |

$ | 650.0 | | |

| 0.0 | % |

(1) Adjusted

EBITDA, adjusted loss for the period and adjusted basic loss per share are non-IFRS measures. See “Non-IFRS Measures: Definitions

and Use” on page 6 and the accompanying Supplemental Notes for the definitions and reconciliations for these non-IFRS measures

and the reasons we believe these measures provide useful information to investors regarding the Group’s financial condition and

results of operations.

(2) In

addition to non-current borrowings, the Group maintains a revolving credit facility which varies based on seasonal flow of funds. The

outstanding balance of the revolving credit facility as of 30 September 2023 was £200.0 million and total current borrowings

including accrued interest payable was £204.4 million.

Revenue Analysis

Commercial

Commercial revenue

for the quarter was £90.4 million, an increase of £3.0 million, or 3.4%, over the prior year quarter.

| · | Sponsorship

revenue was £56.2 million, a decrease of £1.6 million, or 2.8%, over the

prior year quarter. |

| · | Retail,

Merchandising, Apparel & Product Licensing revenue was £34.2 million,

an increase of £4.6 million, or 15.5%, over the prior year quarter, primarily due to

the extension of our partnership with adidas until the end of the 2034/35 season and strong

Megastore performance. |

Broadcasting

Broadcasting revenue

for the quarter was £39.3 million, an increase of £4.3 million, or 12.3%, over the prior year quarter, primarily due to our

men’s first team participating in the UEFA Champions League compared to the UEFA Europa League in the prior year quarter, as well

as increased income from the Premier League.

Matchday

Matchday revenue

for the quarter was £27.4 million, an increase of £6.1 million, or 28.6%, over the prior year quarter, primarily due to playing

one more home game in the current year quarter, compared to the prior year quarter.

Other Financial Information

Operating

expenses

Total operating

expenses for the quarter were £184.7 million, an increase of £21.0 million, or 12.8%, over the prior year quarter.

Employee

benefit expenses

Employee benefit

expenses for the quarter were £90.3 million, an increase of £8.0 million, or 9.7%, over the prior year quarter, primarily

due to the men’s first team participating in the UEFA Champions League in the current year, in addition to investment in the first

team playing squad.

Other operating expenses

Other operating

expenses for the quarter were £43.5 million, an increase of £5.7 million, or 15.1%, over the prior year quarter. This is

primarily due to increased commercial costs and increased matchday costs, due to hosting one additional home game in the current year

quarter.

Depreciation

and amortization

Depreciation for

the quarter was £4.1 million, an increase of £0.6 million, or 17.1%, over the prior year quarter. Amortization for the quarter

was £46.8 million, an increase of £6.7 million, or 16.7%, over the prior year quarter, due to investment in the first team

playing squad. The unamortized balance of registrations at 30 September 2023 was £539.9 million.

Profit on

disposal of intangible assets

Profit on disposal

of intangible assets for the quarter was £29.5 million, an increase of £12.9 million, or 77.7%, over the prior year quarter,

primarily due to the disposals of Elanga, Fred and Henderson.

Net finance

costs

Net finance costs

for the quarter were £34.7 million, compared to £31.0 million in the prior year quarter. This is primarily due to an unfavorable

swing in foreign exchange rates resulting in unrealized foreign exchange losses on unhedged USD borrowings.

Income tax

The income tax

credit for the quarter was £7.0 million, compared to an income tax credit of £7.9 million in the prior year quarter.

Cash flows

Overall cash and

cash equivalents (including the effects of exchange rate movements) increased by £5.7 million in the quarter to 30 September 2023

compared to the cash position at 30 June 2023.

Net cash inflow

from operating activities for the quarter was £21.5 million, compared to net cash outflow of £6.0 million in the prior year

quarter.

Net capital expenditure

on property, plant and equipment for the quarter was £9.1 million, an increase of £4.7 million over the prior year quarter,

primarily due to expenditure relating to training facilities for our Academy and Women’s teams

Net capital expenditure

on intangible assets for the quarter was £106.5 million, an increase of £18.2 million over the prior year quarter, due to

increased investment in the first team playing squad.

