LTC Properties, Inc. (NYSE: LTC) (“LTC” or the “Company”), a

real estate investment trust that primarily invests in seniors

housing and health care properties, today announced operating

results for the second quarter ended June 30, 2023.

Three Months Ended

June 30,

2023

2022

(unaudited)

Net income available to common

stockholders

$

6,028

$

54,065

Diluted earnings per common share

$

0.15

$

1.36

NAREIT funds from operations ("FFO")

attributable to common stockholders

$

27,178

$

25,350

NAREIT diluted FFO per common share

$

0.66

$

0.64

FFO attributable to common stockholders,

excluding non-recurring items

$

27,178

$

24,491

Funds available for distribution

("FAD")

$

27,935

$

26,779

FAD, excluding non-recurring items

$

27,935

$

25,598

Second quarter 2023 financial results were impacted by:

- Higher interest income from financing receivables due to the

acquisition of 11 assisted living and memory care communities

during 2023 first quarter, and three skilled nursing centers during

the 2022 third quarter. These acquisitions are being accounted for

as financing receivables in accordance with U.S. Generally Accepted

Accounting Principles (“GAAP”);

- Higher interest income from mortgage loans resulting from

mortgage loan originations in the 2023 first quarter and 2022

second quarter;

- Lower interest and other income due to the payoff of two

mezzanine loans during the 2023 first quarter;

- Higher interest expense primarily due to a higher outstanding

balance and higher interest rates on LTC’s revolving line of

credit, and the issuance of $75.0 million senior unsecured notes

during the 2022 second quarter; and

- Recorded a $12.1 million impairment loss to reduce the carrying

value of two assisted living communities to their estimated fair

value as a result ongoing negotiations for the potential sale these

communities. One of these properties is non-revenue generating, and

the other produces minimal rent.

During the second quarter of 2023, LTC completed the following

transactions:

- As previously announced, contributed $45.0 million to a $54.1

million joint venture for the purchase of a 242-unit independent

living, assisted living and memory care campus in Ohio. The campus,

which was built between 2019 and 2022, is now operated by current

LTC operator, Encore Senior Living (“Encore”). The seller, LTC’s JV

partner, has the option to purchase the campus during the third and

fourth lease years, with an exit IRR of 9.75%. The lease term is 10

years at an initial yield of 8.25% on LTC’s allocation of the JV

investment. LTC committed to fund $2.1 million of lease incentives

under the new lease. Rent is expected to be approximately $3.9

million per year;

- As previously announced, originated a $16.5 million mortgage

loan secured by a skilled nursing center in Illinois. The center,

which was built in 2010 and renovated in 2021, has 150 beds and is

now operated by current LTC operator, Ignite Medical Resorts. The

loan term is five years at an interest rate of 8.75%;

- As previously disclosed, sold a 70‑unit assisted living

community in Florida for $4.9 million;

- Sold a 39-unit assisted living community in New Jersey for $2.0

million;

- Entered into an agreement to sell two assisted living

communities in Pennsylvania with a total of 130 units for $11.5

million. The sale is expected to close during the third quarter of

2023. Accordingly, the Company anticipates recording a gain on sale

of approximately $5.2 million from these non-revenue producing

assets;

- As previously disclosed, LTC agreed to defer up to $1.5

million, or up to $300,000 per month for May through September

2023, in interest payments due on a mortgage loan secured by 15

skilled nursing centers located in Michigan and operated by

Prestige Healthcare. LTC deferred $600,000 in interest payments

during the 2023 second quarter and deferred $300,000 in interest

payments in July 2023;

- Provided $645,000 of abated rent during the 2023 second quarter

and $215,000 of abated rent in July 2023 to the same operator for

whom abated rent has been previously provided. LTC has agreed to

provide rent abatements up to $215,000 per month through the end of

2023;

- As previously announced, transitioned a portfolio of eight

assisted living communities with 500 units in Illinois, Ohio and

Michigan to Encore. LTC agreed to provide assistance in the 2023

second quarter to the former operator of this portfolio and as part

of the transition, LTC received repayment of $1.3 million of

deferred rent which represents $934,000 of April and May 2023

deferred rent and $316,000 of unrecorded deferred rent provided in

2022. Cash rent under the new two-year lease with Encore is based

on mutually agreed upon fair market rent beginning in month four of

the lease (September 2023);

- Paid $4.0 million in regular scheduled principal payments under

the Company’s senior unsecured notes; and

- Borrowed $56.3 million under the Company’s revolving line of

credit.

