Jackson Financial Inc. (NYSE: JXN) (Jackson®) today announced

financial results for the three months ended September 30,

2022.

Key Highlights

- Net income of $1,479 million, or $16.83 per diluted share,

including the impact of non-economic hedging results under GAAP

accounting

- Adjusted operating earnings1 of $373 million, or $4.24 per

diluted share

- Total annuity account value of $198 billion decreased 20% from

the third quarter of 2021 primarily due to lower equity

markets

- Continued progress in the registered index-linked annuity

(RILA) business, with third quarter sales of $562 million, up from

$490 million in the second quarter of 2022

- Returned $88 million to shareholders in the third quarter

through $39 million of share repurchases and $49 million in

dividends and now anticipate ending 2022 at or above the midpoint

of the full-year capital return target of $425-$525 million

- Increased capital position at the operating company, with an

estimated Risk-Based Capital (RBC) ratio at Jackson National Life

Insurance Company (JNLIC) up significantly from the second quarter

of 2022

- Cash and highly liquid securities at the holding company of

nearly $800 million at the end of the third quarter. This is above

Jackson’s minimum liquidity buffer of $250 million.

Laura Prieskorn, President and Chief Executive Officer of

Jackson, stated, “Jackson continued its strong momentum in the

third quarter, reinforcing our proven ability to successfully

navigate market stresses. We generated strong sales in the

attractive RILA market, increased our capital position at the

operating company, and maintained robust levels of excess cash at

the holding company. Our healthy balance sheet enables the ongoing

execution of our balanced capital management strategy, including

our continued commitment to returning capital to shareholders. We

returned $88 million to shareholders during the quarter and now

expect to deliver at or above the midpoint of our targeted

$425-$525 million capital return range for 2022.”

Consolidated Third Quarter 2022

Results

Jackson reported net income of $1,479 million, or $16.83 per

diluted share for the three months ended September 30, 2022,

compared to net income of $206 million, or $2.18 per diluted share

for the three months ended September 30, 2021. The stronger current

quarter net income primarily reflects improved net hedge results,

mainly due to a benefit from a larger comparative increase in

interest rates in the third quarter of 2022 relative to the prior

year period. Additionally, net income in the third quarter reflects

$868 million of income from business reinsured to third parties.

This benefit was primarily due to a gain on a funds withheld

reinsurance treaty and the related net investment income, which do

not impact our capital or free cash flow and can be volatile from

quarter to quarter.

Adjusted operating earnings for the three months ended September

30, 2022 were $373 million, or $4.24 per diluted share, compared to

$487 million, or $5.16 per diluted share for the three months ended

September 30, 2021. The decrease in adjusted operating earnings was

primarily due to lower net investment income and reduced fee income

from lower assets under management (AUM), partially offset by lower

agent asset-based trail commissions expense and lower deferred

acquisition costs (DAC) amortization.

__________________________

1

For the reconciliation of non-GAAP

measures to the most comparable GAAP measure, please see the

explanation of Non-GAAP Financial Measures in the Appendix to this

release.

Adjusted operating earnings included the impact of two notable

items, which negatively impacted pretax earnings by $76 million in

the third quarter of 2022, compared to a pretax benefit of $35

million in the third quarter of 2021. Current period notable pretax

items are summarized below.

- A negative impact of $54 million from underperformance of

private equity and other limited partnership returns relative to a

10% annualized return assumption. Overperformance of these

investments relative to the annual return assumption resulted in a

benefit of $98 million in the third quarter of 2021.

- Acceleration of DAC amortization due in part to a -4.5%

separate account return for the current quarter, which resulted in

a negative impact of $22 million. This same item resulted in a

negative impact of $63 million in the third quarter of 2021, when

the separate account return was -0.2%. The primary driver of the

impacts above is a DAC amortization benefit in the current year

period from the release of the historical returns from the mean

reversion formula, and a negative impact from this same item in the

third quarter of 2021.

