EOG Resources Cuts Capital Budget, Records $1.57 Billion in Charges

May 07 2020 - 5:22PM

Dow Jones News

By Micah Maidenberg

EOG Resources Inc. said Thursday it would cut $1 billion more

out of its capital-spending plan for the year, another example of

how shale-oil companies are pushing to conserve cash as the

Covid-19 pandemic puts tremendous pressure on demand for crude.

The company also recorded $1.57 billion in impairments in the

quarter, weighing on profit. Net income plunged to $9.8 million, or

2 cents a share, for the first quarter, from $635.4 million, or

$1.10 a share, a year earlier.

"These unprecedented market conditions have super-charged our

unique culture to vigorously lower costs and generate innovative

productivity gains," Chief Executive William Thomas said in a

statement.

The company said revenue rose to $4.72 billion for the first

quarter from $4.06 billion a year earlier.

For 2020, EOG now expects capital spending of $3.3 billion to

$3.7 billion, $1 billion less than its last plan. The new forecast

is $3 billion lower than its original plan given at the start of

the year.

The company said its new strategy for the year reflects "the

significant decline and increased volatility of commodity prices"

and its goal to generate strong returns and support its

dividend.

Average crude selling prices in the U.S. fell 16% year over year

to $46.97 a barrel, EOG said.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

May 07, 2020 17:07 ET (21:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

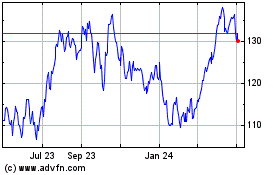

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Aug 2024 to Sep 2024

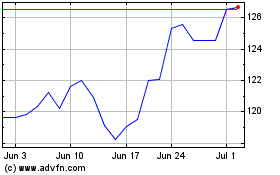

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Sep 2023 to Sep 2024