A Dearth of Positive Catalysts - Analyst Blog

February 22 2012 - 4:01AM

Zacks

Stocks will likely struggle for direction given the absence of

any positive catalysts that can push them to new highs. Greece will

remain in the news, as the country suffered a credit rating

downgrade from Fitch following the release of details about the

private sector debt swap.

There is growing unease in the market that while the latest deal

may have averted the possibility of a disruptive near-term default

it is not expected to provide the last word on the country’s

struggles to stay within the union, either.

Greece’s bond swap with its private creditors will help bring

down its debt load by €107 billion. This is accomplished by forcing

bond holders to accept a 53.5% loss on the face value of their

holdings. This bond swap, coupled with a tough new austerity

package that the country had to agree to implement as a price for a

second bailout, will reduce its level of indebtedness from the

current 164% of GDP to around 120% by 2020. But many in the market

are justifiably skeptical of these estimates from the IMF, which is

a party to the bailout.

In addition to a host of assumptions about privatization

proceeds and the direction of interest rates, the IMF forecast for

2020 depends on the Greek economy growing at over 2% annually over

the next seven years after staying flat this year. Please keep in

mind that Greek economy has been in a recession over the last four

years that has resulted in the economy shrinking in excess of a

cumulative 16% in that time period. Given the severity of the new

austerity measures that accompanied the latest bailout deal, the

economy is more likely to remain in the red for quite some

time.

On the earnings front, luxury homebuilder Toll

Brothers (TOL) came out with weaker than expected results

this morning. Dell (DELL) came modestly short of

EPS expectations after the close on Tuesday and also provided weak

guidance for the current quarter. Brocade

Communications (BRCD) came out with better than expected

results. Hewlett-Packard (HP) reports after the

close today.

BROCADE COMM SY (BRCD): Free Stock Analysis Report

DELL INC (DELL): Free Stock Analysis Report

HELMERICH&PAYNE (HP): Free Stock Analysis Report

TOLL BROTHERS (TOL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

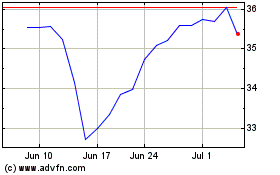

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Apr 2024 to May 2024

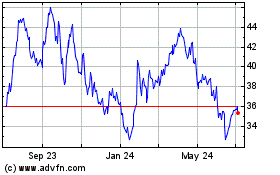

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From May 2023 to May 2024