SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For August, 2023

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

CIA. DE SANEAMENTO

BÁSICO DO ESTADO DE SÃO PAULO - SABESP

Catia Cristina Teixeira

Pereira

Chief Financial Officer

and Investor Relations Officer

Luiz Roberto Tiberio

Head of Investor Relations

SABESP announces

2Q23 results

São

Paulo, August 10, 2023 - Companhia de Saneamento Básico do Estado de São Paulo - SABESP (B3: SBSP3; NYSE: SBS), one

of the largest water and sewage services providers in the world based on the number of customers, announces today its second quarter

of 2023 results. The Company’s operating and financial information, except when indicated otherwise is presented in Brazilian

Reais, in accordance with the Brazilian Corporate Law. All comparisons in this release, unless otherwise stated, refer to the same

period of 2022. |

|

Highlights

In 2Q23, adjusted EBITDA

totaled R$ 2,220.8 million, up by R$ 710.9 million (+47.1%) over the R$ 1,509.9 million reported in 2Q22, excluding the effects of the

Incentivized Dismissal Program - IDP. Consequently, the EBITDA margin adjusted to the IDP reached 36.1% compared to 28.7%, and the adjusted

EBITDA margin (excluding both the IDP and the construction revenue) reached 45.4% compared to 36.7%.

Including the effects

of the IDP, adjusted EBITDA totaled R$ 1,691.2 million, up by R$ 181.3 million (+12.0%) over the R$ 1,509.9 million reported in 2Q22.

Excluding the provision

for the IDP, net income came to R$ 1,273.3 million in 2Q23, up by R$ 850.9 million (+201%). Including the effect of the IDP, net income

came to R$ 743.7 million in 2Q23, compared to the R$ 422.4 million reported in 2Q22, an increase of R$ 321.3 million (+76.1%).

Revenue from sanitation

services

Increase of R$ 740.8

million (+16.6%), impacted by: (i) an average impact of 11.9%, resulting from the tariff adjustments of 12.8% since May 2022 and 9.6%

since May 2023; (ii) a 2.6% increase in total billed volume; and (iii) higher average tariff due to the increase in ranges with higher

consumption in the residential category.

Incentivized Dismissal

Program – IDP

In June 2023, the Company

implemented the IDP to pacifically reduce the workforce. The deadline for registrations in the IDP was from June 1 to 30, 2023, and had

the adhesion of 1,862 employees, whose employment terminations are being analyzed and will occur from July 1, 2023 to June 30, 2024.

In 2Q23, the Company

recorded a provision of R$ 529.6 million for the indemnity incentives of the employees who joined the IDP, with a payback slightly higher

than 12 months.

Impacts from the exchange

variation

In 2Q23, there was a

positive exchange variation, with a YoY impact of R$ 328.5 million, due to the depreciation of the U.S. Dollar and the Yen in 2Q23, compared

to the appreciation of the U.S. Dollar and the depreciation of the Yen in 2Q22, as shown below:

| |

2Q23 |

2Q22 |

| Debt in foreign currency - R$ million |

2,475.7 |

2,695.1 |

| Foreign currency debt as a percentage of total debt - % |

13.2 |

15.2 |

| U.S. variation in the quarter - % |

(5.1) |

10.6 |

| Yen variation in the quarter - % |

(12.8) |

(1.1) |

Organizational structure

and public tender of Olímpia

Over the last six months,

the Company underwent a restructuring process and reorganized its Executive Board so that decision-making considers a unified and strategic

corporate vision. The management has been making efforts towards gains in efficiency and discipline in capital allocation, including a

review of the capex plan and the approval of the Shared Services Center, which is being constituted.

In May, competing with

eight companies, the Company was awarded a contract to provide water supply and sewage services in the municipality of Olímpia

for a period of 30 years. It was the first time in history that a state-owned company won a basic sanitation bidding process in Brazil.