Total shareholders’ equity was $9.0 billion or $103.58 per

diluted share as of September 30, 2022, down from $10.4 billion or

$114.78 per diluted share as of year-end 2021. The decline was

primarily due to increased unrealized investment losses, partially

offset by positive net income. Adjusted book value2 was $12.4

billion or $142.84 per diluted share as of September 30, 2022, up

from $8.9 billion or $98.69 per diluted share as of year-end 2021.

The increase was primarily the result of non-operating net hedging

gains during the nine months ended September 30, 2022, as well as

adjusted operating earnings of $952 million. Jackson’s financial

leverage ratio3 of 17.5% as of September 30, 2022, was down from

22.9% as of year-end 2021 and remained below our 20-25% target

range.

Segment Results – Pretax Adjusted

Operating Earnings2

Three Months Ended

(in millions)

September 30, 2022

September 30, 2021

Retail Annuities

$364

$527

Institutional Products

20

21

Closed Life and Annuity Blocks

33

68

Corporate and Other

(13)

(45)

Total1

$404

$571

Retail Annuities

Retail Annuities reported pretax adjusted operating earnings of

$364 million in the third quarter of 2022 compared to $527 million

in the third quarter of 2021. The current quarter was negatively

impacted by lower fee income due to reduced AUM, lower limited

partnership income relative to the prior year period, partially

offset by lower DAC amortization and lower operating expenses. The

current quarter had a comparative DAC amortization benefit from the

release of the historical returns from the mean reversion formula

relative to the impact in the third quarter of 2021. This more than

offset the unfavorable impact of the higher (accelerated) DAC

amortization expense resulting from a -4.5% separate account return

in the current quarter, which was larger than the DAC acceleration

impact that was realized in the third quarter of 2021, when the

separate account return was approximately -0.2%. In periods where

separate account returns are lower than our long-term assumption,

amortization is shifted from future years driving acceleration of

DAC amortization in the current period.

__________________________

2

For the reconciliation of non-GAAP

measures to the most comparable GAAP measure, please see the

explanation of Non-GAAP Financial Measures in the Appendix to this

release.

3

For the discussion and reconciliation of

the non-GAAP financial leverage ratio, please see the

reconciliation in the Appendix to this release.

4

See reconciliation of Net Income to Total

pretax adjusted operating earnings in the Appendix to this

release.

Total annuity sales of $3.6 billion were down 25% from the third

quarter of 2021. Variable annuity sales were down 39% compared to

the third quarter of 2021, primarily due to the decline in equity

markets and shifting consumer preferences in a rising interest rate

environment. This was partially offset by $562 million of sales of

RILA products in the third quarter of 2022, which were launched in

the fourth quarter of 2021. Despite the lower sales level in the

current quarter, annuity net flows excluding the business ceded to

Athene were essentially flat. In total, annuity sales without

lifetime benefit guarantees represented 41% of total annuity sales,

up from 34% in the third quarter of 2021. We continue to generate

fee-based sales, with third quarter advisory annuity sales of $178

million, compared to $330 million in the third quarter of 2021.

Institutional Products

Institutional Products reported pretax adjusted operating

earnings of $20 million in the third quarter of 2022 compared to

$21 million in the third quarter of 2021. Total sales for the third

quarter were $314 million. Net flows totaled $(114) million in the

third quarter of 2022, and total account value of $8.4 billion was

down from $8.8 billion in the third quarter of 2021.

Closed Life and Annuity Blocks

Closed Life and Annuity Blocks reported pretax adjusted

operating earnings of $33 million in the third quarter of 2022

compared to $68 million in the third quarter of 2021. The current

quarter decline was primarily due to lower levels of limited

partnership income compared to the prior year period, partially

offset by lower death and other policy benefits.

Corporate and Other

Corporate and Other reported a pretax adjusted operating loss of

$(13) million in the third quarter of 2022 compared to $(45)

million in the third quarter of 2021. The improved result is

primarily due to higher net investment income resulting from higher

levels of capital, partially offset by higher interest expense from

the issuance of senior notes.