Subsequent to June 30, 2023, LTC completed the following

transactions:

- Originated a $17.0 million mezzanine loan with an affiliate of

Galerie Living. The mezzanine loan was utilized to recapitalize an

existing 130-unit assisted living, memory care and independent

living campus in Georgia, as well as the construction of 89

additional units. The existing campus was built in 2020 and is 95%

occupied. The loan term is five years at an initial yield of 8.75%

and an IRR of 12.0%;

- Paid $17.2 million in regular scheduled principal payments

under the Company’s senior unsecured notes; and

- Borrowed $34.0 million under the Company’s revolving line of

credit.

Conference Call

Information

LTC will conduct a conference call on Friday, July 28, 2023, at

8:00 a.m. Pacific Time (11:00 a.m. Eastern Time), to provide

commentary on its performance and operating results for the quarter

ended June 30, 2023. The conference call is accessible by telephone

and the internet. Interested parties may access the live conference

call via the following:

Webcast

www.LTCreit.com

USA Toll-Free Number

1-888‑506‑0062

International Number

1-973‑528‑0011

Conference Access Code

152241

Additionally, an audio replay of the call will be available one

hour after the live call through August 11, 2023 via the

following:

USA Toll-Free Number

1‑877‑481‑4010

International Number

1-919-882-2331

Conference Number

48641

About LTC

LTC is a real estate investment trust (REIT) investing in

seniors housing and health care properties primarily through

sale-leasebacks, mortgage financing, joint-ventures and structured

finance solutions including preferred equity and mezzanine lending.

LTC’s investment portfolio includes 213 properties in 29 states

with 29 operating partners. Based on its gross real estate

investments, LTC’s investment portfolio is comprised of

approximately 50% seniors housing and 50% skilled nursing

properties. Learn more at www.LTCreit.com.

Forward-Looking

Statements

This press release includes statements that are not purely

historical and are “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding the Company’s expectations, beliefs,

intentions or strategies regarding the future. All statements other

than historical facts contained in this press release are

forward-looking statements. These forward-looking statements

involve a number of risks and uncertainties. Please see LTC’s most

recent Annual Report on Form 10‑K, its subsequent Quarterly Reports

on Form 10‑Q, and its other publicly available filings with the

Securities and Exchange Commission for a discussion of these and

other risks and uncertainties. All forward-looking statements

included in this press release are based on information available

to the Company on the date hereof, and LTC assumes no obligation to

update such forward-looking statements. Although the Company’s

management believes that the assumptions and expectations reflected

in such forward-looking statements are reasonable, no assurance can

be given that such expectations will prove to have been correct.

The actual results achieved by the Company may differ materially

from any forward-looking statements due to the risks and

uncertainties of such statements.

LTC PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

(unaudited, amounts in thousands,

except per share amounts)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Revenues:

Rental income

$

31,537

$

31,628

$

63,272

$

61,952

Interest income from financing

receivables(1)

3,830

—

7,581

—

Interest income from mortgage loans

11,926

10,097

23,170

19,733

Interest and other income

953

1,299

3,723

2,126

Total revenues

48,246

43,024

97,746

83,811

Expenses:

Interest expense

11,312

7,523

21,921

14,666

Depreciation and amortization

9,376

9,379

18,586

18,817

Impairment loss

12,076

—

12,510

—

Provision for credit losses

187

305

1,918

659

Transaction costs

91

67

208

99

Property tax expense

3,187

4,019

6,480

8,001

General and administrative expenses

6,091

5,711

12,385

11,519

Total expenses

42,320

27,004

74,008

53,761

Other operating income:

Gain on sale of real estate, net

302

38,094

15,675

38,196

Operating income

6,228

54,114

39,413

68,246

Income from unconsolidated joint

ventures

376

376

752

751

Net income

6,604

54,490

40,165

68,997

Income allocated to non-controlling

interests

(430

)

(107

)

(857

)

(202

)

Net income attributable to LTC Properties,

Inc.