| |

|

|

|

|

|

|

|

|

R$ million |

| |

|

2Q23 |

2Q22 |

Var. (R$) |

% |

1H23 |

1H22 |

Var. (R$) |

% |

| |

Revenue from sanitation services |

5,192.3 |

4,451.5 |

740.8 |

16.6 |

10,101.6 |

8,749.7 |

1,351.9 |

15.5 |

| |

Construction revenue |

1,263.2 |

1,154.7 |

108.5 |

9.4 |

2,442.8 |

2,042.9 |

399.9 |

19.6 |

| |

COFINS and PASEP/TRCF taxes |

(301.0) |

(340.8) |

39.8 |

(11.7) |

(691.4) |

(656.8) |

(34.6) |

5.3 |

| (=) |

Net operating income |

6,154.5 |

5,265.4 |

889.1 |

16.9 |

11,853.0 |

10,135.8 |

1,717.2 |

16.9 |

| |

Costs and expenses |

(3,909.4) |

(3,230.1) |

(679.3) |

21.0 |

(7,083.2) |

(6,107.0) |

(976.2) |

16.0 |

| |

Construction costs |

(1,234.8) |

(1,129.5) |

(105.3) |

9.3 |

(2,387.8) |

(1,997.0) |

(390.8) |

19.6 |

| |

Equity pickup |

10.0 |

5.9 |

4.1 |

69.5 |

16.4 |

11.5 |

4.9 |

42.6 |

| |

Other operating income (expenses), net |

50.5 |

2.4 |

48.1 |

2,004.2 |

65.1 |

4.9 |

60.2 |

1,228.6 |

| (=) |

Earnings before financial result, income

tax, and social contribution |

1,070.8 |

914.1 |

156.7 |

17.1 |

2,463.5 |

2,048.2 |

415.3 |

20.3 |

| |

Financial result |

(14.0) |

(324.4) |

310.4 |

(95.7) |

(273.6) |

15.7 |

(289.3) |

(1,842.7) |

| (=) |

Earnings before income tax and s

ocial contribution |

1,056.8 |

589.7 |

467.1 |

79.2 |

2,189.9 |

2,063.9 |

126.0 |

6.1 |

| |

Income tax and social contribution |

(313.1) |

(167.3) |

(145.8) |

87.1 |

(698.8) |

(665.9) |

(32.9) |

4.9 |

| (=) |

Net income |

743.7 |

422.4 |

321.3 |

76.1 |

1,491.1 |

1,398.0 |

93.1 |

6.7 |

| |

Earnings per share (R$)* |

1.09 |

0.62 |

|

|

2.18 |

2.05 |

|

|

* Number of shares = 683,509,869

Adjusted EBITDA reconciliation

(non-accounting measures)

| |

|

|

|

|

|

|

|

|

R$ million |

| |

|

2Q23 |

2Q22 |

Var. (R$) |

% |

1H23 |

1H22 |

Var. (R$) |

% |

| |

Net income |

743.7 |

422.4 |

321.3 |

76.1 |

1,491.1 |

1,398.0 |

93.1 |

6.7 |

| |

IDP |

529.6 |

- |

529.6 |

- |

529.6 |

- |

529.6 |

- |

| (=) |

Adjusted Net Income (excluding IDP) |

1,273.3 |

422.4 |

850.9 |

201.4 |

2,020.7 |

1,398.0 |

622.7 |

44.5 |

| |

Income tax and social contribution |

313.1 |

167.3 |

145.8 |

87.1 |

698.8 |

665.9 |

32.9 |

4.9 |

| |

Financial result |

14.0 |

324.4 |

(310.4) |

(95.7) |

273.6 |

(15.7) |

289.3 |

(1,842.7) |

| |

Other operating income (expenses), net |

(50.5) |

(2.4) |

(48.1) |

2,004.2 |

(65.1) |

(4.9) |

(60.2) |

1,228.6 |

| |

Depreciation and amortization |

670.9 |

598.2 |

72.7 |

12.2 |

1,327.9 |

1,187.9 |

140.0 |

11.8 |

| (=) |

Adjusted EBITDA (excluding IDP)* |

2,220.8 |

1,509.9 |

710.9 |

47.1 |

4,255.9 |

3,231.2 |

1,024.7 |

31.7 |

| |

(%) Adjusted EBITDA Margin (excluding IDP) |

36.1 |

28.7 |

|

|

35.9 |

31.9 |

|

|

| |

(%) Adjusted EBITDA Margin (excluding IDP) on Net Revenue, excluding Construction |

45.4 |

36.7 |

|

|

45.2 |

39.9 |

|

|

* Adjusted EBITDA corresponds to income

before (i) other operating income (expenses), net; (ii) financial result; (iii) income tax and social contribution; and (iv) depreciation

and amortization expenses.

In 2Q23, the net operating

revenue, which considers construction revenue, totaled R$ 6,154.5 million, an increase of 16.9% over 2Q22.

Excluding construction

costs and the provision for IDP, costs and expenses totaled R$ 3,379.8 million, an increase of R$ 149.7 million (R$ 4.6%). Considering

the IDP and construction costs, costs and expenses totaled R$ 5,144.2 million, an increase of 18.0%.

Adjusted EBIT, of R$

1,020.3 million, increased by 11.9% over the R$ 911.7 million recorded in 2Q22.

Excluding the effects

of IDP, adjusted EBITDA was R$ 2,220.8 million in 2Q23 (R$ 8,112.3 million in the last 12 months), with an adjusted EBITDA margin of 36.1%

(34.1% in the last 12 months).

Considering the IDP and

the effects of revenue and construction costs, adjusted EBITDA totaled R$ 1,691.2 million, up by 12.0% over the R$ 1,509.9 million reported

in 2Q22 (R$ 7,582.7 million in the last 12 months).

Excluding the effects

of revenue and construction costs, the adjusted EBITDA margin reached 34.0% in 2Q23, compared to 36.1% in 2Q22 (40.3% in the last 12 months).

The Adjusted EBITDA margin

was 27.5% in 2Q23, compared to 28.7% in 2Q22 (31.9% in the last 12 months).

| 2. | Revenue from sanitation services |

The gross operating revenue

from sanitation services, which excludes construction revenue, totaled R$ 5,192.3 million in 2Q23, an increase of R$ 740.8 million (+16.6%)

over the R$ 4,451.5 million recorded in 2Q22.

