Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 29 2023 - 3:10PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For November, 2023

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

Organizational Instrument |

|

Type:

Institutional Policy |

Phase:

Effective |

|

Title:

NOMINATION |

Number and Version:

PI0033 – V.2 |

|

Issuer:

PS |

Approver:

VIRGINIA TAVARES RIBEIRO - VIRGINIARIBEIRO |

Validity of the 1st version:

10/29/2018 |

Validity of this version:

10/25/2023 |

|

Related Areas (Coverage):

SABESP |

Processes:

- |

| 1.1 | This Nomination Policy establishes the rules for

nominating candidates for the Board of Directors, statutory Audit Committee, statutory Executive Board (“Management’s Members”),

and Fiscal Council, as applicable, of Companhia de Saneamento Básico do Estado de São Paulo ("Sabesp" or "Company"). |

| 1.2 | The nomination of members for the other statutory

and non-statutory Committees of the Company will follow the terms of this Policy, observing, where applicable, the procedures established

for members of the Board of Directors and the general and specific rules provided in the internal regulations of the respective Committee

and/or Internal Regulations of the Board of Directors, as applicable. |

| 2.1 | Determine the criteria for the nomination of the

Management’s Members under Law 6,404 of December 15, 1976, Law 13,303 of June 30, 2016, State Decree 62,349 of December 26, 2016,

the Company's Bylaws, the Novo Mercado Regulation, and the Manual for Listed Companies on the NYSE, as well as other regulations, policies,

and instructions issued by law, the Brazilian Securities and Exchange Commission (CVM), and the Company at any time, aiming to regulate

topics related to this Policy. |

| 2.2 | Establish the rules that will substantiate the compliance

verification of the nomination process for Management’s Members and Fiscal Council members, in compliance with current standards

and legislation, prioritizing the best corporate governance practices with due transparency. |

| 3.1 | Company Shareholders and Board members must observe

the Nomination Policy in choosing the Management’s Members and Fiscal Council members under their responsibility. |

| 3.1.1 | It is the exclusive responsibility of the Governor

of the State of São Paulo to nominate members of the Company's

Executive Board. |

| 3.2 | This Nomination Policy must be made widely available

to shareholders and the market through the Company's website, on the Investor Relations page, and on the website of the Brazilian Securities

and Exchange Commission. |

| 3.3 | The supervision of the nomination and evaluation

process of Executive Officers, Board of Directors members, and Fiscal Council members will be the responsibility of the Eligibility and

Advisory Committee, under Article 10 of Federal Law 13,303/2016 and the Company's Bylaws. |

| 3.3.1 | The minutes of the meetings of the Eligibility and

Advisory Committee are disclosed to the market through the Company’s website, on the Investor Relations page, and on the Brazilian

Securities and Exchange Commission website, to verify compliance by the appointed members with the requirements defined in this Nomination

Policy. |

|

Organizational Instrument |

|

Type:

Institutional Policy |

Phase:

Effective |

|

Title:

NOMINATION |

Number and Version:

PI0033 – V.2 |

|

Issuer:

PS |

Approver:

VIRGINIA TAVARES RIBEIRO - VIRGINIARIBEIRO |

Validity of the 1st version:

10/29/2018 |

Validity of this version:

10/25/2023 |

|

Related Areas (Coverage):

SABESP |

Processes:

- |

| 3.3.2 | All candidates must have the availability of time

for the position for which they are appointed, and if they are public administration members, they cannot receive compensation for participating

in more than two Boards of Directors or Fiscal Councils of a public company or government-controlled company. |

| 3.4 | Candidates for the Board of Directors and Executive

Board must be citizens of unblemished reputation and notable knowledge, considering, whenever possible, diversity criteria including diversity

of experiences, behaviors, cultural aspects, age, and gender, as well as educational background and professional experience to allow the

Company to benefit from a plurality of arguments and a decision-making process with greater quality and security, and must alternatively

meet one of the requirements of subitems “a”, “b”, and “c” of item I and, cumulatively, the requirements

of items II and III of Article 17 of Law 13,303/2016. |

| 3.4.1 | At any time, a Board member may be identified as

a corporate risk expert, provided they demonstrate experience in leadership positions in risk and compliance management, including, but

not limited to, director or manager of risk and compliance, CEO of an insurance company, consultant or manager in consultancy focused

on risk management and compliance, executive member of a risk and compliance committee; excluded from this criterion those with only the

curriculum of statutory executive officers in general (without a specific focus on risks and compliance), members of risk committees or

subcommittees, members of the military or politics, executives in controllership, among others. |

