Kirby Corporation Expects 2008 Third Quarter Net Earnings to be $.73 to $.76 Per Share, After Impact of Hurricanes Gustav and Ik

September 23 2008 - 6:18PM

PR Newswire (US)

- 2008 third quarter earnings expected to be $.73 to $.76 per share

compared with $.64 per share for the 2007 third quarter HOUSTON,

Sept. 23 /PRNewswire-FirstCall/ -- Kirby Corporation ("Kirby")

(NYSE:KEX) announced today that following the impact of Hurricanes

Gustav and Ike it expects its 2008 third quarter earnings to be

$.73 to $.76 per share compared with 2007 third quarter earnings of

$.64 per share. Kirby estimates the 2008 third quarter effect of

Hurricanes Gustav and Ike will be in the $.08 to $.09 per share

range. Joe Pyne, Kirby's President and Chief Executive Officer,

commented, "Hurricane Ike made landfall on September 13 in the

Houston/Galveston area as a strong Category 2 hurricane. Because of

Hurricane Ike's size and its unpredictable course, much of the Gulf

Coast petrochemical and refining capacity was shut down prior to

making landfall. Ike's windfield and storm surge significantly

affected the Houston and Port Arthur/Beaumont petrochemical and

refining capacity, much of which is still not operating. The Gulf

Coast contains over 90% of the United States base petrochemical

production. As of Friday, September 19, one week after Hurricane

Ike's landfall, approximately 50% of this capacity was idle. This

compares with approximately 35% idled one week after Hurricane

Rita's 2005 landfall, and less than 10% idled one week after

Hurricane Katrina's 2005 landfall. Gulf Coast petrochemical

production continues to recover with outages of less than 40% of

capacity as of Monday, September 22. Additionally, an eight mile

stretch of the Gulf Intracoastal Waterway between the Houston Ship

Channel and Port Arthur, Texas remains closed due to obstructions

in the waterway. This part of the waterway should reopen tomorrow,

eleven days after Ike made landfall. Hurricane Gustav, which made

landfall between Houma and Morgan City, Louisiana on September 1,

also created disruptions to our Gulf Coast diesel engine services

operations and our four Gulf Coast based offshore barge and tug

units. The disruptions to our inland marine transportation

operations were not as severe from Gustav as they were from Ike,

primarily due to fewer closures of our customers' facilities and

only limited waterway closures." Mr. Pyne further commented,

"Although none of Kirby's active tank barges and towboats were

materially damaged by the hurricanes, a large portion of them were

idled. Because of our customers' inability to produce products

which require marine transportation movements in the Houston and

Port Arthur/Beaumont areas, coupled with the closure of the Gulf

Intracoastal Waterway, the impact of Hurricane Ike was

significantly greater than Hurricanes Katrina and Rita in 2005. We

do anticipate a return to strong pre-hurricane operating

fundamentals after customer facilities begin operating at normal

levels. Offsetting some of the negative effects of the hurricanes

on the 2008 third quarter's operating results is an estimated $.03

to $.04 per share positive timing impact from falling diesel fuel

prices, which declined from an average of $4.33 per gallon on July

14 to an average of $3.29 per gallon on September 22. We will

further address the impact of the hurricanes and fuel on our

operating results when we announce our 2008 third quarter results,

and fourth quarter and year guidance, on Wednesday afternoon,

October 29, and in our conference call on Thursday morning, October

30, 2008." Kirby Corporation, based in Houston, Texas, operates

inland tank barges and towing vessels, transporting petrochemicals,

black oil products, refined petroleum products and agricultural

chemicals throughout the United States inland waterway system.

Kirby also owns and operates four ocean-going barge and tug units

transporting dry-bulk commodities in United States coastwise trade.

Through the diesel engine services segment, Kirby provides

after-market service for medium-speed and high-speed diesel engines

and reduction gears used in marine, power generation and railroad

applications. Statements contained in this press release with

respect to the future are forward-looking statements. These

statements reflect management's reasonable judgment with respect to

future events. Forward-looking statements involve risks and

uncertainties. Actual results could differ materially from those

anticipated as a result of various factors, including cyclical or

other downturns in demand, significant pricing competition,

unanticipated additions to industry capacity, changes in the Jones

Act or in U.S. maritime policy and practice, fuel costs, interest

rates, weather conditions, and timing, magnitude and number of

acquisitions made by Kirby. Forward-looking statements are based on

currently available information and Kirby assumes no obligation to

update any such statements. A list of additional risk factors can

be found in Kirby's annual report on Form 10-K for the year ended

December 31, 2007, filed with the Securities and Exchange

Commission. DATASOURCE: Kirby Corporation CONTACT: Steve Holcomb of

Kirby Corporation, +1-713-435-1135 Web site:

http://www.kirbycorp.com/

Copyright

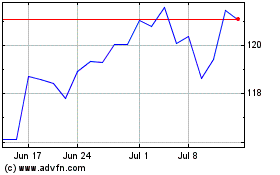

Kirby (NYSE:KEX)

Historical Stock Chart

From Jun 2024 to Jul 2024

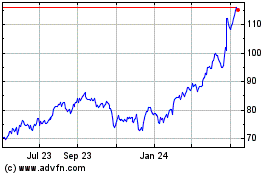

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024