Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 27 2023 - 11:24AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For July, 2023

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| Fiscal Year Starting on: January 1, 2022 |

|

|

| Fiscal Year Ending on: December 31, 2022 |

|

|

| Reference Date: December 31, 2023 |

|

|

| Approved by the Board of Directors on: July 20, 2023 |

|

|

| Section - Principle - Practice |

Option |

Explanation |

| 1.1.1 The company's capital stock shall consist of common shares only. |

Y |

|

| 1.2.1 Shareholders’ agreements shall not bind the exercise of voting rights of any manager or member of any of its supervision and control bodies. |

NA |

|

| 1.3.1 The executive board shall use the shareholders’ meeting to report on the conduct of the Company’s business, wherefore Management shall publish a manual in order to simplifying and encouraging participation in such shareholders’ meetings. |

Y |

|

| 1.3.2 The minutes of any shareholders’ meeting shall enable full understanding of the discussions at the meeting, even if they are drafted in the form of a summary of facts, and provide an identification of the votes cast by the shareholders. |

Y |

|

| 1.4.1 The board of directors shall conduct a critical analysis of the advantages and disadvantages of the protection measures and its characteristics, and especially of pricing parameter and triggers, where applicable, as well as explain such measures and characteristics. |

NA |

|

| 1.4.2 Any provisions rendering it impossible to remove the measure from the bylaws, i.e. those known as ‘immutable clauses’ shall not be used. |

NA |

|

| 1.4.3 Should the bylaws determine that a public offering of shares (OPA) shall be held whenever a shareholder or group of shareholders directly or indirectly achieves a material interest in the voting capital, then the offering pricing rule shall not impose any additions of premiums substantially above the economic value or market value of such shares. |

NA |

|

| 1.5.1 The Company’s bylaws shall set forth that: (i) any transactions characterizing a direct or indirect sale of a controlling equity interest shall be carried out together with a public offering of shares (OPA) directed at all shareholders at the same price and on the same terms as secured by the selling shareholder; and (ii) the managers will opine on the terms and conditions of any corporate restructuring, capital increase or any such other transactions as may give rise to a change in control and state whether they ensure a fair and equitable treatment for the Company’s shareholders. |

Y |

|

| 1.6.1 The bylaws shall set forth that the board of directors shall issue their opinion on any OPA the subject of which are shares or any securities convertible into or exchangeable for shares issued by the Company, which opinion shall contain, among other relevant information, management’s views on any acceptance of such OPA and on the Company’s economic value. |

Y |

|

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 1.7.1 The Company shall prepare and publish an income allocation policy as outlined by the board of directors. Such policy shall provide, among other points, the frequency of dividend payouts and the parameter to be used for determining the relevant amounts (as percentages of the adjusted net profit and the free cash flow, among others). |

Y |

|

| 1.8.1 The bylaws shall clearly and accurately identify the public interest that justified the creation of the mixed-capital company in a specific chapter. |

Y |

The Company's Bylaws clearly and precisely identifies the public interest that justified the creation of Sabesp in Article 2, in “Chapter I - Name, Headquarters, Purpose and Term”, which states that, regarding the provision of basic sanitation services, focusing on their universalization in the State of São Paulo: "ARTICLE 2 – The Company’s main corporate purpose is to render basic sanitation services in view of its universal service in the state of São Paulo, without losing long-term financial sustainability, comprising the following activities: water supply, sanitary sewage, drainage and handling of urban rain water, urban cleaning and handling of solid waste, in addition to other related activities, including the planning, operation and maintenance of production systems, storage, preservation and trading of energy, to itself or third parties and trading of services, products, benefits and rights that, direct or indirectly, result from its assets, projects and activities, and it may also operate as a subsidiary anywhere in the country or abroad providing the services mentioned above." Sabesp was created in 1973 from the consolidation of several water and sewer utility companies in order to plan, execute and operate public utilities in basic sanitation. Brazil’s Federal Constitution sets forth that it is commonly incumbent upon the Union, States and Municipalities to foster basic sanitation programs, whereas the São Paulo State Constitution provides that basic sanitation policies should create and develop institutional and financial mechanisms aimed at ensuring the benefits of sanitation to the entire population, while fostering and implementing common solutions shared between State and Municipalities through regional integrated action plans. |

| 1.8.2 The board of directors shall monitor the Company’s activities and have policies, mechanisms and internal controls in place to determine any costs of serving the public interest, as well as any reimbursement of the Company or the other shareholders and investors by the controlling shareholder. |

Y |

The Board of Directors, which is the joint decision-making body responsible for the Company’s higher governance, shall be convened, under its Internal Regulations, at regular meetings once a month, and at special meetings whenever the Company’s interests so require. Any matters referred to the Board of Directors for review shall be submitted with a proposal approved by the Executive Board or the Company’s relevant bodies, as well as a legal opinion, where necessary for reviewing any particular matter. It is further established that the Board of Directors makes decisions by a majority of votes cast by those attending the relevant meeting, and in the event of a tie, the proposal having received the vote of the director chairing the meeting shall prevail. Additionally, the Board of Directors is advised by an Audit Committee, which holds regular meetings twice a month and special meetings whenever needed. Such Committee is responsible for tracking and monitoring accounting, internal auditing, independent auditing, compliance and risk management activities. The Audit Committee keeps the Board of Directors regularly informed of its activities through opinions, recommendations, reports and decision-making subsidies. The Board of Directors directs, monitors and controls the Company’s activities by performing the following duties, as set forth in article 14 of the Bylaws: (a) approving the strategic planning; (b) approving the business plan and the annual and multi-annual programs; (c) approving the spending and investment budgets; (d) reviewing the achievement of goals and targeted results; (e) deciding on the utility and service pricing and billing policy, subject to the regulatory framework for the relevant sector; (f) monitoring the execution of plans, programs, projects and budgets; (g) setting public policy objectives and priorities that are compatible with the Company’s area of operation and business purpose; (h) preparing, assessing and approving institutional policies and (i) implementing and supervising risk management and internal control systems. Additionally, it is important to note that (i) any adjustments and revisions to the charges billed for the provision of utility services will adhere to the guidelines set forth by applicable laws and by the São Paulo State Public Services Regulatory Agency (ARSESP), through a process involving public consultations and hearings and (ii) postponements for the application of readjustments, discounts and exemptions are assessed by the Executive Board and Board of Directors and, when applicable, requests for rebalance are presented to ARSESP.

