UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For August 31, 2021

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Harmony Gold Mining Company Limited

Registration number 1950/038232/06

Incorporated in the Republic of South Africa

ISIN: ZAE000015228

JSE share code: HAR

(Harmony and/or the Company)

RESULTS FOR THE YEAR ENDED 30 JUNE 2021 – SHORT FORM ANNOUNCEMENT

Johannesburg. Tuesday, 31 August 2021. Harmony Gold Mining Company Limited is pleased to announce its financial and operating results for the year ended 30 June 2021 (FY21).

•In Phase 2 of embedding a proactive safety culture focused on leadership and behaviour

•Covid-19 vaccination drive protecting our employees

•66% increase in production profit to R12.0bn (US$777m) from R7.2bn (US$459m)

•1% increase in underground recovered grade to 5.51g/t from 5.45g/t

•26% increase in gold production to 47 755kg (1 535 352oz) from 37 863kg (1 217 323oz)

•19% increase in total mineral resources to 141.2Moz

•16% increase in total mineral reserves to 42.45Moz

•43% increase in revenue to R41 733m (US$2 710m) from R29 245m (US$1 867m)

•83% increase in operating free cash flow to R6.5bn (US$424m) from R3.6bn (US$228m)

•758% increase in net profit of R5.6bn (US$352m) from a loss of R850m (US$56m)

•60% reduction in net debt to R542m (US$38m) from R1 361m (US$79m)

•Net debt to EBITDA at 0.1x from 0.2x

•HEPS increased by 699% to 923 SA cents (60 US cents) from a comparative headline loss per share of 154 SA cents (10 US cents)

•Interim dividend declared and paid during FY21 of 110 SA cents (7.7 US cents) per ordinary share (June 2020: nil)

•Final dividend of 27 SA cents (approximately 1.8 US cents) per ordinary share declared (June 2020: nil)

•30MW in renewable energy to be rolled out in the first phase of our strategy to decarbonise.

OPERATING RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended 30 June 2021

|

Year ended 30 June 2020

|

%

change

|

|

Gold produced

|

Kg

|

47 755

|

37 863

|

|

26

|

|

Oz

|

1 535 352

|

1 217 323

|

|

26

|

|

Underground grade

|

g/t

|

5.51

|

5.45

|

|

1

|

|

Gold price received

|

R/kg

|

851 045

|

735 569

|

|

16

|

|

US$/oz

|

1 719

|

1 461

|

|

18

|

|

Cash operating costs

|

R/kg

|

600 592

|

553 513

|

|

(9)

|

|

US$/oz

|

1 213

|

1 099

|

|

(10)

|

|

Total costs and capital

|

R/kg

|

707 445

|

647 364

|

|

(9)

|

|

US$/oz

|

1 429

|

1 286

|

|

(11)

|

|

All-in sustaining costs

|

R/kg

|

723 054

|

651 356

|

|

(11)

|

|

US$/oz

|

1 460

|

1 293

|

|

(13)

|

|

Production profit

|

R million

|

11 958

|

7 197

|

|

66

|

|

US$ million

|

777

|

459

|

|

69

|

|

Average Exchange rate

|

R:US$

|

15.4

|

15.66

|

|

(2)

|

FINANCIAL RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended 30 June 2021

|

Year ended 30 June 2020

|

%

change

|

|

Basic earnings/(loss) per share

|

SA cents

|

919

|

(164)

|

>100

|

|

US cents

|

58

|

(10)

|

>100

|

|

Headline earnings/(loss)

|

R million

|

5 575

|

(828)

|

>100

|

|

US$ million million

|

362

|

(53)

|

>100

|

|

Headline earnings/(loss) per share

|

SA cents

|

923

|

(154)

|

>100

|

|

US cents

|

60

|

(10)

|

>100

|

FY22 group production and cost guidance

Production guidance for FY22 is estimated to be between 1.547Moz and 1.630Moz at an all-in sustaining cost of between R765 000/kg to R800 000/kg. Underground recovered grade is planned to be about 5.40g/t to 5.57g/t.

“We delivered a stellar set of full-year results as the resilience and determination shown throughout the company ensured we achieved our strategic objectives. We adapted to a changed environment in the face of the ongoing Covid-19 pandemic with the successful acquisition and integration of Mponeng and related assets reflecting in our numbers. This demonstrates how we have further transformed our earnings profile through the acquisition of high grade assets, while delivering on our strategy of safe, profitable ounces and increasing margins,” said chief executive officer, Peter Steenkamp.

“Our re-engineered portfolio and deleveraged balance sheet will allow us to extract further value from our assets while at the same creating optionality for the business. As we continue on our growth strategy, we have identified substantial opportunities in our existing portfolio through exploration and brownfield projects which will extend the life of some of our larger and higher-grade assets, adding lower-risk, higher-margin ounces to Harmony's portfolio,” concluded Steenkamp.

Notice of Final Gross Cash Dividend

Our dividend declaration for the six months ended 30 June 2021 is as follows:

Declaration of final gross cash ordinary dividend no. 90

The Board has approved, and notice is hereby given, that a final gross cash dividend of 27 SA cents (US 1.8 cents*) per ordinary share in respect of the six months ended 30 June 2021, has been declared payable to the registered shareholders of Harmony on Monday, 18 October 2021.

