KBR Announces 2010 Earnings Guidance

January 07 2010 - 8:03AM

Business Wire

KBR (NYSE:KBR) announced today that the company’s guidance for

estimated earnings per diluted share from continuing operations is

in the range of $1.60 to $1.80 for the fiscal year 2010.

Included in these estimates is an approximately 50 percent

revenue decline from KBR’s LogCAP project in 2010 from the full

year 2009 levels. The estimated LogCAP revenue decline is based on

recent reports from the U.S. Government indicating a withdrawal of

troops from current levels of approximately 120,000 down to an

approximate sustainment level of between 35,000 and 50,000 by the

end of summer 2010, as well as KBR’s assumptions regarding the

ongoing transition from LogCAP III to LogCAP IV in Iraq. However,

KBR’s LogCAP revenue decline assumptions for 2010 are subject to

change in both timing and scope depending on conditions on the

ground and direction from its government customer.

KBR is a global engineering, construction and services company

supporting the energy, hydrocarbon, government services, minerals,

civil infrastructure, power and industrial markets. For more

information, visit www.kbr.com.

NOTE: The statements in this press release that are not

historical statements, including statements regarding future

financial performance (such as earnings or earnings per diluted

share), are forward-looking statements within the meaning of the

federal securities laws. These statements are subject to numerous

risks and uncertainties, many of which are beyond the company's

control, that could cause actual results to differ materially from

the results expressed or implied by the statements. These risks and

uncertainties include, but are not limited to: the outcome of and

the publicity surrounding audits and investigations by domestic and

foreign government agencies and legislative bodies; potential

adverse proceedings by such agencies and potential adverse results

and consequences from such proceedings; the enforceability of the

company’s indemnities from Halliburton Company; changes in capital

spending by the company’s customers; the company’s ability to

obtain contracts from existing and new customers and perform under

those contracts; structural changes in the industries in which the

company operates, escalating costs associated with and the

performance of fixed-fee projects and the company’s ability to

control its cost under its contracts; claims negotiations and

contract disputes with the company’s customers; changes in the

demand for or price of oil and/or natural gas; protection of

intellectual property rights; compliance with environmental laws;

changes in government regulations and regulatory requirements;

compliance with laws related to income taxes; unsettled political

conditions, war and the effects of terrorism; foreign operations

and foreign exchange rates and controls; the development and

installation of financial systems; increased competition for

employees; and operations of joint ventures, including joint

ventures that are not controlled by the company.

KBR's Annual Report on Form 10-K dated February 25, 2009,

subsequent Forms 10-Q, recent Current Reports on Forms 8-K, and

other Securities and Exchange Commission filings discuss some of

the important risk factors that KBR has identified that may affect

the business, results of operations and financial condition. KBR

undertakes no obligation to revise or update publicly any

forward-looking statements for any reason.

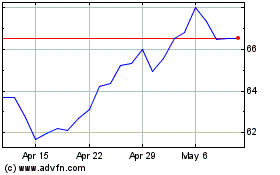

KBR (NYSE:KBR)

Historical Stock Chart

From May 2024 to Jun 2024

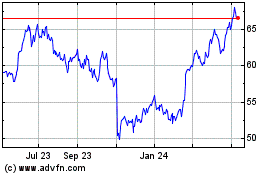

KBR (NYSE:KBR)

Historical Stock Chart

From Jun 2023 to Jun 2024