Finally, considering the nature of the sanitation business, the Company understands that the cost of serving the public interest is the very cost of providing the services that comprise the Company’s business purpose, which are disclosed on a quarterly basis in its financial statements, as well as in the items 7.1 and 10.8 of the Comapny's Reference Form filed at CVM on July 4, 2023 (referring to the base date of December 31, 2022). |

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 2.1.1 The board of directors shall, without prejudice to any of its other duties under the law and the bylaws or any other practices set forth in the Code: (i) determine business strategies considering the impacts of the Company’s activities on society and the environment aiming at the Company’s perpetuity and long-term value creation; (ii) to assess, from time to time, the Company’s risk exposure and the effectiveness of its risk management systems, internal controls and compliance system and to approve a risk management policy consistent with the Company’s business strategies; (iii) to define the Company’s ethical principles and values and to ensure the issuer’s consistent transparency in its relationship with all stakeholders; and (iv) to annually review the corporate governance system with a view to improving it. |

Y |

The Company adheres to recommended practices: (i) the strategic planning considers the impacts of the Company’s activities on society and the environment and, as set forth in article 14, item I, of the Bylaws, shall be approved by the Board of Directors. In addition, article 14, item XV, of the Bylaws provides that the Board of Directors shall also set public policy goals and priorities that are consistent with the Company’s area of operation and business purpose; (ii) under the Bylaws, it is incumbent upon the Board of Directors to implement and oversee risk management and internal controls systems set up to prevent and mitigate the main risks to which the Company is exposed, including risks relating to the accuracy of its accounting and financial information and to events of corruption and fraud. Additionally, the Board of Directors is also responsible for approving some of the Company’s institutional policies, as required under the Bylaws, including its compliance, internal audit and corporate risk management policies. The Board of Directors is advised by an Audit Committee which consists of three independent directors and is assigned the following duties: (a) monitoring the Company’s internal auditing, compliance and internal controls activities (Art. 28, item XVI of the Bylaws); (b) assessing and monitoring the Company’s risk exposures (Art. 28, item XVII of the Bylaws); (c) monitoring the effectiveness of the Company’s internal controls, risk management and compliance (Art. 3 of the Audit Committee’s Internal Regulations); (iii) on February 25, 2021, the Board of Directors approved the most recent revision of the Company's Code of Conduct and Integrity which set forth in arts. 4.1 and 4.2 the Company's ethical principles and values. The transparency in the relationship with stakeholders is one of the principles set forth in said Code. The Board of Directors shall also oversee the implementation of a previous inquiry mechanism for answering questions about the application of the Code of Conduct and Integrity (Art. 14, item XXXIV of Bylaws)), as well as discuss, approve and monitor decisions on the compliance program and the Code of Conduct and Integrity (Art. 14, item XXX of Bylaws)); (iv) as set forth in article 14, item XXX, of the Bylaws, the Board of Directors shall discuss, approve and monitor any decision involving corporate governance practices, relationship with stakeholders, the people management policy, the compliance program, and the Code of Conduct and Integrity. Article 14, item VIII, of the Bylaws provides that the Board of Directors shall annually review the related-party transactions policy, which occurred on October 24, 2022. Additionally, article 28 of the Bylaws provides that it is incumbent upon the Audit Committee, which is an advisory body tied to the Board of Directors, to: (a) permanently assess the accounting practices and the internal controls and processes in place at the Company with a view to identifying any critical issues, financial risks and potential contingencies and suggesting such improvements as it may deem necessary; (b) monitor the Company’s internal auditing, compliance and internal control activities; and (c) assess, monitor and recommend to Management any corrections or improvements to the Company’s internal policies, including the related-party transactions policy. |

| 2.2.1 The bylaws shall provide that: (i) a majority of the board of directors shall consist of outside members, and at least one third of the board of directors shall consist of independent members; and (ii) the board of directors shall annually assess and disclose who its independent members are, while indicating and justifying any such circumstances as may compromise their independence. |

P |

(i) Notwithstanding that there are no provisions in the Bylaws requiring a majority of the Board of Directors to consist of outside member and at least one third thereof to consist of independent members, the current make-up of the Board of Directors is in line with the recommended practice, with an outside membership of 82 percent and an independent membership of 36 percent, one of whom being the representative of minority shareholders. Additionally, the Company informs that its Bylaws are adherent to the Novo Mercado Regulations, the segment in which its shares have been listed since 2002. (ii) Even though there is no explicit provision in the Bylaws requiring the Board of Directors to conduct an annual assessment of the independent status of each its independent member or to report any such circumstance as may compromise each such member’s independence, the Board of Directors’ Internal Regulations provide, in § 4 of article 29, that the independent status of the directors shall be reassessed on an annual basis, recorded in the minutes of its relevant meets and disclosed in the Reference Form. The Company further informs that, under article 11 of the Bylaws, the designation of nominees to the Board of Directors as independent members is decided upon by the Shareholders’ Meeting appointing them. In addition, also considered independent member are any members elected by the minority shareholders through a separate vote, as set forth in article 141, §§ 4 and 5, and article 239 of Federal Law No 6,404/1976, as well as article 22, § 4, of Federal Law No. 1,303/2016. Lastly, it is noted that the independent status of the current independent members of the Board of Directors who were elected by the controlling shareholder has been: (1) verified at the time of their election at the Annual Shareholders’ Meeting (AGM) held on April 28, 2023; (2) mentioned in the Management’s Proposal published on the occasion of the 2023 AESM; (3) reaffirmed in the Company's Reference Form filed at CVM on July 4, 2023 (referring to the base date of December 31, 2022). |

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 2.2.2 The board of directors shall approve a nomination policy providing: (i) for the nomination process for members of the board of directors, including nominations for membership in other Company bodies in such process; and (ii) that the board of directors shall be made up in view of the time availability of its members to perform their duties and the diversity of their knowledge, experiences, behaviors, culture, age groups and genders. |

Y |

The Company has a nomination policy in place, as approved by the Board of Directors on October 29, 2018 , and also has an Eligibility and Advisory Committee, which is charged with overseeing the nomination and assessment process for managers and fiscal council members, as set forth in the Bylaws, and subject to the provisions of article 10 of Federal Law No. 13,303/2016 (State-Owned Companies Act). Such committee consists of up to three members, elected and dismissed by the Shareholders’ Meeting.

