Current Report Filing (8-k)

September 04 2020 - 4:31PM

Edgar (US Regulatory)

0000027904

false

0000027904

2020-09-04

2020-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 4, 2020

DELTA AIR LINES, INC.

(Exact name

of registrant as specified in its charter)

|

Delaware

|

001-05424

|

58-0218548

|

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

P.O. Box 20706, Atlanta, Georgia 30320-6001

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (404) 715-2600

Registrant’s Web site address: www.delta.com

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

DAL

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

On September 4, 2020, the New York Transportation

Development Corporation (“NYTDC”) issued its Special Facilities Revenue Bonds, Series 2020 (Delta Air Lines, Inc. –

LaGuardia Airport Terminals C&D Redevelopment Project), in the aggregate principal amount of $1,511,015,000 (the “2020

Bonds”). NYTDC loaned the proceeds from the 2020 Bonds to Delta Air Lines, Inc. (“Delta,” “we” or

“us”) to finance a portion of the costs of a construction project that is currently in process at LaGuardia Airport

in Queens, New York, consisting of the demolition of existing Terminals C and D, the design and construction of new terminal facilities

(the “Facilities”), the payment of capitalized interest on the 2020 Bonds and on a portion of the New York Transportation

Development Corporation Special Facilities Revenue Bonds, Series 2018 (Delta Air Lines, Inc. – LaGuardia Airport Terminals

C&D Redevelopment Project), and the payment of costs related to issuance of the 2020 Bonds.

We are required to pay debt service on the

2020 Bonds through payments under loan agreements with NYTDC, and we have guaranteed the 2020 Bonds. Our obligations under the

guaranty, the loan agreements and the related notes are secured by mortgages (the “Leasehold Mortgages”) on our lease

of the Facilities and related property (the “Lease”) from the Port Authority of New York and New Jersey (the “PANYNJ”).

The 2020 Bonds were issued as term bonds

as follows:

|

Series 2020 Term Bonds

|

|

Maturity Dates

|

Amount

|

Initial Long-Term Interest Rate

|

Yield

|

|

October 1, 2030

|

$220,280,000

|

4.000%

|

4.050%

|

|

October 1, 2035

|

$304,435,000

|

5.000%

|

4.300%(1)

|

|

October 1, 2040

|

$421,265,000

|

5.000%

|

4.450%(1)

|

|

October 1, 2045

|

$565,035,000

|

4.375%

|

4.550%

|

|

|

(1)

|

Yield to the optional par call date of October 1, 2030.

|

Each maturity of the 2020 Bonds is subject

to annual mandatory sinking fund redemption requirements commencing four years prior to its maturity. Interest will be payable

by us on April 1, 2021 and on each October 1 and April 1 thereafter.

The 2020 Bonds maturing after October 1,

2030 are subject to optional redemption, in whole or in part, at our option on any date on or after October 1, 2030 at a price

equal to the unpaid principal amount of the bonds to be redeemed, plus accrued but unpaid interest to but not including the date

of redemption. In addition, the 2020 Bonds are subject to optional redemption at a price equal to the unpaid principal amount of

the bonds to be redeemed, plus accrued but unpaid interest to but not including the date of redemption, if a failure to redeem

the bonds (or a portion thereof) may adversely affect the exclusion of interest from the gross income of the holders and redemption

would permit continuance of such exclusion.

The 2020 Bonds are also subject to mandatory

redemption at a price equal to the unpaid principal amount of the bonds to be redeemed, plus accrued but unpaid interest to but

not including the date of redemption, (i) to the extent the PANYNJ pays unamortized capital investment attributable to lessee debt

under the Lease, (ii) if the PANYNJ pays the lessee debt under the Lease after a default by us under the Lease, (iii) to the extent

we make any payment in connection with certain releases of the premises pursuant to the Leasehold Mortgages, or (iv) in certain

circumstances, if interest on the 2020 Bonds is determined to be taxable as a result of our breach of an applicable representation,

warranty or covenant.

On or after October 1, 2030, the 2020 Bonds

maturing after October 1, 2030 may be subject to mandatory tender for purchase, in whole or in part, at our option.

Amounts payable with respect to the 2020

Bonds can be accelerated upon the occurrence of certain events of default, including failure to pay principal and interest when

due and the occurrence of certain bankruptcy events with respect to us.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

DELTA AIR LINES, INC.

|

|

|

|

|

|

By: /s/ Paul A. Jacobson

|

|

Date: September 4, 2020

|

Paul

A. Jacobson

Executive Vice President and Chief

Financial Officer

|

|

|

|

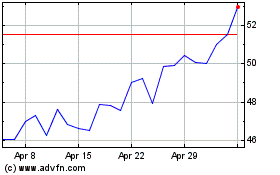

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

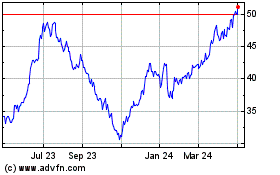

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Sep 2023 to Sep 2024