0001773383false00017733832024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024

DYNATRACE, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Delaware | | 001-39010 | | 47-2386428 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

1601 Trapelo Road, Suite 116 | | |

Waltham, | Massachusetts | | 02451 |

(Address of principal executive offices) | | (Zip Code) |

(781) 530-1000

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | DT | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Conditions.

On February 8, 2024, Dynatrace, Inc. (the "Company") issued a press release announcing, and will hold a conference call to discuss, the Company's financial results and other information for the quarter ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this report and incorporated into this Item 2.02 by reference.

The information in this Item 2.02 of this Report on Form 8-K and Exhibits 99.1 and 99.2 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

No. | | Description |

| |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: February 8, 2024 | DYNATRACE, INC. | |

| | | |

| By: | /s/ James Benson | |

| | Name: James Benson | |

| | Title: Senior Vice President, Chief Financial Officer & Treasurer | |

| | | |

Dynatrace Reports Third Quarter Fiscal Year 2024 Financial Results

Exceeds high end of guidance across all Q3 metrics

Delivers ARR growth of 21% year-over-year on a constant currency basis

Achieves GAAP Operating Margin of 10% and Non-GAAP Operating Margin of 29%

WALTHAM, Mass., February 8, 2024 - Dynatrace (NYSE: DT), the leader in unified observability and security, today announced financial results for the third quarter of fiscal 2024 ended December 31, 2023.

"Our Q3 results of balanced growth, profitability, and free cash flow reflect our continued ability to execute successfully in a dynamic market,” said Rick McConnell, Chief Executive Officer. “As customers look to address the business challenges of modern cloud environments, they are coming to Dynatrace for a more comprehensive observability architecture that enables them to drive innovation, optimize costs, and mitigate risk. Our contextual analytics, hypermodal AI, and automation differentiate the Dynatrace platform in the market and provide us with a powerful advantage to capture the opportunity ahead of us.”

Third Quarter Fiscal 2024 and Other Recent Business Highlights:

All growth rates are compared to the third quarter of fiscal 2023, unless otherwise noted.

Financial Highlights:

•Total ARR of $1,425 million, an increase of 23%, or 21% on a constant currency basis

•Total Revenue of $365 million, an increase of 23%, or 21% on a constant currency basis

•Subscription Revenue of $348 million, an increase of 25%, or 23% on a constant currency basis

•GAAP Income from Operations of $36 million, and Non-GAAP Income from Operations of $105 million

•GAAP EPS of $0.14, and Non-GAAP EPS of $0.32, both on a dilutive basis

Business Highlights:

•Platform innovation: Dynatrace recently hosted over 2,000 in-person attendees and over 4,000 virtual attendees for Perform 2024, the company's annual customer conference. As part of showcasing the value and innovation of the Dynatrace® platform, the company announced the following current and planned enhancements:

◦Dynatrace AI Observability provides insights into all layers of AI-powered applications, including large language models (LLMs) and generative AI solutions, to manage cost, experience, reliability, and security.

◦Dynatrace OpenPipeline empowers customers with full visibility of data at the point of ingest into the Dynatrace platform and evaluates data streams five to ten times faster than legacy technologies, based on our testing.

◦Dynatrace Data Observability helps ensure data collected via external sources, such as OpenTelemetry and Dynatrace APIs, is reliable and accurate.

•Runecast acquisition: On January 29, 2024, we announced the signing of a definitive agreement to acquire Runecast, an AI-powered security and compliance solution provider. This planned addition to the Dynatrace platform will enable customers to proactively prevent cloud misconfigurations and compliance issues with automated, AI-driven, real-time vulnerability assessments.

•Extended partnerships: Dynatrace achieved the Amazon Web Services (AWS) Security Competency, reflecting our deep technical expertise in helping customers proactively remediate vulnerabilities and defend against threats across their AWS environments. The AWS Security Competency helps customers select validated AWS Partner Network members who provide technology that helps organizations adopt, develop, and deploy security solutions on AWS.

•Industry and customer recognition: Dynatrace was named a Leader in both the Cloud-Native Observability and Security quadrants in the 2023 ISG Provider Lens, Multi-Public Cloud Solutions Report, highlighting Dynatrace’s innovation and go-to-market success in the converging spaces of observability and security. Also, Dynatrace was recognized as a Gartner® Peer Insights™ Customers’ Choice in the 2023 Voice of the Customer for Application Performance Monitoring and Observability report for the fifth consecutive year.1 In addition, Dynatrace won the 2023 Silverlinings Innovation Award for Best Cloud AI Solution, for the platform’s Davis® AI and its proven ability to boost the performance and security of software environments.

•Workplace recognition: We were named one of the Best Places to Work in Boston, San Francisco, and Colorado by BuiltIn; a Great Place to Work® in 13 of the countries where we operate; one of the Top 10 Best Workplaces in Tech in Austria by 2024 Great Place to Work®; and a Top Company in Austria by Kununu.