Furthermore, it is worth noting that the appointment of candidates for Management positions (Board of Directors and Executive Board), Fiscal Council, and Statutory Committees in companies indirectly controlled by the State, such as the Company, is as follows (i) the Government Secretariat submits the names of the candidates for the Board of Directors, Executive Board, and/or Fiscal Council to the State Capital Defense Council (CODEC). Such appointment shall be accompanied by the State Governor’s approval, completed and filed registration forms, and corresponding documents; (ii) CODEC submits the aforementioned documentation and requests the company’s Eligibility and Advisory Committee to assess compliance, which has up to 7 days to respond; (iii) the company sends the minutes of the Eligibility and Advisory Committee’s meeting to CODEC.

Regarding Board of Directors’ members: (i) The company submits to CODEC the request for calling an Extraordinary Shareholders’ Meeting for the election of the members approved; (ii) in possession of the Eligibility and Advisory Committee’s minutes, which includes an opinion on the compliance of the appointment, CODEC sends an advisory opinion to the State Attorney General Office and the company’s Board of Directors to resolve at a General Shareholders’ Meeting the election of members of the Fiscal Council and Board of Directors and the appointment of the Board’s Chair; (iii) The Board of Directors prepares the proposal for the election and calls the Extraordinary Shareholders’ Meeting for the election of members, with a thirty-day notice.

The Nomination Policy and the structure of the Committee are available on the Company’s website (https://ri.sabesp.com.br/en/corporate-governance/boards-board-committee-and-executive-board/), and on the website of the Brazilian Securities Commission (www.gov.br/cvm). For more information, see item 7.1(a) of the Company's Reference Form filed at CVM on July 4, 2023 (referring to the base date of December 31, 2022). |

| 2.3.1 The chief executive officer shall not cumulatively hold the position of chairman of the board of directors. |

Y |

|

| 2.4.1 The Company shall implement an annual assessment process for the board of directors and its committees, such as joint decision-making bodies, the chairman of the board of directors, the board members, taken individually, and the governance department, if any. |

Y |

Since 2018, the Company has a specific, formal and annual process in place to assess the performance of the Board of Directors, its Committees, the chairman of the Board of Directors and the other board members, as well as the Committee members, taken individually, which is in accordance with Federal Law No. 13,303/16, in particular item III of art. 13, and State Council of Capital Defense (CODEC) Resolution No. 4, of November 29, 2019.

In 2022, the evaluation process of the Board of Directors and Committees was conducted with the assistance of the HSM do Brasil S.A (“HSM”) and analyzed matters related to performance, commitment, and conduct of those evaluated in the pursuit of organizational objectives established in the business plan and in the long-term corporate strategies. Management and Committee members were collectively and individually evaluated by filling out online forms, which included the following items:

a) Exposure of the management acts employed regarding the lawfulness and effectiveness of the administrative work;

b) Contribution to the result for the year;

c) Achievement of the objectives established in the business plan and compliance with the long-term strategy;

d) Work of the Board of Directors;

e) Technical knowledge and knowledge of the Company;

f) Interaction of the Executive Board with the Board of Directors; and

g) Self-evaluation.

Additionally, to check whether the Board of Directors’ members previously reviewed the matters that is discussed during the meetings, the evaluation process analyzes the availability, time dedicated to the function and, especially regarding the preparation of meetings, assess their participation in the definition of agendas and in the proposition of relevant matters for effective contribution in the decision-making process.

The points identified for improvement, obtained from the result of the evaluation, have been used to instruct those submitted to the evaluation regarding the needs of collective or individual adjustments for the continuous improvement of management performance as to the Company’s objectives.

Additionally, the Company informs that it does not formally have a governance department in its organization chart. Such activities are conducted by the Sustainability and Governance Department, which is assessed, as are the other employees, within the scope of the annual competency and performance assessment. For more information on this assessment process, see item 7.1(b) of the Company's Reference Form filed at CVM on July 4, 2022 (referring to the base date of December 31, 2022). |

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 2.5.1 The board of directors shall approve a succession plan for the chief executive office, and shall keep it up to date, which plan shall be prepared in coordination with the chairman of the board of directors. |

N |

The Company has no succession plan because, since it is a mixed capital company controlled by the State of São Paulo, it is solely incumbent upon the São Paulo State Governor to nominate the Company’s officers. This is so under the provisions of article 47, item XIII, of the State Constitution. Notwithstanding the State’s nomination, under article 14, item XL, of the Bylaws, it is incumbent upon the Board of Directors to appoint and remove members of the Executive Board. We should point out that any nominees for membership of the Executive Board shall meet the requirements and clear the prohibitions set forth in Federal Law No. 6,404/76 and Federal Law No. 13,303/16, particularly the provisions of article 17 thereof. Additionally, the Company has an Eligibility and Advisory Committee responsible for overseeing the nomination and assessment process for managers and fiscal council members, subject to the provisions of article 10 of Federal Law No. 13,303/2016 (State-Owned Companies Law). The current members of this committee were elected at the Company's Shareholders' Meeting held on June 3, 2019 and at the Shareholders' Meeting held on November 24, 2021. |

| 2.6.1 The Company shall have a onboarding program for new members of the board of directors, which shall be previously structured so that said new members are introduced to key individuals within the Company and shown to its facilities, and shall address topics deemed key to understanding the Company’s business. |

Y |

The Company has an onboarding program in place for new members of the Board of Directors, fiscal council and Executive Board, as approved by the Board of Directors on October 29, 2018. The program aims to share key information on the Company with new members so they can properly perform their duties. The program includes a corporate presentation of those responsible for the key business processes, making key corporate documents available, a tour of the facilities, a training and development program under Federal Law No. 13,303/16, and an introduction to the performance assessment process. |

| 2.7.1 The compensation for members of the board of directors shall be proportional to their duties and responsibilities and the time required from them. There shall be no compensation based on attendance at meetings, and the variable compensation for directors, if any, shall not be linked to short-term results. |

Y |

|

| 2.8.1 The board of directors shall have internal regulations in place to govern its responsibilities, duties and rules of operation, including: (i) the duties of the chairman of the board of directors; (ii) the rules for replacing the chairman of the board in the event of their absence or vacancy; (iii) the measures to be taken in any conflict of interest situations; and (iv) specification of the time in advance within which materials shall be received for discussion at meetings, with an appropriate degree of depth. |

Y |

|

| 2.9.1 The board of directors shall put together an annual calendar with the dates of regular meetings, which shall not be less than six or more than twelve, and shall also call special meetings whenever necessary. Said calendar shall contemplate an annual theme-based agenda including the relevant topics and discussion dates. |

