UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event

reported): November 12, 2009

HERSHA

HOSPITALITY TRUST

(Exact

name of registrant as specified in its charter)

|

Maryland

|

|

001-14765

|

|

251811499

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

44

Hersha Drive

Harrisburg,

Pennsylvania 17102

(Address

and zip code of

principal

executive offices)

Registrant’s

telephone number, including area code:

(717) 236-4400

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instructions A.2. below):

|

|

o

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

o

|

Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

|

Pre-commencement communications

pursuant to Rule 13e4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item

8.01. Other Events

This Form

8-K updates the Annual Report on Form 10-K for the year ended December 31, 2008,

which was filed on March 6, 2009 (the “2008 10-K”), of Hersha Hospitality Trust

(the “Company”).

Disposition

of Hotel Properties

In July

2009, the Company sold the Mainstay Suites and Comfort Inn, located in

Frederick, Maryland (“Mainstay Suites and Comfort Inn, Frederick”) and the

Hilton Garden Inn, located in Gettysburg, Pennsylvania (“Hilton Garden

Inn”). Also in July 2009, the Company sold its 55% interest in

its consolidated joint venture that owns the Sheraton Four Points, located in

Revere, Massachusetts (“Sheraton Four Points”). Prior to the sale of

these properties and consolidated joint venture interest, the Company reported

the operating revenues and expenses of these hotels in hotel operating

revenues and hotel operating expenses. Beginning with the

Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2009, the

Company classified the Mainstay Suites and Comfort Inn, Hilton Garden Inn, and

Sheraton Four Points as “Assets Held for Sale” and reported revenues, expenses,

and gains on the disposition of the Mainstay Suites and Comfort Inn, Hilton

Garden Inn, and Sheraton Four Points as income (loss) from discontinued

operations.

Transfer

of Investment in Land Parcel

In

September 2009, we transferred our investment in the land parcel located at 440

West 41

st

Street, located in New York, New York (“41

st

Street”) to Metro Forty First Street, LLC, an entity controlled by a

non-affiliated third party. This land parcel was part of the

consideration given to acquire our 100% interest in York Street,

LLC. Prior to the transfer of 41

st

Street, the Company reported the operating revenues and expenses of this land

parcel in revenues and operating expenses. Beginning with the

Company’s Quarterly Report on Form 10-Q for the quarter ended September 30,

2009, the Company reported revenues and expenses of 41

st

Street as income (loss) from discontinued operations.

Assets

Held for Sale

During

the third quarter of 2009, the Board of Trustees authorized management of the

Company to sell the Comfort Inn, located in North Dartmouth, MA (the “Comfort

Inn, North Dartmouth”). Beginning with the Company’s Quarterly Report

on Form 10-Q for the quarter ended September 30, 2009, the Company classified

the Comfort Inn, North Dartmouth as “Assets Held for Sale” and reported revenues

and expenses on the Comfort Inn, North Dartmouth as income (loss) from

discontinued operations. Prior to this reclassification, the Company

reported the operating revenues and expenses of this hotel in hotel operating

revenues and hotel operating expenses.

Also

during the third quarter of 2009, the Board of Trustees authorized management of

the Company to sell the Company’s two land parcels located at 39

th

Street and 8

th

Avenue, New York, New York (“8

th

Avenue”) and Nevins Street, Brooklyn, New York (“Nevins

Street”). Beginning with the Company’s Quarterly Report on Form 10-Q

for the quarter ended September 30, 2009, the Company classified 8

th

Avenue and Nevins Street as “Assets Held for Sale” and reported revenues and

expenses of 8

th

Avenue and Nevins Street as income (loss) from discontinued

operations. Prior to this reclassification, the Company reported the

revenues and expenses of 8

th

Avenue and 41

st

Street in revenues and operating expenses.

U.S.

generally accepted accounting principles (“US GAAP”) requires the Company to

retroactively adjust previously issued annual financial statements to reflect

the reclassification of the financial results of the Mainstay Suites and Comfort

Inn, Frederick, Hilton Garden Inn, Sheraton Four Points, 41

st

Street, Comfort Inn, North Dartmouth, 8

th

Avenue and Nevins Street as income (loss) from discontinued operations, if those

financial statements are incorporated by reference in a registration statement

filed with the Securities and Exchange Commission under the Securities Act of

1933 even though those financial statements relate to periods prior to the dates

of the sales.