Net cash inflow

from financing activities for the quarter was £99.8 million, compared to a net cash outflow of £0.9m in the prior year quarter,

due to a drawdown of £100.0 million on our revolving facilities.

Balance sheet

Our USD non-current

borrowings as of 30 September 2023 were $650 million, which was unchanged from 30 September 2022. As a result of the year-on-year

change in the USD/GBP exchange rate from 1.1173 at 30 September 2022 to 1.2208 at 30 September 2023, our non-current borrowings

when converted to GBP were £528.8 million, compared to £577.4 million at the prior year quarter.

In addition to

non-current borrowings, the Group maintains a revolving credit facility which varies based on seasonal flow of funds. Current borrowings

at 30 September 2023 were £204.4 million compared to £102.9 million at 30 September 2022.

As of 30 September 2023,

cash and cash equivalents were £80.8 million compared to £24.3 million at the prior year quarter.

About Manchester United

Manchester United

is one of the most popular and successful sports teams in the world, playing one of the most popular spectator sports on Earth. Through

our 146-year football heritage we have won 67 trophies, enabling us to develop what we believe is one of the world’s leading sports

and entertainment brands with a global community of 1.1 billion fans and followers. Our large, passionate and highly engaged fan base

provides Manchester United with a worldwide platform to generate significant revenue from multiple sources, including sponsorship, merchandising,

product licensing, broadcasting and matchday initiatives which in turn, directly fund our ability to continuously reinvest in the club.

Cautionary

Statements

This press release

contains forward-looking statements. You should not place undue reliance on such statements because they are subject to numerous risks

and uncertainties relating to the Company’s operations and business environment, all of which are difficult to predict and many

are beyond the Company’s control. These statements often include words such as “may,” “might,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“seek,” “believe,” “estimate,” “predict,” “potential,” “continue,”

“contemplate,” “possible” or similar expressions. The forward-looking statements contained in this press release

are based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations.

You should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties

and assumptions. Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should

be aware that many factors could affect its actual financial results or results of operations and could cause actual results to differ

materially from those in these forward-looking statements. These factors are more fully discussed in the “Risk Factors” section

and elsewhere in the Company’s Registration Statement on Form F-1, as amended (File No. 333-182535) and the Company’s

Annual Report on Form 20-F (File No. 001-35627) as supplemented by the risk factors contained in the Company’s other

filings with the Securities and Exchange Commission.

Non-IFRS

Measures: Definitions and Use

Adjusted EBITDA

is defined as loss for the period before depreciation, amortization, profit on disposal of intangible assets, net finance costs, and

tax.

Adjusted

EBITDA is useful as a measure of comparative operating performance from period to period and among companies as it is reflective of changes

in pricing decisions, cost controls and other factors that affect operating performance, and it removes the effect of our asset base

(primarily depreciation and amortization), material volatile items (primarily profit on disposal

of intangible assets), capital structure (primarily finance costs), and items outside the control of our management (primarily taxes).

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for an analysis

of our results as reported under IFRS as issued by the IASB. A reconciliation of loss for the period to adjusted EBITDA is presented

in supplemental note 2.

| 2. | Adjusted

loss for the period (i.e. adjusted net loss) |

Adjusted

loss for the period is calculated, where appropriate, by adjusting for foreign exchange losses/gains on unhedged US dollar denominated

borrowings (including foreign exchange gains/losses immediately reclassified from the hedging reserve

following change in contract currency denomination of future revenues), and fair value movements on embedded foreign exchange derivatives,

subtracting/adding the actual tax credit/expense for the period, and adding the adjusted tax credit for the period (based on an normalized

tax rate of 21%; 2022: 21%). The normalized tax rate of 21% is the current US federal corporate income tax rate.

