Ecolab Reports 22% Second Quarter EPS Increase to $0.44

July 24 2007 - 8:35AM

Business Wire

Ecolab Inc. (NYSE:ECL): 2007 SECOND QUARTER HIGHLIGHTS: Record

diluted net income per share, +22% to $0.44; excluding $0.02 tax

benefit, EPS +17% to $0.42 Record sales, +11% to $1.4 billion

Strong U.S., Canada and Latin America sales results propel growth

Europe sales and profits improve Cash flow from operations

increases 25% to $221 million Second Quarter and Six Months Ended

June 30 (unaudited) Second Quarter % Six Months % 2007 2006

increase 2007 2006 increase (Millions, except per share) Net Sales

$ 1,362.4 $ 1,225.9 11 % $ 2,616.6 $ 2,346.0 12 % � Operating

Income 173.0 153.2 13 % 321.4 284.6 13 % � Pretax Income 159.6

142.2 12 % 296.3 263.3 13 % Taxes 49.3 49.0 1 % 96.5 92.2 5 % Net

Income $ 110.3 $ 93.2 18 % $ 199.8 $ 171.1 17 % � Diluted Net

Income Per Share $ 0.44 $ 0.36 22 % $ 0.79 $ 0.66 20 % Diluted

Average Shares Outstanding 250.7 256.7 -2 % 252.6 257.4 -2 %

Continued strong growth from its U.S., Canada and Latin America

operations led Ecolab�s second quarter results to record levels for

the period ended June 30, 2007. Ecolab's consolidated sales

increased 11% to a record $1.4 billion in the second quarter of

2007; measured in fixed currencies, sales rose 8%. Net income

increased 18% to a record $110 million. Diluted earnings per share

were up 22% to a record $0.44. Excluding a benefit from tax audit

settlements, earnings per share rose 17% to $0.42. Commenting on

the quarter, Douglas M. Baker, Jr., Ecolab�s Chairman, President

and Chief Executive Officer said, �We turned in another excellent

quarter as we continued to enjoy the benefits of our global

business balance. Solid growth trends in U.S., Canada and Latin

America, along with improvement in Europe, drove the sales and

profit gain. �We continue to expect strong results for 2007, as we

both deliver on the current year and invest for future growth. We

will be introducing new product platforms in key businesses in the

second half of 2007 that will deliver superior customer results,

once again demonstrating Ecolab�s industry leadership, and driving

future growth. We are also using our momentum to make important

long term investments in the fundamental business growth drivers,

particularly in Europe and Asia Pacific, and are confident in the

returns they will generate. We are excited about our opportunities,

both over the near and long term, and by our abilities to

successfully capitalize on them. We believe our future remains

strong, and we are determined to continue delivering superior

shareholder value.� Second quarter 2007 sales for Ecolab's U.S.

Cleaning & Sanitizing operations rose 8% to $589 million, led

by strong Institutional, Healthcare and Textile Care gains and

continued good growth from Food & Beverage and Vehicle Care.

Ecolab's U. S. Cleaning & Sanitizing operating income rose 16%

to $100 million. U.S. Other Services sales increased 8% to $114

million in the second quarter benefiting from strong gains by Pest

Elimination and improved sales growth by GCS. Operating income

increased 3% to $11 million. Continued profit gains at Pest

Elimination were partially offset by a charge for an increase in

legal reserves. Excluding the charge, U.S. Other Services operating

income would have risen 17%. Sales of Ecolab's International

operations, when measured at fixed currency rates, rose 7% to $633

million in the second quarter. Latin America reported double-digit

sales growth and Asia Pacific and Canada showed attractive gains.

Europe/Middle East/Africa (EMEA) recorded improved sales growth.

Fixed currency operating income rose 8% to $63 million. When

measured at public currency rates, International sales increased

14% and operating income rose 18%. Currency translation had a

favorable impact on net income growth of approximately $3.4 million

for the second quarter of 2007. Beginning in the second quarter,

the Corporate segment includes investments in the development of

business systems (previously reported in the International segment)

and investments we are making to optimize our business structure as

part of our ongoing efforts to improve our efficiency and returns.

The provision for income taxes for the second quarter of 2007

reflected an income tax rate of 30.9% compared to an income tax

rate of 34.4% for the second quarter of 2006. Excluding the benefit

of various audit settlements, the adjusted effective income tax

rate for the second quarter 2007 was 34.3%. Ecolab reacquired 3.4

million shares of its common stock during the second quarter. The

company reacquired 7.7 million shares in the first half of 2007.

