SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For August, 2023

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE

SÃO PAULO – SABESP

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID

(CNPJ): 43.776.517/0001-80

Company Registry (NIRE): 35.3000.1683-1

NOTICE TO THE MARKET

Companhia de Saneamento Básico

do Estado de São Paulo – Sabesp (“Company” or “Sabesp”) hereby informs its shareholders

and the market in general that, on August 03, 2023, it received Official Letter 230/2023/CVM/SEP/GEA-2 (“Official Letter”),

issued by the Brazilian Securities and Exchange Commission (CVM), as transcribed as follows:

“Official Letter 230/2023/CVM/SEP/GEA-2

Rio de Janeiro, August 3, 2023.

Att. to Mrs.

Catia Cristina Teixeira Pereira

Investor Relations Officer of

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO – SABESP

Phone: (11) 3388-8247

Email: dri@sabesp.com.br

C/C: Issuers Listing and Supervision Department of B3 S.A. –

- Brasil, Bolsa, Balcão.

Emails: emissores@b3.com.br; ana.pereira@b3.com.br; ana.zane@b3.com.br

Subject: Request for clarification – News article disclosed in the media

Dear Officer,

1. We refer to the news article published on the website of the

Valor Econômico newspaper on 07/31/2023, at 7:40 p.m., entitled “Sabesp’s privatization will be carried out through

follow-on, with a reference investor, says Tarcísio de Freitas”, with the following content:

Sabesp’s privatization will be carried out

through follow-on, with a reference investor, says Tarcísio de Freitas

The model is more flexible than that of Eletrobras,

which dispersed capital; the initiative foresees investments of R$ 66 billion until 2029

By Taís Hirata, Valor — São Paulo

07/31/2023 7:40 p.m.

Sabesp’s privatization will be carried out through

follow-on, where the São Paulo State’s stake of 50.3% will be diluted — the final stake has not been defined yet. The

idea is to diversify the company’s capital but with the possibility of having

reference shareholders, i.e. investors who could

have increased control over the business, thus ensuring a long-term direction for the company.

This model was announced late Monday afternoon (31),

right after a meeting of the Investment Partnerships Program (PPI).

The model chosen for Sabesp is similar to that of

Eletrobras but with increased flexibility to allow shareholders to have greater control over the business. This format was selected

among three others that underwent studies with the IFC: a follow-on with total dilution of capital, with no defined control, similar to

what happened with Eletrobras; the partial sale of the company; and the total sale of the company.

The model proposed by the State foresees investments

of R$ 66 billion until 2029, which is R$ 10 billion more than Sabesp’s current investment plan, and acceleration of the universalization

goal - from 2033 to 2029.

Investments include, in addition to universalization

of services, water desalination projects, investments in the cleaning of the Tietê and Pinheiros rivers, and interventions to address

climate change.

No definition of golden share yet

The State will continue as Sabesp’s minority shareholder

but the exact stake is yet to be defined, said the governor.

The São Paulo government has not decided yet

whether or not to have a golden share in Sabesp once the company is privatized. This decision will be made in the future, according to

Natalia Resente, Secretary of Environment, Infrastructure, and Logistics.

“The State will stay to ensure the acceleration

of the universalization goals and the objectives brought about by the privatization. The State will stay to monitor the company’s

growth but the matter regarding the golden share will be analyzed”, she said.

Sabesp’s privatization should also include

clauses for the participation of private shareholders but the idea is to have reference investors, i.e. shareholders with greater control

to direct the company with a long-term vision, says Rafael Benini, Secretary of Investment Partnerships. The idea is not to have majority

shareholders or necessarily create a controlling block, he says.

The reference shareholder could have slightly larger

shareholding and guaranteed seats on the board of directors, Benini explains.

However, these definitions are yet to be detailed. “The

idea is not to have anyone controlling the company, but a few shareholders with seats on the board to direct the company. But we are still

not certain about having a controlling block. We currently want to prevent that while having shareholders capable of directing the company”,

he said.

2. Concerning the content of the news article, especially the highlighted

excerpts, we hereby request that you state whether the information contained in said news article is true, and if so, we request that

you provide additional clarification on the matter and state the reasons why the topics addressed in the highlighted excerpts were

not included in the Material Fact disclosed by the Company on the same day 07/31/2023, at 11:05 p.m.