Y |

|

| 2.9.2 The meetings of the board of directors shall regularly allow for exclusive sessions for outside members, without any executives or other guests in attendance, so that such members can align with each other and discuss any such themes as may create discomfort. |

Y |

|

| 2.9.3 The minutes of meetings of the board of directors shall be clearly worded and record the decisions made, the persons attending, votes the votes against them, and abstentions from voting. |

Y |

Article 21, item 1, of the Board of Directors’ Internal Regulations provides that the such meeting minutes are to be worded clearly and contain a record of the members in attendance and the decisions made, including any abstentions and votes against them. |

| 3.1.1 The executive board shall, without prejudice to their duties under the law and the bylaws or any other practices set forth in the Code: (i) implement the risk management policy and, whenever necessary, propose to the board of directors any revision of such policy to reflect changes in the risks to which the Company is exposed; and (ii) implement and maintain effective monitoring and reporting mechanisms, processes and programs for financial and operational performance and for impacts of the Company’s activities on society and the environment. |

Y |

|

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 3.1.2 The executive board shall have its own internal regulations providing for its framework, procedures, roles and responsibilities. |

Y |

|

| 3.2.1 There shall be no seats on the executive board or management positions reserved for direct nomination by any shareholders. |

P |

As a mixed-capital company controlled by the State of São Paulo, even though it is solely incumbent upon the São Paulo State Governor to nominate the Company’s officers under article 47, item XIII, of the State Constitution, it is incumbent upon the Board of Directors to appoint and remove members of the Executive Board. We should point out that any nominees for membership of the Executive Board shall meet the requirements and clear the prohibitions set forth in Federal Law No. 6,404/76 and Federal Law No. 13,303/16, particularly the provisions of article 17 thereof. Additionally, the Company informs that it has an Eligibility and Advisory Committee responsible for overseeing the nomination and assessment process for managers and fiscal council members, subject to the provisions of article 10 of Federal Law No. 13,303/2016 (State-Owned Companies Law). Such committee consists of up to three members, elected and dismissed by the Shareholders’ Meeting. Concerning management positions, the Company selects professionals from among its own employees through an in-house selection process designed to identify the potential nominee whose profile best fits the opening available or, where a successor is nominated, to evaluate the profile and potential of such nominees. In addition, succession preparation and training actions are carried out. |

| 3.3.1 The chief executive officer shall be assessed annually by a formal process conducted by the board of directors based on financial and non-financial targets achieved for the Company by the board of director. |

Y |

The Company has a performance assessment process in place for the Executive Board, as a joint decision-making body, as well as the officers, taken individually, including the Chief Executive Officer, which is in accordance with Federal Law No. 13,303/16, particularly article 13, item III and CODEC Resolution No. 4/19. In 2022, the online assessment was held between August 23 and September 8, 2021, with advice from HSM do Brasil S.A (“HSM”). The assessment process addresses topics related to the Directors' performance and conduct in reaching the organizational objectives set out in the business plan and long-term corporate strategy. The CEO's assessment result was approved by the Board of Directors on November 12, 2022. For more information regarding the executives, board members and Board Committees, see item 7.1 (b) of Company's Reference Form filed at CVM on July 4, 2023 (referring to the base date of December 31, 2022). |

| 3.3.2 The assessment results for other officers, including any proposals from the chief executive officers as to the targets to be agreed upon and tenures, promotions or dismissal of executives from the relevant positions, shall be presented, analyzed, discussed and approved at a meeting of the board of directors. |

Y |

The Company has a performance assessment process in place for the Executive Board, as a joint decision-making body, as well as the officers, taken individually, which process is compliant with Federal Law No. 13,303/16, particularly article 13, item III and CODEC Resolution No. 4/19. In 2022, the online assessment was held between August 1 and September 22, with advice from HSM do Brasil S.A (“HSM”). The results of this assessment were made available to the Chief Executive Officer and to the Chairman of the Board of Directors for their assessment and were approved by Board of Directors on Setember 22, 2022. The Governor of the State of São Paulo is solely responsible for matters referring to the permanence, promotion or dismissal of Officers, a fact arising from Article 47, Item XIII, of the State Constitution, since, as a mixed capital company, the Company is controlled by the State of São Paulo. |

| 3.4.1 The compensation of the executive board shall be set by means of a compensation policy approved by the board of directors through a formal, transparent procedure that takes into consideration the costs and risks involved. |

Y |

The Company has a compensation policy, approved by the Board of Directors, which establishes the criteria to establish the compensation of the members of the management (executive officers and members of the Board of Directors) and members of the Fiscal Council, of the Statutory Audit Committee and of the Eligibility and Advisory Committee, in compliance with Novo Mercado’s Regulations, the Bylaws, the provisions of Federal Laws 6,404/1976 and 13,303/2016 and of the Resolution 01/2023 of the State Council of Capital Defense (CODEC - Conselho de Defesa dos Capitais do Estado). For the Executive Board, the policy establishes: (a) a monthly compensation; (b) an annual bonus, equal to the monthly compensation, calculated pro rata temporis; (c) an annual contingent bonus, which is limited to an amount equivalent to up to six times the monthly compensation or 10 percent of the total amount paid out by the Company as dividends or interest on equity, whichever is less, as calculated for the period comprised by the entire calendar year, and is cumulatively conditional upon: (I) income having been determined for a quarterly, semi-annual or annual period; and (II) the mandatory dividend having been paid out to the shareholders, albeit by way of interest on equity, based on income then determined; (d) an annual rest, as paid leave, for a period of thirty (30) calendar days, with additional payment corresponding to one third (1/3) of the monthly compensation; (e) the FGTS payment, except when the Officer is not entitled to the severance fine or advance notice; (f) benefits including meal vouchers, food vouchers, health insurance plans and private pension plans. The maximum overall annual amount payable as compensation for managers, advisory board members and audit committee members is annually approved at a Shareholders’ Meeting, it being incumbent upon the Board of Directors to approve any annual bonus payment to any officers. For more information regarding the remuneration policy, see item 8.1 of Company's Reference Form filed at CVM on July 4, 2023 (referring to the base date of December 31, 2022). |

| 3.4.2 The compensation of the executive board shall be tied to results achieved, with medium and long-term targets clearly and objectively related to long-term value creation for the Company. |