The main factors that

led to the increase were:

| · | An average impact of 11.9%, resulting from the tariff adjustments of 12.8% since May 2022 and 9.6% since

May 2023; |

| · | An increase of 2.6% in the total billed volume; and |

| · | A rise in the average tariff due to the increase in ranges with higher consumption in the residential

category. |

Construction revenue

increased by R$ 108.5 million (+9.4%), due to higher investments made.

The following tables

show the water and sewage billed volumes, on a quarter-over-quarter and year-over-year basis per customer category.

| WATER AND SEWAGE BILLED VOLUME1 - million m3 |

| |

Water |

Sewage |

Water + Sewage |

| Category |

2Q23 |

2Q22 |

% |

2Q23 |

2Q22 |

% |

2Q23 |

2Q22 |

% |

| Residential |

476.9 |

465.9 |

2.4 |

418.7 |

406.7 |

3.0 |

895.6 |

872.6 |

2.6 |

| Commercial |

47.7 |

46.7 |

2.1 |

45.5 |

44.8 |

1.6 |

93.2 |

91.5 |

1.9 |

| Industrial |

8.8 |

8.7 |

1.1 |

9.6 |

9.5 |

1.1 |

18.4 |

18.2 |

1.1 |

| Public |

12.1 |

11.7 |

3.4 |

10.9 |

10.1 |

7.9 |

23.0 |

21.8 |

5.5 |

| Total retail |

545.5 |

533.0 |

2.3 |

484.7 |

471.1 |

2.9 |

1,030.2 |

1,004.1 |

2.6 |

| Wholesale² |

11.6 |

12.1 |

(4.1) |

5.4 |

4.1 |

31.7 |

17.0 |

16.2 |

4.9 |

| Total |

557.1 |

545.1 |

2.2 |

490.1 |

475.2 |

3.1 |

1,047.2 |

1,020.3 |

2.6 |

| |

Water |

Sewage |

Water + Sewage |

| Category |

1H23 |

1H22 |

% |

1H23 |

1H22 |

% |

1H23 |

1H22 |

% |

| Residential |

948.6 |

935.2 |

1.4 |

831.1 |

813.4 |

2.2 |

1,779.7 |

1,748.6 |

1.8 |

| Commercial |

94.1 |

91.1 |

3.3 |

89.2 |

87.7 |

1.7 |

183.3 |

178.8 |

2.5 |

| Industrial |

17.4 |

17.0 |

2.4 |

19.0 |

18.7 |

1.6 |

36.4 |

35.7 |

2.0 |

| Public |

22.2 |

21.3 |

4.2 |

20.0 |

18.7 |

7.0 |

42.2 |

40.0 |

5.5 |

| Total retail |

1,082.3 |

1,064.6 |

1.7 |

959.3 |

938.5 |

2.2 |

2,041.6 |

2,003.1 |

1.9 |

| Wholesale² |

23.8 |

24.2 |

(1.7) |

10.8 |

9.9 |

9.1 |

34.6 |

34.1 |

1.5 |

| Total |

1,106.1 |

1,088.8 |

1.6 |

970.1 |

948.4 |

2.3 |

2,076.2 |

2,037.2 |

1.9 |

1. Not reviewed by external auditors

2. Wholesale includes volumes

of reuse water and non-domestic sewage

| 5. | Costs, administrative & selling expenses and construction costs |

Costs, administrative

and selling expenses increased by R$ 679.3 million in 2Q23 (+21.0%). Excluding the provision for IDP, the increase was R$ 149.7 million

(R$ 4.6%).

Costs, administrative

and selling expenses as a percentage of net revenue (excluding construction revenue) were 79.9% in 2Q23 compared to 78.6% in 2Q22. Excluding

the effects of IDP, the share in 2Q23 was 69.1%.