1 Gartner, Voice of the Customer for Application Performance Monitoring and Observability, 29 December 2023.

Gartner® and Gartner Peer Insights™ are trademarks of Gartner, Inc. and/or its affiliates. All rights reserved.

Gartner® Peer Insights™ content consists of the opinions of individual end users based on their own experiences, and should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose.

Third Quarter 2024 Financial Highlights

(Unaudited – In thousands, except per share data)

| | | | | | | | | | | | |

| Three Months Ended December 31, | |

| 2023 | | 2022 | |

| Key Operating Metric: | | | | |

| Annual recurring revenue | $ | 1,425,284 | | | $ | 1,162,591 | | |

Year-over-Year Increase | 23 | % | | | |

Year-over-Year Increase - constant currency (*) | 21 | % | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Revenue: | | | | |

| Total revenue | $ | 365,096 | | | $ | 297,456 | | |

Year-over-Year Increase | 23 | % | | | |

| | | | |

| | | | |

Year-over-Year Increase - constant currency (*) | 21 | % | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Subscription revenue | $ | 348,294 | | | $ | 279,152 | | |

Year-over-Year Increase | 25 | % | | | |

| | | | |

| | | | |

Year-over-Year Increase - constant currency (*) | 23 | % | | | |

| | | | |

| GAAP Financial Measures: | | | | |

| GAAP income from operations | $ | 35,720 | | | $ | 33,887 | | |

| GAAP operating margin | 10 | % | | 11 | % | |

| | | | |

| GAAP net income | $ | 42,691 | | | $ | 15,026 | | |

| | | | |

| GAAP net income per share - diluted | $ | 0.14 | | | $ | 0.05 | | |

| | | | |

| GAAP shares outstanding - diluted | 299,246 | | | 291,228 | | |

| | | | |

| Net cash provided by operating activities | $ | 75,657 | | | $ | 61,962 | | |

| | | | |

| Non-GAAP Financial Measures: | | | | |

Non-GAAP income from operations (*) | $ | 104,636 | | | $ | 80,653 | | |

Non-GAAP operating margin (*) | 29 | % | | 27 | % | |

| | | | |

Non-GAAP net income (*) | $ | 96,184 | | | $ | 73,469 | | |

| | | | |

| | | | |

Non-GAAP net income per share - diluted (*) | $ | 0.32 | | | $ | 0.25 | | |

| | | | |

| | | | |

Non-GAAP shares outstanding - diluted (*) | 299,246 | | | 291,228 | | |

| | | | |

Free Cash Flow (*) | $ | 67,357 | | | $ | 57,574 | | |

* Use of Non-GAAP Financial Measures

In our earnings press releases, conference calls, slide presentations, and webcasts, we may use or discuss non-GAAP financial measures, as defined by Regulation G. The GAAP financial measure most directly comparable to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, are included in this press release after the consolidated financial statements. Our earnings press releases containing such non-GAAP reconciliations can be found in the Investor Relations section of our website at ir.dynatrace.com.

Financial Outlook

Based on information available as of February 8, 2024, Dynatrace is issuing guidance for the fourth quarter and updating guidance for full year fiscal 2024 in the table below.

This guidance reflects foreign exchange rates as of January 31, 2024. We now expect foreign exchange to be a tailwind of approximately $10 million on ARR and approximately $13 million on revenue for fiscal 2024. Given recent weakening in the U.S. dollar, this represents an incremental tailwind of approximately $15 million to ARR and $6 million to revenue for the full year when compared to our prior guidance.

Growth rates for ARR, Total revenue, and Subscription revenue are presented in constant currency to provide better visibility into the underlying growth of the business.

All growth rates below are compared to the fourth quarter and full year of fiscal 2023.

| | | | | | | | | |

| (In millions, except per share data) | Q4 Fiscal 2024 Guidance | | | | |

| Total revenue | $372 - $377 | | | | |

| As reported | 18% - 20% | | | | |

| Constant currency | 18% - 19% | | | | |

| Subscription revenue | $353 - $358 | | | | |

| As reported | 20% - 22% | | | | |

| Constant currency | 20% - 21% | | | | |

| Non-GAAP income from operations | $85 - $90 | | | | |

| Non-GAAP operating margin | 23% - 24% | | | | |

| Non-GAAP net income | $79 - $84 | | | | |

| Non-GAAP net income per diluted share | $0.26 - $0.28 | | | | |

| Diluted weighted average shares outstanding | 300 - 301 | | | | |

| | | | | | | | | | | | | | | | | |

| (In millions, except per share data) | Current Guidance Fiscal 2024 | | Prior Guidance Fiscal 2024* | | Guidance Change