3. We also request that you inform us if, as indicated in the news

article, the public announcement of the guidelines of the Company’s privatization process model, as defined by the Executive Board

of the State Privatization Program (CDPED), was indeed

made late Monday afternoon (31), right after that body’s

meeting, and, therefore, before the disclosure of a Material Fact by the Company, and if affirmative, the reasons why you believe such

announcement would comply with the provisions of CVM Resolution 44/21.

4. The clarification must include a copy of this Official Letter

and be forwarded through the Empresas.NET System, under the “Comunicado ao Mercado” category, type “Esclarecimentos

sobre questionamentos da CVM/B3”. Compliance with this request for clarification through a Notice to the Market does not exempt

the Company from the responsibility for the untimely disclosure of a Material Fact, according to CVM Resolution 44/21.

5. It is worth noting that according to article 3 of CVM Resolution

44/21, the Investor Relations Officer is responsible for disclosing and informing the CVM and, if applicable, the stock exchange and the

organized over-the-counter market entity where the company’s securities are traded, of any material act or fact occurred or related

to its business, as well as for ensuring its wide and immediate dissemination, simultaneously in all the markets in which such securities

are traded.

6. We would also like to remind the Company that it is obliged

to question management, the controlling shareholders, as well as all other persons with access to material acts or facts, to ascertain

whether they are aware of any information that must be disclosed to the market, as provided for in the sole paragraph of article 4 of

CVM Resolution 44/21.

7. According to the sole paragraph of article 6 of CVM Resolution

44/21, it is the responsibility of controlling shareholders or management of publicly-held companies to – directly or represented

by the Investor Relations Officer – immediately disclose any pending material act or fact to the market in the event of the information

is out of the Company’s control, or if there is atypical fluctuation in the price or traded amount of securities issued by publicly-held

companies, or referenced thereto. Therefore, if any relevant information is leaked (i.e. it has been disclosed by the press), a Material

Fact must be disclosed to the market no matter if said information arises or not from clarification provided by the company’s representatives.

8. We also emphasize that article 8 of CVM Resolution 44/21 sets

forth that it is the responsibility of controlling shareholders, executive officers, members of the board of directors, the fiscal

council, and any other bodies with technical or advisory roles created under statutory provisions, as well as company employees to maintain

the confidentiality of information on material acts or facts of which they have insider knowledge because of the position they hold at

the company until these acts or facts are disclosed to the market, as well as to ensure that their subordinates and third parties

in whom they trust will also maintain the confidentiality of said acts or facts, willfully accepting the consequences for noncompliance

(our highlight).

9. As determined by the Corporate Relations Department, we inform

you that, in the exercise of its legal duties, said administrative authority, under item II of article 9 of Law 6,385/76, and articles

7 and 8 of CVM Resolution 47/21, will impose, by August 4, 2023, a punitive fine of R$1,000.00 (one thousand reais) on the Company,

due to noncompliance with the required regulations, without prejudice to other administrative sanctions.

Clarification:

The Company emphasizes that the studies on the potential privatization

are conducted by the Executive Board of the Privatization Program – CDPED, a body of the São Paulo State Government, the

Company’s controlling shareholder (“Controlling Shareholder”).

In this regard, based on the resolutions taken in the Joint Ordinary

Meeting of the Executive Board of the State Privatization Program and the Board of the State Public-Private Partnerships Program, held

on July 31, 2023 (“CDPED Meeting”), in which Mr. André Salcedo, CEO of Sabesp, participated as a guest, the

Company disclosed a material fact on the same date (“Material Fact”), after the closing of trading on B3 S.A. –

Brasil, Bolsa, Balcão (“B3”) and New York Stock Exchange – NYSE. The Minutes of the 3rd Meeting of the

Investment Partnerships Program of the São Paulo State (PPI-SP), referring to the 39th Joint Ordinary Meeting, concerning the 275th

Ordinary Meeting of the Executive Board of the State Privatization Program, established by State Law 9,361, of 07/05/1996, and the 122nd

Ordinary Meeting of the Board of the State Public-Private Partnerships Program, established by State Law 11,688, of 05/19/2004, can be

found in the edition of the Official Gazette of the State of August 1.

The information contained in the Material Fact reproduces the investments

taken into consideration in the study to approve the Company’s economic and financial capacity, sent in December 2021 to São

Paulo State Utility Services Regulatory Agency – Arsesp, updated by the IPCA, and the decision taken at the CDPED Meeting, notably

the approval of the approach to conducting a public offering of Sabesp’s shares, from which specialized studies will continue to

detail the model to be chosen so that non-definitive, unapproved, or potentially speculative information was not disclosed.