In

assessing the comparative performance of the business, in order to get a clearer view of the underlying financial performance of the

business, it is useful to strip out the distorting effects of the items referred to above and then to apply a ‘normalized’

tax rate (for both the current and prior periods) of the weighted average US federal corporate income tax rate of 21% (2022: 21%) applicable

during the financial year. A reconciliation of loss/profit for the period to adjusted loss/profit for the period is

presented in supplemental note 3.

| 3. | Adjusted

basic and diluted loss per share |

Adjusted

basic and diluted loss per share are calculated by dividing the adjusted loss for the period by the weighted average number of ordinary

shares in issue during the period. Adjusted diluted loss per share is calculated by adjusting the

weighted average number of ordinary shares in issue during the period to assume conversion of all dilutive potential ordinary shares.

There is one category of dilutive potential ordinary shares: share awards pursuant to the 2012 Equity Incentive Plan (the “Equity

Plan”). Share awards pursuant to the Equity Plan are assumed to have been converted into ordinary shares at the beginning of the

financial year. Adjusted basic and diluted loss per share are presented in supplemental note 3.

Key Performance Indicators

| | |

Three

months ended 30

September | |

| | |

2023 | |

2022 | |

| Revenue | |

| | |

| |

| Commercial

% of total revenue | |

| 57.5 | % |

60.8 | % |

| Broadcasting % of total

revenue | |

| 25.0 | % |

24.4 | % |

| Matchday % of total revenue | |

| 17.5 | % |

14.8 | % |

| |

|

2023/24

Season |

|

2022/23

Season |

|

| Home Matches Played |

|

|

|

|

|

|

| PL |

|

|

4 |

|

3 |

|

| UEFA competitions |

|

|

1 |

|

1 |

|

| Domestic Cups |

|

|

- |

|

- |

|

| Away Matches Played |

|

|

|

|

|

|

| PL |

|

|

3 |

|

3 |

|

| UEFA competitions |

|

|

1 |

|

1 |

|

| Domestic Cups |

|

|

- |

|

- |

|

| |

|

|

|

|

|

|

| Other |

|

|

|

|

|

|

| Employees at period end |

|

|

1,142 |

|

1,205 |

|

| Employee benefit expenses % of revenue |

|

|

57.5 |

% |

57.3 |

% |

| Contacts

|

|

| |

|

Investor Relations:

Corinna Freedman

Head of Investor Relations

+44 738 491 0828

Corinna.Freedman@manutd.co.uk |

Media Relations:

Andrew Ward

Director of Media Relations & Public Affairs

+44 161 676 7770

andrew.ward@manutd.co.uk |

CONSOLIDATED

STATEMENT OF PROFIT OR LOSS

(unaudited; in

£ thousands, except per share and shares outstanding data)

| | |

Three

months ended 30

September | |

| | |

2023 | | |

2022 | |

| Revenue from

contracts with customers | |

| 157,096 | | |

| 143,654 | |

| Operating expenses | |

| (184,762 | ) | |

| (163,644 | ) |

| Profit

on disposal of intangible assets | |

| 29,481 | | |

| 16,608 | |

| Operating

profit/(loss) | |

| 1,815 | | |

| (3,382 | ) |

| Finance costs | |

| (34,968 | ) | |

| (49,730 | ) |

| Finance

income | |

| 349 | | |

| 18,742 | |

| Net finance

costs | |

| (34,619 | ) | |

| (30,988 | ) |

| Loss before income tax | |

| (32,804 | ) | |

| (34,370 | ) |

| Income

tax credit | |

| 7,047 | | |

| 7,854 | |

| Loss

for the period | |

| (25,757 | ) | |

| (26,516 | ) |

| | |

| | | |

| | |

| Basic and diluted loss

per share: | |

| | | |

| | |

| Basic

and diluted loss per share (pence) (1) | |

| (15.79 | ) | |

| (16.26 | ) |

| Weighted

average number of ordinary shares used as the denominator in calculating basic and diluted loss per share (thousands) (1) | |

| 163,159 | | |

| 163,062 | |

(1) For

the three months ended 30 September 2023 and the three months ended 30 September 2022, potential ordinary shares are anti-dilutive,

as their inclusion in the diluted loss per share calculation would reduce the loss per share, and hence have been excluded.