P |

The compensation for the Executive Board includes an annual contingent bonus in an amount equivalent to up to six times the monthly compensation or 10 percent of the total amount paid out by the Company as dividends or interest on equity, whichever is less, as calculated for the period comprised by the entire calendar year, and is cumulatively conditional upon: (a) income having been determined for a quarterly, semi-annual or annual period; and (b) the mandatory dividend having been paid out to the shareholders, albeit by way of interest on equity, based on income then determined. It is worth noting that the State Capital Defense Council (Codec), a collegiate body of the Treasury and Planning Secretariat of the São Paulo State Government, is responsible for establishing the mandatory guidelines regarding the compensation of Executive Officers and Fiscal Council Members of the companies controlled by the State, such as the Company. |

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 3.4.3 The incentive framework shall be consistent with the risk limits set by the board of directors and prohibit any one person from controlling both the decision-making process and the inspection thereof. No one shall decide on their own compensation. |

P |

The compensation of the Boards of Directors members, Executive Officers, and Fiscal Council members is established at a General Shareholders’ Meeting, according to article 152 of Federal Law 6,404/1976 (Brazilian Corporation Law); therefore, the Executive Board shall not resolve on or oversee its own compensation. The Board of Directors is responsible for resolving on a potential annual bonus, provided that the Company actually generates profit, according to the provisions of the Institutional Compensation Policy; therefore there is no provision for distributing profit linked to risk limits. However, it is worth noting that the establishment of the overall compensation of Executive Officers takes into account the various aspects of the company’s operating environment, challenges, risks, complexities, and opportunities, as well as market practices and procedures to attract and retain professionals capable of achieving the long-term objectives defined for the organization. |

| 4.1.1 The statutory audit committee shall: (i) have as part of its role the duty to advise the board of directors on the quality control and monitoring of financial statements, internal controls, risk management and compliance; (ii) have a majority consisting of independent members and be coordinated by an independent member; (iii) have at least one of its independent members with proven experience in corporate accounting, internal controls, finance and auditing, on a cumulative basis; and (iv) have its own budget for hiring consultants to handle accounting, legal or other affairs, where an outside expert’s opinion is required. |

Y |

(i) The Company has a Statutory Audit Committee to advise the Board of Directors, as set forth in Article 26 of the Bylaws. Here is a list of some of its duties, provided for in Art. 28 of the Bylaws: (a) to monitor, assess and review the preparation of quarterly, interim and annual financial statements, seeking to ensure its integrity and quality, reporting to the Board of Directors where necessary; (b) to permanently assess the accounting practices and the internal controls and processes in place at the Company with a view to identifying any critical issues, financial risks and potential contingencies and suggesting such improvements as it may deem necessary; (c) monitor the Company’s internal auditing, compliance and internal control activities; and (d) to assess and monitor the Company’s risk exposures. (ii) The Company's Audit Committee consists of three independent Directors, in accordance with the requirements set forth in Federal Law No. 13,303/2016, the Novo Mercado Regulations, the Regulations of the Securities and Exchange Commission, and the New York Stock Exchange (where applicable for foreign issuers). (iii) Under the Company's Bylaws, all of its members shall possess sufficient technical knowledge of finance and accounting matters, and at least one of them, the Fiancial Expert, shall have proven experience in internally accepted corporate accounting practices and for reviewing, preparing and assessing financial statements, as well as knowledge of internal controls and market information disclosure policy. The Audit Committee shall have a Coordinator and at least one Financial Expert (cumulation of such functions being allowed), both appointed by the Board of Directors, being that any member of the Committee may be appointed as Coordinator. (iv) The Audit Committee may request that specialist services be hired to support its activities, including on accounting and legal issues, the compensation for which shall be borne by the Committee’s own annual budget, as approved in accordance with articles 28, item XIV and 30 of the Bylaws. Additionally, the Committee has a budget to carry out its assignments. |

| 4.2.1 The fiscal council shall have its own internal regulations describing its structure, procedures, work plan, rules and responsibilities, without creating any constraints on the individual work of its members. |

Y |

|

| 4.2.2 The minutes of fiscal council meetings shall observe the same rules of disclosure as do those of meetings of the board of directors. |

P |

The decisions/opinions issued by the fiscal council shall be made available on the Brazilian Securities Commission’s website within a period of 7 business days, as set forth by CVM Resolution 80/2022. The Company believes that it complies with the applicable legislation and regulations in force, respecting the peculiarities of each Board. |

| 4.3.1 The Company shall introduce a policy for contracting extra-audit services with its independent auditors, as approved by the board of directors, forbidding the engagement of any such extra-audit services as might compromise the auditors’ independence. The Company shall not engage as independent auditor anyone having provided internal audit services thereto less than three years earlier. |

P |

Notwithstanding that the Company has no formal policy in place for contracting extra-audit services approved by the Board of Directors, the engagement of any service provided by the independent audit firm or related firms other than those comprised in typical audit activities is referred to the Audit Committee for a prior opinion, as set forth in article 28, item VII, of the Bylaws. Additionally, the Company informs that it gives priority to using professionals from its own personnel, who are hired via public exam, for internal audit activities. If such services should need to be outsourced, the contracting thereof shall be conducted based on a specific regulation in compliance with Law No. 13,303/16 (State-Owned Companies Law). |

| 4.3.2 The independent audit team shall report to the board of directors, through the audit committee, if any. The audit committee shall monitor the effectiveness of the independent auditors’ work, as well as their independence. It shall also assess and discuss the annual work plan for the independent auditors and submit it to the board of directors for review. |

Y |

|

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 4.4.1 The Company shall have an internal audit department reporting directly to the board of directors. |

Y |

Under article 36 of the Company's Bylaws, the Internal Audit department reports to the Board of Directors through the Audit Committee and, in an administrative link, to the Chief Executive Officer. Although it has an indirect connection with the Board of Directors, the Company informs that, in accordance with article 28, item XVI, of the Bylaws, it is incumbent upon the Audit Committee to monitor internal audit activities, and such committee consists of three independent directors. The Audit Committee has Internal Regulations approved by the Board of Directors, the latest revision of which was approved on August 12, 2021 and according to which the Committee shall keep the Board of Directors regularly informed of the Committee’s activities, particularly in respect of any such matters that may have a significant impact on the Company’s business or financial position. The Company informs, further, that as set forth in article 14, item VII(d), of its Bylaws, it is also incumbent upon the Board of Directors to approve the Internal Audit Policy. The Board of Directors shall, under article 28, item I, of the Bylaws, approve the appointment and removal of the person responsible for Internal Audit based on a proposal signed by the Audit Committee. Certified for Quality Assessment (QA) by The Institute of Internal Auditors, through its Brazilian counterpart Instituto dos Auditores Internos do Brasil, the Audit Department consists of professionals with diverse educational backgrounds (Business, Information Technology, Accounting Sciences, Economics, Engineering, Law, among others), which enables it to engage in a works of different nature. The vast majority of the team members have graduate degree studies, some of whom holding certifications such as Certification in Control-Self Assessment (CCSA), and COBIT (Control Objectives for Information and Related Technologies). |

| 4.4.2 In the event that this activity is outsourced, the internal audit services shall not be performed by the same firm providing audit services on the financial statements. The Company shall not contract internal audit with anyone having provided independent audit services thereto less than three years earlier. |