Capitalization and

Liquidity

(Unaudited, in billions)

September 30, 2022

June 30, 2022

December 31, 2021

Statutory Total Adjusted Capital

(TAC) Jackson National Life Insurance Company

$9.5

$8.7

$6.6

Statutory TAC at JNLIC was $9.5 billion as of the current

quarter, up from $8.7 billion as of the second quarter of 2022. TAC

increased from the second quarter primarily due to positive net VA

guarantee results, base contract cash flows, and tax benefits

including deferred tax asset related items.

The higher TAC led to a significant increase in JNLIC’s

estimated RBC ratio from the second quarter of 2022. RBC company

action level (CAL) required capital was essentially unchanged over

this period as the benefit from higher interest rates was broadly

offset by the negative impact of lower equity markets.

Cash and highly liquid securities at the holding company totaled

nearly $800 million at the end of the quarter. This was above our

minimum liquidity buffer of $250 million. The adjusted RBC ratio5,

which includes the excess liquidity, was up significantly from the

second quarter due to the increased operating company RBC ratio.

Despite the volatile market environment, the adjusted RBC ratio was

above the targeted range for normal operating conditions.

Earnings Conference Call

Jackson will host a conference call and webcast Thursday,

November 10, 2022 at 10 a.m. ET to review the third quarter

results. The live webcast is open to the public and can be accessed

at https://investors.jackson.com. A replay will be available

following the call.

To register for the webcast, click here.

__________________________

5

The adjusted RBC ratio reflects the

capital and capital requirements of Jackson National Life Insurance

Company and its subsidiaries, adjusted to include cash and highly

liquid securities at Jackson Financial Inc. in excess of our target

minimum.

FORWARD-LOOKING STATEMENT

This press release may contain certain statements that

constitute “forward-looking statements.” Forward-looking statements

generally may be identified by their use of terms including

“anticipate,” “estimate,” “believe,” “expect,” “could,” “forecast,”

“may,” “intend,” “plan,” “predict,” “project,” “will,” or “would,”

and similar terms and phrases, including references to assumptions.

Forward-looking statements are not guarantees of future

performance, are subject to assumptions, and are inherently

susceptible to risks and uncertainties, many of which are beyond

our control, which could cause actual results to differ materially

from such statements. Forward-looking statements include statements

regarding our intentions, beliefs, assumptions, plans, objectives,

goals, targets, strategies, future events or performance, and

underlying assumptions concerning, among other things, our

expectations with respect to distributing capital to our

shareholders; financial position; results of operations; cash

flows; financial goals and targets; prospects; growth strategies or

expectations; laws and regulations; customer retention; and the

impact of prevailing capital markets and economic conditions. We

caution you that forward-looking statements are not guarantees of

future performance or outcomes and that actual performance and

outcomes of our actual results of operations, financial condition

and liquidity, and the development of the market in which we

operate, may differ materially from those made in or suggested by

the forward-looking statements contained in this release. The

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2021 and other reports filed with the U.S. Securities

and Exchange Commission (the SEC) and also available in the

investor relations section of the Company’s website at

investors.jackson.com under the heading “SEC Filings” include

additional factors that could cause actual results and outcomes to

differ materially from those reflected in the forward-looking

statements.

Certain financial data included in this release consists of

non-GAAP (Generally Accepted Accounting Principles) financial

measures. These non-GAAP financial measures may not be comparable

to similarly titled measures presented by other entities, nor

should they be construed as an alternative to other financial

measures determined in accordance with GAAP. Although the Company

believes these non-GAAP financial measures provide useful

information to users in measuring the financial performance and

condition of its business, users are cautioned not to place undue

reliance on any non-GAAP financial measures and ratios included in

this release. A reconciliation of the non-GAAP financial measures

to the most directly comparable GAAP financial measure can be found

in the “Non-GAAP Financial Measures” Appendix of this release.

Certain financial data included in this release consists of

statutory accounting principles (“statutory”) financial measures,

including “total adjusted capital.” These statutory financial

measures are included in or derived from the Jackson National Life

Insurance Company annual and/or quarterly statements filed with the

Michigan Department of Insurance and Financial Services and

available on the Company’s website at

investors.jackson.com/financials/statutory-filings.