R$ million

| |

2Q23 |

2Q22 |

Var. (R$) |

% |

1H23 |

1H22 |

Var. (R$) |

% |

Salaries, payroll charges and benefits,

and Pension plan obligations |

1,347.4 |

776.0 |

571.4 |

73.6 |

2,091.6 |

1,444.2 |

647.4 |

44.8 |

| General supplies |

90.4 |

109.5 |

(19.1) |

(17.4) |

177.9 |

181.4 |

(3.5) |

(1.9) |

| Treatment supplies |

138.5 |

142.5 |

(4.0) |

(2.8) |

303.4 |

289.8 |

13.6 |

4.7 |

| Services |

643.1 |

599.4 |

43.7 |

7.3 |

1,268.1 |

1,111.4 |

156.7 |

14.1 |

| Electricity |

386.8 |

376.1 |

10.7 |

2.8 |

782.6 |

788.0 |

(5.4) |

(0.7) |

| General expenses |

395.6 |

356.7 |

38.9 |

10.9 |

710.4 |

635.8 |

74.6 |

11.7 |

Share of the municipal government

in the collection |

207.0 |

172.3 |

34.7 |

20.1 |

393.5 |

335.2 |

58.3 |

17.4 |

| Other general expenses |

188.6 |

184.4 |

4.2 |

2.3 |

316.9 |

300.6 |

16.3 |

5.4 |

| Tax expenses |

19.3 |

18.8 |

0.5 |

2.7 |

41.1 |

37.9 |

3.2 |

8.4 |

| Depreciation and amortization |

670.9 |

598.2 |

72.7 |

12.2 |

1,327.9 |

1,187.9 |

140.0 |

11.8 |

| Allowance for doubtful accounts |

217.4 |

252.9 |

(35.5) |

(14.0) |

380.2 |

430.6 |

(50.4) |

(11.7) |

| Costs, administrative & selling expenses |

3,909.4 |

3,230.1 |

679.3 |

21.0 |

7,083.2 |

6,107.0 |

976.2 |

16.0 |

% of net revenue (excluding construction

revenue) |

79.9 |

78.6 |

|

|

75.3 |

75.5 |

|

|

% of net revenue (excluding construction

revenue and IDP) |

69.1 |

78.6 |

|

|

69.6 |

75.5 |

|

|

Salaries, payroll charges

and benefits, and Pension plan obligations

The R$ 571.4 million

increase (+73.6%) recorded in 2Q23 was mainly due to:

| · | An increase of R$ 529.6 million, due to the provision created for employees who joined the IDP; and |

| · | The salary adjustment of 4.9% (R$ 19.5 million) in May 2023 and the application of 1% referring to the

Career and Salary Plan in February 2023, partially offset by the 1.5% decline in the average number of employees. |

General supplies

Decrease of R$ 19.1 million

(-17.4%), spread across various items, the main ones as follows:

| · | R$ 3.3 million with fuel and lubricants; |

| · | R$ 1.9 million for the maintenance of water and sewage networks, connections, and systems; and |

| · | R$ 1.8 million with the conservation of furniture and facilities. |

Services

Service expenses totaled

R$ 643.1 million, an increase of R$ 43.7 million (+7.3%) over the R$ 599.4 million recorded in 2Q22. The main increases were:

| · | R$ 31.8 million paid to technical services, mainly IT consulting, maintenance, and support; and |

| · | R$ 23.1 million for the maintenance of water and sewage networks, connections, and systems. |

The increases above were

offset by the R$ 11.2 million decrease in advertising services.

Electricity

Electricity expenses

totaled R$ 386.8 million in 2Q23, an increase of R$ 10.7 million (+2.8%) compared to the R$ 376.1 million recorded in 2Q22. The main factor

that contributed to this variation was the R$ 11.3 million increase in expenses with natural gas, referring to a contract for water pumping

between reservoirs. In 2Q23, services were not used but the payment was made to fulfill the contractual obligations of the termination,

which was in the “Take or Pay” model, the only option offered by Comgás to supply the Rio Grande Taiaçupeba

Raw Water Pumping Plant at the time of contracting in 1Q21.

The Free Market Tariffs

(FMT) accounted for 54.3% of total expenses in 2Q23 (49.4% in 2Q22), while the Regulated Market Tariffs (RMT) accounted for 45.7% in the

same period (50.6% in 2Q22).

The variations in the

FMT and RMT tariffs and consumption were offset against each other and did not have a significant impact on total expenses.

General expenses

Increase of R$ 38.9 million

(+10.9%), totaling R$ 395.6 million in 2Q23, compared to the R$ 356.7 million recorded in 2Q22, mainly from the higher provision for transfer

to the municipal funds for environmental sanitation and infrastructure, of R$ 34.7 million.

Depreciation and amortization

The R$ 72.7 million increase

(+12.2%) was mainly due to the beginning of operations of intangible assets, totaling R$ 5.9 billion.

Allowance for doubtful

accounts

Decrease of R$ 35.5 million

(-14.0%), from R$ 252.9 million in 2Q22 to R$ 217.4 million in 2Q23, due to higher recovery through the execution of agreements in 2Q23.

| 6. | Other net operating income (expenses) |

Increase of R$ 48.1 million,

mainly due to a higher application of contractual fines to suppliers in 2Q23, of R$ 44.4 million.

| |

|

|

|

R$ million |

| |

2Q23 |

2Q22 |

Var. (R$) |

% |

| Financial expenses, net of income |

(219.4) |

(157.2) |

(62.2) |

39.6 |

| Monetary and exchange variations, net |

205.4 |

(167.2) |

372.6 |

(222.8) |

| Financial Result |

(14.0) |

(324.4) |

310.4 |

(95.7) |

Financial expenses,

net of revenue

| |

|

|

|

|

R$ million |

| |

2Q23 |

2Q22 |

Var. (R$) |

% |

| Financial expenses |

|

|

|

|

| |

Interest and charges on domestic borrowings and financing |

(254.0) |

(215.8) |

(38.2) |

17.7 |

| |

Interest and charges on international borrowings and financing |

(23.2) |

(9.8) |

(13.4) |

136.7 |

| |

Other financial expenses |

(96.4) |

(92.7) |

(3.7) |

4.0 |

| Total financial expenses |

(373.6) |

(318.3) |

(55.3) |

17.4 |

| Financial revenue |

154.2 |

161.1 |

(6.9) |

(4.3) |

| Financial expenses, net of revenue |

(219.4) |

(157.2) |

(62.2) |

39.6 |

The main impacts resulted

from:

| · | An increase of R$ 38.2 million in interest and

charges on domestic borrowings and financing, mainly due to: (i) funding from IDB INVEST 2022 and IDB INVEST 2023 (in July 2022 and May