| 3.5 | Fiscal Council members must comply with the requirements

and prohibitions of Article 26 of Law 13,303/2016 and Article 147 of Law 6,404/1976. |

| 3.6 | Compliance with legal requirements and the provisions

of Sabesp’s Bylaws must be proven through a signed statement and presentation of documents, as established in the Registration Form

for Nomination as Management’s Members and Fiscal Council Members. |

| 3.6.1 | Additionally, Management’s Members must fill

out the Corporate Governance Form and inform the Company’s Corporate Governance Secretariat whenever there is a change in their

registration details. |

| 3.7 | The requirements outlined in the main section of

Article 17, item I, may be waived in the case of a Company employee being appointed as an Management’s Members, provided that the

minimum legal requirements of Article 17, Paragraph 5, items I, II, and III of Law 13,303/2016 are met. |

| 3.8 | The representative of employees on the Board of

Directors must meet the same requirements as other Management’s Members and will be elected directly by employees, in a separate

vote, under the Bylaws. |

| 3.9 | The controlling shareholder will be guaranteed the

power to elect the majority of the Board of Directors members, under item “a” of Article 116 of Law 6,404/1976. |

|

Organizational Instrument |

|

Type:

Institutional Policy |

Phase:

Effective |

|

Title:

NOMINATION |

Number and Version:

PI0033 – V.2 |

|

Issuer:

PS |

Approver:

VIRGINIA TAVARES RIBEIRO - VIRGINIARIBEIRO |

Validity of the 1st version:

10/29/2018 |

Validity of this version:

10/25/2023 |

|

Related Areas (Coverage):

SABESP |

Processes:

- |

| 3.10 | In addition to the requirements of Article 17 of

Law 13,303/16, those appointed to the Audit Committee must observe Article 25 of the same Law, Paragraph 2 of Article 31- C of CVM Resolution

23/2021, Section 301(3) of the Sarbanes-Oxley Act (American Law 107-204), and Section 303A-07 of the NYSE Listed Company Manual. |

| 3.10.1 | Audit Committee members must have sufficient technical

knowledge in accounting and finance, and at least 1 (one) of them must have recognized experience in internationally accepted corporate

accounting, analysis, preparation, and evaluation of financial statements, knowledge of internal controls, and market information disclosure

policies, and shall be responsible for coordination (financial expert). |

| 3.10.2 | At least one Audit Committee member must have sufficient

technical knowledge in the sanitation sector or a related area (industry expert). |

| 3.10.3 | The Audit Committee will be composed of 3 (three)

Board members who cumulatively meet the requirements of independence, technical knowledge, and availability of time. |

| 3.10.4 | Having served a term of office for any period, Audit

Committee members can only reintegrate into such a body in the Company after a minimum of 3 (three) years from the end of their term of

office. |

| 3.11 | Compliance with these conditions must be proven through

documentation, as established in the Registration Form for the Audit Committee, kept at the Company’s headquarters for a minimum

period of 5 (five) years, counted from the last day of the Audit Committee member’s term of office. |

| 3.12 | The provisions of Paragraph 2 of Article 17 and

its items, as well as Paragraph 3 of Law 13,303/16, are prohibited for appointment to the Board of Directors and Executive Board. |

| 3.13 | Those appointed as independent members of the Board

of Directors must also observe the requirements and prohibitions of Article 22 of Law 13,303/2016 and Paragraph 2 of Article 6 of Exhibit

K of CVM Resolution 80/22. The appointment of a person whose voting right in Board of Directors meetings is bound by a shareholder’s

agreement relating to the Company is prohibited. |

| 3.14 | To verify the qualification of the Independent Board

Member, the situations described below must be analyzed to ascertain whether they imply the loss of independence of the Independent Board

Member due to the characteristics, magnitude, and extent of the relationship: |

I.

Has a family relationship by affinity up to the second degree with the controlling shareholder, Company’s

Management’s member, or administrator of the controlling shareholder;

II.

is or has been, in the last 3 (three) years, an employee or executive officer of affiliates, subsidiaries,

or commonly controlled companies;

III.

has commercial relationships, including service provision or supply of general inputs, with the Company,

its controlling shareholder, or affiliates, subsidiaries, or commonly controlled companies;

|

Organizational Instrument |

|

Type:

Institutional Policy |

Phase:

Effective |

|

Title:

NOMINATION |

Number and Version:

PI0033 – V.2 |

|

Issuer:

PS |

Approver:

VIRGINIA TAVARES RIBEIRO - VIRGINIARIBEIRO |

Validity of the 1st version:

