SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For January, 2024

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO

DE SÃO PAULO – SABESP

Publicly-held company

CNPJ No 43.776.517/0001-80

NIRE nº

35.3000.1683-1

MATERIAL FACT

Companhia de Saneamento Básico

do Estado de São Paulo – Sabesp (“Company”), in compliance with the terms set forth in Resolution of the

Brazilian Securities and Exchange Commission (“CVM”) No. 44, of August 23, 2021, as in effect, hereby informs its shareholders

and the market in general that, on this date, it was approved, in the 1002nd meeting of the Board of Directors of the Company,

the 31th issuance of simple, unsecured and non-convertible debentures, in up to three series (“Issuance”

and “Debentures”, respectively), for public distribution, under the automatic registration rite, targeted to professional

investors, pursuant to CVM Resolution No. 160 (“CVM Resolution 160”), of July 13, 2022, as amended, to Law 6,385, of

December 7, 1976, as amended, as well as other legal and regulatory provisions (“Offer”), in the initial amount of

two billion and five hundred million reais (R$ 2,500,000,000.00), on the respective issuance date, noting that the amount originally offered

may be increased by up to twenty percent (20%), that is, by up to five hundred million reais (R$ 500,000,000.00) ("Hot Issue

"), in which case it may reach a total volume of up to three billion reais (R$ 3,000,000,000.00).

It shall be adopted the procedure for collecting

the investment intentions of the potential professional investors (bookbuilding procedure) in the Debentures, in order to define together

with the Company: (i) the number of series of the Offer; (ii) the number of Debentures to be placed in each series of the Offer, according

to communicating vessels system; (iii) the final interest to be used in connection to the remuneration of each series; and (iv) the placing

or not placing of the additional debentures, in the connection to the Hot Issue, as well as the series where should be allocated this

additional debentures and, consequently, the aggregate amount of the Offer. It shall not be allowed the partial distribution of the Debentures.

The Offer will target professional investors only,

in compliance with Articles 11 and 13 of CVM Resolution 30, of May 11, 2021, as amended. The process of structuring the Offer and distribution

of the Debentures will be undertaken by a consortium of financial institutions belonging to the Securities Distribution System.

The entirety of the proceeds from the Issuance

will be used to the refinance of its financial commitments maturing in 2024 and to replenish and reinforce the Company's cash position.

The amount equivalent to the entirety of the proceeds

raised through the Issuance will be allocated to the project categories described in the Framework (as defined below).

The Debentures are characterized as "ESG

bonds for the use of sustainable and blue resources" ("Sustainable and Blue Debentures"), based on the Issuer's

commitment to allocate an amount equivalent the entirety of the proceeds raised in the Issuance to the categories of projects described

in the Sustainable Finance Framework ("Framework") prepared in December 2023 by the Company, which was duly verified

and validated by means of a second opinion ("Second Opinion") issued by Attest ESG da Exame Ltda, in its capacity as

independent appraiser.

This Material Fact is disclosed by the Company

exclusively for informative purposes, in accordance with current regulations, and should not be interpreted or considered, for all legal

purposes, as a material or effort to sell or offer.

In accordance

with the applicable regulations and according to the rules of conduct set forth therein, additional information about the Company and

the Offer shall be viewed on CVM’s website (http://www.gov.br/cvm) and the Company’s website (https://ri.sabesp.com.br).

São Paulo, January 29, 2024.

Catia Cristina Teixeira Pereira

Chief Financial Officer and Investor Relations

Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: January 29, 2024

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

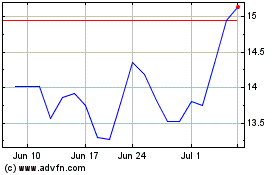

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

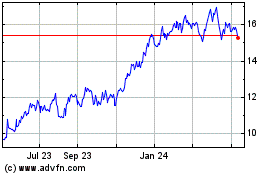

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024