P |

In line with national and international standards, internal audit services, if outsourced, shall not be carried out by the same company providing audit services on the financial statements. Additionally, the Company informs that it gives priority to using professionals from its own personnel, who are hired via public exam, for internal audit activities. If such services should need to be outsourced, the contracting thereof would have to be conducted based on a specific regulation in compliance with Law No. 13,303/16 (State-Owned Companies Law). |

| 4.5.1 The Company shall have a risk management policy in place, as approved by the board of directors, which includes a definition of the risks from which protection is sought, the tools used to provide such protection, the organizational framework for risk management, and a suitability assessment of the operating framework and internal controls designed to check its effectiveness, while establishing guidelines for setting acceptable limits to the Company’s exposure to such risks. |

Y |

The Company has had a formal corporate risk management policy in place since 2010, the latest revision of which was approved by the Board of Directors on December 18, 2018. Such policy includes requirements recommended by the Brazilian Code of Corporate Governance, among other things, aims to set guidelines and define concepts and competencies for corporate risk management process. The risks from which protection is sought and the tools used to provide such protection are contemplated by the Company’s risk management methodology, which is based on the COSO ERM - Committee of Sponsoring Organizations of the Treadway Commission – Enterprise Risk Management model, in the standard ABNT NBR ISO 31000, in a flexible way to reflect the characteristics and peculiarities of both Sabesp and its business environment. The risk management organizational framework is set forth in article 34, together with Article 20, Paragraph 1, of the Bylaws, which provides for the existence of a department reporting to the Chief Executive Officer and led by a statutory officer appointed by the Board of Directors to carry out compliance and risk management activities. A corporate risk map, approved by the Board of Directors, is maintained to monitor the global and domestic trends to foresee scenarios that may adversely affect the operations, thus ensuring the compliance with strategic goals. In this sense, the risks are divided into four types (strategic, financial, operational and compliance) and monitored through indicators, periodically measured for their impact and likelihood of occurrence. The risk management process run annually or when necessary, such risks are evaluated by the competent hierarchical levels to define mitigating actions required for each situation. Risks assessed at a significant and critical level are monitored by the Company’s Executive Board and Board of Directors. As of the date of this Corporate Governance Report, the compliance and risk management area has 17 professionals trained in data processing, mathematics, accounting, engineering, information technology, law, chemistry, and business administration. Concerning risk exposure limits, the policy sets forth a guideline whereby they must be determined by threshold levels, considering impact and likely of occurrence. For more information, see items 5.1 of the Company's Reference Form filed at CVM on July 4, 2023 (referring to the base date of December 31, 2022). |

| 4.5.2 It is incumbent upon the board of directors to ensure that the executive board has mechanisms and internal controls in place to know, assess and control risks, so they can be kept at levels compatible to the limits set, including a compliance program aimed at compliance with laws, regulations and internal and external rules. |

Y |

According to the Company’s Corporate Risk Management Policy, the last update of which was approved by the Board of Directors on December 18, 2018, risks must be assessed and monitored across the board in the organization, and the assignment of responsibilities for risk approval and treatment must observe hierarchic levels. In addition to being in charge of assessing the effectiveness of corporate risk management and control procedures, the Board of Directors shall, among other things: (a) assess and approve the Institutional Policy of Risk Management; b) know the corporate risk management methodology; c) verify the effectiveness of the corporate risk management and control procedures; d) evaluate and approve the hierarchic levels defining risk approval and treatment responsibilities; (e) assess and approve from time to time the corporate risk mapping and risk mitigation action plans within the scope of responsibilities of the Company's Board of Directors; and (f) monitor and evaluate, every six months, the progress of the implementation of corporate risk mitigation action plans under its responsibility; g) know the result of the effectiveness evaluation of the risk management procedures, carried out by the Audit Department; h) know the report of the risk management activities. Additionally, article 14, item XXXV, of the Bylaws charges the Board of Director with the obligation to implement and oversee the risk management and internal control systems set up to prevent and mitigate the main risks to which the Company is exposed, including risks relating to the accuracy of its accounting and financial information and to events of corruption and fraud. In this regard, the Bylaws also provide that the Compliance Program shall be approved by the Board of Directors (art. 35, item VI), which is also responsible for discussing, approving and monitoring decisions pertaining to such program (art. 14, item XXX). |

| 4.5.3 The executive board shall assess, at least annually, the effectiveness of the risk management and internal control policies and systems, as well as the compliance program, and report to the board of directors on such assessment. |

Y |

According to the Annual Audit Plan, the Internal Audit annually assesses the effectiveness of risk management and internal controls policies and systems, as well as the compliance program, reporting to the Chief Executive’s Office and to the Audit Committee, which is an advisory body of the Board of Directors. The last reportings to the Audit Committee were on: (i) November 23, 2022, to assess the risk and compliance management process; and (ii) April 11, 2023, due to the disclosure of test results related to internal controls. |

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 5.1.1 The Company shall have a conduct committee, which shall be given autonomy and independence and report directly to the board of directors, in charge of implementing, disseminating, training, reviewing and updating the code of conduct and the grievance reporting channel, as well as conducting investigations and proposing corrective actions for breaches of the code of conduct. |