10/29/2018 |

Validity of this version:

10/25/2023 |

|

Related Areas (Coverage):

SABESP |

Processes:

- |

IV.

holds a position with decision-making power in the conduct of the activities of a company or entity

that has commercial relationships with the Company or its controlling shareholder;

V.

receives other compensation from the Company, its controlling shareholder, affiliates, subsidiaries,

or commonly controlled companies other than that related to acting as a member of the Board of Directors or committees of the Company,

its controlling shareholder, its affiliates, subsidiaries, or commonly controlled companies,

except cash benefits derived from participation in the company's share capital and benefits from supplementary pension plans; and

| VI. | founded the company and has significant influence over it. |

| 3.15 | It is prohibited to appoint for the Fiscal Council

members of the management bodies and employees of the Company or a subsidiary or of the same group, as well as the spouse or relative

up to the third degree, of a Company Management’s Members, according to Law 13,303/16, State Decree 62,349/16, and Federal Decree

8,945/16. |

| 3.16 | The provisions of items I and II of Paragraph 3 of

Article 147 of Law 6,404/76 and items IV and V of Paragraph 2 of Article 17 of Law 13,303/16 must be proven by a Statement in the terms

defined by the Brazilian Securities and Exchange Commission (CVM). |

| 3.17 | The appointment of candidates for the Board of Directors,

Fiscal Council, and Executive Board must observe the rules provided for in Law 6,404 of December 15, 1976, to which they are subject. |

| 3.18 | Minority shareholders linked to the controlling

shareholder or under their determining influence are prohibited from requesting inclusion or contributing with their shares to, together

with other shareholders, reach the minimum percentage necessary for inclusion, in the Remote Voting Form, of candidates to run for positions

on the Board of Directors and Fiscal Council to be filled in a separate election reserved for minority shareholders. |

| 3.19 | The provisions of this Policy that expressly reflect

the text of the applicable legislation will lose their effectiveness if the respective legal provisions are repealed or declared unconstitutional. |

| Referenced Exhibits (Exhibit Base) |

Referenced Documents |

Registration Information |

| --- |

--- |

--- |

| Attached Files (Supplementary Files of the Organizational Instrument) |

| PI0033v2 – Appendix 01 – Nomination of Members.pdf |

|

|

Appendix:

Nomination of Members |

Number

0001 |

|

Attached to Instrument:

PI0033v2 – Nomination |

| 1. | Nominations must be submitted to the Company, who will take the internal actions,

as required. |

| 2. | Nominations must include: |

| 2.1. | Updated and signed résumé; |

2.2 Copy of identity document

with photograph, showing RG [General Register] and CPF [Individual Taxpayers Register] numbers;

| 2.3. | Copy of proof of address of the nominee issued in the past ninety (90) days; |

| 2.4. | Registration form provided for in item 3.6 of the

Company’s Nomination Policy, and the relevant supporting documents; and |

| 2.5. | Corporate Governance Form provided by the Company's Corporate Governance Secretariat;

and |

| 2.6. | The declarations required by this Policy. |

| 3. | If applicable, the Eligibility and Advisory Committee

will be responsible for checking compliance of the nomination process. |

| 3.1. | In the absence of important documents, the Eligibility

and Advisory Committee will return the nomination process to the CEO, who will request the missing information. |

| 3.2. | Upon completion of the analysis, the minutes of

the meeting will be issued by the Eligibility and Advisory Committee in accordance with State Capital Protection Board (CODEC) Resolution

No. 002/2023, and forwarded to the CEO for continuity of the process. |

| 3.3. | The investiture of the candidate will be conditioned

on the verification, by the Eligibility and Advisory Committee, of the requirements and prohibitions applicable to the position. |

| 4. | The nominations made by shareholders must be presented

in a timely manner, so that compliance of the nomination can be checked. |

4.1 Exceptionally,

the nominations made during the Meeting may be analyzed by the Meeting’s Secretary.

| 5. | Regarding the nomination for the Board of Officers,

members of the Audit Committee and other Committees, the Chairman of the Board of Directors may invite the candidate to a previous presentation

before the Directors in a joint session, and any director may request verification of additional requirements regarding the integrity

and technical skills of the candidate. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: November 28, 2023

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

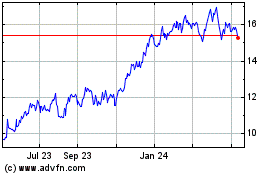

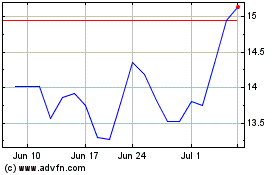

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024