BOK Financial Tops Estimates - Analyst Blog

July 28 2011 - 2:42PM

Zacks

BOK Financial

Corporation’s

(BOKF)

second quarter 2011 earnings came in at $69.0 million or $1.00 per

share, which were above the Zacks Consensus Estimate of 98 cents.

The results also compare favorably with the prior-quarter earnings

of $64.8 million or 94 cents per share and prior-year earnings of

$63.5 million or 93 cents per share.

Results primarily reflect a

decrease in loan loss provisions and improved credit quality.

Increase in fees and commissions revenue also supported top-line

growth.

BOK Financial’s net

interest revenue totaled $174.0 million in the reported quarter, up

2% sequentially. While net interest margin decreased 7 basis points

(bps) from the prior quarter to 3.40%, average earning assets grew

$354 million.

Outstanding loan balances

at BOK Financial were $10.7 billion as of June 30, 2011, up from

$10.6 billion as of March 31, 2011. Growth in commercial loan and

residential mortgage loan balances was partially offset by lower

commercial real estate loans and consumer loans. However,

period-end deposits totaled $17.6 billion as of June 30, 2011, down

from $17.9 billion as of March 31, 2011.

Fees and commissions

revenue totaled $127.8 million, up 4% sequentially. The growth was

fueled by higher transaction card revenue, mortgage banking revenue

and deposit service charges, partially offset by lower brokerage

and trading revenue.

BOK Financial’s total

operating expenses were $203.2 million, up 14% sequentially.

Excluding changes in the fair value of mortgage servicing rights,

operating expenses totaled $189.7 million, up $8.1 million from the

prior quarter. The company experienced an increase in both

personnel expenses and non-personnel expenses.

The increase in personnel

expenses was primarily due to increased incentive compensation

expense while the advancement in non-personnel expenses was largely

brought about by increased mortgage banking expenses.

The credit quality of BOK

Financial’s loan portfolio continued to improve.

Nonperforming assets

totaled $351 million or 3.23% of outstanding loans and repossessed

assets as of March 31, 2011 compared with $379 million or 3.54%,

respectively, as of the same date.

Net loans charged off

dropped 17% to $8.5 million from $10.3 million in the prior

quarter. Provision for credit losses decreased 57% to $2.7 million

from $6.3 million in the prior quarter.

BOK Financial’s capital

ratios remained strong. The company and its subsidiary bank

exceeded the regulatory definition of well capitalized at June 30,

2011. Tier 1 and total capital ratios were 13.30% and 16.80%,

respectively, as of June 30, 2011 compared with 12.97% and 16.48%,

as of March 31, 2011. Moreover, its tangible common equity ratio

advanced to 9.71% as of June 30, 2011 from 9.54% as of March 31,

2011.

Dividend

Update

BOK Financial announced an

increase in the quarterly cash dividend to 27.5 cents per share

from 25 cents paid in the first quarter of 2011. The increased

dividend was paid during the second quarter of 2011.

On July 26, 2011, the board

of directors of BOK Financial approved a quarterly cash dividend of

27.5 cents per share payable on or about August 26, 2011, to

shareholders of record as of August 12, 2011.

Our

Take

The strategic expansions

and local-leadership based business model of BOK Financial, which

has peers such as Cullen/Frost Bankers Inc.

(CFR) and First Financial Bankshares

Inc. (FFIN), have aided its expansion into a leading

financial service provider from a small bank in

Oklahoma.

The

company’s diverse revenue stream, sturdy capital position and

expense control initiatives augur well for investors. The dividend

increase will also bode well and boost investors’

confidence.

However, with a sluggish

recovery of the economy, a significant turnaround in revenue would

remain elusive. Additionally, we also expect both top and bottom

lines to bear the brunt of regulatory issues.

BOK Financial shares are

maintaining a Zacks #3 Rank, which translates into a short-term

Hold recommendation.

BOK FINL CORP (BOKF): Free Stock Analysis Report

CULLEN FROST BK (CFR): Free Stock Analysis Report

Zacks Investment Research

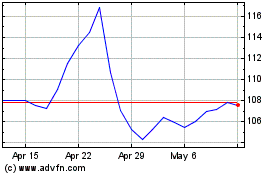

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From May 2024 to Jun 2024

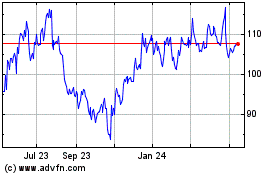

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Jun 2023 to Jun 2024