at Midpoint** |

| Total ARR | $1,485 - $1,495 | | $1,480 - $1,490 | | $5 |

| As reported | 19% - 20% | | 19% - 20% | | — bps |

| Constant currency | 18% - 19% | | 19% - 20% | | (100) bps |

| Total revenue | $1,422 - $1,427 | | $1,409 - $1,419 | | $11 |

| As reported | 23% | | 22% | | 100 bps |

| Constant currency | 22% | | 21% - 22% | | 50 bps |

| Subscription revenue | $1,352 - $1,357 | | $1,334 - $1,344 | | $16 |

| As reported | 25% | | 23% - 24% | | 150 bps |

| Constant currency | 24% | | 22% - 23% | | 150 bps |

| Non-GAAP income from operations | $388 - $393 | | $377 - $386 | | $9 |

| Non-GAAP operating margin | 27.25% - 27.5% | | 27% | | 50 bps |

| Non-GAAP net income | $348 - $353 | | $328 - $337 | | $18 |

| Non-GAAP net income per diluted share | $1.16 - $1.18 | | $1.09 - $1.12 | | $0.06 |

| Diluted weighted average shares outstanding | 299 - 300 | | 300 - 301 | | (1) |

| Free cash flow | $330 - $335 | | $313 - $320 | | $16 |

| Free cash flow margin | 23% | | 22% - 23% | | 50 bps |

*Prior guidance was issued on November 2, 2023.

**Changes in our guidance metrics are rounded to the nearest 50 bps.

Reconciliations of non-GAAP income from operations, non-GAAP net income, non-GAAP net income per diluted share and free cash flow guidance to the most directly comparable GAAP measures are not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures; in particular, the measures and effects of share-based compensation expense, employer taxes and tax deductions specific to equity compensation awards that are directly impacted by future hiring, turnover and retention needs, as well as unpredictable fluctuations in our stock price. We

expect the variability of the above charges to have a significant, and potentially unpredictable, impact on our future GAAP financial results.

Conference Call and Webcast Information

Dynatrace will host a conference call and live webcast to discuss its results and business outlook for investors and analysts at 8:00 a.m. Eastern Time today, February 8, 2024. To access the conference call from the U.S. and Canada, dial (866) 405-1247, or internationally, dial (201) 689-8045 with conference ID# 13743643. The call will also be available live via webcast on the company’s website, ir.dynatrace.com.

An audio replay of the call will also be available until 11:59 p.m. Eastern Time on February 22, 2024, by dialing (877) 660-6853 from the U.S. or Canada, or for international callers by dialing (201) 612-7415 and entering conference ID# 13743643. In addition, an archived webcast will be available at ir.dynatrace.com.

We announce material financial information to our investors using our Investor Relations website, press releases, SEC filings and public conference calls and webcasts. We also use these channels to disclose information about the company, our planned financial and other announcements, attendance at upcoming investor and industry conferences, and for complying with our disclosure obligations under Regulation FD.

Non-GAAP Financial Measures & Key Metrics

In addition to disclosing financial measures prepared in accordance with GAAP, this press release and the accompanying tables contain certain non-GAAP financial measures.

Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. Dynatrace considers these non-GAAP financial measures to be important because they provide useful indicators of its performance and liquidity measures. These are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short and long-term operational plans. In addition, investors often use similar measures to evaluate the performance of a company. Non-GAAP financial measures are presented for supplemental informational purposes only for understanding the company’s operating performance. The non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from non-GAAP financial measures presented by other companies. The GAAP financial measure most directly comparable to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, are included in this press release after the consolidated financial statements.

Dynatrace presents constant currency amounts for Revenue and Annual Recurring Revenue to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign currency rate fluctuations. Dynatrace provides this non-GAAP financial information to aid investors in better understanding our performance.

Annual Recurring Revenue (ARR) is defined as the daily revenue of all subscription agreements that are actively generating revenue as of the last day of the reporting period multiplied by 365. We exclude from our calculation of Total ARR any revenues derived from month-to-month agreements and/or product usage overage billings.

Constant Currency amounts for ARR, Total Revenue and Subscription Revenue are presented to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign exchange rate fluctuations. To present this information, current and comparative prior period results for entities reporting in currencies other than United States dollars are converted into United States dollars using the average exchange rates from the comparative period rather than the actual exchange rates in effect during the respective periods. All growth comparisons relate to the corresponding period in the last fiscal year.

Dollar-Based Gross Retention Rate is defined as the ARR from all customers as of one year prior, less contraction and customer churn, divided by the total ARR from one year prior. This metric reflects the percentage of ARR from all customers as of the year prior that has been retained.

Dollar-Based Net Retention Rate (NRR) is defined as the Dynatrace ARR at the end of a reporting period for the cohort of Dynatrace accounts as of one year prior to the date of calculation, divided by the Dynatrace ARR one year prior to the date of calculation for that same cohort. Our dollar-based net retention rate reflects customer renewals, expansion, contraction and churn, and excludes the benefit of Dynatrace ARR resulting from the conversion of Classic products to the Dynatrace platform. Effective the first quarter of fiscal year 2023, we began to exclude the

headwind associated with the Dynatrace perpetual license ARR given diminishing impact of perpetual license ARR. We believe that eliminating the perpetual license headwind results in a dollar-based net retention rate metric that better reflects Dynatrace’s ability to expand existing customer relationships. Dollar-based net retention rate is presented on a constant currency basis.