2023, respectively), with an impact of R$ 25.4 million in interest in local currency; and (ii) an increase in the average DI rate (from

12.38% in 2Q22 to 13.65% in 2Q23); |

| · | An increase of R$ 13.4 million in interest and charges on international borrowings and financing, mainly

due to an increase in the interest rate of some contracts with IDB and IBRD, due to the variation of the SOFR rate (from 1.5% in June

2022 to 5.1% in June 2023); and |

| · | A decrease of R$ 6.9 million in financial revenues, mainly on financial investments in 2Q23, as a result

of lower average cash. |

Monetary and exchange

variation, net

| |

|

|

|

|

R$ million |

| |

2Q23 |

2Q22 |

Var. (R$) |

% |

| Monetary and exchange variations on liabilities |

|

|

|

|

| |

Monetary variations on borrowings and financing |

(38.1) |

(91.3) |

53.2 |

(58.3) |

| |

Exchange variations on borrowings and financing |

263.7 |

(64.8) |

328.5 |

(506.9) |

| |

Other monetary variations |

(71.2) |

(80.1) |

8.9 |

(11.1) |

| Total monetary and exchange variations on liabilities |

154.4 |

(236.2) |

390.6 |

(165.4) |

| Monetary and exchange variations on assets |

51.0 |

69.0 |

(18.0) |

(26.1) |

| Monetary and exchange variations, net |

205.4 |

(167.2) |

372.6 |

(222.8) |

The positive effect of

net monetary and exchange variations in 2Q23 was R$ 372.6 million, especially due to:

| · | A decrease of R$ 53.2 million in monetary variations on borrowings and financing, mainly because of the

decrease in the Amplified Consumer Price Index - IPCA (from 2.22% in 2Q22 to 0.76% in 2Q23); and |

| · | An exchange variation gain of R$ 328.5 million on borrowings and financing, due to the depreciation of

the U.S. Dollar and the Yen in 2Q23 (-5.14% and -12.83%, respectively), compared to the appreciation of the U.S. Dollar and the depreciation

of the Yen in 2Q22 (10.56% and -1.08%, respectively). |

| 8. | Income tax and social contribution |

The R$ 145.8 million

increase in 2Q23 was mainly due to:

| · | An increase of R$ 889.1 million in net operating revenue; and |

| · | Exchange variation gains, with an impact of R$ 328.5 million. |

The factors above were

mainly offset by the R$ 784.6 million increase in costs and expenses, which include a provision of R$ 529.6 million referring to the IDP

and the R$ 105.3 million increase in construction costs.

| Operating indicators* |

2Q23 |

2Q22 |

% |

| Water connections1 |

10,242 |

9,916 |

3.3 |

| Sewage connections1 |

8,728 |

8,500 |

2.7 |

| Population directly served – water2 |

28.1 |

27.8 |

1.1 |

| Population directly served – sewage2 |

24.8 |

24.6 |

0.8 |

| Number of employees |

12,221 |

12,381 |

(1.3) |

| Water volume produced in the quarter3 |

734 |

711 |

3.2 |

| Water volume produced in the semester3 |

1,467 |

1,424 |

3.0 |

| IPM - Micromeasured Water Loss (%)3 |

29.5 |

28.4 |

3.9 |

| IPDt (liters/connection x day)3 |

256 |

250 |

2.4 |

1. Total active and inactive connections in thousands of units at the end of the period. Excludes water connections in Mauá in

2Q22

2. In millions of inhabitants,

at the end of the period. Excludes wholesale supply

3. Millions of m³. Excludes

volumes produced in the municipalities of Aguaí, Mauá, and Tapiratiba in 2Q22

* Not reviewed by external auditors.

| Economic variables at the end of the quarter * |

2Q23 |

2Q22 |

| IPCA - Amplified Consumer Price Index1 |

0.76 |

2.22 |

| INPC - National Consumer Price Index1 |

0.79 |

2.12 |

| IPC - Consumer Price Index1 |

0.66 |

2.33 |

| DI - Interbank Deposit2 |

13.65 |

12.38 |

| U.S. dollar3 |

4.8192 |

5.2380 |

| Japanese yen3 |

0.0334 |

0.0386 |

1. Accrued in the quarter (%)

2. Average quarterly rate (%)

3. Ptax sale rate on the last

day

* Not reviewed by external auditors

| 10. | Borrowings and financing |

On June 14, the Company

executed a financing agreement of R$ 1 billion with the International Finance Corporation - IFC, an institution of the World Bank. The

financing is linked to annual social goals, which characterizes it as a sustainability-linked loan. The funds are being directed to investments

in basic sanitation infrastructure in the São Paulo Metropolitan Region from 2021 to 2025. The investments are being destined for

the expansion of the sewage system to improve water quality in the Pinheiros River, in the city of São Paulo.

Also in the second quarter,

the Second Tranche of Loan 12.676-0, totaling R$ 470 million, with the Inter-American Investment Corporation - IDB Invest was contracted.

This operation is guaranteed by PROPARCO (Societé de Promotion et de Participation Pour la Cóperation Économic

S.A.), of the AFD Group (Agence Française de Développement). Together with other existing financing, the funds will

be used in the Fourth Stage of the Tietê River Depollution Project, the largest environmental sanitation program in Brazil

and part of Integra Tietê.