6,174

54,383

39,308

68,795

Income allocated to participating

securities

(146

)

(318

)

(293

)

(407

)

Net income available to common

stockholders

$

6,028

$

54,065

$

39,015

$

68,388

Earnings per common share:

Basic

$

0.15

$

1.37

$

0.95

$

1.74

Diluted

$

0.15

$

1.36

$

0.95

$

1.73

Weighted average shares used to

calculate earnings per common share:

Basic

41,145

39,492

41,113

39,347

Diluted

41,232

39,665

41,200

39,520

Dividends declared and paid per common

share

$

0.57

$

0.57

$

1.14

$

1.14

_______________

(1)

Represents rental income from

acquisitions through sale-leaseback transactions, subject to leases

which contain purchase options. In accordance with GAAP, the

properties are required to be presented as financing receivables on

our Consolidated Balance Sheets and the rental income to be

presented as Interest income from financing receivables on our

Consolidated Statements of Income.

Supplemental Reporting

Measures

FFO and FAD are supplemental measures of a real estate

investment trust’s (“REIT”) financial performance that are not

defined by U.S. generally accepted accounting principles (“GAAP”).

Investors, analysts and the Company use FFO and FAD as supplemental

measures of operating performance. The Company believes FFO and FAD

are helpful in evaluating the operating performance of a REIT. Real

estate values historically rise and fall with market conditions,

but cost accounting for real estate assets in accordance with GAAP

assumes that the value of real estate assets diminishes predictably

over time. We believe that by excluding the effect of historical

cost depreciation, which may be of limited relevance in evaluating

current performance, FFO and FAD facilitate like comparisons of

operating performance between periods. Occasionally, the Company

may exclude non-recurring items from FFO and FAD in order to allow

investors, analysts and our management to compare the Company’s

operating performance on a consistent basis without having to

account for differences caused by unanticipated items.

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), means net income available to common

stockholders (computed in accordance with GAAP) excluding gains or

losses on the sale of real estate and impairment write-downs of

depreciable real estate, plus real estate depreciation and

amortization, and after adjustments for unconsolidated partnerships

and joint ventures. The Company’s computation of FFO may not be

comparable to FFO reported by other REITs that do not define the

term in accordance with the current NAREIT definition or have a

different interpretation of the current NAREIT definition from that

of the Company; therefore, caution should be exercised when

comparing our Company’s FFO to that of other REITs.

We define FAD as FFO excluding the effects of straight-line

rent, amortization of lease inducement, effective interest income,

deferred income from unconsolidated joint ventures, non-cash

compensation charges, capitalized interest and non-cash interest

charges. GAAP requires rental revenues related to non-contingent

leases that contain specified rental increases over the life of the

lease to be recognized evenly over the life of the lease. This

method results in rental income in the early years of a lease that

is higher than actual cash received, creating a straight-line rent

receivable asset included in our consolidated balance sheet. At

some point during the lease, depending on its terms, cash rent

payments exceed the straight-line rent which results in the

straight-line rent receivable asset decreasing to zero over the

remainder of the lease term. Effective interest method, as required

by GAAP, is a technique for calculating the actual interest rate

for the term of a mortgage loan based on the initial origination

value. Similar to the accounting methodology of straight-line rent,

the actual interest rate is higher than the stated interest rate in

the early years of the mortgage loan thus creating an effective

interest receivable asset included in the interest receivable line

item in our consolidated balance sheet and reduces down to zero

when, at some point during the mortgage loan, the stated interest

rate is higher than the actual interest rate. FAD is useful in

analyzing the portion of cash flow that is available for

distribution to stockholders. Investors, analysts and the Company

utilize FAD as an indicator of common dividend potential. The FAD

payout ratio, which represents annual distributions to common

shareholders expressed as a percentage of FAD, facilitates the

comparison of dividend coverage between REITs.