Dynatrace Customers are defined as accounts, as identified by a unique account identifier, that generate at least $10,000 of Dynatrace ARR as of the reporting date. In infrequent cases, a single large organization may comprise multiple customer accounts when there are distinct divisions, departments or subsidiaries that operate and make purchasing decisions independently from the parent organization. In cases where multiple customer accounts exist under a single organization, each customer account is counted separately based on a mutually exclusive accounting of ARR.

Free Cash Flow is defined as net cash provided by (used in) operating activities less capital expenditures (reflected as "purchase of property and equipment" and "capitalized software additions" in our financial statements).

About Dynatrace

Dynatrace exists to make the world's software work perfectly. Our unified platform combines broad and deep observability and continuous runtime application security with the most advanced AIOps to provide answers and intelligent automation from data at an enormous scale. This enables innovators to modernize and automate cloud operations, deliver software faster and more securely, and ensure flawless digital experiences. That's why the world's largest organizations trust the Dynatrace® platform to accelerate digital transformation.

Cautionary Language Concerning Forward-Looking Statements

This press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding management’s expectations related to platform innovation, the Runecast acquisition (which is subject to customary closing conditions and expected to close later in Dynatrace's fourth quarter which ends on March 31, 2024), partnerships, and business outlook, including our financial guidance for the fourth quarter and full year of fiscal 2024. These forward-looking statements include, but are not limited to, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts and statements identified by words such as “will,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, our ability to maintain our revenue growth rates in future periods; market adoption of our product offerings; continued demand for, and spending on, our solutions; our ability to innovate and develop solutions that meet customer needs, including through Davis AI; the ability of our platform and solutions to effectively interoperate with customers’ IT infrastructures; our ability to acquire new customers and retain and expand our relationships with existing customers; our ability to expand our sales and marketing capabilities; our ability to compete; our ability to maintain successful relationships with partners; security breaches, other security incidents and any real or perceived errors, failures, defects or vulnerabilities in our solutions; our ability to protect our intellectual property; our ability to hire and retain necessary qualified employees to grow our business and expand our operations; our ability to successfully complete acquisitions and to integrate newly acquired businesses and offerings; the effect on our business of the macroeconomic environment, associated global economic conditions and geopolitical disruption; and other risks set forth under the caption “Risk Factors” in our Form 10-Q filed on February 8, 2024 and our other SEC filings. We assume no obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise.

DYNATRACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited – In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Nine Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Subscription | $ | 348,294 | | | $ | 279,152 | | | $ | 999,245 | | | $ | 790,016 | |

| Service | 16,802 | | | 18,304 | | | 50,437 | | | 54,039 | |

| Total revenue | 365,096 | | | 297,456 | | | 1,049,682 | | | 844,055 | |

| Cost of revenue: | | | | | | | |

| Cost of subscription | 46,888 | | | 36,891 | | | 134,584 | | | 105,393 | |

| Cost of service | 16,744 | | | 15,044 | | | 47,961 | | | 46,264 | |

| Amortization of acquired technology | 4,237 | | | 3,889 | | | 12,035 | | | 11,669 | |

| Total cost of revenue | 67,869 | | | 55,824 | | | 194,580 | | | 163,326 | |

| Gross profit | 297,227 | | | 241,632 | | | 855,102 | | | 680,729 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

Research and development (1) | 80,102 | | | 54,531 | | | 220,468 | | | 156,847 | |

Sales and marketing (1) | 132,723 | | | 112,292 | | | 385,445 | | | 323,313 | |

General and administrative (1) | 43,232 | | | 34,354 | | | 127,075 | | | 107,485 | |

| Amortization of other intangibles | 5,451 | | | 6,573 | | | 16,838 | | | 19,719 | |

| Restructuring and other | (1) | | | (5) | | | (1) | | | (15) | |

| Total operating expenses | 261,507 | | | 207,745 | | | 749,825 | | | 607,349 | |

| Income from operations | 35,720 | | | 33,887 | | | 105,277 | | | 73,380 | |

| Interest income (expense), net | 10,605 | | | (4,787) | | | 26,260 | | | (7,475) | |

| Other (expense) income, net | (3,901) | | | 1,617 | | | (6,724) | | | (1,847) | |

| Income before income taxes | 42,424 | | | 30,717 | | | 124,813 | | | 64,058 | |

| Income tax benefit (expense) | 267 | | | (15,691) | | | (8,125) | | | (36,392) | |

| Net income | $ | 42,691 | | | $ | 15,026 | | | $ | 116,688 | | | $ | 27,666 | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.14 | | | $ | 0.05 | | | $ | 0.40 | | | $ | 0.10 | |

| Diluted | $ | 0.14 | | | $ | 0.05 | | | $ | 0.39 | | | $ | 0.10 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 294,869 | | | 287,957 | | | 293,295 | | | 287,120 | |

| Diluted | 299,246 | | | 291,228 | | | 298,335 | | | 290,803 | |

(1) Prior period results have been updated to allocate depreciation expense to operating expenses based upon location and headcount.