Business Outlook Ecolab expects sales for both domestic and

international operations (in fixed currencies) to increase in the

third quarter 2007 over the third quarter 2006. Gross margins are

expected to approximate the 51% recorded last year. Selling,

general and administrative expenses as a ratio to sales are

expected to be in the 36%-37% range. Interest expense is expected

to approximate $12 million. The effective tax rate in the quarter

is expected to be approximately 34%. Overall, currency translation

is expected to benefit third quarter earnings. Diluted earnings per

share are expected to be in the $0.48-$0.49 range in the third

quarter of 2007. Diluted earnings per share were $0.43 for the

third quarter of 2006. For the full year ending December 31, 2007,

Ecolab now expects diluted earnings per share in the $1.64-$1.66

range, excluding the $0.02 per share impact of the second quarter

tax benefit. The estimated effective tax rate in the quarter and

full year forecasts do not reflect the impact of discrete events

that, if and when they occur, are recognized in the appropriate

period. With sales of $5 billion and more than 13,000

sales-and-service associates, Ecolab Inc. (NYSE: ECL) is the global

leader in cleaning, sanitizing, food safety and infection

prevention products and services. Ecolab delivers comprehensive

programs and services to the foodservice, food and beverage

processing, healthcare, and hospitality markets in more than 160

countries. More news and information is available at

www.ecolab.com. Ecolab will host a live webcast to review the

second quarter earnings announcement today at 1:00 p.m. Eastern

Time. The webcast will be available to the public on Ecolab's

website at http://www.ecolab.com/investor. A replay of the webcast

will be available at that site through August 3, 2007. Listening to

the webcast requires Internet access, the Windows Media Player,

Real Player or other compatible streaming media player. This news

release contains various �Forward-Looking Statements� within the

meaning of the Private Securities Litigation Reform Act of 1995.

These include statements concerning our 2007 third quarter and full

year financial and business prospects, including product launches;

estimated sales; gross margins; selling, general and administrative

expenses; interest expense; effective tax rates; currency

translation; and diluted earnings per share. These statements,

which represent Ecolab�s expectations or beliefs concerning various

future events, are based on current expectations that involve a

number of risks and uncertainties that could cause actual results

to differ materially from those of such Forward-Looking Statements.

We caution that undue reliance should not be placed on

Forward-Looking Statements, which speak only as of the date made.

Risks and uncertainties that may affect operating results and

business performance are set forth under Item 1A of our most recent

Form 10-K and include the vitality of the foodservice, hospitality,

travel, health care and food processing industries; our ability to

develop competitive advantages through technological innovations;

restraints on pricing flexibility due to contractual obligations;

pressure on operations from consolidation of customers or vendors;

changes in oil or raw material prices or unavailability of adequate

and reasonably priced raw materials or substitutes therefore; the

effect of future acquisitions or divestitures or other corporate

transactions; the costs and effects of complying with: (i) laws and

regulations relating to the environment and to the manufacture,

storage, distribution, sale and use of our products, (ii) changes

in tax, fiscal, governmental and other regulatory policies and

(iii) changes in accounting standards, including the impact of FIN

48, which could increase the volatility of our quarterly tax rate;

economic factors such as the worldwide economy, interest rates and

currency movements including, in particular, our exposure to

foreign currency risk; the occurrence of (a) litigation or claims,

(b) the loss or insolvency of a major customer or distributor, (c)

war (including acts of terrorism or hostilities which impact our

markets), (d) natural or manmade disasters, or (e) severe weather

conditions or public health epidemics affecting the foodservice,

hospitality and travel industries; our ability to attract and

retain high caliber management talent; and other uncertainties or

risks reported from time to time in our reports to the Securities

and Exchange Commission. Except as may be required under applicable

law, we undertake no duty to update our Forward-Looking Statements.