R$ Thousand

| DEBT PROFILE |

| |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 onwards |

TOTAL |

% of total |

| Local Currency |

|

|

|

|

|

|

|

|

|

| Debêntures |

360,436 |

1,204,595 |

1,334,339 |

1,212,543 |

1,357,016 |

655,401 |

1,543,790 |

7,668,120 |

41 |

| Caixa Econômica Federal |

50,923 |

106,589 |

113,242 |

120,311 |

127,810 |

135,646 |

981,275 |

1,635,796 |

9 |

| BNDES |

117,665 |

235,331 |

214,938 |

205,029 |

192,377 |

72,783 |

222,545 |

1,260,668 |

7 |

| National IDB |

123,444 |

249,099 |

260,899 |

330,209 |

315,069 |

420,959 |

2,357,473 |

4,057,152 |

22 |

| IFC |

7,600 |

22,800 |

34,200 |

41,800 |

60,800 |

83,600 |

493,053 |

743,853 |

4 |

| Lease¹ |

47,884 |

50,309 |

34,600 |

33,492 |

36,754 |

40,336 |

92,066 |

335,441 |

2 |

| Leasing (others)² |

37,476 |

17,633 |

10,550 |

4,500 |

708 |

- |

- |

70,867 |

0 |

| Others |

5,505 |

2,994 |

2,760 |

142 |

- |

- |

- |

11,401 |

0 |

| Interest and other charges |

438,951 |

7,193 |

- |

- |

- |

- |

- |

446,144 |

2 |

| Total in Local Currency |

1,189,884 |

1,896,543 |

2,005,528 |

1,948,026 |

2,090,534 |

1,408,725 |

5,690,202 |

16,229,442 |

87 |

| Foreign Currency |

|

|

|

|

|

|

|

|

|

| IDB |

24,766 |

49,532 |

62,432 |

25,799 |

25,799 |

25,799 |

377,410 |

591,537 |

3 |

| IBRD |

14,650 |

29,299 |

29,299 |

29,299 |

29,299 |

29,299 |

261,176 |

422,321 |

2 |

| JICA |

71,571 |

143,141 |

143,141 |

143,141 |

143,141 |

143,141 |

652,125 |

1,439,401 |

8 |

| Interest and other charges |

22,488 |

- |

- |

- |

- |

- |

- |

22,488 |

0 |

| Total in Foreign Currency |

133,475 |

221,972 |

234,872 |

198,239 |

198,239 |

198,239 |

1,290,711 |

2,475,747 |

13 |

| TOTAL |

1,323,359 |

2,118,515 |

2,240,400 |

2,146,265 |

2,288,773 |

1,606,964 |

6,980,913 |

18,705,189 |

100 |

1. Refers to work contracts signed as Assets Lease;

2. Obligations related to leasing

agreements, mainly vehicle leases

Covenants

The table below shows

the most restrictive clauses in 2Q23:

| |

Covenants |

| Adjusted EBITDA / Adjusted Financial Expenses |

Equal to or higher than 2.80 |

| EBITDA / Financial Expenses Paid |

Equal to or higher than 2.35 |

| Adjusted Net Debt / Adjusted EBITDA |

Equal to or lower than 3.80 |

| Net Debt / Adjusted EBITDA |

Equal to or lower than 3.50 |

| Total Adjusted Debt / Adjusted EBITDA |

Lower than 3.65 |

| Other Onerous Debt1 / Adjusted EBITDAA |

Equal to or lower than 1.30 |

| Adjusted Current Ratio |

Higher than 1.00 |

1 “Other Onerous

Debts” corresponds to the sum of pension plan obligations and healthcare plan, installment payment of tax debts, and installment

payment of debts with the electricity supplier.

In 2Q23, the Company

met the requirements of its borrowings and financing agreements.

Investments totaled R$

1,294.3 million in 2Q23, presented as additions in the notes to the quarterly information under Contract Asset, Intangible Assets, and

Property, Plant and Equipment, of R$ 1,278.1 million, R$ 6.9 million, and R$ 9.3 million, respectively. Cash disbursed in 2Q23 referring

to investments, including from previous periods, totaled R$ 944.7 million.

The table below shows

investments broken down by water, sewage:

| |

|

|

R$ million |

| |

Water |

Sewage |

Total |

| Investment |

564.5 |

729.8 |

1,294.3 |

|

For more information, please contact:

