Kayne Anderson MLP Investment Company Announces Public Offering of Common Stock

August 05 2010 - 4:24PM

Business Wire

Kayne Anderson MLP Investment Company (the “Company”) (NYSE:

KYN) announced that it has commenced a public offering of 6,750,000

shares of its common stock. The Company also intends to grant the

underwriters a 45-day option to purchase up to 1,012,500 additional

common shares to cover over-allotments, if any. Net proceeds from

the offering will be used to make additional portfolio investments

that are consistent with the Company’s investment objective and

policies and for general corporate purposes.

UBS Investment Bank, BofA Merrill Lynch, Citi and Morgan Stanley

are acting as joint book-running managers. RBC Capital Markets,

Stifel Nicolaus Weisel, Baird, Madison Williams and Company and

Wunderlich Securities are acting as co-managers on the offering. A

copy of the preliminary prospectus supplement and the base

prospectus relating to the offering may be obtained from the

following addresses:

UBS Investment Bank

Attn: Prospectus Department

299 Park Avenue

New York, NY 10171

Telephone: 888-827-7275

BofA Merrill Lynch

Attn: Prospectus Department

4 World Financial Center

New York, NY 10080

Email:

dg.prospectus_requests@baml.com

Citi

Attn: Prospectus Department

Brooklyn Army Terminal

140 58th Street, 8th Floor

Brooklyn, NY 11220

Telephone: 800-831-9146

Email:

batprospectusdept@citi.com

Morgan Stanley

Attn: Prospectus Department

180 Varick Street, 2nd Floor

New York, NY 10014

Email:

prospectus@morganstanley.com

Telephone: 866-718-1649

Investors may also obtain these documents free of charge from

the Company’s website at www.kaynefunds.com/KynSECFilings.php or

the Securities and Exchange Commission’s (“SEC”) website at

www.sec.gov.

An investor should read the Company’s preliminary prospectus

supplement and the base prospectus carefully before investing. The

preliminary prospectus supplement and the base prospectus contain

important information about the Company and its investment

objective and policies, risks, charges and expenses.

This press release does not constitute an offer to sell or a

solicitation to buy the securities described herein, nor shall

there be any sale of these securities in any state or jurisdiction

in which such offer or solicitation or sale would be unlawful prior

to registration or qualification under the laws of such state or

jurisdiction. A registration statement relating to these securities

was filed with, and has been declared effective by, the SEC.

Kayne Anderson MLP Investment Company is a non-diversified,

closed-end management investment company registered under the

Investment Company Act of 1940, whose common stock is traded on the

New York Stock Exchange. The Company's investment objective is to

obtain a high after-tax total return by investing at least 85% of

its total assets in energy-related master limited partnerships and

their affiliates (collectively, “MLPs”), and in other companies

that, as their principal business, operate assets used in the

gathering, transporting, processing, storing, refining,

distributing, mining or marketing of natural gas, natural gas

liquids, crude oil, refined petroleum products or coal.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release contains "forward-looking statements" as defined under the

U.S. federal securities laws. Generally, the words "believe,"

"expect," "intend," "estimate," "anticipate," "project," "will" and

similar expressions identify forward-looking statements, which

generally are not historical in nature. Forward-looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ from the Company's historical experience

and its present expectations or projections indicated in any

forward-looking statements. These risks include, but are not

limited to, changes in economic and political conditions;

regulatory and legal changes; MLP industry risk; leverage risk;

valuation risk; interest rate risk; tax risk; and other risks

discussed in the Company's filings with the SEC. You should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements made herein. There is no assurance that the Company's

investment objective will be attained.

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2024 to Jun 2024

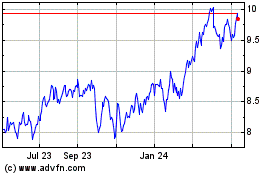

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Jun 2023 to Jun 2024