There can be no assurance that management’s expectations,

beliefs, projections or targets will result or be achieved or

accomplished. Any forward-looking statements reflect Jackson’s

views and assumptions as of the date of this release and Jackson

disclaims any obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by law.

ABOUT JACKSON

Jackson® (NYSE: JXN) is committed to helping clarify the

complexity of retirement planning—for financial professionals and

their clients. Through our range of annuity products, financial

know-how, history of award-winning service* and streamlined

experiences, we strive to reduce the confusion that complicates

retirement planning. We take a balanced, long-term approach to

responsibly serving all our stakeholders, including customers,

shareholders, distribution partners, employees, regulators and

community partners. We believe by providing clarity for all today,

we can help drive better outcomes for tomorrow. For more

information, visit www.jackson.com.

Visit investors.jackson.com to view information regarding

Jackson Financial Inc., including a supplement regarding the third

quarter 2022 results. We use this website as a primary channel for

disclosing key information to our investors, some of which may

contain material and previously non-public information.

*SQM (Service Quality Measurement Group) Contact Center Awards

Program for 2004 and 2006-2021, for the financial services

industry. (To achieve world-class certification, 80% or more of

call-center customers surveyed must have rated their experience as

very satisfied, the highest rating possible).

Jackson® is the marketing name for Jackson Financial Inc.,

Jackson National Life Insurance Company® (Home Office: Lansing,

Michigan) and Jackson National Life Insurance Company of New York®

(Home Office: Purchase, New York).

APPENDIX

Non-GAAP Financial Measures

In addition to presenting our results of operations and

financial condition in accordance with GAAP, we use and report

selected non-GAAP financial measures. Management believes the use

of these non-GAAP financial measures, together with relevant GAAP

financial measures, provides a better understanding of our results

of operations, financial condition and the underlying performance

drivers of our business. These non-GAAP financial measures should

be considered supplementary to our results of operations and

financial condition that are presented in accordance with GAAP and

should not be viewed as a substitute for the GAAP financial

measures. Other companies may use similarly titled non-GAAP

financial measures that are calculated differently from the way we

calculate such measures. Consequently, our non-GAAP financial

measures may not be comparable to similar measures used by other

companies.

Adjusted Operating Earnings

Adjusted Operating Earnings is an after-tax non-GAAP financial

measure, which we believe should be used to evaluate our financial

performance on a consolidated basis by excluding certain items that

may be highly variable from period to period due to accounting

treatment under GAAP or that are non-recurring in nature, as well

as certain other revenues and expenses that we do not view as

driving our underlying performance. Adjusted Operating Earnings

should not be used as a substitute for net income as calculated in

accordance with GAAP. However, we believe the adjustments to net

income are useful for gaining an understanding of our overall

results of operations.

For additional detail on the excluded items, please refer to the

supplement regarding the third quarter ended September 30, 2022,

posted on our website, https://investors.jackson.com.

The following is a reconciliation of Adjusted Operating Earnings

to net income (loss) attributable to Jackson Financial Inc.

(Jackson), the most comparable GAAP measure.

GAAP Net Income (Loss) to Adjusted

Operating Earnings

Three Months Ended

(in millions)

September 30, 2022

September 30, 2021

Net income (loss) attributable to

Jackson Financial Inc.

$

1,479

$

206

Income tax expense (benefit)

559

(16

)

Pretax income (loss) attributable to

Jackson Financial Inc.

