EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Statements of Changes in Net Assets Available for Benefits

| | | | | | | | | | | |

| Year Ended September 30 |

| 2021 | | 2022 |

|

| |

|

| Plan interest in Master Trust investment income (loss), net (Note 8) | $ | 764,181,322 | | | (722,740,175) | |

Interest income on notes receivable from participants

| 759,421 | | | 619,739 | |

| Transfers from (to) other plans, net (Note 4) | 13,271,408 | | | (21,232,663) | |

| Participant contributions | 99,310,467 | | | 103,367,683 | |

| Rollover contributions | 11,510,536 | | | 9,754,118 | |

| Employer contributions | 42,837,013 | | | 45,836,185 | |

| Benefits paid to participants | (291,261,769) | | | (297,269,013) | |

| Increase (decrease) in net assets available for benefits | 640,608,398 | | | (881,664,126) | |

| | | |

| Measurement Solutions PSP Spin Off (Note 4) | $ | (117,910,347) | | | — | |

| | | |

| Net assets available for benefits, beginning of year | 3,350,973,547 | | | 3,873,671,598 | |

| | | |

| Net assets available for benefits, end of year | $ | 3,873,671,598 | | | 2,992,007,472 | |

| | | |

| | | |

| | | |

| See accompanying Notes to Financial Statements. | | | |

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

(1) DESCRIPTION OF PLAN

The following description of the Emerson Electric Co. (Emerson or the Company) Employee Savings Investment Plan (the Plan) provides only general information. Participants should refer to the Plan prospectus, the Plan document and the Plan's summary plan description for additional information.

General

The Plan is a defined contribution plan subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA). In general, any non-excludable employee of a Company business unit which participates in the Plan is eligible to participate. The Management Review Committee is responsible for oversight and administrative responsibility for the investment management and funding of the Plan.

Participant Accounts

The Plan maintains a separate account for each participant. Within the account, the participant's interest in each of the Plan's investments is recorded for participant contributions, Company contributions, and any dividends, investment earnings or losses.

Contributions

Eligible participants may generally elect to have up to 40% of compensation, in increments of 1%, contributed to the Plan, while highly compensated employees may be subject to further limits. Contributions may be made on a pre-tax, after-tax, or Roth basis, as elected by the participant and subject to certain ERISA and Plan limitations. New employees are automatically enrolled in the Plan after 45 days with an initial employee contribution rate of 6% of pre-tax eligible compensation. These automatic contributions are invested in an age appropriate Vanguard Target Retirement Trust, unless any such participant makes an election to affirmatively opt out in accordance with procedures established by the Company. In addition, participants have the ability to set an automatic annual increase of their elective deferrals.

Eligible participants may receive Company matching contributions equal to a percentage of a portion of each participant's contribution. Additionally, certain participants who are not eligible for or are no longer accruing benefits in the Company’s principal U.S. defined benefit plan also receive a nonelective Company contribution and increased match each year in the Plan. Unvested Company contributions forfeited by terminated employees may be allocated to reduce future matching contributions or pay Plan expenses. Forfeitures of $2,515,241 and $2,070,795 were used to reduce Employer contributions in 2022 and 2021, respectively. Forfeitures used to pay Plan expenses were insignificant in both years. Net Assets Available for Benefits included unallocated forfeitures of $907,318 and $1,137,444 as of September 30, 2022 and 2021, respectively.

Vesting

Participant contributions and any related dividends, earnings and losses are always 100% vested. Company matching contributions, a one-time $1,000 contribution in 2018, and any related dividends, earnings or losses generally vest at the rate of 20% per year of service for the first 5 years for most employees. Thereafter, any matching contributions are fully vested. The nonelective Company contributions cliff vest after 3 years. All amounts fully vest upon attaining retirement age (age 55), or due to death, total and permanent disability, or termination of the Plan.

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

Investment Options

Participants designate the portion of their total contribution to be invested in the various Plan investment funds in 1% increments. Participants may change their investment elections at any time, and transfer any part of an existing account balance to any other available investment fund, as permitted by Plan and fund policies. Transfers are made in 1% increments. A maximum of 6 transfers may be made per quarter. No advance notice is required for transfers. Certain restrictions exist on transfers into or out of the Emerson Common Stock Fund by the Company's executive officers.

