Earnings Scorecard: Ecolab - Analyst Blog

March 06 2012 - 9:15AM

Zacks

Ecolab’s (ECL)

fourth-quarter fiscal 2011 adjusted earnings per share of 70 cents

matched the Zacks Consensus Estimate. Profit tumbled 32% year over

year as double-digit growth in sales was masked by charges

associated with the company’s $8.3 billion acquisition of

Illinois-based water treatment company Nalco Holding and

restructuring program.

Highlights from the

Quarter

Net sales surged roughly 17% year

over year to a record $1,845.3 million, yet missed the Zacks

Consensus Estimate of $1,934 million. Sales were boosted by the

company’s Food & Beverage and Kay businesses coupled with the

contributions from the Latin American operation and Nalco

acquisition.

Gross margin fell year over year on

account of inventory step-up cost associated with the Nalco buyout

while operating margin was hit by the hefty restructuring and

acquisition-related charges.

The Minnesota-based company

reaffirmed its earnings forecast for fiscal 2012 and initiated

guidance for the first quarter which was below the Zacks Consensus

Estimate.

We have discussed the quarterly

results at length here: Ecolab's EPS Meets, Sales Lag.

Agreement – Estimate

Revisions

Estimate for fiscal 2012 is evenly

balanced with 2 analysts (out of 15) having lowered their forecasts

over the past month with a couple of positive revisions. Over the

past week, there were 2 positive revisions accompanied by a single

downward movement.

Estimate for first-quarter 2012

elicit a comprehensive downward drift with 5 analysts (out of 11)

having slashed their forecasts over the last week and month with

none moving in the opposite direction over these periods.

Estimates for fiscal 2013 are

inclined towards the negative side with 4 analysts (out of 12)

having trimmed their projections over the last 7 and 30 days with

just one raising his/her forecast over these timelines.

Magnitude – Consensus

Estimate Trend

Given the lack of directional

pressure, estimate for fiscal 2012 has remained static (at $3.02)

over the last 7 and 30 days. However, due to the downward

revisions, estimates for first-quarter 2012 and fiscal 2013 have

been reduced by 6 cents each over the past week and month.

Our Take

Ecolab leads in cleaning,

sanitizing, pest elimination and food safety solutions with annual

sales of roughly $6.8 billion. The company is investing in

strategic areas such as product innovation and sales organization

while rationalizing operating costs to enhance margins.

We believe that Ecolab’s strong

international presence will continue to boost its growth in the

upcoming reporting periods, buoyed by emerging markets.

Asia-Pacific and Latin America represent the key growth engine for

the company’s overseas operations. Moreover, the uptick in hotel

lodging demand and favorable food and beverage market trends

represents healthy tailwinds.

Management remains optimistic

regarding improvement in end-market demand, its ability to attract

new customers, and opportunities for greater customer penetration

through new product development. Ecolab is also active on the

acquisition front and continues to explore opportunities to expand

into emerging markets.

To drive efficiency and

profitability, Ecolab is restructuring its European business. The

restructuring, once completed, has been projected to fetch annual

cost saving of more than $120 million.

Ecolab is also employing

appropriate pricing strategy to offset higher delivered product

costs. Moreover, the company remains committed to delivering

incremental returns to investors leveraging a solid balance sheet

and healthy cash flows.

Ecolab expects profit in the first

quarter and fiscal 2012 to be boosted by higher sales volume,

pricing, margin leverage, new products as well as synergies from

acquisitions and restructuring.

However, we remain cautious about

aggressive competition and the impact of foreign exchange movements

on overseas sales. The company’s U.S. Cleaning & Sanitizing and

International divisions face stiff competition from

Clorox (CLX) and Church &

Dwight (CHD).

Moreover, raw material costs are

expected to remain a headwind moving ahead. We are also aware of

the dilutive impact of the restructuring expenses on the company’s

bottom line. The company’s back-to-back acquisitions could also

lead to substantial integration risk. As such, we remain Neutral on

the stock, which is backed by a short-term Zacks #3 Rank

(Hold).

About Earnings Estimate

Scorecard

As a PhD from MIT, Len Zacks

proved over 30 years ago that earnings estimate revisions are the

most powerful force impacting stock prices. He turned this ground

breaking discovery into two of the most celebrating stock rating

systems in use today. The Zacks Rank for stock trading in a 1 to 3

month time horizon and the Zacks Recommendation for long-term

investing (6+ months). These “Earnings Estimate Scorecard” articles

help analyze the important aspects of estimate revisions for each

stock after their quarterly earnings announcements. Learn more

about earnings estimates and our proven stock ratings at

http://www.zacks.com/education/

CHURCH & DWIGHT (CHD): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

ECOLAB INC (ECL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

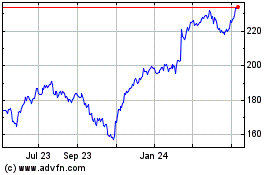

Ecolab (NYSE:ECL)

Historical Stock Chart

From Sep 2024 to Oct 2024

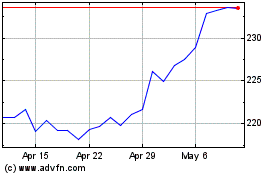

Ecolab (NYSE:ECL)

Historical Stock Chart

From Oct 2023 to Oct 2024