2,038

190

Non-operating adjustments – (income)

loss:

Fees

attributed to guaranteed benefit reserves

(771

)

(728

)

Net

movement in freestanding derivatives

253

493

Net reserve

and embedded derivative movements

(714

)

997

DAC and DSI

impact

458

(169

)

Assumption

changes

—

—

Total guaranteed

benefits and hedging results

(774

)

593

Net realized investments (gains) losses

including change in fair value of funds withheld embedded

derivative

(549

)

79

Net investment income on funds withheld

assets

(313

)

(300

)

Other

items

2

9

Total

non-operating adjustments

(1,634

)

381

Pretax Adjusted Operating

Earnings

404

571

Operating income taxes

31

84

Adjusted Operating Earnings

$

373

$

487

Weighted Average diluted shares

outstanding1

87,895,919

94,464,343

Net income (loss) per diluted

share

$

16.83

$

2.18

Adjusted Operating Earnings per diluted

share

$

4.24

$

5.16

Adjusted Book Value

Adjusted Book Value excludes accumulated other comprehensive

income (AOCI) attributable to Jackson. We exclude AOCI attributable

to Jackson from Adjusted Book Value because our invested assets are

generally invested to closely match the duration of our

liabilities, which are longer duration in nature, and therefore we

believe period-to-period fair market value fluctuations in AOCI to

be inconsistent with this objective. We believe excluding AOCI

attributable to Jackson is more useful to investors in analyzing

trends in our business. AOCI attributable to Jackson does not

include AOCI arising from investments held within the funds

withheld account related to the Athene Reinsurance Transaction.

Changes in AOCI within the funds withheld account related to the

Athene Reinsurance Transaction offset the related non-operating

earnings from the Athene Reinsurance Transaction resulting in a

minimal net impact on Adjusted Book Value of Jackson.

__________________________

6

The calculation of basic and diluted

earnings per share and weighted average shares of common stock

outstanding reflects a 104,960.3836276-for-1 stock split effected

on September 9, 2021. All share and earnings per share information

presented herein have been retroactively adjusted to reflect the

stock split.

Financial Leverage Ratio

We use Financial Leverage Ratio to manage our financial

flexibility and ensure we maintain our financial strength ratings.

Total financial leverage is the ratio of total debt to Total

Adjusted Capitalization (combined total debt and Adjusted Book

Value).

Adjusted Book Value & Debt

Financial Leverage Ratio

(in millions)

September 30, 2022

December 31, 2021

Total shareholders’ equity

$

8,974

$

10,394

Adjustments to total shareholders’

equity:

Exclude Accumulated Other Comprehensive

Income attributable to Jackson Financial Inc.

3,402

(1,457

)

Adjusted Book Value (a)

$

12,376

$

8,937

Debt (b)

$

2,634

$

2,649

Financial Leverage Ratio

(b/[a+b])

17.5

%

22.9

%

Condensed Consolidated Balance

Sheets

September 30,

December 31,

2022

2021

(in millions, except per share

data)

Assets

Investments:

Debt Securities, available-for-sale, net

of allowance for credit losses of $31 and $9 at September 30,

2022 and December 31, 2021, respectively (amortized cost: 2022

$48,868; 2021 $49,378)

$

41,681

$

51,547

Debt Securities, at fair value under fair

value option

2,124

1,711

Debt Securities, trading, at fair

value

102

117

Equity securities, at fair value

234

279

Mortgage loans, net of allowance for

credit losses of $79 and $94 at September 30, 2022 and

December 31, 2021, respectively

11,223

11,482

Mortgage loans, at fair value under fair

value option

508

—

Policy loans (including $3,487 and $3,467

at fair value under the fair value option at September 30,

2022 and December 31, 2021, respectively)

4,446

4,475

Freestanding derivative instruments

1,950

1,417

Other invested assets

3,622

3,199

Total investments

65,890

74,227

Cash and cash equivalents

5,331

2,623

Accrued investment income

509

503

Deferred acquisition costs

12,797

14,249

Reinsurance recoverable, net of allowance

for credit losses of $10 and $12 at September 30, 2022 and

December 31, 2021, respectively

30,796

33,126

Deferred income taxes, net

759

954

Other assets

1,846

928

Separate account assets

185,042

248,949

Total assets

$

302,970

$

375,559

Condensed Consolidated Balance

Sheets

September 30,

December 31,

2022

2021

(in millions, except per share

data)

