BOK Financial Reiterated at Neutral - Analyst Blog

June 03 2011 - 9:15AM

Zacks

After a detailed analysis

of the company fundamentals following first quarter 2011 earnings

results and in light of the current economic environment, we

reaffirm our Neutral recommendation on BOK Financial Corporation

(BOKF).

BOK Financial’s first

quarter 2011 earnings of 94 cents per share were slightly ahead of

the Zacks Consensus Estimate of 91 cents. The results also compare

favorably with the prior quarter’s earnings of 86 cents per share

and prior-year quarter’s earnings of 88 cents per share.

Results primarily reflect a

rise in interest revenue, lower expenses and an improvement in

credit metrics. However, fees and commissions revenue remained

stretched with a drop in mortgage banking income. BOK Financial

also announced a dividend increase.

Strategic expansions and

the local-leadership based business model of BOK Financial, which

has peers such as Cullen/Frost Bankers Inc.

(CFR) and First Financial Bankshares

Inc. (FFIN), have aided its expansion into a leading

financial service provider from a small bank in Oklahoma. Going

forward, we believe that its diverse revenue stream and expense

control initiatives would augment its earnings.

Capital ratios at BOK

Financial are exhibiting an uptrend while asset quality trends are

also improving. The company also continues to return wealth to its

shareholders in the form of dividends and concurrent with the first

quarter 2011 earnings results, it has also announced a sixth

consecutive annual hike since it paid its first cash dividend in

the second quarter of 2005. The increased dividend was paid last

month. Such a shareholder friendly approach augurs well for the

stock.

However, as economic and

employment conditions are likely to remain weak, we expect revenue

growth to be restricted. Additionally, we also expect both top and

bottom lines to bear the brunt of regulatory issues. Therefore, the

risk and reward profile of the company seems somewhat balanced for

BOK Financial and we reiterate our Neutral

recommendation.

BOK Financial shares are

maintaining a Zacks #2 Rank, which translates into a short-term Buy

recommendation.

BOK FINL CORP (BOKF): Free Stock Analysis Report

CULLEN FROST BK (CFR): Free Stock Analysis Report

FIRST FIN BK-TX (FFIN): Free Stock Analysis Report

Zacks Investment Research

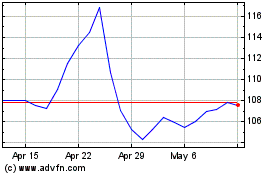

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From May 2024 to Jun 2024

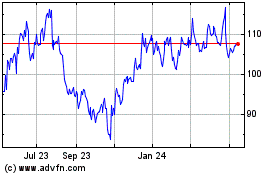

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Jun 2023 to Jun 2024