Limited Brands

Inc. (LTD) is persistently trying every means to make its

way in this sluggish economic environment by adopting optimum

inventory strategy, better expense management, merchandise

initiatives and prudent capital spending with an aim to generate

healthy cash flows and augment its financial position. The

endeavors undertaken helped the stock to gain a firm foothold in

the market, well reflected by a 22% rise in the share price, so far

in the year.

The Company Counts

Upon

Limited Brands’ Bath &

Body Works segment is gaining traction, thanks to a rise in store

transactions, enhancement in the direct channel business and growth

in new stores. Victoria’s Secret Stores has been performing well,

and the company is also revamping its La Senza brandboth at home in

Canada and internationally by improving product assortments, store

operations and layout.

Limited Brands is keen to augment

its retail footprint across the globe by expanding aggressively in

Canada and other international markets. Another driving factor is

the travel retail concept. These are small Victoria’s Secret stores

(of about 1,000 square foot) operating under a wholesale model, and

primarily located in airports and tourist destinations. These

stores provide significant growth opportunities and are an

innovative way to advertise.

Limited Brands is also actively

managing its cash flows and returning much of its free cash to

shareholders’ through share repurchases or dividend. In fiscal

2011, the company returned more than $2.3 billion to stockholders

via share buyback and dividend.

Riding on Positive

Comps

Limited Brands has sustained its

growth momentum. The company’s comparable-store sales for February

2012 rose 8% following an increase of 9% in January 2012 and a 12%

jump in February 2011. For March, management now expects

comparable-store sales to rise in the low single digits.

Comparable-store sales for February

increased 10% at Victoria’s Secret Stores & Victoria’s Secret

Beauty, 7% at Bath & Body Works & The White Barn Candle Co.

and 1% at La Senza. Sales at Victoria’s Secret Direct climbed

5%.

Healthy Quarterly

Results

Limited Brands posted

better-than-expected fourth-quarter 2011 results on the back of an

improving sales environment witnessed across its Victoria's Secret

and Bathand Body Works chains.

The quarterly earnings of $1.50 per

share beat the Zacks Consensus Estimate of $1.46, and rose 19% from

$1.26 earned in the prior-year quarter. The company posted net

sales of $3,515.4 million that rose 2% from the prior-year quarter,

and comfortably beat the Zacks Consensus Estimate of $3,492

million.

Limited Brands posted a

comparable-store sales growth of 7% during the fourth quarter of

2011 compared with 9% in the previous quarter and 10% in the

prior-year quarter.The company now expects comparable-store sales

to increase in the low-to-mid single digits in the first quarter

and between 2% and 4% in fiscal 2012.

But Guidance below

Expectation

Management guided earnings for the

first quarter in the range of 35 cents to 40 cents and for fiscal

2012 between $2.60 and $2.80 per share.

However, the guidance failed to

impress the analysts covering the stock, who were expecting much

more from the specialty retailer of women’s intimate and other

apparel, beauty and personal care products. Consequently, the Zacks

Consensus Estimate witnessed a fall, since the company’s earnings

release.

The Zacks Consensus Estimates for

both the first and second quarters of 2012 fell 5 cents to 40 cents

and 49 cents, respectively, in the last 30 days. For fiscal 2012

and 2013, the Zacks Consensus Estimates dropped 9 cents and 14

cents to $2.83 and $3.21, respectively, in the last 30 days.

Challenging Economy and

Competition

The economy is still not out of the

woods, and whether 2012 will mark the complete resurrection is

tough to say, unless some concrete steps are taken. Cuts are deep

and wounds not completely healed. Each and every company is vying

to survive the downturn, and trying every means to reach the

helm.

Limited Brandsfaces stiff

competition from chain specialty stores, department stores and

discount retailers on attributes such as, marketing, design, price,

service, quality, and brand image. Competitors having a larger

number of stores, greater market presence, brand recognition, and

financial resources will likely continue to weigh on the company’s

results. The La Senza brand has been facing the headwinds,

witnessing a fall of 3% in comparable-store sales during the fourth

quarter of 2011.

Moreover, the company’s customers

are sensitive to macroeconomic factors including interest rate

hikes, increase in fuel and energy costs, sluggishness in the

housing market, and high unemployment and household debt levels,

which may affect their spending.

Closing

Commentary

Given the pros and cons, we

reiterate our long-term “Neutral” recommendation on the stock with

a price target of $50.00. Moreover, Limited Brands, which competes

with Gap Inc. (GPS) and Hanesbrands

Inc. (HBI), holds a Zacks #3 Rank that translates into a

short-term “Hold” rating.

GAP INC (GPS): Free Stock Analysis Report

HANESBRANDS INC (HBI): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

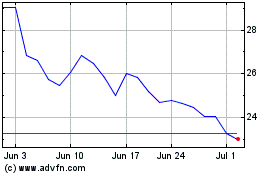

Gap (NYSE:GPS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Jul 2023 to Jul 2024