UNAUDITED SHARE-BASED COMPENSATION

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Nine Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue | $ | 6,975 | | | $ | 4,285 | | | $ | 19,660 | | | $ | 13,410 | |

| Research and development | 18,678 | | | 11,057 | | | 50,119 | | | 29,339 | |

| Sales and marketing | 15,947 | | | 13,385 | | | 48,823 | | | 37,399 | |

| General and administrative | 13,222 | | | 6,777 | | | 34,696 | | | 24,705 | |

| Total share-based compensation | $ | 54,822 | | | $ | 35,504 | | | $ | 153,298 | | | $ | 104,853 | |

DYNATRACE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| | | | | | | | | | | |

| December 31, 2023 | | March 31, 2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 782,649 | | | $ | 555,348 | |

| Accounts receivable, net | 361,653 | | | 442,518 | |

| Deferred commissions, current | 90,059 | | | 83,029 | |

| Prepaid expenses and other current assets | 52,301 | | | 37,289 | |

| Total current assets | 1,286,662 | | | 1,118,184 | |

| Property and equipment, net | 49,408 | | | 53,576 | |

| Operating lease right-of-use assets, net | 65,895 | | | 68,074 | |

| Goodwill | 1,312,691 | | | 1,281,812 | |

| Other intangible assets, net | 54,118 | | | 63,599 | |

| Deferred tax assets, net | 129,119 | | | 79,822 | |

| Deferred commissions, non-current | 79,724 | | | 86,232 | |

| Other assets | 21,596 | | | 14,048 | |

| Total assets | $ | 2,999,213 | | | $ | 2,765,347 | |

| | | |

| Liabilities and shareholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 13,230 | | | $ | 21,953 | |

| Accrued expenses, current | 171,929 | | | 188,380 | |

| | | |

| Deferred revenue, current | 757,141 | | | 811,058 | |

| Operating lease liabilities, current | 16,288 | | | 15,652 | |

| Total current liabilities | 958,588 | | | 1,037,043 | |

| Deferred revenue, non-current | 38,508 | | | 34,423 | |

| Accrued expenses, non-current | 29,918 | | | 29,212 | |

| Operating lease liabilities, non-current | 58,002 | | | 59,520 | |

| Deferred tax liabilities | 321 | | | 280 | |

| | | |

| Total liabilities | 1,085,337 | | | 1,160,478 | |

| | | |

| Shareholders' equity: | | | |

Common shares, $0.001 par value, 600,000,000 shares authorized, 295,777,477 and 290,411,108 shares issued and outstanding at December 31, 2023 and March 31, 2023, respectively | 296 | | | 290 | |

| Additional paid-in capital | 2,186,766 | | | 1,989,797 | |

| Accumulated deficit | (236,701) | | | (353,389) | |

| Accumulated other comprehensive loss | (36,485) | | | (31,829) | |

| Total shareholders' equity | 1,913,876 | | | 1,604,869 | |

| Total liabilities and shareholders' equity | $ | 2,999,213 | | | $ | 2,765,347 | |

DYNATRACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited – In thousands)

| | | | | | | | | | | |

| Nine Months Ended

December 31, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 116,688 | | | $ | 27,666 | |

Adjustments to reconcile net income to cash provided by operations: | | | |

Depreciation | 11,781 | | | 9,012 | |

Amortization | 29,067 | | | 31,566 | |

Share-based compensation | 153,298 | | | 104,853 | |

Deferred income taxes | (49,579) | | | 2,057 | |

| Loss on extinguishment of debt | — | | | 5,925 | |

Other | 7,016 | | | 3,114 | |

Net change in operating assets and liabilities: | | | |

Accounts receivable | 83,444 | | | 40,314 | |

Deferred commissions | 874 | | | (17,198) | |

Prepaid expenses and other assets | (27,437) | | | 29,616 | |

Accounts payable and accrued expenses | (24,022) | | | 19,365 | |

Operating leases, net | 1,253 | | | (36) | |

Deferred revenue | (55,946) | | | (21,796) | |

Net cash provided by operating activities | 246,437 | | | 234,458 | |

| | | |

| Cash flows from investing activities: | | | |

Purchase of property and equipment | (16,662) | | | (15,625) | |

Capitalized software additions | (4,655) | | | — | |

| Acquisition of a business, net of cash acquired | (32,297) | | | — | |

Net cash used in investing activities | (53,614) | | | (15,625) | |

| | | |

| Cash flows from financing activities: | | | |

Repayment of term loans | — | | | (281,125) | |

| Debt issuance costs | — | | | (1,949) | |

Proceeds from employee stock purchase plan | 19,472 | | | 17,806 | |

| Proceeds from exercise of stock options | 24,205 | | | 15,102 | |

Equity repurchases | — | | | (15) | |

Net cash provided by (used in) financing activities | 43,677 | | | (250,181) | |

| | | |

| Effect of exchange rates on cash and cash equivalents | (9,199) | | | (9,168) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 227,301 | | | (40,516) | |

| | | |

| Cash and cash equivalents, beginning of period | 555,348 | | | 462,967 | |

| Cash and cash equivalents, end of period | $ | 782,649 | | | $ | 422,451 | |

| | | |

| | | |

| | | |

| | | |

DYNATRACE, INC.

