A full-line sporting goods retailer, Dick's Sporting

Goods Inc. (DKS) hit the bull’s eye with its fourth

quarter and fiscal 2011 earnings, which met the Zacks Consensus

Estimate. The company’s results kept afloat mainly on robust sales

performance benefiting from store expansions and better

margins.

The overall analyst sentiment for Dick’s remains positive,

driven by the company’s consistent performance and a strong

outlook. The current Zacks Consensus Estimate for first-quarter and

fiscal 2012 are 38 cents and $2.41 per share, respectively, which

is at the higher end of the company’s recent earnings guidance

range.

Fourth Quarter Synopsis

Dick's Sporting Goods Inc. delivered fourth quarter and fiscal

2011 results, in line with the Zacks Consensus Estimate. The

results came ahead of the year-ago comparisons, mainly driven by

increased sales resulting from opening of new stores and improved

margins.

Dick’s’ fourth-quarter 2011 adjusted earnings jumped 16% to 88

cents a share from the year-ago level of 76 cents a share, meeting

the high-end of the company’s recently revised guidance range of 87

- 88 cents per share. Dick’s also fully met the Zacks Consensus

Estimate of 88 cents per share.

In fiscal 2011, the company reported adjusted earnings of $2.02

per share, up 24% from last year and at the higher-end of the

company’s guidance range of $2.01 to $2.02 per share. Annual

earnings also met the Zacks Consensus Estimate of $2.02 a

share.

An increase of 0.1% in consolidated comparable-store sales

(comps) and opening of new stores aided an increase of 6.1% year

over year in net sales to $1,611.6 million during the quarter.

However, total revenue fell marginally short of the Zacks Consensus

Estimate of $1,612.0 million.

Net sales at Dick’s spiked 7% to $5,211.8 million for fiscal

2011, mainly driven by a 2.0% consolidated comps growth and opening

of new stores. Fiscal year revenue slightly missed the Zacks

Consensus Estimate of $5,217.0 million.

The 0.1% comps growth in the fourth quarter was in line with the

company’s January 2012 guidance and was driven by a 9.0% increase

in Golf Galaxy store sales and a 52.0% growth in the e-commerce

business, offset by a 2.5% rise in Dick's Sporting Goods store

sales.

(Read our full coverage on this earnings report: Dick’s Meets

Bottom Line)

Agreement of Estimate Revisions

Following the company’s recent quarter performance, estimate

revision trend mostly remained in the positive direction with

majority of analysts raising their estimates and only a few pulling

down estimates. For the first quarter of 2012, 15 out of 22

analysts positively revised their estimates in the last 30 days

whereas none of the analysts lowered their estimates in the same

period.

For fiscal 2012, 15 out of 23 analysts moved up their estimates

in the last 30 days while 2 analysts slashed the same. For fiscal

2013, estimate revisions in the last 30 days include 6 analysts

raising estimates while none moving in the opposite direction.

However, there were no positive or negative revisions by

analysts in the last 7 days for the first quarter of 2012, fiscal

2012 and 2013.

Magnitude of Estimate Revisions

The recent estimate revision trends point to an overall positive

bias on the part of the analysts, which is reflected in the form of

higher earnings estimates for the next quarter, fiscal 2012 and

fiscal 2013 over the last 30 days. Estimates for the three

reporting periods, however, remained stable over the last 7 days

with no estimate revisions.

Driven by the positive revisions for first quarter estimate and

the absence of any negative movement, the Zacks Consensus Estimate

for the first quarter moved up by 2 cents in the last 30 days. The

current first quarter estimate stands at 38 cents per share.

Majority positive estimate revisions for fiscal 2012 were only

slightly offset by the fewer negative revisions in the last 30

days, driving estimates to move up by 3 cents to $2.41 per share.

In the last 30 days, fiscal 2013 estimates rose by 6 cents to $2.76

per share on account of only upward estimate revisions and no

downward revisions.

Our Recommendation

Pittsburgh-based Dick's Sporting Goods remains the dominant

player in the industry with significant store expansion and

potential share gain opportunities in the U.S. We remain optimistic

about the company’s competitive position and consistency of

earnings growth.

Further, we remain impressed by the company’s strategy of

alternatively investing in key strategic areas including new

stores, eCommerce, inventory management systems and private brands.

In 2012, the company expects to spend a gross of $241 million

toward capital expenditures while it expects net spending to reach

$190 million.

We also remain impressed by the company’s solid balance sheet,

which is characterized by strong cash position and no outstanding

borrowing under its credit facility. On the other hand, investors

remain encouraged by Dick’s practice of returning cash to

shareholders in the form of dividend payouts and share

repurchases.

However, the sporting goods market is highly competitive in

nature and Dick’s failure to compete effectively in terms of price,

quality or product will thwart its growth potential. The company

faces stiff competition from Foot Locker Inc. (FL)

and Wal-Mart Stores Inc. (WMT). Moreover, a weak

economy will likely continue to weigh on the company’s

profitability in the long term.

Dick's Sporting Goods currently has a short-term Zacks #2 Rank

(Buy). We maintain our long-term ‘Neutral’ recommendation on the

stock.

About Earnings Estimate Scorecard

As a PhD from MIT, Len Zacks proved over 30 years ago that

earnings estimate revisions are the most powerful force impacting

stock prices. He turned this ground breaking discovery into two of

the most celebrating stock rating systems in use today. The Zacks

Rank for stock trading in a 1 to 3 month time horizon and the Zacks

Recommendation for long-term investing (6+ months). These “Earnings

Estimate Scorecard” articles help analyze the important aspects of

estimate revisions for each stock after their quarterly earnings

announcements. Learn more about earnings estimates and our proven

stock ratings at http://www.zacks.com/education

DICKS SPRTG GDS (DKS): Free Stock Analysis Report

FOOT LOCKER INC (FL): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

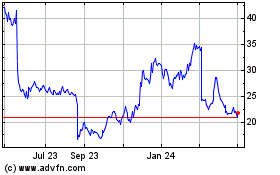

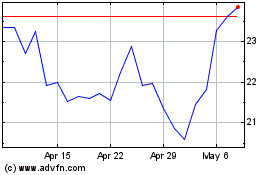

Foot Locker (NYSE:FL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Foot Locker (NYSE:FL)

Historical Stock Chart

From Jul 2023 to Jul 2024