Investor Relations

Tel. +55 (11) 3388-8793 / 9267

E-mail: sabesp.ri@sabesp.com.br

Statements contained in this press

release may contain information that is forward-looking and reflects management's current view and estimates of future economic circumstances,

industry conditions, SABESP performance, and financial results. Any statements, expectations, capabilities, plans and assumptions contained

in this press release that do not describe historical facts, such as statements regarding the declaration or payment of dividends, the

direction of future operations, the implementation of principal operating and financing strategies and capital expenditure plans, the

factors or trends affecting financial condition, liquidity or results of operations are forward-looking statements within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties. There is no guarantee that

these results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions,

industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially

from current expectations. |

Income Statement

| Brazilian Corporate Law |

|

R$ '000 |

| |

2Q23 |

2Q22 |

| Net Operating Income |

6,154,537 |

5,265,400 |

| Operating Costs |

(4,210,675) |

(3,531,903) |

| Gross Profit |

1,943,862 |

1,733,497 |

| Operating Expenses |

|

|

| Selling |

(285,237) |

(233,525) |

| Estimated losses with doubtful accounts |

(217,426) |

(252,932) |

| Administrative expenses |

(430,852) |

(341,202) |

| Other operating revenue (expenses), net |

50,487 |

2,351 |

| Operating Income Before Shareholdings |

1,060,834 |

908,189 |

| Equity Result |

10,047 |

5,923 |

| Earnings Before Financial Results, net |

1,070,881 |

914,112 |

| Financial, net |

(278,528) |

(261,419) |

| Exchange gain (loss), net |

264,481 |

(62,955) |

| Earnings before Income Tax and Social Contribution |

1,056,834 |

589,738 |

| Income Tax and Social Contribution |

|

|

| Current |

(402,699) |

(180,174) |

| Deferred |

89,608 |

12,894 |

| Net Income for the period |

743,743 |

422,458 |

| Registered common shares ('000) |

683,509 |

683,509 |

| Earnings per shares - R$ (per share) |

1.09 |

0.62 |

| Depreciation and Amortization |

(670,772) |

(598,165) |

| Adjusted EBITDA |

1,691,166 |

1,509,926 |

| % over net revenue |

27.5% |

28.7% |

Balance Sheet

| Brazilian Corporate Law |

|

R$ '000 |

| ASSETS |

06/30/2023 |

|

12/31/2022 |

| Current assets |

|

|

|

| Cash and cash equivalents |

1,327,173 |

|

1,867,485 |

| Financial investments |

929,178 |

|

1,677,873 |

| Trade receivables |

3,300,714 |

|

3,062,574 |

| Related parties and transactions |

219,803 |

|

205,793 |

| Inventories |

120,614 |

|

124,247 |

| Restricted cash |

37,873 |

|

37,474 |

| Currrent recoverable taxes |

244,820 |

|

242,906 |

| Other assets |

82,032 |

|

66,312 |

| Total current assets |

6,262,207 |

|

7,284,664 |

| |

|

|

|

| Noncurrent assets |

|

|

|

| Trade receivables |

216,758 |

|

215,234 |

| Related parties and transactions |

951,059 |

|

950,950 |

| Escrow deposits |

195,530 |

|

170,093 |

| National Water and Sanitation Agency – ANA |

5,138 |

|

9,193 |

| Other assets |

176,429 |

|

146,362 |

| |

|

|

|

| Equity investments |

154,907 |

|

110,765 |

| Investment properties |

46,702 |

|

46,726 |

| Contract assets |

8,674,300 |

|

8,613,968 |

| Intangible assets |

40,399,382 |

|

39,320,871 |

| Property, plant and equipment |

371,209 |

|

338,939 |

| Total noncurrent assets |

51,191,414 |

|

49,923,101 |

| |

|

|

|

| Total assets |

57,453,621 |

|

57,207,765 |

| |

|

|

|

| LIABILITIES AND EQUITY |

06/30/2023 |

|

12/31/2022 |

| Current liabilities |

|

|

|

| Trade payables |

256,679 |

|

430,946 |

| Borrowings and financing |

2,578,954 |

|

2,245,960 |

| Accrued payroll and related charges |

900,340 |

|

498,504 |

| Taxes and contributions |

232,698 |

|

293,461 |

| Dividends and interest on capital payable |

709 |

|

741,725 |

| Provisions |

1,019,086 |

|

924,038 |

| Services payable |

588,456 |

|

723,242 |

| Public-Private Partnership – PPP |

207,467 |

|

222,413 |

| Program Contract Commitments |

61,381 |

|

100,188 |

| Other liabilities |

604,203 |

|

476,865 |

| Total current liabilities |

6,449,973 |

|

6,657,342 |

| |

|

|

|

| Noncurrent liabilities |

|

|

|

| Borrowings and financing |

16,126,235 |

|

16,712,711 |

| Deferred income tax and social contribution |

101,914 |

|

189,278 |

| Deferred Cofins and Pasep |

162,591 |

|

159,723 |

| Provisions |

649,245 |

|

686,746 |

| Pension obligations |

2,135,644 |

|

2,150,191 |

| Public-Private Partnership – PPP |

2,616,942 |

|

2,736,768 |

| Program Contract Commitments |

12,566 |

|

12,197 |

| Other liabilities |

450,950 |

|

569,276 |

| Total noncurrent liabilities |

22,256,087 |

|

23,216,890 |

| |

|

|

|

| Total liabilities |

28,706,060 |

|

29,874,232 |

| |

|

|

|

| Equity |

|

|

|

| Paid-up capital |

15,000,000 |

|

15,000,000 |

| Profit reserve |

12,078,963 |

|

12,155,890 |

| Other comprehensive income |

177,643 |

|

177,643 |

| Retained earnings |

1,490,955 |

|

- |

| Total equity |

28,747,561 |

|

27,333,533 |

| |

|

|

|

| Total equity and liabilities |

57,453,621 |

|

57,207,765 |

Cash Flow

| Brazilian Corporate Law |

|

|

R$ '000 |

| |

|

Jan-Jun

2023 |

|

Jan-Jun

2022 |

| Cash flow from operating activities |

|

|

|

| |

Profit before income tax and social contribution |

2,189,778 |

|

2,063,940 |

| Adjustment for Net income reconciliation: |

|

|

|

| |

Depreciation and amortization |

1,327,916 |

|

1,187,911 |

| |

Residual value of property, plant and equipment and intangible assets written-off |