For some participants, the Company’s matching contributions are invested according to the participant’s actual or default investment allocation for elective contributions. For other participants, the Company’s matching contributions are invested in the Emerson Common Stock Fund. Participants are allowed to immediately transfer any Company matching contributions to other funds offered in the Plan, subject to the number of allowed fund transfers within a quarter. The portion of participants’ total contribution allocated to the Emerson Common Stock Fund is limited to 20%. Additionally, participants are not able to complete investment exchanges or rollovers into the Emerson Common Stock Fund if the portion of their total account balance held in the Emerson Common Stock Fund exceeds 20%, or will after the transaction is completed.

Available mutual fund investments as of September 30, 2022 included the following: equity and equity index funds investing primarily in common stocks – Dodge & Cox Stock Fund, Primecap Odyssey Aggressive Growth Fund, Vanguard U.S. Growth Fund, Vanguard Selected Value Fund, Vanguard Extended Market Index Fund, Vanguard Growth Index Fund, Vanguard Emerging Markets Stock Index Fund, Vanguard Total International Stock Index Fund and Vanguard Value Index Fund; a fixed income index fund investing in a diversified portfolio of bonds – Vanguard Short-Term Bond Index Fund. Collective funds and trusts, which are private, include the following: equity funds investing primarily in common stocks – Capital Group U.S. and International Equity Funds, Vanguard Institutional Total International Stock Market Index Trust and the Vanguard Institutional 500 Index Trust; balanced trusts investing in a mix of stocks, bonds and cash – the Vanguard Target Retirement Trusts ranging from 2020 to 2070 and the Vanguard Target Retirement Income Trust; fixed income trusts investing primarily in a diversified portfolio of bonds – Loomis Sayles Core Plus Fixed Income Trust and the Vanguard Institutional Total Bond Market Index Trust. Participants may also invest in the JP Morgan 100% U.S. Treasury Securities Money Market Fund and the Emerson Common Stock Fund. All funds may temporarily invest in cash and cash equivalents and also hold cash for liquidity.

Notes Receivable from Participants in Master Trust

Participants can borrow from the Plan at a rate of 1% over the Prime Rate on the date of borrowing as received by Vanguard from Reuters. Notes are secured by the balance in the participant’s account, with payment terms generally between one and four years. With certain exceptions, participants can borrow the lesser of 50% of their vested account balance or $50,000, reduced by the highest outstanding note balance during the prior 12 months. Notes are not issued to participants who already have a note outstanding. Participant notes are valued at amortized cost plus accrued interest. Under ERISA guidelines, certain delinquent notes are deemed to be distributed for Internal Revenue Service (IRS) Form 5500 reporting.

Pursuant to the Coronavirus Aid, Relief, and Economic Security (CARES) Act enacted in March 2020, Plan participants could request a delay of note repayments for repayments that occurred between March 27, 2020 and December 31, 2020. If a delay was granted, the participant’s note was reamortized and included any interest accrued during the period of delay. The ability to request a delay in note repayments under the CARES Act ceased as of December 31, 2020.

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

Benefit Payments

Upon a participant's retirement after age 55, death, disability or other termination of employment with the Company, the entire vested balance in the participant's account is available for distribution. Each participant's distribution under the Plan is payable as a lump sum, installments or other forms of payment retained from prior plans. Partial distributions (up to one per month) are permitted with a minimum amount of $100. Participants may elect to receive a lump sum distribution entirely in cash, or in a combination of cash and shares of Emerson common stock. Distribution of vested account balances of at least $5,000 may be deferred by retired employees until age 72, at which time required minimum distributions under ERISA must begin. Pursuant to the CARES Act, participants who were currently receiving required minimum distributions were offered the option to waive their 2020 payment and participants who were due to receive the first required distribution in 2020 had their distribution automatically waived. The ability to request special waivers with respect to required minimum distributions under the CARES Act ceased as of December 31, 2020.

Participants who are actively employed by the Company may withdraw all or a portion of their after-tax contributions, vested matching contributions that have been in the Plan at least two years, and amounts transferred or rolled-over from another plan qualified under Section 401 of the Internal Revenue Code (the Code). If a participant is at least age 59½, all contributions in the Plan can be withdrawn. Roth 401(k) withdrawals must fulfill the five year participation period.

