DaVita Maintained at Neutral - Analyst Blog

October 17 2011 - 12:14PM

Zacks

We have reiterated our Neutral recommendation on DaVita

Inc. (DVA) based on strong top-line growth, partially

offset by higher operating expenses.

However, we continue to exercise caution in the near term due to

the volatile economic environment, which can have a

negative impact

on earnings.

DaVita reported second-quarter net operating income of $114.4

million, or $1.17 per share, which exceeded the Zacks Consensus

Estimate by 3 cents. The earnings were also higher than $110.4

million or $1.06 per share in the comparable quarter of last

year.

DaVita has been generating strong operating cash flow, which it

expects to continue in the future. This makes the company confident

about meeting its future cash requirements for capital expenditures

as well as share repurchases and acquisitions.

Additionally, DaVita’s preferred growth strategy over the years

has been the acquisition of dialysis centers and businesses that

own and operate dialysis centers, as well as other ancillary

services and strategic initiatives.

In addition, the company is slowly moving into the international

market with the opening of a center in Singapore and an acquisition

of a

minority stake in a company with two centers in India. These

factors are expected to drive modest growth in the long run.

However, a significant portion of DaVita’s dialysis and related

lab services revenues are generated from patients who have

commercial payors as the primary payor, but the mix of treatments

reimbursed by non-government payors, as a percentage of total

treatments, has been falling consistently over the years.

Moreover, the shift in payor mix will be additionally harmful as

the Medicaid rate has been reduced by many states in 2011 with more

states considering the possibility of reducing the rate.

Plus, DaVita is facing multiple investigations that allege

over-billing of Medicare and over-use of Epogen, a medicine used

for increasing the red blood cells in kidney patients. If the

charges are found to be true, DaVita will not only suffer

substantial reduction in goodwill, but will also face several

lawsuits and

heavy penalties, weighing heavily on the financials.

The Zacks Consensus Estimate for the third quarter is currently

at $1.29 per share, up about 12.24% year-over-year. Of the 14 firms

covering the stock, two have revised their estimates downwards in

the last 30 days with no upward revisions.

For 2011, earnings are expected to be about $4.81 per share,

climbing about 9.92% year-over-year. The company competes with

Gentiva Health Services Inc. (GTIV) and

HealthSouth Corporation (HLS).

DaVita currently caries a Zacks #2 Rank, implying a short term

Buy rating.

DAVITA INC (DVA): Free Stock Analysis Report

GENTIVA HEALTH (GTIV): Free Stock Analysis Report

HEALTHSOUTH CP (HLS): Free Stock Analysis Report

Zacks Investment Research

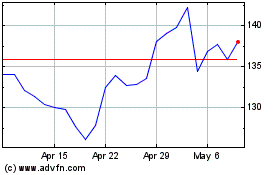

DaVita (NYSE:DVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

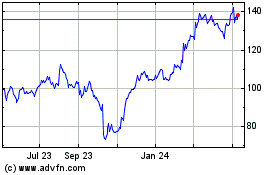

DaVita (NYSE:DVA)

Historical Stock Chart

From Nov 2023 to Nov 2024