(ECL-E) ECOLAB INC. CONSOLIDATED STATEMENT OF INCOME SECOND QUARTER

AND SIX MONTHS ENDED JUNE 30, 2007 (unaudited) � Second Quarter Six

Months (millions, except per share) 2007 2006 2007 2006 � � Net

Sales $ 1,362.4 $ 1,225.9 $ 2,616.6 $ 2,346.0 � Cost of Sales 669.5

608.0 1,285.2 1,160.5 Selling, General and Administrative Expenses

� 519.9 � 464.7 � 1,010.0 � 900.9 � Operating Income 173.0 153.2

321.4 284.6 � Interest Expense, Net � 13.4 � 11.0 � 25.1 � 21.3 �

Income before Income Taxes 159.6 142.2 296.3 263.3 � Provision for

Income Taxes � 49.3 � 49.0 � 96.5 � 92.2 � Net Income $ 110.3 $

93.2 $ 199.8 $ 171.1 � Diluted Net Income per Common Share $ 0.44 $

0.36 $ 0.79 $ 0.66 � Weighted-Average Common Shares Outstanding

Basic 246.0 252.2 247.8 252.8 Diluted 250.7 256.7 252.6 257.4

ECOLAB INC. OPERATING SEGMENT INFORMATION (unaudited) � First

Quarter Second Quarter Six Months (millions) 2007 2006 2007 2006

2007 2006 � Net Sales � United States Cleaning & Sanitizing $

568.2 $ 513.5 $ 589.3 $ 544.4 $ 1,157.5 $ 1,057.9 Other Services �

102.1 � � 93.2 � � 113.7 � � 105.0 � � 215.8 � � 198.2 � Total

670.3 606.7 703.0 649.4 1,373.3 1,256.1 International 573.3 535.3

633.2 589.3 1,206.5 1,124.6 Effect of Foreign�Currency Translation

� 10.6 � � (21.9 ) � 26.2 � � (12.8 ) � 36.8 � � (34.7 )

Consolidated $ 1,254.2 � $ 1,120.1 � $ 1,362.4 � $ 1,225.9 � $

2,616.6 � $ 2,346.0 � � � Operating Income � United States Cleaning

& Sanitizing $ 99.2 $ 79.5 $ 99.8 $ 86.1 $ 199.0 $ 165.6 Other

Services � 9.3 � � 8.0 � � 11.0 � � 10.6 � � 20.3 � � 18.6 � Total

108.5 87.5 110.8 96.7 219.3 184.2 International 41.6 45.3 63.3 58.6

104.9 103.9 Corporate (2.2 ) - (4.3 ) - (6.5 ) - Effect of

Foreign�Currency Translation � 0.5 � � (1.4 ) � 3.2 � � (2.1 ) �

3.7 � � (3.5 ) Consolidated $ 148.4 � $ 131.4 � $ 173.0 � $ 153.2 �

$ 321.4 � $ 284.6 � Note: The Corporate segment includes

investments in the development of business systems (previously

reported in Q1 in the International segment) and other business

efficiency investments. ECOLAB INC. CONSOLIDATED BALANCE SHEET June

30, 2007 � June 30 December 31 June 30 (millions) 2007 2006 2006

(unaudited) (unaudited) � Assets Current assets Cash and cash

equivalents $ 72.2 $ 484.0 $ 105.9 Accounts receivable, net 930.8

867.6 831.8 Inventories 387.9 364.9 348.1 Deferred income taxes

80.0 86.9 62.7 Other current assets � 68.7 � 50.2 � 69.9 Total

current assets 1,539.6 1,853.6 1,418.4 � Property, plant and

equipment, net 987.5 951.6 903.0 � Goodwill, net 1,064.0 1,035.9

977.4 � Other intangible assets, net 229.4 223.8 200.4 � Other

assets, net � 319.9 � 354.5 � 412.1 � Total assets $ 4,140.4 $

4,419.4 $ 3,911.3 � Liabilities and Shareholders' Equity Current

liabilities Short-term debt $ 295.2 $ 509.0 $ 262.6 Accounts

payable 338.1 330.9 274.8 Compensation and benefits 205.5 252.7

190.0 Income taxes 19.5 17.7 28.8 Other current liabilities � 429.2

� 392.5 � 385.0 Total current liabilities 1,287.5 1,502.8 1,141.2 �

Long-term debt 563.9 557.1 544.8 � Postretirement health care and

pension benefits 437.1 420.2 328.2 � Other liabilities 262.2 259.1

199.1 � Shareholders' equity � 1,589.7 � 1,680.2 � 1,698.0 � Total

liabilities and shareholders' equity $ 4,140.4 $ 4,419.4 $ 3,911.3

Note: The June 30, 2006 balance sheet includes $38.1 million of

capitalized software that has been reclassified from Other Assets

to Property, Plant and Equipment to conform to the June 30, 2007

and December 31, 2006 presentation.

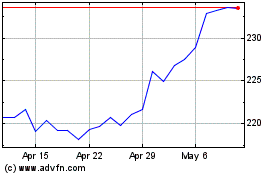

Ecolab (NYSE:ECL)

Historical Stock Chart

From Aug 2024 to Sep 2024

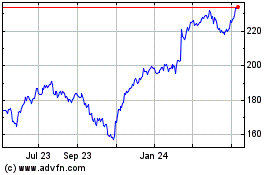

Ecolab (NYSE:ECL)

Historical Stock Chart

From Sep 2023 to Sep 2024