Current Report Filing (8-k)

October 09 2019 - 4:36PM

Edgar (US Regulatory)

false0000795266KBH

0000795266

2019-10-03

2019-10-03

0000795266

us-gaap:RightsMember

2019-10-03

2019-10-03

0000795266

us-gaap:CommonStockMember

2019-10-03

2019-10-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: October 3, 2019

(Date of earliest event reported)

KB HOME

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-9195

|

|

95-3666267

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

10990 Wilshire Boulevard

Los Angeles, California 90024

(Address of principal executive offices)

Registrant’s telephone number, including area code: (310) 231-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange

on which registered

|

|

Common Stock (par value $1.00 per share)

|

KBH

|

New York Stock Exchange

|

|

Rights to Purchase Series A Participating Cumulative Preferred Stock

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Long-Term Incentive Awards.

On October 3, 2019, the management development and compensation committee (“Committee”) of the board of directors of KB Home (“Company”) approved grants of long-term incentive awards pursuant to the Amended KB Home 2014 Equity Incentive Plan to the Company’s named executive officers and to certain other senior Company executives. The awards to the named executive officers consisted solely of performance-based restricted stock units (each, a “PSU”) corresponding to a target award amount of shares of KB Home common stock (“Award Shares”) for each recipient.

Each PSU entitles a recipient to receive between 0% to 200% of the recipient’s Award Shares based on the Company’s achieving over the three-year performance period commencing on December 1, 2019 and ending on November 30, 2022 specified levels of (a) cumulative adjusted earnings per share; (b) average adjusted return on invested capital; and (c) revenue growth performance relative to a peer group of high-production public homebuilding companies. The earnings per share performance measure will determine 40%, the average return on invested capital performance measure will determine 35%, and the relative revenue growth performance measure will determine 25%, of the final number of shares of KB Home common stock that may be issued pursuant to each PSU. Each PSU recipient is also entitled to receive a proportionate amount of credited cash dividends that are paid in respect of one share of KB Home common stock with a record date between the grant date and the date the Committee determines the applicable performance achievements. If performance over the performance period for all three performance measures is below specific thresholds, each PSU recipient will receive no shares of KB Home common stock and no credited cash dividend amount.

The below table shows the respective Award Shares granted to the Company’s named executive officers on October 3, 2019.

|

|

|

|

|

|

|

Named Executive Officer

|

|

Performance-Based Restricted Stock Units (#)

|

|

Jeffrey T. Mezger

|

|

151,057

|

|

Jeff J. Kaminski

|

|

42,296

|

|

Matthew W. Mandino

|

|

60,423

|

|

Albert Z. Praw

|

|

27,190

|

|

Brian J. Woram

|

|

25,680

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: October 9, 2019

|

KB Home

|

|

|

|

|

|

|

|

By:

|

/s/ William A. (Tony) Richelieu

|

|

|

William A. (Tony) Richelieu

Vice President, Corporate Secretary

and Associate General Counsel

|

|

|

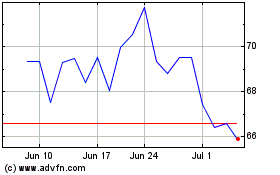

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

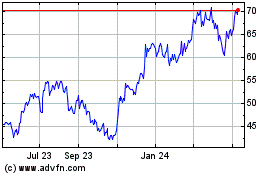

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024