5,304 |

|

6,132 |

| |

Allowance for doubtful accounts |

380,231 |

|

430,626 |

| |

Provision and inflation adjustment |

196,776 |

|

196,108 |

| |

Interest calculated on loans and financing payable |

616,940 |

|

467,713 |

| |

Inflation adjustment and foreign exchange gains (losses) on loans and financing |

(238,972) |

|

(367,162) |

| |

Interest and inflation adjustment losses |

11,586 |

|

16,962 |

| |

Interest and inflation adjustment gains |

(123,034) |

|

(23,479) |

| |

Financial charges from customers |

(196,290) |

|

(192,460) |

| |

Margin on intangible assets arising from concession |

(54,921) |

|

(45,930) |

| |

Provision for Consent Decree (TAC) and Knowledge retention program (KRP) |

529,245 |

|

(650) |

| |

Equity result |

(16,381) |

|

(11,506) |

| |

Interest and inflation adjustment (Public-Private Partnership) |

245,427 |

|

245,923 |

| |

Provision from São Paulo agreement |

159,970 |

|

277,747 |

| |

Pension obligations |

103,842 |

|

94,333 |

| |

Other adjustments |

13,816 |

|

7,639 |

| |

|

5,151,233 |

|

4,353,847 |

| Changes in assets |

|

|

|

| |

Trade accounts receivable |

(407,986) |

|

(430,272) |

| |

Accounts receivable from related parties |

4,834 |

|

(13,148) |

| |

Inventories |

3,633 |

|

(9,373) |

| |

Recoverable taxes |

(1,914) |

|

(11,109) |

| |

Escrow deposits |

(17,109) |

|

3,418 |

| |

Other assets |

(36,865) |

|

(17,477) |

| Changes in liabilities |

|

|

|

| |

Trade payables and contractors |

(411,979) |

|

(223,755) |

| |

Services payable |

(294,756) |

|

(165,337) |

| |

Accrued payroll and related charges |

1,847 |

|

33,207 |

| |

Taxes and contributions payable |

(240,857) |

|

(64,599) |

| |

Deferred Cofins/Pasep |

2,868 |

|

1,221 |

| |

Provisions |

(139,229) |

|

(136,721) |

| |

Pension obligations |

(118,389) |

|

(110,672) |

| |

Other liabilities |

(473,658) |

|

(209,921) |

| Cash generated from operations |

3,021,673 |

|

2,999,309 |

| |

|

|

|

|

| |

Interest paid |

(902,553) |

|

(574,784) |

| |

Income tax and contribution paid |

(606,093) |

|

(660,655) |

| |

|

|

|

|

| Net cash generated from operating activities |

1,513,027 |

|

1,763,870 |

| |

|

|

|

|

| Cash flows from investing activities |

|

|

|

| |

Acquisition of contract assets and intangible assets |

(1,505,652) |

|

(1,494,633) |

| |

Restricted cash |

(399) |

|

(3,125) |

| |

Financial investments |

828,829 |

|

442,878 |

| |

Investment properties |

(6,304) |

|

- |

| |

Purchases of tangible assets |

(40,286) |

|

(22,800) |

| Net cash used in investing activities |

(723,812) |

|

(1,077,680) |

| |

|

|

|

|

| Cash flow from financing activities |

|

|

|

| |

Loans and financing |

|

|

|

| |

Proceeds from loans |

833,095 |

|

1,181,233 |

| |

Repayments of loans |

(917,982) |

|

(1,007,862) |

| |

Payment of interest on shareholders'equity |

(823,671) |

|

(603,541) |

| |

Public-Private Partnership – PPP |

(380,199) |

|

(316,230) |

| |

Program Contract Commitments |

(40,770) |

|

(14,150) |

| Net cash used in financing activities |

(1,329,527) |

|

(760,550) |

| |

|

|

|

|

| Increase/(decrease) in cash and cash equivalents |

(540,312) |

|

(74,360) |

| |

|

|

|

|

| Represented by: |

|

|

|

| Cash and cash equivalents at beginning of the year |

1,867,485 |

|

717,929 |

| Cash and cash equivalents at end of the year |

1,327,173 |

|

643,569 |

| Increase/(decrease) in cash and cash equivalents |

(540,312) |

|

(74,360) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: August 11, 2023

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

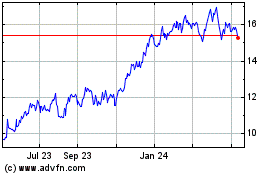

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

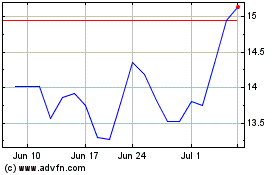

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024