While the Company uses FFO and FAD as supplemental performance

measures of our cash flow generated by operations and cash

available for distribution to stockholders, such measures are not

representative of cash generated from operating activities in

accordance with GAAP, and are not necessarily indicative of cash

available to fund cash needs and should not be considered an

alternative to net income available to common stockholders.

Reconciliation of FFO and

FAD

The following table reconciles GAAP net income available to

common stockholders to each of NAREIT FFO attributable to common

stockholders and FAD (unaudited, amounts in thousands, except per

share amounts):

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

GAAP net income available to common

stockholders

$

6,028

$

54,065

$

39,015

$

68,388

Add: Impairment loss

12,076

—

12,510

—

Add: Depreciation and amortization

9,376

9,379

18,586

18,817

Less: Gain on sale of real estate, net

(302

)

(38,094

)

(15,675

)

(38,196

)

NAREIT FFO attributable to common

stockholders

27,178

25,350

54,436

49,009

Add: Non-recurring items

—

(859

)

(4)

262

(1)

(436

)

(6)

FFO attributable to common stockholders,

excluding non-recurring items

$

27,178

$

24,491

$

54,698

$

48,573

NAREIT FFO attributable to common

stockholders

$

27,178

$

25,350

54,436

49,009

Non-cash income:

Add: straight-line rental adjustment

423

293

888

527

Add: amortization of lease incentives

230

206

439

602

(7)

Less: Effective interest income

(2,220

)

(1,387

)

(3,828

)

(2,789

)

Net non-cash income

(1,567

)

(888

)

(2,501

)

(1,660

)

Non-cash expense:

Add: Non-cash compensation charges

2,137

2,012

4,225

3,937

Add: Provision for credit losses

187

305

1,918

(2)

659

Net non-cash expense

2,324

2,317

6,143

4,596

Funds available for distribution (FAD)

$

27,935

$

26,779

58,078

51,945

Less: Non-recurring income

—

(1,181

)

(5)

(1,570

)

(3)

(1,181

)

(5)

Funds available for distribution (FAD),

excluding non-recurring items

$

27,935

$

25,598

$

56,508

$

50,764

_______________

(1)

Represents the net of (2) and (3)

below.

(2)

Includes $1,832 of provision for

credit losses related to the $121,321 acquisition accounted for as

a financing receivable and $61,900 of mortgage loan

originations.

(3)

Represents the prepayment fee and

exit IRR related to the payoff of two mezzanine loans.

(4)

Represents (5) below partially

offset by the provision for credit losses related to the

origination of two mortgage loans during 2022 second quarter

($322).

(5)

Represents the lease termination

fee received in connection with the sale of a 74-unit assisted

living community.

(6)

Represents (5) from above

partially offset by the provision for credit losses related to the

origination of two mortgage loans during the second quarter of 2022

and a $25,000 mezzanine loan during the first quarter of 2022

($572) and (7) below.

(7)

Includes a lease incentive

balance write-off of $173 related to a closed property and lease

termination.

Reconciliation of FFO and FAD

(continued)

The following table continues the reconciliation between GAAP

net income available to common stockholders and each of NAREIT FFO

attributable to common stockholders and FAD (unaudited, amounts in

thousands, except per share amounts):

