Kraft Foods Inc. (KFT) posted fourth-quarter

2011 operating EPS of 57 cents per share, which was in-line with

the Zacks Consensus Estimate. However, it went up 23.9% from 47

cents reported in the prior-year quarter.

In fiscal year 2011, Kraft delivered operating EPS of $2.29 per

share, in-line with the Zacks Consensus Estimate, while beating the

year-ago period by 13.4%.

The results of fourth quarter 2011 exclude the integration

program costs of 8 cents per share and spin-off costs of 2 cents

per share, while the fiscal 2011 earnings exclude the integration

program costs of 28 cents per share and spin-off costs of 2 cents

per share. The fourth quarter of 2010 also excludes the integration

program costs of 15 cents per share, while the fiscal year 2010

excludes gain from discontinuing operations of 95 cents,

acquisition-related expenses and costs of 21 cents, integration

program costs of 29 cents and other health care legislation impact

of 8 cents per share.

Including the one-time charges, reported earnings were 47 cents

per share in the fourth quarter 2011, up 51.6%. However, reported

earnings declined 16.7% to $1.99 per share in fiscal 2011.

Management credited the robust sales growth, effective cost

management and prudent investments in the company’s iconic brands

for strong results in the quarter. Kraft also remained in-line with

its long-term growth targets.

Following the strong results, Kraft expects its 2012 operating

earnings to grow at least 9%, despite a higher effective tax rate

and a 4 percentage point headwind from higher pension costs.

Revenues and Margins

Revenues in the quarter soared 6.6% to $14.7 billion, while

organic growth was 6.1%. In fiscal 2011, revenues increased 10.5%

to $54.4 billion, while organic growth was 6.6% driven by strong

top-line growth in all regions. Pricing accounted for 6.0

percentage points of growth and volume and mix contributed 0.6

percentage points. The Zacks Consensus Revenue Estimate was $14.8

billion for the fourth-quarter, while it was $54.3 billion for the

fiscal 2011 period.

Excluding acquisition-related integration program costs and

spin-off costs, underlying operating income surged 7.4% to $1.7

billion in the fourth quarter. It grew 9.7% to $7.2 billion in

fiscal 2011, driven by effective input cost management, favorable

foreign currency and volume/mix growth. However, these were

partially offset by unrealized gains/losses from hedging activities

and the negative impacts from the Starbucks CPG business, a unit of

Starbucks Corporation (SBUX).

Underlying operating margin was 11.6% in the fourth quarter,

while it was 13.3% in the fiscal year of 2011.

Kraft also expects its organic revenue guidance for 2012 to grow

approximately 5%, including a negative impact of up to one

percentage point from product pruning in North America.

Region-wise Details

North America: Revenue surged 8.9% in the

fourth-quarter, while 5.1% in the fiscal 2011. Organic revenue

bolstered 7.0% and 4.8% in the quarter and the full-year of 2011,

respectively. Higher pricing across each business segment and

significant contributions from new products fueled the growth.

Segment operating income increased 12.7% in the reported

quarter, while it grew 3.6% in fiscal 2011, on the back of

continued focus on cost management.

Europe: Revenues climbed 7.5% in the

fourth-quarter, while 14.9% in the fiscal 2011. Organic revenue

increased 3.1% and 4.6% in the quarter and the full-year of 2011,

respectively. Positive volume/mix contributed to the increase.

Power brands also fueled the growth by more than 7%.

Segment operating income increased 1.2% in the reported quarter,

while it grew 26.1% in fiscal 2011, on the back of continued

investment behind Power brands.

Developing Markets: Revenues delivered strong

growth despite volatile market conditions, with a rise of 2.4% in

the fourth-quarter, while 16.2% in the fiscal 2011. Organic revenue

increased 7.2% and 11.2% in the quarter and the full-year of 2011,

respectively. Higher pricing and positive volume/mix contributed to

the increase. Power brands also fueled the growth by approximately

17%.

Segment operating income increased 30.8% in the reported

quarter, while it grew 30.2% in fiscal 2011.

Other Financial Details

At the end of December 31, 2011, Kraft had $4.5 billion of

operating cash flows compared with $3.7 billion at the prior year

end. Free cash flow at the end of the year decreased to $3.24

billion from 3.26 billion generated at the end of December 31,

2010.

Kraft’s plan to spin off its North American grocery business to

its shareholders and split itself into two independent public

companies is on track. It will split into a high-growth global

snacks business with estimated revenue of approximately $32 billion

and a high-margin North American grocery business with estimated

revenue of approximately $16 billion, by the end of 2012.

Global snacks will consist of the current Kraft Foods Europe and

Developing Markets units as well as the North American snacks and

confectionery businesses. The North American grocery business would

consist of the current U.S. Beverages, Cheese, Convenient Meals and

Grocery segments and the non-snack categories in Canada and Food

Service.

Kraft expects that it will incur one-time restructuring,

transition and transaction costs of $1.6 billion to $1.8 billion as

it prepares to separate into two companies. In addition, the

company estimates that it may incur between $400 million and $800

million of potential debt breakage and financing fees as it

executes a migration of debt to the North American grocery

company.

The Way Forward

The company continues to make tangible progress in cost

management, primarily driving negative overhead growth to cut costs

and improve effectiveness.

Further, we are encouraged by the company’s recently

strengthened business model by increasing investments in promotion

and marketing that increased its pricing power and improved product

positioning. These initiatives are paying off now, and margins are

improving.

However, higher commodity costs, increased marketing expenses,

competition from private labels and presence of tough competitors

like Unilever Plc. (UL) and ConAgra Foods

Inc. (CAG) concern us.

Currently, we prefer to rate the stock as Neutral. Further,

Kraft Foods holds the Zacks #3 Rank, which translates into a

short-term Hold rating.

CONAGRA FOODS (CAG): Free Stock Analysis Report

KRAFT FOODS INC (KFT): Free Stock Analysis Report

STARBUCKS CORP (SBUX): Free Stock Analysis Report

UNILEVER PLC (UL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

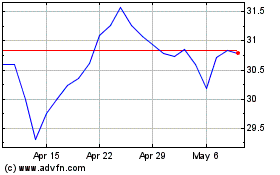

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From May 2024 to Jun 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Jun 2023 to Jun 2024