Current Report Filing (8-k)

October 18 2022 - 4:17PM

Edgar (US Regulatory)

0001227654false00012276542022-10-182022-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 18, 2022

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-31921 | 36-3972986 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

9900 West 109th Street

Suite 100

Overland Park, KS 66210

(Address of principal executive offices)

(913) 344-9200

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | CMP | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Introductory Note.

As previously disclosed, on September 14, 2022, Compass Minerals International, Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Koch Minerals & Trading LLC (“KM&T” and together with certain of its affiliates as outlined in the Stock Purchase Agreement, the “Investor”), pursuant to which the Company agreed to issue and sell in a private placement to the Investor 6,830,700 shares of the Company’s common stock, par value $0.01 per share for an aggregate purchase price of $252 million (the “Private Placement”).

On October 18, 2022, the Company consummated the Private Placement and issued 6,830,700 shares at a per share purchase price of $36.87 to the Investor (through its affiliate KM&T Investment Holdings, LLC) pursuant to the terms of the Stock Purchase Agreement (the “Purchase Price”).

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth under the Introductory Note of this Current Report on Form 8-K relating to the Private Placement is incorporated by reference herein.

The issuance of the Issued Shares was exempt from registration pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The Investor represented to the Company that it is an “accredited investor” as defined in Rule 501 of the Securities Act and that the Issued Shares are being acquired solely for investment and with no intention to distribute, and appropriate legends will be affixed to any certificates evidencing any Issued Shares.

Item 7.01 Regulation FD Disclosure.

On October 18, 2022, the Company issued a press release announcing the consummation of the Private Placement. A copy of this press release is being furnished as Exhibit 99.1 and incorporated by reference herein.

The information contained in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

FORWARD-LOOKING STATEMENTS

This Current Report may contain forward-looking statements, including, without limitation, statements about the company's lithium brine development project; the KM&T investment; synergies between the company and KM&T and Koch Industries, Inc. (“KII”); ability to leverage KM&T and KII expertise and build value, progress the lithium project, strengthen the balance sheet and enhance execution capabilities; use of investment proceeds; project funding needs; construction of a DLE plant; eventual LCE production capacity; and value creation opportunities. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters, and may generally be identified by the use of words such as. We use words such as “may,” “would,” “could,” “should,” “will,” “likely,” “expect,” “anticipate,” “believe,” “intend,” “plan,” “potential,” “future,” “target,” “forecast,” “outlook,” “project,” “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements or forward-looking information. These statements are based on the company’s current expectations and involve risks and uncertainties that could cause the company’s actual results to differ materially. The differences could be caused by a number of factors, including, without limitation, (i) weather conditions, (ii) inflation, the cost and availability of transportation for the distribution of the company’s products and foreign exchange rates, (iii) pressure on prices and impact from competitive products, (iv) any inability by the company to successfully implement its strategic priorities or its cost-saving or enterprise optimization initiatives, and (v) the risk that the company may not realize the expected financial or other benefits from the proposed development of its lithium mineral resource or its investment in Fortress North America. For further information on these and other risks and uncertainties that may affect the company’s business, see the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the company’s Transition Report on Form 10-KT for the transition period ended Sept. 30, 2021 and its Quarterly Reports on Form 10-Q for the quarters ended Dec. 31, 2021, March 31, 2022 and June 30, 2022 filed with the SEC, as well as the company's other SEC filings. The company undertakes no obligation to update any forward-looking statements made in this press release to reflect future events or developments, except as required by law. Because it is not possible to predict or identify all such factors, this list cannot be considered a complete set of all potential risks or uncertainties.

The Company has completed an initial assessment to define the lithium resource at the Company’s existing operations in accordance with applicable Commission regulations, including Subpart 1300. Pursuant to Subpart 1300, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company’s mineral resource estimates, including estimates of the lithium resource, are based on many factors, including assumptions regarding extraction rates and duration of mining operations, and the quality of in-place resources. For example, the process technology for commercial extraction of lithium from brines with low lithium and high impurity (primarily magnesium) is still developing. Accordingly, there is no certainty that all or any part of the lithium mineral resource identified by the Company’s initial assessment will be converted into an economically extractable mineral reserve.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Exhibit Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| COMPASS MINERALS INTERNATIONAL, INC. |

| | |

Date: October 18, 2022 | By: | /s/ Lorin Crenshaw |

| | Name: Lorin Crenshaw |

| | Title: Chief Financial Officer |

| | |

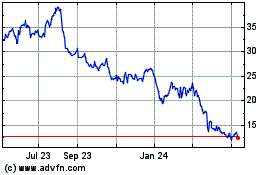

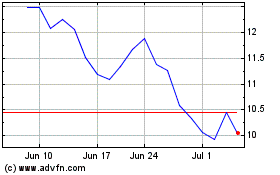

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From May 2024 to Jun 2024

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Jun 2023 to Jun 2024