GAAP to Non-GAAP Reconciliations

(Unaudited - In thousands, except percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| GAAP | | Share-based compensation | | Employer payroll taxes on employee stock transactions | | Amortization of other intangibles | | Restructuring & other | | Non-GAAP |

| Non-GAAP income from operations: |

| | | | | | | | | | | |

| Cost of revenue | $ | 67,869 | | | $ | (6,975) | | | $ | (284) | | | $ | (4,237) | | | $ | — | | | $ | 56,373 | |

| Gross profit | 297,227 | | | 6,975 | | | 284 | | | 4,237 | | | — | | | 308,723 | |

| Gross margin | 81 | % | | | | | | | | | | 85 | % |

| Research and development | 80,102 | | | (18,678) | | | (1,196) | | | — | | | — | | | 60,228 | |

| Sales and marketing | 132,723 | | | (15,947) | | | (1,029) | | | — | | | 201 | | | 115,948 | |

| General and administrative | 43,232 | | | (13,222) | | | (360) | | | — | | | (1,739) | | | 27,911 | |

| Amortization of other intangibles | 5,451 | | | — | | | — | | | (5,451) | | | — | | | — | |

| Restructuring and other | (1) | | | — | | | — | | | — | | | 1 | | | — | |

| Income from operations | $ | 35,720 | | | $ | 54,822 | | | $ | 2,869 | | | $ | 9,688 | | | $ | 1,537 | | | $ | 104,636 | |

| Operating margin | 10 | % | | | | | | | | | | 29 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| GAAP | | Share-based compensation | | Employer payroll taxes on employee stock transactions | | Amortization of other intangibles | | Restructuring & other | | Non-GAAP |

| Non-GAAP income from operations: |

| | | | | | | | | | | |

| Cost of revenue | $ | 55,824 | | | $ | (4,285) | | | $ | (114) | | | $ | (3,889) | | | $ | — | | | $ | 47,536 | |

| Gross profit | 241,632 | | | 4,285 | | | 114 | | | 3,889 | | | — | | | 249,920 | |

| Gross margin | 81 | % | | | | | | | | | | 84 | % |

Research and development (1) | 54,531 | | | (11,057) | | | (329) | | | — | | | — | | | 43,145 | |

Sales and marketing (1) | 112,292 | | | (13,385) | | | (297) | | | — | | | — | | | 98,610 | |

General and administrative (1) | 34,354 | | | (6,777) | | | (68) | | | — | | | 3 | | | 27,512 | |

| Amortization of other intangibles | 6,573 | | | — | | | — | | | (6,573) | | | — | | | — | |

| Restructuring and other | (5) | | | — | | | — | | | — | | | 5 | | | — | |

| Income from operations | $ | 33,887 | | | $ | 35,504 | | | $ | 808 | | | $ | 10,462 | | | $ | (8) | | | $ | 80,653 | |

| Operating margin | 11 | % | | | | | | | | | | 27 | % |

(1) Prior period results have been updated to allocate depreciation expense to operating expenses based upon location and headcount.

DYNATRACE, INC.

GAAP to Non-GAAP Reconciliations

(Unaudited - In thousands, except per share data)

| | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| Non-GAAP net income: | | | |

| Net income | $ | 42,691 | | | $ | 15,026 | |

| Income tax (benefit) expense | (267) | | | 15,691 | |

| Non-GAAP effective cash tax | (18,516) | | | (9,080) | |

| Interest (income) expense, net | (10,605) | | | 4,787 | |

| Cash received from interest, net | 10,064 | | | 1,896 | |

| Share-based compensation | 54,822 | | | 35,504 | |

| Employer payroll taxes on employee stock transactions | 2,869 | | | 808 | |

| Amortization of other intangibles | 5,451 | | | 6,573 | |

| Amortization of acquired technology | 4,237 | | | 3,889 | |

| Transaction, restructuring, and other | 1,537 | | | (8) | |

| Loss (gain) on currency translation | 3,901 | | | (1,617) | |

| Non-GAAP net income | $ | 96,184 | | | $ | 73,469 | |

| | | |

| Share count: | | | |

| Weighted-average shares outstanding - basic | 294,869 | | | 287,957 | |

| Weighted-average shares outstanding - diluted | 299,246 | | | 291,228 | |

| | | |

| Shares used in non-GAAP per share calculations: | | | |

| Weighted-average shares outstanding - basic | 294,869 | | | 287,957 | |

| Weighted-average shares outstanding - diluted | 299,246 | | | 291,228 | |

| | | |

| Non-GAAP net income per share: | | | |

| Net income per share - basic | $ | 0.14 | | | $ | 0.05 | |

| Net income per share - diluted | $ | 0.14 | | | $ | 0.05 | |

| Non-GAAP net income per share - basic | $ | 0.33 | | | $ | 0.26 | |

| Non-GAAP net income per share - diluted | $ | 0.32 | | | $ | 0.25 | |

| | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| Free Cash Flow: | | | |