Actively employed participants may request, subject to approval, a withdrawal of all or a portion of their pre-tax contributions subject to demonstration of substantial financial hardship. If, prior to December 31, 2020, a participant requested a coronavirus-related distribution of up to $100,000 under the Coronavirus Aid, Relief, and Economic Security (CARES) Act enacted in March 2020, the Plan permits repayment of such distributions for up to three years following such distribution in accordance with the CARES Act.

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements have been prepared on the accrual basis of accounting. Purchases and sales of securities are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date. Benefit payments are recorded when paid as all assets are available to pay benefits.

Investment Valuation and Income Recognition

See Notes 8 and 9 regarding investments in the Master Trust.

Risks and Uncertainties

The Plan invests in securities and mutual funds which are exposed to various risks, including interest rate, market and credit risks. Due to the level of risk associated with certain investments, it is at least reasonably possible that significant changes in the values of investment securities could occur in the near term. Such changes could materially affect participants’ account balances and the amounts reported in the Statement of Net Assets Available for Benefits.

Operating Expenses

Administrative expenses are paid solely by the Plan participants.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

(3)TAX STATUS

The IRS has determined, and informed the Company by a letter dated May 16, 2017, that the Plan and its related trust are designed in accordance with applicable sections of the Code. Plan amendments have been made subsequently which were not specifically covered by the 2017 letter. The Plan administrator and the Plan's tax counsel believe that the Plan is designed and currently being operated in compliance with the applicable requirements of the Code, and therefore remains tax qualified. As of September 30, 2022, there are no uncertain tax positions.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

(4)TRANSFERS TO OR FROM OTHER PLANS

During 2022, net assets of $17,692,440 were transferred out of the Plan related to the divestiture of Therm-O-Disc.

Also during 2022, net assets of $11,448,158 were transferred out of the Plan related to the transfer of Paradigm to Aspen Tech of which Emerson Electric Co. is a majority shareholder.

During 2021, net assets of $5,803,862 were transferred into the Plan related to the acquisition of American Governor.

Effective October 1, 2020, Micro Motion, Inc. (Micro) and Daniel Measurement and Control, Inc. (Daniel) became participating employers under the Measurement Solutions Profit Sharing Plan (f/k/a Rosemount, Inc. Profit Sharing Retirement Plan) (Measurement Solutions Plan). As such, the accounts of active employees of Micro and Daniel totaling $117,910,347 were spun off from the Plan and transferred to the Measurement Solutions Plan.

In 2022 and 2021, certain participant accounts were transferred to or from other Company sponsored benefit plans, as those participants transferred from one Company business unit to another.

(5)RELATED PARTY AND PARTY-IN-INTEREST TRANSACTIONS

Certain investments in the Master Trust, including some mutual funds and collective funds, are managed by Vanguard, the Plan’s trustee and recordkeeper. Additionally, the Company is the Plan sponsor and the Emerson common stock is an investment option. These transactions qualify as “party-in-interest” transactions and are allowed under ERISA regulations.

(6)PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions and terminate the Plan at any time, subject to the provisions of ERISA. In the event of Plan termination, participants become fully vested in their accounts.

(7)RECONCILIATION OF FINANCIAL STATEMENTS TO IRS FORM 5500

Following is a reconciliation of Net Assets Available for Benefits per the financial statements to the Plan’s IRS Form 5500.

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

| | | | | | | | | | | |

| September 30 |

| 2021 | | 2022 |

| | | |

| Net Assets Available for Benefits per the financial statements | $ | 3,873,671,598 | | | 2,992,007,472 | |

| Participant notes deemed distributed, end of year | (541,146) | | | (510,811) | |

| Amount allocated to withdrawing participants | (353,538) | | | — | |

| | | |

| Net Assets Available for Benefits per IRS Form 5500 | $ | 3,872,776,914 | | | 2,991,496,661 | |

Following is a reconciliation of benefits paid to participants per the financial statements to the Plan’s IRS Form 5500.