CONSOLIDATED

BALANCE SHEET

(unaudited; in

£ thousands)

| | |

As

of | |

| | |

30

September 2023 | | |

30

June

2023 | | |

30

September

2022 | |

| ASSETS | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant

and equipment | |

| 256,961 | | |

| 253,282 | | |

| 244,642 | |

| Right-of-use assets | |

| 8,417 | | |

| 8,760 | | |

| 3,677 | |

| Investment properties | |

| 19,923 | | |

| 19,993 | | |

| 20,203 | |

| Intangible assets | |

| 966,766 | | |

| 812,382 | | |

| 920,941 | |

| Deferred tax asset | |

| 6,244 | | |

| - | | |

| 644 | |

| Trade receivables | |

| 45,014 | | |

| 22,303 | | |

| 19,325 | |

| Derivative

financial instruments | |

| 190 | | |

| 7,492 | | |

| 36,683 | |

| | |

| 1,303,515 | | |

| 1,124,212 | | |

| 1,246,115 | |

| Current assets | |

| | | |

| | | |

| | |

| Inventories | |

| 5,046 | | |

| 3,165 | | |

| 3,752 | |

| Prepayments | |

| 36,418 | | |

| 16,487 | | |

| 30,912 | |

| Contract assets – accrued

revenue | |

| 47,343 | | |

| 43,332 | | |

| 46,139 | |

| Trade receivables | |

| 28,920 | | |

| 31,167 | | |

| 51,224 | |

| Other receivables | |

| 11,677 | | |

| 9,928 | | |

| 1,929 | |

| Income tax receivable | |

| - | | |

| 5,317 | | |

| 4,547 | |

| Derivative financial instruments | |

| 6,646 | | |

| 8,317 | | |

| 12,137 | |

| Cash and

cash equivalents | |

| 80,829 | | |

| 76,019 | | |

| 24,277 | |

| | |

| 216,879 | | |

| 193,732 | | |

| 174,917 | |

| Total

assets | |

| 1,520,394 | | |

| 1,317,944 | | |

| 1,421,032 | |

CONSOLIDATED

BALANCE SHEET (continued)

(unaudited; in

£ thousands)

| | |

As

of | |

| | |

30

September 2023 | | |

30

June

2023 | | |

30

September

2022 | |

| EQUITY AND LIABILITIES | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 53 | | |

| 53 | | |

| 53 | |

| Share premium | |

| 68,822 | | |

| 68,822 | | |

| 68,822 | |

| Treasury shares | |

| (21,305 | ) | |

| (21,305 | ) | |

| (21,305 | ) |

| Merger reserve | |

| 249,030 | | |

| 249,030 | | |

| 249,030 | |

| Hedging reserve | |

| (2,947 | ) | |

| 4,002 | | |

| 659 | |

| Retained

deficit | |

| (221,669 | ) | |

| (196,652 | ) | |

| (196,029 | ) |

| | |

| 71,984 | | |

| 103,950 | | |

| 101,230 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Deferred tax liabilities | |

