Current Report Filing (8-k)

May 09 2023 - 4:34PM

Edgar (US Regulatory)

0001227654false00012276542023-05-052023-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 5, 2023

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-31921 | 36-3972986 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

9900 West 109th Street

Suite 100

Overland Park, KS 66210

(Address of principal executive offices)

(913) 344-9200

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | CMP | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On May 5, 2023, Compass Minerals International, Inc. (the “Company”) entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Fortress North America, LLC (“FNA”), FRS Group LLC (“FRS”, and together with FNA, “Fortress”) and those persons set forth on Exhibit A and Exhibit B attached thereto (collectively, the “Sellers”), pursuant to which the Company purchased the remaining membership interests of FNA and FRS not previously owned by the Company, which represented approximately 55% of the ownership of Fortress (the “Transaction”). As previously disclosed, the Company has been an approximately 45% minority owner of Fortress, a next-generation fire retardant company, since its most recent investment in January, 2022.

The Transaction signed and closed on May 5, 2023. As a result of the Transaction, the Company became the sole member of FNA and FRS, and FNA and FRS became wholly-owned indirect subsidiaries of the Company.

As consideration for the Transaction and in exchange for the purchased membership interests, the Company has (1) paid approximately $26 million in cash to the Sellers (the “Closing Payment”), (2) agreed to make certain payments of up to $28 million in aggregate, which may be made in cash or in the Company’s common stock, par value $0.01 per share (the “Common Stock”) at the election of the Company, to the Sellers upon achievement of certain milestones as set forth in the Purchase Agreement (the “Milestone Payments”) and (3) agreed to pay to the Sellers certain annual cash earn-out payments in an amount equal to $0.30 per gallon of Fortress fire retardant sold for a period of 10 years after the closing, contingent upon Fortress achieving certain EBITDA performance thresholds, as provided in the Purchase Agreement (the “Earn-Out Payments”). Additionally, the Company and Fortress have established a bonus pool to be allocated to certain employees and contractors of Fortress.

The Purchase Agreement contains certain representations, warranties and covenants which the Company believes are customary for transactions of this type. The disclosure regarding the Purchase Agreement has been included herewith to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about the Company or any of its subsidiaries or affiliates, including Fortress. The representations, warranties and covenants contained in the Purchase Agreement were made by the parties thereto only for purposes of the Purchase Agreement and as of specific dates as set forth therein; were made solely for the benefit of the parties to the Purchase Agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Purchase Agreement; may have been made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors and security holders. Accordingly, such representations, warranties and covenants or any descriptions thereof should not be relied on by any persons as characterizations of the actual state of facts and circumstances of the Company or any of its subsidiaries or affiliates at the time they were made and the information in the Purchase Agreement should be considered in conjunction with the entirety of the factual disclosure about the Company in the Company’s public reports filed with the Securities and Exchange Commission (the “Commission”). Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q covering the date of the Purchase Agreement.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K relating to the Transaction is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On May 9, 2023, the Company issued a press release announcing the signing of the Membership Interest Purchase Agreement and the consummation of the Transaction. A copy of this press release is being furnished as Exhibit 99.1 and incorporated by reference herein.

The information contained in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

FORWARD-LOOKING STATEMENTS

This Current Report may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. Forward-looking statements may generally be identified by the use of words such as “may”, “will”, “anticipate”, “expect”, “intend”, “seek”, “estimate”, “would”, “should”, “plan”, “potential”, “future”, “target”, “project” or variations of these words or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. Forward-looking statements may include, without limitation, statements about the Company’s or Fortress’ future performance or financial condition, the Transaction, the Sellers or their respective affiliates, the anticipated potential benefits of the Transaction and the consideration payable pursuant to the Transaction (including potential future Milestone Payments and Earn-Out Payments). These statements are based on the Company’s current expectations, estimates and projections and involve risks and uncertainties that could cause the Company’s or Fortress’ actual results to differ materially. The differences could be caused by a number of factors including, without limitation, those factors identified in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s Annual and Quarterly Reports on Forms 10-K and 10-Q, as well as the Company’s other Commission filings. Opinions expressed are current opinions as of the date hereof. Investors are cautioned not to place undue reliance on such forward-looking statements and should rely on their own assessment of an investment. The Company undertakes no obligation to update any forward-looking statements made in this Current Report to reflect future events or developments, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Exhibit Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| COMPASS MINERALS INTERNATIONAL, INC. |

| | |

Date: May 9, 2023 | By: | /s/ Lorin Crenshaw |

| | Name: Lorin Crenshaw |

| | Title: Chief Financial Officer |

| | |

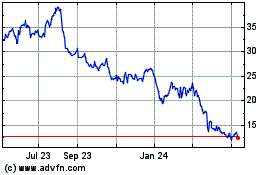

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From May 2024 to Jun 2024

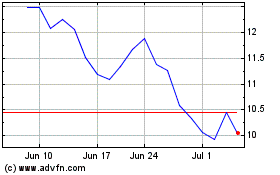

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Jun 2023 to Jun 2024