| Net cash provided by operating activities | $ | 75,657 | | | $ | 61,962 | |

| Purchase of property and equipment | (3,645) | | | (4,388) | |

| Capitalized software additions | (4,655) | | | — | |

| Free Cash Flow | $ | 67,357 | | | $ | 57,574 | |

DYNATRACE, INC.

GAAP to Non-GAAP Reconciliations

(Unaudited - In thousands, except percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended December 31, 2023 |

| GAAP | | Share-based compensation | | Employer payroll taxes on employee stock transactions | | | | Amortization of other intangibles | | Restructuring & other | | Non-GAAP |

| Non-GAAP income from operations: |

| | | | | | | | | | | | | |

| Cost of revenue | $ | 194,580 | | | $ | (19,660) | | | $ | (1,516) | | | | | $ | (12,035) | | | $ | — | | | $ | 161,369 | |

| Gross profit | 855,102 | | | 19,660 | | | 1,516 | | | | | 12,035 | | | — | | | 888,313 | |

| Gross margin | 81 | % | | | | | | | | | | | | 85 | % |

| Research and development | 220,468 | | | (50,119) | | | (4,391) | | | | | — | | | | | 165,958 | |

| Sales and marketing | 385,445 | | | (48,823) | | | (3,341) | | | | | — | | | 399 | | | 333,680 | |

| General and administrative | 127,075 | | | (34,696) | | | (1,125) | | | | | — | | | (5,725) | | | 85,529 | |

| Amortization of other intangibles | 16,838 | | | — | | | — | | | | | (16,838) | | | — | | | — | |

| Restructuring and other | (1) | | | — | | | — | | | | | — | | | 1 | | | — | |

| Income from operations | $ | 105,277 | | | $ | 153,298 | | | $ | 10,373 | | | | | $ | 28,873 | | | $ | 5,325 | | | $ | 303,146 | |

| Operating margin | 10 | % | | | | | | | | | | | | 29 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended December 31, 2022 |

| GAAP | | Share-based compensation | | Employer payroll taxes on employee stock transactions | | | | Amortization of other intangibles | | Restructuring & other | | Non-GAAP |

| Non-GAAP income from operations: |

| | | | | | | | | | | | | |

| Cost of revenue | $ | 163,326 | | | $ | (13,410) | | | $ | (526) | | | | | $ | (11,669) | | | $ | (380) | | | $ | 137,341 | |

| Gross profit | 680,729 | | | 13,410 | | | 526 | | | | | 11,669 | | | 380 | | | 706,714 | |

| Gross margin | 81 | % | | | | | | | | | | | | 84 | % |

Research and development (1) | 156,847 | | | (29,339) | | | (1,259) | | | | | — | | | — | | | 126,249 | |

Sales and marketing (1) | 323,313 | | | (37,399) | | | (1,195) | | | | | — | | | — | | | 284,719 | |

General and administrative (1) | 107,485 | | | (24,705) | | | (510) | | | | | — | | | (380) | | | 81,890 | |

| Amortization of other intangibles | 19,719 | | | — | | | — | | | | | (19,719) | | | — | | | — | |

| Restructuring and other | (15) | | | — | | | — | | | | | — | | | 15 | | | — | |

| Income from operations | $ | 73,380 | | | $ | 104,853 | | | $ | 3,490 | | | | | $ | 31,388 | | | $ | 745 | | | $ | 213,856 | |

| Operating margin | 9 | % | | | | | | | | | | | | 25 | % |

(1) Prior period results have been updated to allocate depreciation expense to operating expenses based upon location and headcount.

DYNATRACE, INC.

GAAP to Non-GAAP Reconciliations

(Unaudited - In thousands, except per share data)