| | | | | | | | | | | |

| Year Ended September 30 |

| 2021 | | 2022 |

| | | |

| Benefits paid to participants per the financial statements | $ | 291,261,769 | | | 297,269,013 | |

| Participant notes deemed distributed, end of year | 541,146 | | | 510,811 | |

| Participant notes deemed distributed, beginning of year | (404,265) | | | (541,146) | |

| Amount allocated to withdrawing participants, end of year | 353,538 | | | — | |

| Amount allocated to withdrawing participants, beginning of year | (54,846) | | | (353,538) | |

| | | |

| Benefits paid to participants per IRS Form 5500 | $ | 291,697,342 | | | 296,885,140 | |

Amounts are allocated to withdrawing participants on IRS Form 5500 for benefit claims that have been processed and approved for payment, but not yet paid as of September 30, 2022 and 2021.

(8)MASTER TRUST

All of the Plan’s investments are held in a Master Trust, consisting of the Plan and other defined contribution plans of Emerson Electric Co. and subsidiaries. All Plan income or loss is derived from Master Trust investment appreciation or depreciation and investment income (interest and dividends). Net appreciation/depreciation includes the gains and losses on investments bought and sold as well as held during the year.

Each participating plan’s interest in the assets of the Master Trust is based on participant account balances. Additionally, notes receivable from participants are included in the Master Trust. Master Trust investment income and expenses are allocated to participating plans based on respective balances.

The Plan’s investments in the Master Trust are stated at fair value. The fair values of mutual funds and Emerson common stock are based on quoted market prices in active markets. Money market funds are stated at cost, which approximates fair value. Investments measured using the net asset value (NAV) as a practical expedient are primarily collective funds and trusts where the underlying securities have observable prices available from active markets. There are no redemption restrictions or unfunded commitments related to these investments. The cost basis of investments held under the Plan is determined using the average cost method of accounting.

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

The following table presents the fair values of all investments in the Master Trust and the Plan's interest in the Master Trust balances.

| | | | | | | | | | | |

| Year Ended September 30, 2022 |

| Master Trust Balances | | Plan's Interest in Master Trust Balances |

|

| | |

| Mutual funds | $ | 1,049,153,773 | | | 717,740,148 | |

| Collective funds and trusts | 3,206,527,460 | | | 1,779,311,236 | |

| Emerson Common Stock Fund | 462,708,947 | | | 311,627,831 | |

| Money market funds | 301,974,435 | | | 162,108,761 | |

| | | |

| Total investments at fair value | $ | 5,020,364,615 | | | 2,970,787,976 | |

| | | |

| | | | | | | | | | | |

| Year Ended September 30, 2021 |

| Master Trust Balances | | Plan's Interest in Master Trust Balances |

|

| | |

| Mutual funds | $ | 1,507,013,447 | | | 1,021,796,712 | |

| Collective funds and trusts | 4,102,426,560 | | | 2,258,783,361 | |

| Emerson Common Stock Fund | 618,214,642 | | | 416,669,000 | |

| Money market funds | 273,560,481 | | | 154,501,288 | |

| | | |

| Total investments at fair value | $ | 6,501,215,130 | | | 3,851,750,361 | |

Investment income for the entire Master Trust follows.

| | | | | | | | | | | |

| Year Ended September 30 |

| 2021 | | 2022 |

|

| |

|

| Net appreciation (depreciation) in fair value of investments | $ | 1,169,020,774 | | | (1,308,017,489) | |

| Dividends and Interest, net of fees | 72,043,740 | | | 107,451,762 | |

| | | |

| Total Master Trust investment income (loss) | $ | 1,241,064,514 | | | (1,200,565,727) | |

| | | |

| Plan’s share of Master Trust investment income (loss) | $ | 764,181,322 | | | (722,740,175) | |

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

(9)FAIR VALUE MEASUREMENTS

Under ASC 820 Fair Value Measurement, a formal hierarchy and framework exists for measuring fair value and making disclosures about fair value measurements and the reliability of valuation inputs. Within the hierarchy, Level 1 instruments use observable market prices for the identical item in active markets and have the most reliable valuations. Level 2 instruments, of which there are none, are valued through broker/dealer quotation or through market-observable inputs for similar items in active markets, including forward and spot prices, interest rates and volatilities. Level 3 instruments, of which there are none, are valued using inputs not observable in an active market, such as entity-developed future cash flow estimates, and are considered the least reliable.