P |

The Company has an Ethics Commission reporting to Board of Directors and consisting of representatives of all its Offices and the areas of Audit, Ombudsman, Legal Affairs, People and Risk Management and Compliance. Its duties comprise drawing up, reviewing and disseminating the Code of Conduct and Integrity, as well as ensuring the Code is relevant, up-to-date, disseminated and enforced. In turn, any investigations and corrective actions for breaches of the Code are conducted in accordance with the nature of the occurrence, by the Audit Department (high risk to the Company, including fraud and corruption), and by decentralized organizational units (other situations considered of low risk). The Officers decide on the application of the proposed disciplinary measures for misconduct, except when it is related to moral or sexual harassment. In these matters, the Harassment Investigation Commission investigates complaints of moral and sexual harassment. In turn, the Ethics Commission establishes the penalty for sexual harassment cases and recommends disciplinary measures for bullying cases. The decision on the application is assigned to the respective decentralized organizational unit or to the Board, as the case may be. The Ethics Commission must monitor and request periodic training on the Code for Employees and members of the Management. Annualy, Code of Conduct and Integrity training for managers and employees is provided by Compliance and Personnel Departments. |

| 5.1.2 The code of conduct, as prepared by the executive board with support from the conduct committee and approved by the board of directors, shall: (i) govern the Company’s internal and external relationships, describing the commitment expected by the Company from its directors, officers, shareholders, employees, suppliers and stakeholders, who shall adhere to appropriate conduct standards; (ii) manage conflicts of interest and provide for abstention of any member of the board of directors, the audit committee or the conduct committee, if any, in case of conflict; (iii) clearly outline the scope and reach of any actions aimed at investigating into the occurrence of any situations deemed to have taken place with the use of insider information (for example, using insider information for business purposes or to gain advantages in any securities trading); and (iv) provide that ethical principles shall underpin any negotiations of contracts, agreements, proposed amendments to the bylaws, as well as any of the policies governing the entire Company, and set a maximum amount for third-party goods or services that managers and employees may accept free of charge or as a favor. |

Y |

|

| 5.1.3 The whistleblowing channel shall be given autonomy and independence and be impartial, following procedural guidelines set forth by the executive board and approved by the board of directors. It shall be operated in an independent and impartial manner and ensure the anonymity of its users, while timely fostering the investigations and actions needed. |

Y |

The Company has an external Whistleblowing Channel, operated by a specialized company, ready to handle any internal and external reports of deviations from the Code of Conduct and Integrity, such as fraud, corruption and illegal acts. The guidelines for the whistleblowing channel, as approved by the Executive Board and the Board of Directors, provide that: (a) Any and all leaders or employees, irrespective of their position or title, or any contractor, faced with any suspected or known situation deemed unlawful, shall report the fact to the Sabesp Whistleblowing Channel; (b) Every fact or act suspected to be unlawful shall be identified as an event and recorded, and the relevant investigation shall be deployed, to the extent that minimum elements exists with which to work; (c) Any investigation shall at all times be conducted in an objective and impartial manner, upholding the principles of immediacy and due process; (d) Anonymity is ensured in every event, unless a court ruling determines otherwise; (e) Information secrecy and confidentiality shall be preserved throughout the investigation process; (f) In view of the employer’s disciplinary power, the application of any penalty shall take place in the cases set forth in the CLT (Brazilian Consolidated Labor Laws); and (g) With a view to improving the channel’s independence, the reports are taken with the support of a third-party firm of renowned capability. The Audit Department is responsible for processing complaints and investigations. The Audit Committee is responsible for monitoring the procedures adopted for investigating violations of the Code of Conduct and Integrity considered to be of high risk, as well as the events recorded in the Whistleblowing Channel. It should also be noted that the complaints investigation results are submited to the Audit Committee and the recurring cases are reported to the Ethics and Conduct Commission, for preventive actions. |

| 5.2.1 The Company’s governance rules shall ensure a clear separation and definition of functions, duties and responsibilities associated with all governance agents. They shall also set the approval limits for each hierarchic level with a view to minimizing any potential conflicts of interest. |

Y |

Without prejudice to any statutory or regulatory provisions, the Bylaws provides for the duties of the Shareholders’ Meeting (art. 5), the Board of Directors (art. 14), the Executive Board (art. 19) and the officers, taken individually (art. 20), the fiscal council (art. 22), the Audit Committee (art. 28), the Eligibility and Advice Committee (art. 31, § 1), the Compliance and Risk Management Deppartment (art. 35) and the Internal Audit (art. 36). It is also noted that the Internal Regulations for those bodies also contain detailed provisions and add a few powers and duties. Additionally, the Company's Bylaws also sets approval limits for the closing of any legal transactions by the relevant bodies, namely: the Board of Directors (art. 14, item XXII), and the Executive Board (art. 19, item III, subparagraph (b)). |

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 5.2.2 The Company’s governance rules shall be made public and require anyone who is not independent in respect of any matter under discussion or resolution by the Company’s governing or supervising bodies shall report, in a timely fashion, their conflict of interests or particular interest. Failing this, such rules shall require another person to report the conflict if it is known thereto, in which case, as soon as the conflict of interest relative to a specific topic is identified, the person concerned shall withdraw, including physically, from the discussions and resolutions. The rules shall also provided that any such temporary withdrawal shall be recorded in the relevant minutes. |

Y |

According to the Code of Conduct and Integrity, leaders and employees, in discharging their internal and external duties, shall ensure that there are no conflicts of interest with the Company and make any situations or doubts concerning any conflicts of interest known to their superiors or the relevant bodies. Additionally, the Company has a Related-Party Transactions Policy since 2018, which is annualy revised by the Board of Directors. The most recent revision occured on October 20, 2022, which has determined that, in any situations where conflicts of interest may be involved, the members of the statutory bodies shall: (a) state their impediment, as soon as the relevant fact comes to their attention; (b) refrain from taking part in any discussion or resolution on the matter; (c) cause the minutes of the meeting to reflect said fact; and (d) withdraw from the relevant discussions and resolutions. In addition, if any member of a statutory body having a conflict of interest with the Company or a particular interest in the matter under discussion fails to state their impediment, any other member of the relevant body having knowledge of the conflict of interest shall report it, and the minutes shall reflect such member's withdrawal from any discussion and resolution on the matter. Sabesp’s Code of Conduct and Integrity and the Corporate Related-party Transactions Policy are available on the website of the Company (https://ri.sabesp.com.br/) and of the Brazilian Securities Commission (www.gov.br/cvm). |

| 5.2.3 The Company must have conflict of interest management mechanisms for the matters submitted to vote at shareholders’ meeting, so that it can receive and process reports of conflict of interest and annul any votes cast in conflict, even if the process may take place after the meeting. |

P |

In addition to the governance documents that provide for situations of potential conflict of interest (Related-Party Transaction Policy, Internal Regulations, Code of Conduct and Integrity), the Company does not have formally prescribed mechanisms for receiving and processing allegations of conflicts of interest related to votes cast at the Meeting. However, it has implemented mechanisms for identifying related-party transactions. Furthermore, it clarifies that its Bylaws (Article 52) includes a clause for resolving conflicts through arbitration before the Market Arbitration Chamber, under its regulation, regarding any disputes that may arise between the issuer, shareholders, Executive Officers, and Fiscal Council members. The Company has a whistleblowing channel where potential conflicts of interest can be reported. |

| 5.3.1 The bylaws shall specify which transactions with related parties are to be approved by the board of directors, excluding from the process any members potentially having conflicting interests. |