| | | | | | | | | | | |

| Nine Months Ended December 31, |

| 2023 | | 2022 |

| Non-GAAP net income: | | | |

| Net income | $ | 116,688 | | | $ | 27,666 | |

| Income tax expense | 8,125 | | | 36,392 | |

| Non-GAAP effective cash tax | (58,986) | | | (23,454) | |

| Interest (income) expense, net | (26,260) | | | 7,475 | |

| Cash received from (paid for) interest, net | 24,556 | | | (637) | |

| Share-based compensation | 153,298 | | | 104,853 | |

| Employer payroll taxes on employee stock transactions | 10,373 | | | 3,490 | |

| Amortization of other intangibles | 16,838 | | | 19,719 | |

| Amortization of acquired technology | 12,035 | | | 11,669 | |

| Transaction, restructuring, and other | 5,325 | | | 745 | |

| | | |

| Loss on currency translation | 6,724 | | | 1,847 | |

| Non-GAAP net income | $ | 268,716 | | | $ | 189,765 | |

| | | |

| Share count: | | | |

| Weighted-average shares outstanding - basic | 293,295 | | | 287,120 | |

| Weighted-average shares outstanding - diluted | 298,335 | | | 290,803 | |

| | | |

| Shares used in non-GAAP per share calculations: | | | |

| Weighted-average shares outstanding - basic | 293,295 | | | 287,120 | |

| Weighted-average shares outstanding - diluted | 298,335 | | | 290,803 | |

| | | |

| Non-GAAP net income per share: | | | |

| Net income per share - basic | $ | 0.40 | | | $ | 0.10 | |

| Net income per share - diluted | $ | 0.39 | | | $ | 0.10 | |

| Non-GAAP net income per share - basic | $ | 0.92 | | | $ | 0.66 | |

| Non-GAAP net income per share - diluted | $ | 0.90 | | | $ | 0.65 | |

| | | | | | | | | | | |

| Nine Months Ended December 31, |

| 2023 | | 2022 |

| Free Cash Flow: | | | |

Net cash provided by operating activities | $ | 246,437 | | | $ | 234,458 | |

| Purchase of property and equipment | (16,662) | | | (15,625) | |

| Capitalized software additions | $ | (4,655) | | | — | |

| Free Cash Flow | $ | 225,120 | | | $ | 218,833 | |

Contacts

Investor Contact:

Noelle Faris

VP, Investor Relations

Noelle.Faris@dynatrace.com

Media Relations:

Jerome Stewart

VP, Marketing

Jerome.Stewart@dynatrace.com

v Total ARR Expansion Trends1 1 FY22 FY23 FY24 ($ in millions) Q1-22 Q2-22 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 Year-over-Year ARR (As Reported) $823 $864 $930 $995 $1,031 $1,065 $1,163 $1,247 $1,294 $1,344 $1,425 Year-over-Year increase 37% 35% 29% 29% 25% 23% 25% 25% 25% 26% 23% TTM FX headwind/(tailwind)2 (30) (8) 21 20 47 61 29 29 (3) (27) (17) ARR - Constant Currency 794 856 951 1,014 1,078 1,126 1,191 1,276 1,291 1,316 1,408 Year-over-Year ARR Increase - Constant Currency3 32% 34% 32% 31% 31% 30% 28% 28% 25% 24% 21% TTM Perpetual License Rolloff - Constant Currency4 24 25 34 27 23 21 11 8 6 5 5 ARR Excluding TTM Perp License Rolloff - Constant Currency 817 881 985 1,041 1,102 1,148 1,203 1,283 1,297 1,322 1,413 Year-over-Year ARR Growth ex-Perp - Constant Currency 36% 38% 36% 35% 34% 33% 29% 29% 26% 24% 22% Q1-22 Q2-22 Q3-22 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Q1-24 Q2-24 Q3-24 Q3-24 TTM Quarter-over-Quarter ARR (As Reported) $823 $864 $930 $995 $1,031 $1,065 $1,163 $1,247 $1,294 $1,344 $1,425 Net New ARR (As Reported)5 49 41 66 65 36 34 98 84 47 50 82 263 Discontinuation of business in Russia6 6 - Quarterly FX headwind/(tailwind)7 (6) 10 15 1 19 24 (19) (2) (10) 10 (12) (14) Net New ARR - Constant Currency 43 50 81 72 55 58 79 82 37 59 70 248 Year-over-Year Net New ARR Growth – Constant Currency8 44% 97% 12% 29% 28% 15% -3% 15% -33% 2% -12% -6% Quarterly Perpetual License Rolloff - Constant Currency9 6 4 12 5 2 2 2 2 1 1 2 6 Net New ARR Excluding Perpetual License Rolloff - Constant Currency 49 54 93 77 57 60 81 84 38 60 72 254 Year-over-Year Net New ARR Growth ex-Perp - Constant Currency 63% 92% 22% 16% 16% 11% -13% 9% -34% 1% -11% -7% EXHIBIT 99.2

v3.24.0.1

Document and Entity Information Document

|

Feb. 08, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

DYNATRACE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39010

|

| Entity Address, Address Line One |

1601 Trapelo Road, Suite 116

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02451

|

| City Area Code |

781

|

| Local Phone Number |

530-1000

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

DT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001773383

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

47-2386428

|

| Entity Address, City or Town |

Waltham,

|

| Document Period End Date |

Feb. 08, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

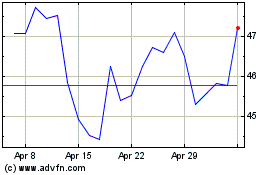

Dynatrace (NYSE:DT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dynatrace (NYSE:DT)

Historical Stock Chart

From Apr 2023 to Apr 2024