Following is a categorization of all Master Trust investments (see Note 8) by level within the ASC 820 fair value hierarchy. Investments valued based on the net asset value practical expedient are excluded from the fair value hierarchy. There were no asset transfers between levels during either year shown.

| | | | | | | | | | | | | | | | | |

| September 30, 2022 |

| Level 1 | | Measured at NAV | | Total |

| | | | | |

| Mutual funds | $ | 1,049,153,773 | | | — | | | 1,049,153,773 | |

| Collective funds and trusts | — | | | 3,206,527,460 | | | 3,206,527,460 | |

| Emerson Common Stock Fund | 462,708,947 | | | — | | | 462,708,947 | |

| Money market funds | 301,974,435 | | | — | | | 301,974,435 | |

| | | | | |

| Total | $ | 1,813,837,155 | | | 3,206,527,460 | | | 5,020,364,615 | |

| | | | | | | | | | | | | | | | | |

| September 30, 2021 |

| Level 1 | | Measured at NAV | | Total |

| | | | | |

| Mutual funds | $ | 1,507,013,447 | | | — | | | 1,507,013,447 | |

| Collective funds and trusts | — | | | 4,102,426,560 | | | 4,102,426,560 | |

| Emerson Common Stock Fund | 618,214,642 | | | — | | | 618,214,642 | |

| Money market funds | 273,560,481 | | | — | | | 273,560,481 | |

| | | | | |

| Total | $ | 2,398,788,570 | | | 4,102,426,560 | | | 6,501,215,130 | |

(10)SUBSEQUENT EVENTS

The Plan has evaluated subsequent events through March 8, 2023, the date the financial statements were available to be issued.

In October 2022, the Board of Directors approved and the Company announced an agreement to sell a majority stake in its Climate Technologies business (which constitutes the Climate Technologies segment, excluding Therm-O-Disc which was divested earlier in fiscal 2022) to private equity funds managed by Blackstone. The transaction is expected to close in the first half of

EMERSON ELECTRIC CO.

EMPLOYEE SAVINGS INVESTMENT PLAN

Notes to Financial Statements

calendar year 2023, subject to regulatory approvals and customary closing conditions. Following the sale, assets of affected participants will be spun-off from the Plan.

Additionally on October 31, 2022, the Company completed the divestiture of its InSinkErator business.

| | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Schedule |

| EMERSON ELECTRIC CO. EMPLOYEE SAVINGS INVESTMENT PLAN |

|

| Schedule of Assets Held (at End of Year) – Attachment for IRS Form 5500, Schedule H, Line 4i |

| As of September 30, 2022 |

|

|

| | | | | | | |

| Identity of Issue | | Investment Type | | Cost*** | | Current Value** |

| | | | | | | |

| * | Participant Loan Fund | | Interest Rate Range: 3.25% - 7.00%** | | | | $ | 13,317,212 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| * | Party-in-Interest | | | | | | |

| ** | Current value and the range of interest rates exclude participant loans deemed distributed in accordance with IRS Form 5500 instructions for Schedule H, Line 4i. |

| *** | Cost excluded in accordance with IRS Form 5500 instructions for Schedule H, Line 4i. |

| | | | | | | |

| | | | | | | |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Management Review Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | EMERSON ELECTRIC CO. | |

| | EMPLOYEE SAVINGS INVESTMENT PLAN | |

| | | |

| by: | /s/ Michael J. Baughman | |

| | Michael J. Baughman, on behalf of the | |

| | Management Review Committee | |

Date: March 8, 2023

EXHIBITS

(a) Exhibits (Listed by numbers corresponding to the Exhibit Table of Item 601 in Regulation S-K).

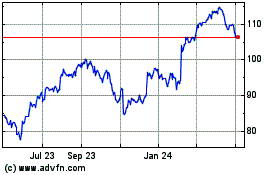

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

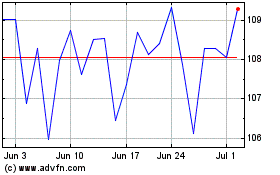

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Apr 2023 to Apr 2024