Liabilities and Equity

Liabilities

Reserves for future policy benefits and

claims payable

$

16,130

$

18,667

Other contract holder funds

58,174

58,726

Funds withheld payable under reinsurance

treaties (including $3,646 and $3,639 at fair value under the fair

value option at September 30, 2022 and December 31, 2021,

respectively)

23,900

29,007

Long-term debt

2,634

2,649

Repurchase agreements and securities

lending payable

27

1,589

Collateral payable for derivative

instruments

1,038

913

Freestanding derivative instruments

2,225

41

Notes issued by consolidated variable

interest entities, at fair value under fair value option

1,745

1,404

Other liabilities

2,352

2,540

Separate account liabilities

185,042

248,949

Total liabilities

293,267

364,485

Equity

Common stock, (i) Class A Common Stock

900,000,000 shares authorized, $0.01 par value per share and

83,666,942 and 88,046,833 shares issued and outstanding at

September 30, 2022 and December 31, 2021, respectively

and (ii) No authorized Class B Common Stock at September 30,

2022 and 100,000,000 shares authorized, $0.01 par value per share

and 638,861 shares issued and outstanding at December 31,

2021

1

1

Additional paid-in capital

6,036

6,051

Treasury stock, at cost; 10,807,076 and

5,778,649 shares at September 30, 2022 and December 31,

2021, respectively

(410

)

(211

)

Accumulated other comprehensive income

(loss), net of tax expense (benefit) of $(1,235) and $194 at

September 30, 2022 and December 31, 2021,

respectively

(5,718

)

1,744

Retained earnings

9,065

2,809

Total shareholders' equity

8,974

10,394

Noncontrolling interests

729

680

Total equity

9,703

11,074

Total liabilities and equity

$

302,970

$

375,559

Condensed Consolidated Income

Statements

Three Months Ended September

30,

Nine Months Ended September

30,

(in millions, except per share

data)

2022

2021

2022

2021

Revenues

Fee income

$

1,908

$

2,063

$

5,854

$

5,963

Premiums

36

37

105

115

Net investment income

640

837

2,022

2,568

Net gains (losses) on derivatives and

investments

1,419

(1,379

)

6,891

(1,194

)

Other income

19

17

60

70

Total revenues

4,022

1,575

14,932

7,522

Benefits and Expenses

Death, other policy benefits and change in

policy reserves, net of deferrals

586

405

2,090

933

Interest credited on other contract holder

funds, net of deferrals and amortization

224

209

628

630

Interest expense

29

6

73

19

Operating costs and other expenses, net of

deferrals

592

699

1,801

2,090

Amortization of deferred acquisition

costs

564

4

2,276

551

Total benefits and expenses

1,995

1,323

6,868

4,223

Pretax income (loss)

2,027

252

8,064

3,299

Income tax expense (benefit)

559

(16

)

1,606

515

Net income (loss)

1,468

268

6,458

2,784

Less: Net income (loss) attributable

to noncontrolling interests

(11

)

62

51

186

Net income (loss) attributable to Jackson

Financial Inc.

$

1,479

$

206

$

6,407

$

2,598

Earnings per share

Basic

$

17.38

$

2.18

$

74.39

$

27.50

Diluted

$

16.83

$

2.18

$

71.73

$

27.50

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221109005839/en/

Investor Relations Contacts: Liz Werner

elizabeth.werner@jackson.com

Andrew Campbell andrew.campbell@jackson.com

Media Contact: Patrick Rich patrick.rich@jackson.com

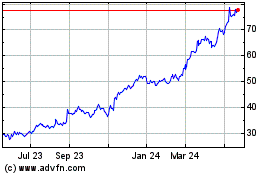

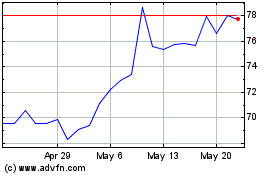

Jackson Financial (NYSE:JXN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Jackson Financial (NYSE:JXN)

Historical Stock Chart

From Nov 2023 to Nov 2024