| - | | |

| 3,304 | | |

| - | |

| Contract liabilities - deferred

revenue | |

| 7,816 | | |

| 6,659 | | |

| 20,382 | |

| Trade and other payables | |

| 203,853 | | |

| 161,141 | | |

| 172,977 | |

| Borrowings | |

| 528,787 | | |

| 507,335 | | |

| 577,367 | |

| Lease liabilities | |

| 7,766 | | |

| 7,844 | | |

| 2,588 | |

| Derivative financial instruments | |

| 850 | | |

| 748 | | |

| - | |

| Provisions | |

| 95 | | |

| 93 | | |

| 11,706 | |

| | |

| 749,167 | | |

| 687,124 | | |

| 785,020 | |

| Current liabilities | |

| | | |

| | | |

| | |

| Contract liabilities - deferred

revenue | |

| 214,666 | | |

| 169,624 | | |

| 171,344 | |

| Trade and other payables | |

| 267,728 | | |

| 236,472 | | |

| 258,443 | |

| Income tax liabilities | |

| 684 | | |

| - | | |

| - | |

| Borrowings | |

| 204,380 | | |

| 105,961 | | |

| 102,892 | |

| Lease liabilities | |

| 971 | | |

| 1,036 | | |

| 1,000 | |

| Derivative financial instruments | |

| 499 | | |

| 931 | | |

| - | |

| Provisions | |

| 10,315 | | |

| 12,846 | | |

| 1,103 | |

| | |

| 699,243 | | |

| 526,870 | | |

| 534,782 | |

| Total

equity and liabilities | |

| 1,520,394 | | |

| 1,317,944 | | |

| 1,421,032 | |

CONSOLIDATED

STATEMENT OF CASH FLOWS

(unaudited; in

£ thousands)

| | |

Three

months ended 30

September | |

| | |

2023 | | |

2022 | |

| Cash flow from operating

activities | |

| | | |

| | |

| Cash generated from

operations (see supplemental note 4) | |

| 25,871 | | |

| 3,619 | |

| Interest paid | |

| (10,574 | ) | |

| (9,628 | ) |

| Interest received | |

| 349 | | |

| 18 | |

Tax refunded/(paid)

| |

| 5,817 | | |

| (52 | ) |

| Net cash inflow/(outflow)

from operating activities | |

| 21,463 | | |

| (6,043 | ) |

| Cash flow from investing

activities | |

| | | |

| | |

| Payments for property, plant

and equipment | |

| (9,029 | ) | |

| (4,393 | ) |

| Payments

for intangible assets | |

| (132,213 | ) | |

| (100,024 | ) |

| Proceeds from sale of intangible

assets | |

| 25,669 | | |

| 11,662 | |

| Net cash outflow from investing

activities | |

| (115,573 | ) | |

| (92,755 | ) |

| Cash flow from financing

activities | |

| | | |

| | |

| Proceeds from borrowings | |

| 100,000 | | |

| - | |

| Principal elements of lease

payments | |

| (200 | ) | |

| (878 | ) |

| Net cash inflow/(outflow)

from financing activities | |

| 99,800 | | |

| (878 | ) |

| Effect of exchange rate changes

on cash and cash equivalents | |

| (880 | ) | |

| 2,730 | |

| Net increase/(decrease)

in cash and cash equivalents | |

| 4,810 | | |

| (96,946 | ) |

| Cash and cash equivalents at

beginning of period | |

| 76,019 | | |

| 121,223 | |

| Cash and cash equivalents

at end of period | |

| 80,829 | | |

| 24,277 | |

SUPPLEMENTAL

NOTES

1 General

information

Manchester United

plc (the “Company”) and its subsidiaries (together the “Group”) is a men’s and women’s professional

football club together with related and ancillary activities. The Company incorporated under the Companies Law (as amended) of the Cayman

Islands.

| 2 | Reconciliation

of loss for the period to adjusted EBITDA |

| | |

Three

months ended 30

September | |

| | |

2023 £’000 | | |

2022

£’000 | |

| Loss for the

period | |

| (25,757 | ) | |

| (26,516 | ) |

| Adjustments: | |

| | | |

| | |

| Income tax credit | |

| (7,047 | ) | |

| (7,854 | ) |

| Net finance costs | |

| 34,619 | | |

| 30,988 | |

| Profit on disposal of intangible

assets | |

| (29,481 | ) | |

| (16,608 | ) |

| Amortization | |

| 46,845 | | |

| 40,139 | |

| Depreciation | |

| 4,102 | | |

| 3,478 | |

| Adjusted

EBITDA | |

| 23,281 | | |

| 23,627 | |

| 3 | Reconciliation

of loss for the period to adjusted loss for the period and adjusted basic and diluted loss