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

NAREIT Basic FFO attributable to common

stockholders per share

$

0.66

$

0.64

$

1.32

$

1.25

NAREIT Diluted FFO attributable to common

stockholders per share

$

0.66

$

0.64

$

1.32

$

1.24

NAREIT Diluted FFO attributable to common

stockholders

$

27,324

$

25,350

$

54,729

$

49,009

Weighted average shares used to calculate

NAREIT diluted FFO per share attributable to common

stockholders

41,489

39,665

41,454

39,520

Diluted FFO attributable to common

stockholders, excluding non-recurring items

$

27,324

$

24,491

$

54,991

$

48,573

Weighted average shares used to calculate

diluted FFO, excluding non-recurring items, per share attributable

to common stockholders

41,489

39,665

41,454

39,520

Diluted FAD

$

28,081

$

26,779

$

58,371

$

51,945

Weighted average shares used to calculate

diluted FAD per share

41,489

39,665

41,454

39,520

Diluted FAD, excluding non-recurring

items

$

28,081

$

25,598

$

56,801

$

50,764

Weighted average shares used to calculate

diluted FAD, excluding non-recurring items, per share

41,489

39,665

41,454

39,520

LTC PROPERTIES, INC.

CONSOLIDATED BALANCE

SHEETS

(amounts in thousands, except per

share)

June 30, 2023

December 31, 2022

ASSETS

(unaudited)

(audited)

Investments:

Land

$

124,901

$

124,665

Buildings and improvements

1,286,615

1,273,025

Accumulated depreciation and

amortization

(393,449

)

(389,182

)

Operating real estate property, net

1,018,067

1,008,508

Properties held-for-sale, net of

accumulated depreciation: 2023—$3,691; 2022—$2,305

6,053

10,710

Real property investments, net

1,024,120

1,019,218

Financing receivables,(1) net of credit

loss reserve: 2023—$1,981; 2022—$768

196,075

75,999

Mortgage loans receivable, net of credit

loss reserve: 2023—$4,761; 2022—$3,930

471,978

389,728

Real estate investments, net

1,692,173

1,484,945

Notes receivable, net of credit loss

reserve: 2023—$463; 2022—$589

45,949

58,383

Investments in unconsolidated joint

ventures

19,340

19,340

Investments, net

1,757,462

1,562,668

Other assets:

Cash and cash equivalents

7,026

10,379

Debt issue costs related to revolving line

of credit

1,925

2,321

Interest receivable

50,593

46,000

Straight-line rent receivable

20,815

21,847

Lease incentives

1,360

1,789

Prepaid expenses and other assets

19,061

11,099

Total assets

$

1,858,242

$

1,656,103

LIABILITIES

Revolving line of credit

$

326,350

$

130,000

Term loans, net of debt issue costs:

2023—$417; 2022—$489

99,583

99,511

Senior unsecured notes, net of debt issue

costs: 2023—$1,364; 2022—$1,477

527,456

538,343

Accrued interest

3,870

5,234

Accrued expenses and other liabilities

41,368

32,708

Total liabilities

998,627

805,796

EQUITY

Stockholders’ equity:

Common stock: $0.01 par value; 60,000

shares authorized; shares issued and outstanding: 2023—41,409;

2022—41,262

413

412

Capital in excess of par value

935,427

931,124

Cumulative net income

1,583,968

1,544,660

Accumulated other comprehensive income

8,568

8,719

Cumulative distributions

(1,703,710

)

(1,656,548

)

Total LTC Properties, Inc. stockholders’

equity

824,666

828,367

Non-controlling interests

34,949

21,940

Total equity

859,615

850,307

Total liabilities and equity

$

1,858,242

$

1,656,103

_______________

(1)

Represents acquisitions through

sale-leaseback transactions, subject to leases which contain

purchase options. In accordance with GAAP, the properties are

required to be presented as financing receivables on our

Consolidated Balance Sheets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727604615/en/

Mandi Hogan (805) 981‑8655

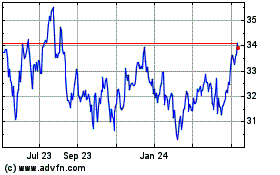

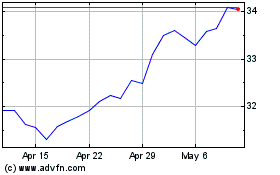

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Oct 2024 to Nov 2024

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Nov 2023 to Nov 2024