Regarding the chronology of events, the Company highlights:

| |

(i) |

the CDPED Meeting to decide on the privatization model to be adopted was held on July 31,

2023, at 5:00 p.m., and was concluded after the closing of the markets in which the Company’s securities are traded; |

| |

(ii) |

after the CDPED Meeting, around 6:50 p.m., a press conference on the matter was held, during

which the Controlling Shareholder informed the public about the decision and responded to journalists’ questions; and |

| |

(iii) |

subsequently, on the same date, Sabesp promptly disclosed the Material Fact. |

Considering that the decisions regarding the privatization studies

are made by the Controlling Shareholder and subsequently informed to the Company, Sabesp considers that the disclosure of the Material

Fact is timely and appropriate, according to CVM Resolution 44, as it occurred after the CDPED Meeting and after the trading hours on

B3 and NYSE.

The Company also clarifies that it has sought pertinent clarification

from its Controlling Shareholder. In response, through the State Capital Defense Council - CODEC, the São

Paulo State Government issued CODEC Letter 166/2023-SFP-12091,

which is attached hereto.

The Company will keep the market duly informed of any information

that should be disclosed under the applicable regulation.

São Paulo, August 4, 2023.

Catia Cristina Teixeira Pereira

Chief Economic, Financial, and

Investor Relations Officer

São Paulo State Government Treasury

and Planning Department

Codec - State Capital Defense Council

CODEC Letter 166/2023-SFP-12091

São Paulo, on the date of the digital signature.

Dear Mrs.,

We refer to the email from

this Company, received on 08/03/2023, which forwards Official Letter 230//2023/CVM/SEP/GEA-2, of 08/03/2023,

from the Brazilian Securities and Exchange Commission/B3, requesting clarifications on the news article published on 07/31/2023,

in the Valor Econômico newspaper, under the title “Sabesp’s privatization will be carried out through follow-on, with

a reference investor, says Tarcísio de Freitas”.

Presently, as informed

by the Investments Partnerships Secretariat and the Secretariat of Environment, Infrastructure, and Logistics, the Board members, during

the 3rd meeting of the Investment Partnerships Program (PPI) referring to the 39th Joint Ordinary Meeting, concerning the 275th Ordinary

Meeting of the Board of Directors of the State Privatization Program and the 122nd Ordinary Meeting of the Board of the State Public-Private

Partnerships Program, agreed with the approach suggested at the initial phase of studies, namely: the potential benefits of the Company’s

privatization, whether in adding and accelerating investments to achieve universalization goals or in reducing tariffs by using part of

the resources generated in the transaction involving a public offering of company shares.

The PPI Board members also

agreed with the continuation of the next phase of specialized studies for a more in-depth

detailing of the model chosen, under the responsibility

of the Investment Partnerships Secretariat. Finally, it was recommended that the matter be brought back to the Decision-Making Board after

the conclusion of the next phase for analysis and decision regarding the next steps.

Regarding all the specificities

of the public offering model mentioned in the news article, mainly the provision for reference investors, we clarify that, as shown by

the position of the PPI Board, these matters will still be subject to analysis after the conclusion of the next phase of the studies and,

therefore, subject to future resolutions of that Board.

Finally, we would like to

emphasize that the public disclosure of the PPI’s Board position was made after market closing. Both the public disclosure of the

Board’s position and the material fact published by the Company occurred during the non-trading period, thus complying with article

5 of CVM Resolution 44/2021.

It is worth noting that

the Company will be readily informed of all material acts and facts relating to this process so that it can adequately disclose any information

to the market in compliance with common rules.

Sincerely,

ARTHUR LUIS PINHO DE LIMA

Chief of Staff

President of CODEC

To Mrs.

CATIA CRISTINA TEIXEIRA PEREIRA

Chief Financial Officer and Investor Relations Officer of COMPANHIA

DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: August 10, 2023

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

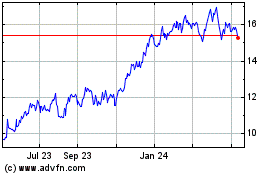

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

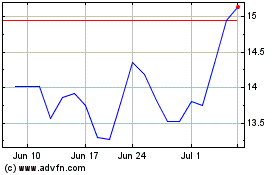

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024