Federal Judge Wraps Up Hearings Into CVS-Aetna Deal

June 06 2019 - 7:45PM

Dow Jones News

By Tom Burton

WASHINGTON -- Two days of unprecedented court hearings on CVS

Health Corp.'s acquisition of Aetna Inc. wrapped up without a firm

date for when a federal judge would rule on a Justice Department

settlement that allowed the deal, and legal uncertainty for the

merged firm could last well into the summer.

Judge Richard Leon heard testimony this week on the nearly $70

billion merger in a proceeding he decided to conduct after

reviewing the terms of the October settlement between the two

companies and the Justice Department that allowed the deal to go

through. Judge Leon has said he is concerned the settlement doesn't

do enough to protect consumers, including those who purchase

medication under the federal drug plan known as Medicare Part D.

CVS and Aetna had been competitors in that business.

He said he would accept final briefs and then hear closing

arguments from supporters and opponents of the deal in July.

Witnesses for medical and consumer groups told the judge that

the terms of the settlement would lessen competition and hurt

consumers.

A major focus of the hearing has been whether a CVS plan to sell

Aetna's Medicare Part D business to WellCare Health Plans Inc.

would sufficiently bolster competition and protect consumers.

Diana Moss, president of the American Antitrust Institute,

testified on behalf of consumer groups that "premiums will increase

as a result of consolidation" of CVS and Aetna. "Sometimes, the

most effective remedy is for the government to move to block a

merger," she said.

Dr. Neeraj Sood, an economist testifying for the American

Medical Association, said there are "significant competitive

concerns" with the Justice Department's settlement allowing the

merger.

"The public here is really vulnerable," said Dr. Sood. The

divestiture to WellCare would lead to far less competition in

Medicare drug plans than existed before the merger, he said, adding

that many patients in the plan are low-income and have numerous

ailments.

Terri Swanson, Aetna's vice president of Medicare products,

disputed that assessment. Speaking on behalf of both companies and

the Justice Department, Ms. Swanson said WellCare had "the most

successful prescription-drug plan this year." In fact, she said,

WellCare has been so competitive that it is expected to roughly

double in size, to about 4 million members by the end of this

year.

CVS executive vice president Alan Lotvin testified that the

company's acquisition of Aetna has allowed the combined company to

start innovative programs to treat chronic disease that can

ultimately result in lower premiums for its customers.

CVS and Aetna closed the deal in November, and they said the

combination of CVS's pharmacies and pharmacy-benefit management

business with Aetna's health insurance would lead to more efficient

care for consumers.

The hearing comes as focus on competition is intensifying. The

Wall Street Journal reported Friday that the Justice Department's

antitrust division is gearing up for an investigation of Alphabet

Inc.'s Google unit. At the same time, the Federal Trade Commission

is considering a similar inquiry of Facebook Inc., and House

Democrats are launching their own hearings.

While a law called the Tunney Act stipulates that the government

must get merger settlements approved by a federal court, that

process normally is fairly routine. Judge Leon, though, is known

for going his own way in his courtroom.

It isn't clear what would happen next if Judge Leon rejects the

settlement. CVS already has sold the assets the Justice Department

required it to divest, and the company has contractual obligations

with WellCare to fulfill the terms it agreed upon with the

government.

At the end of the two days of testimony, a Justice Department

lawyer said there had been multiple misstatements of facts and

asked the judge to allow for more witness testimony. The judge

replied, "This is not a trial. You seem to have a hard time

understanding the distinction."

Write to Tom Burton at tom.burton@wsj.com

(END) Dow Jones Newswires

June 06, 2019 19:30 ET (23:30 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

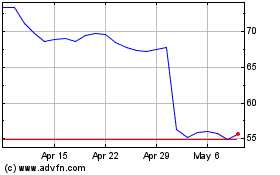

CVS Health (NYSE:CVS)

Historical Stock Chart

From Aug 2024 to Sep 2024

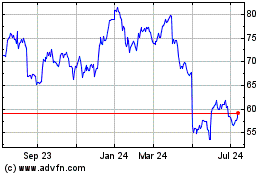

CVS Health (NYSE:CVS)

Historical Stock Chart

From Sep 2023 to Sep 2024