per share |

| | |

Three

months ended

30 September | |

| | |

2023 £’000 | | |

2022

£’000 | |

| Loss for the

period | |

| (25,757 | ) | |

| (26,516 | ) |

| Foreign exchange losses on unhedged

US dollar denominated borrowings | |

| 13,753 | | |

| 40,440 | |

| Fair value movement on embedded

foreign exchange derivatives | |

| 8,163 | | |

| (18,612 | ) |

| Income

tax credit | |

| (7,047 | ) | |

| (7,854 | ) |

| Adjusted loss before income

tax | |

| (10,888 | ) | |

| (12,542 | ) |

| Adjusted

income tax credit (using a normalized tax rate of 21% (2022: 21%)) | |

| 2,286 | | |

| 2,634 | |

| Adjusted

loss for the period (i.e. adjusted net loss) | |

| (8,602 | ) | |

| (9,908 | ) |

| | |

| | | |

| | |

| Adjusted basic and diluted

loss per share: | |

| | | |

| | |

| Adjusted

basic and diluted loss per share (pence) (1) | |

| (5.27 | ) | |

| (6.08 | ) |

| Weighted

average number of ordinary shares used as the denominator in calculating basic and diluted loss per share (thousands) (1) | |

| 163,159 | | |

| 163,062 | |

(1) For

the three months ended 30 September 2023 and the three months ended 30 September 2022 potential ordinary shares are anti-dilutive,

as their inclusion in the diluted loss per share calculation would reduce the loss per share, and hence have been excluded.

| 4 | Cash

generated from operations |

| | |

Three

months ended 30

September | |

| | |

2023 £’000 | | |

2022

£’000 | |

| Loss for the period | |

| (25,757 | ) | |

| (26,516 | ) |

| Income tax credit | |

| (7,047 | ) | |

| (7,854 | ) |

| Loss before income tax | |

| (32,804 | ) | |

| (34,370 | ) |

| Adjustments for: | |

| | | |

| | |

| Depreciation | |

| 4,102 | | |

| 3,478 | |

| Amortization | |

| 46,845 | | |

| 40,139 | |

| Profit on disposal of intangible

assets | |

| (29,481 | ) | |

| (16,608 | ) |

| Net finance costs | |

| 34,619 | | |

| 30,988 | |

| Non-cash employee benefit expense

- equity-settled share-based payments | |

| 740 | | |

| 529 | |

| Foreign exchange gains on operating

activities | |

| (142 | ) | |

| (1,173 | ) |

| Reclassified from hedging reserve | |

| (252 | ) | |

| (163 | ) |

| Changes in working capital: | |

| | | |

| | |

| Inventories | |

| (1,881 | ) | |

| (1,552 | ) |

| Prepayments | |

| (20,119 | ) | |

| (15,566 | ) |

| Contract assets – accrued

revenue | |

| (4,011 | ) | |

| (9,900 | ) |

| Trade receivables | |

| (5,245 | ) | |

| 15,983 | |

| Other receivables | |

| (1,749 | ) | |

| (360 | ) |

| Contract liabilities –

deferred revenue | |

| 46,199 | | |

| 9,182 | |

| Trade and other payables | |

| (8,237 | ) | |

| (17,153 | ) |

| Provisions | |

| (2,713 | ) | |

| 165 | |

| Cash generated from operations | |

| 25,871 | | |

| 3,619 | |

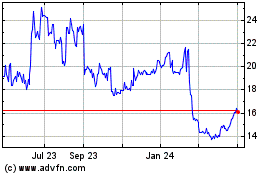

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2024 to May 2024

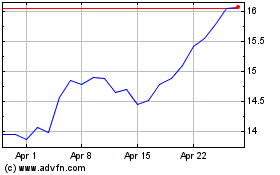

Manchester United (NYSE:MANU)

Historical Stock Chart

From May 2023 to May 2024