Accordingly,

this Form 8-K updates certain information in Items 6, 7, and 8 of the 2008 10-K

to reflect the impact of the reclassification of the financial results of the

Mainstay Suites and Comfort Inn, Frederick, Hilton Garden Inn, Sheraton Four

Points, 41

st

Street, Comfort Inn, North Dartmouth, 8

th

Avenue and Nevins Street as income (loss) from discontinued operations for the

three years ended December 31, 2008, 2007 and 2006. These have no

impact on the Company’s previously reported net income, net income

applicable to common shareholders, funds from operations ("FFO") or

FFO applicable to common shares and partnership units.

Recent Accounting

Pronouncements

Accounting

Standards Codification

In June

2009, the Financial Accounting Standards Board (“FASB”) issued a pronouncement

that established the FASB Accounting Standards Codification as the source of

authoritative accounting principles recognized by the FASB to be applied by

nongovernmental entities in the preparation of financial statements in

conformity with US GAAP. This standard is effective for

interim and annual periods ending after September 15,

2009. The Company has adopted this standard in accordance

with US GAAP. Accordingly, this Form 8-K updates certain information

in Items 7 and 8 of the 2008 10-K to reflect this pronouncement.

Noncontrolling

Interest

Effective

January 1, 2009, we adopted a new accounting standard which defines a

noncontrolling interest as the portion of equity in a subsidiary not

attributable, directly or indirectly, to a parent. Under

this standard, such noncontrolling interests are reported on the consolidated

balance sheets within equity, but separately from the shareholders'

equity. Revenues, expenses and net income or loss

attributable to both the Company and noncontrolling interests are reported on

the consolidated statements of operations. Accordingly, this Form 8-K

updates certain information in Items 6, 7, and 8 of the 2008 10-K to reflect the

presentation of noncontrolling interest.

All other

items of the 2008 10-K remain unchanged, and no attempt has been made to update

matters in the 2008 10-K, except to the extent expressly provided

herein. Refer to the Company’s quarterly reports on Form

10-Q for periods subsequent to December 31, 2008.

The

following items (which are attached as exhibits hereto and were presented in the

2008 10-K) have been revised to reflect the above transaction, as

appropriate:

|

·

|

Form 10-K, Item

6. Selected Financial

Data;

|

|

·

|

Form 10-K, Item

7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations

(“MD&A”);

|

|

·

|

Form 10-K, Item

8. Financial Statements and Supplementary

Data

|

Investors

are cautioned that the MD&A presented herein has been revised to reflect

only the transactions noted above. The MD&A presented

herein has no other changes to the MD&A previously presented in the 2008

10-K. Therefore, it does not purport to update the MD&A included in the 2008

10-K for any information, uncertainties, transactions, risks, events or trends

occurring, or known to management, other than information pertaining directly to

the transaction discussed above. Investors should read

the information contained in this Current Report on Form 8-K together with the

other information contained in the 2008 10-K, the Company’s Form 10-Q for the

quarters ended March 31, 2009, June 30, 2009, and September 30, 2009, filed with

the SEC on May 8, 2009, August 7, 2009, and November 5, 2009, respectively, and

other information filed with, or furnished to, the SEC after March 6,

2009.

Item

9.01. Financial Statements and Exhibits

d.

Exhibits

|

Exhibit

Number

|

|

Exhibit

Description

|

|

|

|

Consent

of KPMG LLP

|

|

|

|

Form

10-K, Item 6. Selected Financial Data

|

|

|

|

Form

10-K, Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

|

|

|

|

Form

10-K, Item 8. Financial Statements and Supplementary

Data

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

|

|

HERSHA

HOSPITALITY TRUST

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 12,

2009

|

|

|

/s/Michael

R. Gillespie

|

|

|

|

|

Michael

R. Gillespie

|

|

|

|

|

Chief

Accounting Officer

|

5

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Oct 2024 to Nov 2024

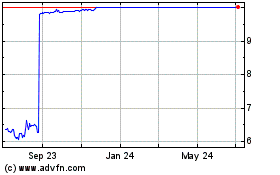

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Nov 2023 to Nov 2024