Y |

|

| 5.3.2 The board of directors shall approve and implement a related-party transactions policy, which shall include, among other rules: (i) a provision that, prior to the approval of any specific transactions or transaction contracting guidelines, the board of directors shall request that the executive board provide market alternatives to the relevant transaction with related parties, as adjusted by the risk factors involved; (ii) a prohibition of any such compensation methods for advisors, consultants or intermediaries as may create conflicts of interest with the Company or its managers, shareholders or classes of shareholders; (iii) a prohibition of any loans in favor of the controlling shareholder and managers; (iv) the events of related-party transactions that are to be based on independent appraisal reports issued without the participation of any party involved in the transaction in question, whether it is a bank, attorney, specialized consulting firm or otherwise, using realistic assumptions and information signed off by third parties; and (v) that any reorganization involving related parties shall ensure an equitable treatment for all shareholders. |

P |

The Company has a Related-Party Transactions Policy ("Policy") in place, which was revised by the Board of Diretors on October 20, 2022, and contemplates part of the requirements listed in this section of the Code, as following. item (i) The Policy provides that any such transactions shall be conducted on an arm's length basis and, where that is not possible, that justifications for said transactions are presented, including where compensatory payment is needed. The Audit Committee, which is responsible for previously reviewing any transactions in excess of R$ 10 million, may request market alternatives to such transactions, which shall, whenever possible, be adjusted by the risk factors involved. Upon review, the Audit Committee shall present to the Board of Directors its conclusions on the appropriateness of the Policy and other relevant rules; item (ii) Concerning the prohibition of any such compensation methods for advisers, consultants or intermediaries as may create conflicts of interest with the Company or its managers, shareholders or classes of shareholders, it is important to add that the Policy does not contain any provision specifically on this topic because the Company’s contracts are governed by its Internal Regulations for Bidding and Procurement issued in accordance with the provisions of Federal Law No. 13,303/16; item (iii) The prohibition of loans in favor of the controlling shareholder or managers is set forth in item 3.6 of the Policy; items (iv) and (v) As for situations requiring appraisal reports and corporate restructuring, the Company is governed by Federal Law No. 6,404/76 and CVM Guiding Opinion No. 35/08, combined with the Bylaws and the Related-Party Transactions Policy, as applicable. |

| 5.4.1 The Company shall adopt, by decision of the board of directors, a securities trading policy for securities issued thereby, which policy shall, without prejudice to the Company’s compliance with the CVM regulations, provide for controls that enable all trades made to be tracked, as well as the investigation and punishment of those responsible on the event of breach of such policy. |

Y |

The Company has a Policy on the Trading of Securities issued by it. The Self-statement (item 3.3.10 of the Policy) is the control method in place for any trades made. With respect to American Depositary Receipts (“ADRs”), the item 3.3.7 of Policy provides that any individuals mentioned in item 3.1.2 of the Policy wishing to deal in Sabesp’s ADRs shall: (a) register themselves with the Company’s ADR depositary bank; (b) carry out their transactions in accordance with the US stock market rules, including, but not limited to, the Securities Act of 1933 and the Securities Exchange Act of 1934, as well as said Policy; and (c) carry out their transactions in accordance with the Depositary Agreement in force between Sabesp, the Depositary, and the ADR owners and holders. The Policy provides that any violation of its provisions and those of Brazilian Securities Commission (“CVM”) Resolution No. 44, of August 23, 2021, constitutes material breach, for the purposes of article 11, § 3, of Federal Law No. 6,385/1976. The Policy provides that any failure to comply with this Policy may be subject to penalties by the CVM, without prejudice to civil, criminal and administrative liability by Sabesp or other bodies and any breaches involving employees are subject to the rules set forth in the corporate procedure for investigation of cases and determination of penalties, as aplicable.

|

| COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO - SABESP |

| REPORT ON THE BRAZILIAN CODE OF CORPORATE GOVERNANCE - PUBLICLY-HELD COMPANIES |

| CVM Resoluction 80/2022 - Annex D |

| 5.5.1 With a view to ensuring greater transparency concerning the use of Company resources, a policy must be drawn up concerning voluntary contributions, including those related to political activities, which shall contain clear and objective principles and rules, and be approved by the board of directors and implemented by the executive board. |

P |

The Company adopts a formal donation policy approved by the Board of Directors on July 22, 2021. This policy includes part of the requirements recommended by the Code, as explained below. The policy establishes limits and the scope to approve donations. All donations made during the period must be annually reported to the Executive Board. The said policy prohibits donations, directly or indirectly, to political parties and their candidates. In addition, the Company: (i) has a Corporate and Financial Support Counselor approved by the Executive Board; (ii) observes the provisions of State Decree No. 61,700/15; and (iii) has a Code of Conduct and Integrity, currrent version as approved by the Board of Directors on February 25, 2021, which prohibits sponsorship and donations representing a political or personal favor from any professional connected with Sabesp, as well as any donation or use of Sabesp resources (funds, assets, vehicles, equipment, e-mails, corporate network and cellular phones, etc.) in political campaigns intended to support political any parties or candidates, among other practices that are prohibited by specific laws.

The Sabesp's Donation and Voluntary Contributions Policy is available on: https://ri.sabesp.com.br/en/corporate-governance/bylaws-of-sabesp-and-policies/ and the Securities and Exchange Commission website (www.gov.br/cvm).. |

| 5.5.2 The policy must provide that the board of directors shall be the body responsible for approving all disbursements relating to political activities. |

Y |

|

| 5.5.3 The voluntary contribution policy for State-controlled companies or companies having relevant, reiterated relationships with the State shall prohibit contributions or donations to political parties or related individuals, notwithstanding that they may be permitted by law. |

Y |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: July 24, 2023

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

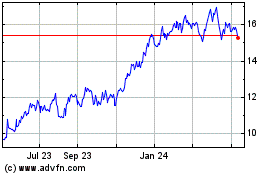

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

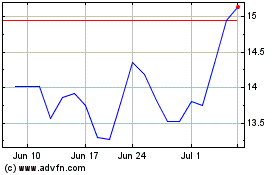

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

From Apr 2023 to Apr 2024