In accordance with paragraphs 11.17(a)(i) to (x) and 11.17(c) of the JSE Listings Requirements the following additional information is disclosed:

•The dividend has been declared out of income reserves;

•The local Dividend Withholding Tax rate is 20% (twenty percent);

•The gross local dividend amount is 27.00000 SA cents (1.83423 cents*) per ordinary share for shareholders exempt from the Dividend Withholding Tax;

•The net local dividend amount is 21.60000 SA cents per ordinary share for shareholders liable to pay the Dividend Withholding Tax;

•Harmony currently has 616 052 197 ordinary shares in issue (which includes 5 941 462 treasury shares); and

•Harmony’s income tax reference number is 9240/012/60/0.

A dividend No. 90 of 27.00000 SA cents (US 1.83423 cents*) per ordinary share, being the dividend for the six months ended 30 June 2021, has been declared payable on Monday 18 October 2021 to those shareholders recorded in the books of the company at the close of business on Friday, 15 October 2021. The dividend is declared in the currency of the Republic of South Africa. Any change in address or dividend instruction to apply to this dividend must be received by the company’s transfer secretaries or registrar not later than Friday, 8 October 2021.

Dividends received by non-resident shareholders will be exempt from income tax in terms of section 10(1)(k)(i) of the Income Tax Act. The dividends withholding tax rate is 20%, accordingly, any dividend will be subject to dividend withholding tax levied at a rate of 20%, unless the rate is reduced in terms of any applicable agreement for the avoidance of double taxation (“DTA”) between South Africa and the country of residence of the shareholder.

Should dividend withholding tax be withheld at a rate of 20%, the net dividend amount due to non-resident shareholders is 21.60000 SA cents per share. A reduced dividend withholding rate in terms of the applicable DTA may only be relied on if the non-resident shareholder has provided the following forms to their CSDP or broker, as the case may be in respect of uncertificated shares or the company, in respect of certificated shares:

(a) a declaration that the dividend is subject to a reduced rate as a result of the application of a DTA; and

(b) a written undertaking to inform the CSDP or broker, as the case may be, should the circumstances affecting the reduced rate change or the beneficial owner cease to be the beneficial owner,

both in the form prescribed by the Commissioner for the South African Revenue Service. Non- resident shareholders are advised to contact their CSDP or broker, as the case may be, to arrange for the abovementioned documents to be submitted prior to the payment of the distribution if such documents have not already been submitted.

In compliance with the requirements of Strate Proprietary Limited (Strate) and the JSE Listings Requirements, the salient dates for payment of the dividend are as follows:

|

|

|

|

|

|

|

|

Last date to trade ordinary shares cum-dividend is

|

Tuesday, 12 October 2021

|

|

Ordinary shares trade ex-dividend

|

Wednesday, 13 October 2021

|

|

Record date

|

Friday, 15 October 2021

|

|

Payment date

|

Monday, 18 October 2021

|

|

|

|

No dematerialisation or rematerialisation of share certificates may occur between Wednesday, 13 October 2021 and Friday, 15 October 2021, both dates inclusive, nor may any transfers between registers take place during this period.

On payment date, dividends due to holders of certificated securities on the SA share register will either be electronically transferred to such shareholders' bank accounts or, in the absence of suitable mandates, dividends will be held in escrow by Harmony until suitable mandates are received to electronically transfer dividends to such shareholders.

Dividends in respect of dematerialised shareholdings will be credited to such shareholders' accounts with the relevant Central Securities Depository Participant (CSDP) or broker.

The holders of American Depositary Receipts (ADRs) should confirm dividend details with the depository bank. Assuming an exchange rate of R14.72/US$1* the dividend payable on an ADR is equivalent to US 1.83423 cents for ADR holders before dividend tax. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

*Based on an exchange rate of R14.72/US$1 at 27 August 2021. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

Short form announcement

This short-form announcement is the responsibility of the board of directors of the Company.

Shareholders are advised that this short-form announcement represents a summary of the information contained in the full announcement (results booklet) and does not contain full or complete details published on the Stock Exchange News Service, via the JSE link at https://senspdf.jse.co.za/documents/2021/jse/isse/HARE/FY21result.pdf and on Harmony’s website (www.harmony.co.za) on 31 August 2021.

The financial results as contained in the condensed consolidated financial statements for the financial year ended 30 June 2021, from which this short-form announcement has been correctly extracted, have been reviewed by PricewaterhouseCoopers Inc., who expressed an unmodified review conclusion thereon.

Any investment decisions by investors and/or shareholders should be based on a consideration of the results booklets as a whole and shareholders are encouraged to review the results booklet, which is available for viewing on the Company’s website and the JSE link, referred to above.

The results booklet is also available for inspection at the registered office of the Company, Randfontein Office Park, Randfontein, 1760, Corner Main Reef Road/Ward Avenue, Randfontein, by emailing HarmonyIR@harmony.co.za and at the offices of the sponsors, JP Morgan. Inspection of the full announcement is available to investors and/or shareholders at no charge, during normal business hours from today, 31 August 2021, together with the aforementioned review report by the Company’s external auditors.

Ends.

For more details, contact:

Jared Coetzer

Head: Investor Relations

+27 (0)82 746 4120

Johannesburg, South Africa

31 August 2021

Sponsor:

J.P. Morgan Equities South Africa Proprietary Limited

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Harmony Gold Mining Company Limited

|

|

|

|

|

Date: August 31, 2021

|

By: /s/ Boipelo Lekubo

|

|

|

Name: Boipelo Lekubo

|

|

|

Title: Financial Director

|

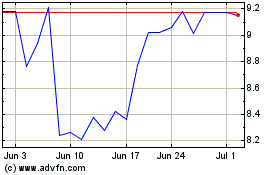

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

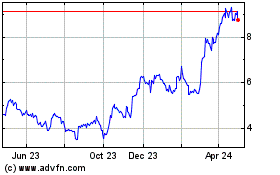

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024